Waste Management to Buy Advanced Disposal--Update

April 15 2019 - 7:33AM

Dow Jones News

By Allison Prang and Cara Lombardo

Waste Management Inc. is buying competitor Advanced Disposal

Services Inc. for around $2.9 billion in one of the biggest

solid-waste company acquisitions in more than a decade.

The companies said the offer of $33.15 a share comes out to a

premium for Advanced Disposal shareholders of 22.1% based on the

company's closing price Friday. Shares most recently closed at

$27.14 a share.

The deal brings together the No. 1 and No. 4 companies in the

sector and is Waste Management's biggest acquisition ever.

The Wall Street Journal reported over the weekend that the

companies were nearing a deal and that it could be announced

Monday.

The companies said the enterprise value of the deal is $4.9

billion. That includes about $1.9 billion of net debt from Advanced

Disposal, they said.

The deal is expected to be immediately accretive to both Waste

Management's cash flow and adjusted earnings, the companies

said.

Advanced Disposal, a waste and recycling collector based in

Ponte Vedra, Fla., had $1.56 billion in revenue in 2018. The

company works in the eastern part of the U.S., mainly in 16 states.

It serves roughly 2.8 million residential customers and 200,000

commercial customers, and it owns or operates around 60 landfills

and recycling centers.

Advanced Disposal went public in 2016 and is part-owned by the

Canada Pension Plan Investment Board, which, according to

Refinitiv, owns around 19% of the company.

Houston-based Waste Management is the largest solid-waste

company in the U.S., with a market value of more than $40 billion.

It owns or operates roughly 250 landfills, the largest network in

the country.

The deal broadens Waste Management's geographic footprint,

adding attractive regions in the waste collection and landfill

segments in states like Minnesota, Illinois, Wisconsin and

Indiana.

Waste Management last year spent more than $450 million on

acquisitions, and Chief Executive James Fish said on a recent

earnings call that it planned to continue spending on deals in

2019.

Last month, a Waste Management subsidiary announced the

acquisition of Petro Waste Environmental, which provides

environmental services and solid-waste disposal to the oil-and-gas

industry.

The companies said the deal is expected to close by the first

quarter of 2020.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

April 15, 2019 07:18 ET (11:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

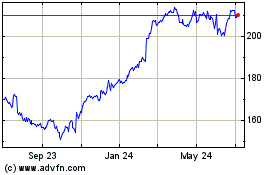

Waste Management (NYSE:WM)

Historical Stock Chart

From Mar 2024 to Apr 2024

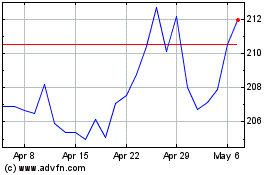

Waste Management (NYSE:WM)

Historical Stock Chart

From Apr 2023 to Apr 2024