UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant

to Rule 13a-16 or 15d-16 Under the

Securities Exchange Act of 1934

February 18, 2025

Commission File Number: 001-32482

WHEATON PRECIOUS METALS CORP.

(Exact name of registrant as specified in its

charter)

Suite 3500 - 1021 West Hastings St.

Vancouver, British Columbia

V6E 0C3

(604) 684-9648

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

DOCUMENTS FILED AS PART OF THIS FORM 6-K

See the Exhibit Index to this Form 6-K.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

WHEATON PRECIOUS METALS CORP. |

|

| |

(Registrant) |

|

| |

|

|

|

| February 18,

2025 |

By: |

/s/

Curt Bernardi |

|

| |

|

Name: |

Curt

Bernardi |

|

| |

|

Title: |

Senior

Vice President, Legal |

|

| |

|

|

and

Corporate Secretary |

|

-2-

EXHIBIT INDEX

- 3 -

Exhibit 99.1

Wheaton Precious Metals Exceeds 2024 Production

Guidance and Provides 2025 and Long-Term Outlook, Projecting 40% Growth in the Next Five Years

TSX | NYSE | LSE: WPM

wheatonpm.com

VANCOUVER, BC, Feb. 18, 2025 /CNW/ - Wheaton Precious

Metals™ Corp. ("Wheaton" or the "Company") is pleased to report 2024 actual production of over 633,000 gold

equivalent ounces2 ("GEOs"), exceeding the upper end of the 2024 production guidance range of 620,000 GEOs2.

The Company also provides 2025 production guidance of 600,000 to 670,000 GEOs3 and forecasts growth of approximately 40% to

870,000 GEOs3 by 2029. Wheaton will provide full production and financial details with the release of its 2024 fourth quarter

and full year results on Thursday, March 13, 2025, after market close.

"Wheaton's diversified portfolio of high-quality,

low-cost assets had an exceptional year in 2024, exceeding the top-end of our annual production guidance range, driven by strong performances,

particularly from Salobo, which achieved record quarterly production in the fourth quarter. Moreover, we continued our corporate development

momentum with investments into four assets, further enhancing and contributing to our five-year growth profile of approximately 40%," said

Randy Smallwood, President and Chief Executive Officer of Wheaton Precious Metals. "The past year ultimately set a strong foundation

for our sector leading growth profile, which we believe will propel Wheaton to a level of precious metals production unprecedented in

the streaming industry. As the leading streaming company with the largest share of revenue derived from precious metals, we believe

Wheaton offers an optimal opportunity for long-term exposure in this sector. With a robust balance sheet and growing demand for streaming

capital, we are confident that Wheaton is strategically positioned to continue driving its industry-leading growth trajectory."

2024 Attributable Production and Sales Using 2024

Commodity Price Assumptions

| Metal |

2024

Production

Guidance |

2024

Actual

Production1 |

2024

Actual

Sales |

| Gold Ounces |

325,000 to 370,000 |

379,742 |

332,701 |

| Silver Ounces ('000s) |

18,500 to 20,500 |

20,657 |

16,072 |

| Other Metals (GEOs2) |

12,000 to 15,000 |

16,196 |

14,940 |

| Palladium Ounces |

|

15,632 |

17,270 |

| Cobalt pounds ('000s) |

|

1,289 |

970 |

| Gold Equivalent Ounces2 |

550,000 to 620,000 |

633,481 |

532,468 |

| 2024 GEOs based on: $2,000 / oz gold, $23 / oz silver, $1,000 / oz palladium, $950 / oz platinum and $13.00 / lb cobalt |

In 2024, gold equivalent production exceeded the upper

limits of the guidance range, primarily resulting from stronger than expected production at Salobo due to higher gold grades and recoveries,

and higher grades at Constancia from the mining of the Pampacancha deposit. These outperformances were partially offset by lower-than-expected

production from San Dimas and Zinkgruvan, in both instances due to lower grades.

As at December 31, 2024, approximately 163,850 GEO2's

were in produced but not yet delivered ("PBND") representing approximately three months of payable production. This build in

PBND is an increase from the preceding four quarters and at the upper end of our guided range of two to three months, due to a significant

increase in quarter-over-quarter production driven by record quarterly production at Salobo coupled with relative differences in timing

of sales.

