Williams, CPPIB Form $3.8 Billion Midstream Venture for Marcellus and Utica Shales

March 18 2019 - 7:14PM

Dow Jones News

By Josh Beckerman

Williams Cos. (WMB) and Canada Pension Plan Investment Board are

forming a $3.8 billion midstream joint venture focused on the

western Marcellus and Utica shales.

The venture will include the Williams-owned Ohio Valley

Midstream system, as well as Utica East Ohio Midstream system,

which was 62%-owned by Williams before a Monday transaction

increased its stake to 100%. Williams bought the other 38% from

Momentum Midstream, whose backers include private-equity firm

Yorktown Partners.

CPPIB will invest about $1.34 billion for a 35% stake in the

venture.

Williams expects the combination of the two systems to "create a

more efficient platform for capital spending in the region,

resulting in reduced operating and maintenance expenses."

CPPIB, which recently invested in Encino Acquisition Partners,

said the venture will provide "additional exposure to the

attractive North American natural gas market."

CPPIB's investment is expected to close in the second or third

quarter.

The joint venture excludes Williams's ownership interests in

Flint Gathering, Cardinal Gathering, Marcellus South Gathering,

Laurel Mountain Midstream and Blue Racer Midstream.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

March 18, 2019 18:59 ET (22:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

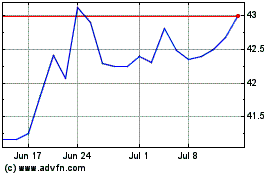

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

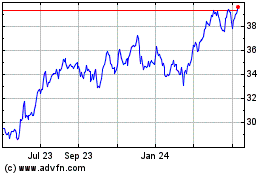

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Apr 2023 to Apr 2024