Commodity Price Assumptions

| Metal |

Previous

2024 Forecast |

Updated

2025 Forecast |

| Gold ($ / oz) |

$ 2,000 |

$ 2,600 |

| Silver ($ / oz) |

$ 23.00 |

$ 30.00 |

| Palladium ($ / oz) |

$ 1,000 |

$ 950 |

| Platinum ($ / oz) |

$ 950 |

$ 950 |

| Cobalt ($ / lb) |

$ 13.00 |

$ 13.50 |

2025 and Long-Term Production Outlook Using 2025

Commodity Price Assumptions

| Metal |

2024

Actual

Production1 |

2025

Production

Guidance |

2029

Target

Production

Guidance |

2030-2034

Average Annual

Production

Guidance |

| Gold Ounces |

379,742 |

350,000 to 390,000 |

|

|

| Silver Ounces ('000s) |

20,657 |

20,500 to 22,500 |

|

|

| Other Metals (GEOs3) |

12,406 |

12,500 to 13,500 |

|

|

|

Gold Equivalent

Ounces3 |

630,485 |

600,000 to 670,000 |

870,000 |

Over 950,000 |

|

2025 and long-term GEOs based on $2,600

/ oz gold, $30 / oz silver, $950 / oz palladium, $950 / oz platinum, and $13.50 / lb cobalt.

For purposes of comparison, 2024 actual

production numbers have been adjusted to reflect 2025 commodity price assumptions. |

2025 Production Outlook

The midpoint of the 2024 guidance range compared to

the midpoint of the 2025 guidance range suggests year-over-year production growth of approximately 10%, in alignment with the Company's

previously stated long-term growth forecast. The Company anticipates that 2025 GEO3 production will increase from levels achieved

in 2024. This forecast growth is driven by stronger attributable production from Antamina, the start-up of several development projects,

and a stable forecast for Salobo production. This increase is expected to be largely offset by lower production from Peñasquito

and Constancia.

Attributable production is forecast to increase at

Antamina in 2025 due to expected higher silver grades, as a result of a higher ratio of copper-zinc ore versus copper-only ore being mined

in 2025. Wheaton's 2025 forecast also includes inaugural production from four projects currently in development; Blackwater, Goose, Mineral

Park and Platreef, all of which are expected to commence in 2025. In addition, the Aljustrel Mine is anticipated to re-start production

in the third quarter of 2025, following the announcement made on September 12, 2023, that as a result of low zinc prices, the production

of zinc and lead concentrates would be temporarily halted from September 24, 2023 onward. Increased production from the forementioned

assets is anticipated to be offset by lower production at Peñasquito, as mining transitions from the Chile Colorado to the main

Peñasco pit, which contains lower relative silver grades. In addition, lower production levels are anticipated at Constancia, predominantly

due to additional gold benches being mined in late 2024 that were brought forward from the 2025 plan, coupled with the expectation that

total mill ore feed from Pampacancha will be approximately 25% in 2025, lower than the typical one-third in prior years as Pampacancha

approaches depletion. After a record-breaking quarter to end 2024, production levels at Salobo are expected to remain consistent, with

higher throughput levels attributable to the Salobo III expansion project anticipated to be offset by lower gold grades.

Long-Term Production Outlook

Production is forecast to increase by approximately

40% over the next five years to 870,000 GEOs3 by 2029, due to growth from multiple Operating assets including Antamina, Aljustrel

and Marmato; Development assets that are in construction, including the Blackwater, Mineral Park, Goose, Platreef, Fenix, Kurmuk, and

Koné projects; and Pre-development assets including the El Domo4 and Copper World projects.

From 2030 to 2034, attributable production is forecast

to average over 950,000 GEOs3 annually and incorporates additional incremental production from Pre-development assets including

the Santo Domingo, Cangrejos, Kudz ze Kayah, Marathon and Kutcho projects, in addition to the Mt. Todd, Black Pine and DeLamar royalties.

Not included in Wheaton's long-term forecast and instead

classified as 'optionality', is potential future production from nine other assets including Pascua-Lama and Navidad, in addition to expansions

at Salobo outside of the Salobo III mine expansion project.

Mr. Wes Carson, P.Eng., Vice President, Mining Operations

is a "qualified person" as such term is defined under National Instrument 43-101, and has reviewed and approved the technical

information disclosed in this news release.

Fourth Quarter and Full Year 2024 Results

Wheaton will release its 2024 fourth quarter and full

year results on Thursday, March 13, 2025, after market close. A conference call will be held on Friday, March 14, 2025, starting at 8:00am

PT (11:00 am ET) to discuss these results. To participate in the live call please use one of the following methods:

Dial toll free from Canada or the US:

1-888-510-2154

Dial from outside Canada or the US: 1-437-900-0527

Pass code:

69732#

Live audio webcast: Webcast Link

Participants should dial in five to ten minutes before

the call.

The conference call will be recorded and available

until March 20, 2025 at 11:59 pm ET. The webcast will be available for one year. You can listen to an archive of the call by one of the

following methods:

Dial toll free from Canada or the US:

1-888-660-6345

Dial from outside Canada or the US: 1-646-517-4150

Pass code:

69732#

Archived audio webcast: Webcast Link

Wheaton Precious Metals' quarterly reporting for the

remainder of 2025 is scheduled to be issued, after market close, on the following dates:

Q1 2025 – Thursday, May 8, 2025

Q2 2025 – Thursday, August 7, 2025

Q3 2025 – Thursday, November 6, 2025

About Wheaton Precious Metals Corp.

Wheaton Precious Metals is the world's premier precious

metals streaming company with the highest-quality portfolio of long-life, low-cost assets. Its business model offers investors leverage

to commodity prices and exploration upside but with a much lower risk profile than a traditional mining company. Wheaton delivers amongst

the highest cash operating margins in the mining industry, allowing it to pay a competitive dividend and continue to grow through accretive

acquisitions. The Company is committed to strong ESG practices and giving back to the communities where Wheaton and its mining partners

operate. As a result, Wheaton has consistently outperformed gold and silver, as well as other mining investments. Wheaton creates sustainable

value through streaming. Wheaton's shares are listed on the Toronto Stock Exchange, New York Stock Exchange and London Stock Exchange

under the symbol WPM. Learn more about Wheaton Precious Metals at www.wheatonpm.com or follow us on social media.

End Notes

| _____________________ |

| 1 Ounces produced represent the quantity of gold, silver, palladium and cobalt contained in concentrate or doré prior to smelting or refining deductions. Production figures and average payable rates are based on information provided by the operators of the mining operations to which the silver, gold, palladium or cobalt interests relate or management estimates in those situations where other information is not available (specifically, final 2024 production information for Sudbury, Zinkgruvan, Neves-Corvo, and Los Filos is based on management estimates). Certain production figures may be updated in future periods as additional information is received. |

| 2 Gold equivalent ounces for 2024 actual production, sales and PBND are calculated by converting silver, palladium and cobalt to a gold equivalent by using the following commodity price assumptions: $2,000 per ounce gold, $23 per ounce silver, $1,000 per ounce palladium, $950 per ounce of platinum and $13.00 per pound cobalt. |

| 3 Gold equivalent forecast production for 2025 and the longer-term outlook are based on the following updated commodity price assumptions: $2,600 per ounce gold, $30 per ounce silver, $950 per ounce palladium, $950 per ounce of platinum and $13.50 per pound cobalt. For purposes of comparison, 2024 actual production numbers have been adjusted to reflect 2025 commodity price assumptions. |

| 4 El Domo references the Silvercorp owned El Domo – Curipamba Project, previously referred to as 'Curipamba'. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking

statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information"

within the meaning of applicable Canadian securities legislation concerning the business, operations and financial performance of Wheaton

and, in some instances, the business, mining operations and performance of Wheaton's Precious Metals Purchase Agreement ("PMPA")

counterparties. Forward-looking statements, which are all statements other than statements of historical fact, include, but are not limited

to, statements with respect to:

- the future price of commodities;

- the estimation of future production from the mineral stream interests

and mineral royalty interests currently owned by the Company (the "Mining Operations") (including in the estimation of production,

mill throughput, grades, recoveries and exploration potential);

- the estimation of mineral reserves and mineral resources (including

the estimation of reserve conversion rates and the realization of such estimations);

- the commencement, timing and achievement of construction, expansion

or improvement projects by Wheaton's PMPA counterparties at Mining Operations;

- the payment of upfront cash consideration to counterparties under

PMPAs, the satisfaction of each party's obligations in accordance with PMPAs and the receipt by the Company of precious metals and cobalt

production or other payments in respect of the applicable Mining Operations under PMPAs;

- the ability of Wheaton's PMPA counterparties to comply with the

terms of a PMPA (including as a result of the business, mining operations and performance of Wheaton's PMPA counterparties) and the potential

impacts of such on Wheaton;

- future payments by the Company in accordance with PMPAs, including

any acceleration of payments;

- the costs of future production;

- the estimation of produced but not yet delivered ounces;

- the future sales of Common Shares under, the amount of net proceeds

from, and the use of the net proceeds from, the at-the-market equity program;

- continued listing of the Common Shares on the LSE, NYSE and TSX;

- any statements as to future dividends;

- the ability to fund outstanding commitments and the ability to

continue to acquire accretive PMPAs;

- projected increases to Wheaton's production and cash flow profile;

- projected changes to Wheaton's production mix;

- the ability of Wheaton's PMPA counterparties to comply with the

terms of any other obligations under agreements with the Company;

- the ability to sell precious metals and cobalt production;

- confidence in the Company's business structure;

- the Company's assessment of taxes payable, including taxes payable

under the GMT, and the impact of the CRA Settlement, and the Company's ability to pay its taxes;

- possible CRA domestic audits for taxation years subsequent to

2017 and international audits;

- the Company's assessment of the impact of any tax reassessments;

- the Company's intention to file future tax returns in a manner

consistent with the CRA Settlement;

- the Company's climate change and environmental commitments; and

- assessments of the impact and resolution of various legal and

tax matters, including but not limited to audits

Generally, these forward-looking statements can be

identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts", "projects", "intends",

"anticipates" or "does not anticipate", or "believes", "potential", or variations of such words

and phrases or statements that certain actions, events or results "may", "could", "would", "might"

or "will be taken", "occur" or "be achieved". Forward-looking statements are subject to known and unknown

risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Wheaton to

be materially different from those expressed or implied by such forward-looking statements, including but not limited to:

- risks associated with fluctuations in the price of commodities

(including Wheaton's ability to sell its precious metals or cobalt production at acceptable prices or at all);

- risks related to the Mining Operations (including fluctuations

in the price of the primary or other commodities mined at such operations, regulatory, political and other risks of the jurisdictions

in which the Mining Operations are located, actual results of mining, risks associated with exploration, development, operating, expansion

and improvement at the Mining Operations, environmental and economic risks of the Mining Operations, and changes in project parameters

as Mining Operations plans continue to be refined);

- absence of control over the Mining Operations and having to rely

on the accuracy of the public disclosure and other information Wheaton receives from the owners and operators of the Mining Operations

as the basis for its analyses, forecasts and assessments relating to its own business;

- risks related to the uncertainty in the accuracy of mineral reserve

and mineral resource estimation;

- risks related to the satisfaction of each party's obligations

in accordance with the terms of the Company's PMPAs, including the ability of the companies with which the Company has PMPAs to perform

their obligations under those PMPAs in the event of a material adverse effect on the results of operations, financial condition, cash

flows or business of such companies, any acceleration of payments, estimated throughput and exploration potential;

- risks relating to production estimates from Mining Operations,

including anticipated timing of the commencement of production by certain Mining Operations;

- Wheaton's interpretation of, or compliance with, or application

of, tax laws and regulations or accounting policies and rules, being found to be incorrect or the tax impact to the Company's business

operations being materially different than currently contemplated, or the ability of the Company to pay such taxes as and when due;

- any challenge or reassessment by the CRA of the Company's tax

filings being successful and the potential negative impact to the Company's previous and future tax filings;

- risks in assessing the impact of the CRA Settlement (including

whether there will be any material change in the Company's facts or change in law or jurisprudence);

- risks related to any potential amendments to Canada's transfer

pricing rules under the Income Tax Act (Canada) that may result from the Department of Finance's consultation paper released June 6, 2023;

- risks relating to Wheaton's interpretation of, compliance with,

or application of the GMT, including Canada's GMTA and the legislation enacted in Luxembourg, that applies to the income of the Company's

subsidiaries for fiscal years beginning on or after December 31, 2023;

- counterparty credit and liquidity risks;

- mine operator and counterparty concentration risks;

- indebtedness and guarantees risks;

- hedging risk;

- competition in the streaming industry risk;

- risks relating to security over underlying assets;

- risks relating to third-party PMPAs;

- risks relating to revenue from royalty interests;

- risks related to Wheaton's acquisition strategy;

- risks relating to third-party rights under PMPAs;

- risks relating to future financings and security issuances;

- risks relating to unknown defects and impairments;

- risks related to governmental regulations;

- risks related to international operations of Wheaton and the Mining

Operations;

- risks relating to exploration, development, operating, expansions

and improvements at the Mining Operations;

- risks related to environmental regulations;

- the ability of Wheaton and the Mining Operations to obtain and

maintain necessary licenses, permits, approvals and rulings;

- the ability of Wheaton and the Mining Operations to comply with

applicable laws, regulations and permitting requirements;

- lack of suitable supplies, infrastructure and employees to support

the Mining Operations;

- risks related to underinsured Mining Operations;

- inability to replace and expand mineral reserves, including anticipated

timing of the commencement of production by certain Mining Operations (including increases in production, estimated grades and recoveries);

- uncertainties related to title and indigenous rights with respect

to the mineral properties of the Mining Operations;

- the ability of Wheaton and the Mining Operations to obtain adequate

financing;

- the ability of the Mining Operations to complete permitting, construction,

development and expansion;

- challenges related to global financial conditions;

- risks associated with environmental, social and governance matters;

- risks related to fluctuations in commodity prices of metals produced

from the Mining Operations other than precious metals or cobalt;

- risks related to claims and legal proceedings against Wheaton

or the Mining Operations;

- risks related to the market price of the Common Shares of Wheaton;

- the ability of Wheaton and the Mining Operations to retain key

management employees or procure the services of skilled and experienced personnel;

- risks related to interest rates;

- risks related to the declaration, timing and payment of dividends;

- risks related to access to confidential information regarding

Mining Operations;

- risks associated with multiple listings of the Common Shares on

the LSE, NYSE and TSX;

- risks associated with a possible suspension of trading of Common

Shares;

- risks associated with the sale of Common Shares under the at-the-market

equity program, including the amount of any net proceeds from such offering of Common Shares and the use of any such proceeds;

- equity price risks related to Wheaton's holding of long-term investments

in other companies;

- risks relating to activist shareholders;

- risks relating to reputational damage;

- risks relating to expression of views by industry analysts;

- risks related to the impacts of climate change and the transition

to a low-carbon economy;

- risks associated with the ability to achieve climate change and

environmental commitments at Wheaton and at the Mining Operations;

- risks related to ensuring the security and safety of information

systems, including cyber security risks;

- risks relating to generative artificial intelligence;

- risks relating to compliance with anti-corruption and anti-bribery

laws;

- risks relating to corporate governance and public disclosure compliance;

- risks of significant impacts on Wheaton or the Mining Operations

as a result of an epidemic or pandemic;

- risks related to the adequacy of internal control over financial

reporting; and

- other risks discussed in the section entitled "Description

of the Business – Risk Factors" in Wheaton's Annual Information Form available on SEDAR+ at www.sedarplus.ca and Wheaton's

Form 40-F for the year ended December 31, 2023 on file with the U.S. Securities and Exchange Commission on EDGAR (the "Disclosure").

Forward-looking statements are based on assumptions

management currently believes to be reasonable, including (without limitation):

- that there will be no material adverse change in the market price

of commodities;

- that the Mining Operations will continue to operate and the mining

projects will be completed in accordance with public statements and achieve their stated production estimates;

- that the mineral reserves and mineral resource estimates from

Mining Operations (including reserve conversion rates) are accurate;

- that public disclosure and other information Wheaton receives

from the owners and operators of the Mining Operations is accurate and complete;

- that the production estimates from Mining Operations are accurate;

- that each party will satisfy their obligations in accordance with

the PMPAs;

- that Wheaton will continue to be able to fund or obtain funding

for outstanding commitments;

- that Wheaton will be able to source and obtain accretive PMPAs;

- that the terms and conditions of a PMPA are sufficient to recover

liabilities owed to the Company;

- that Wheaton has fully considered the value and impact of any

third-party interests in PMPAs;

- that expectations regarding the resolution of legal and tax matters

will be achieved (including CRA audits involving the Company);

- that Wheaton has properly considered the application of Canadian

tax laws to its structure and operations and that Wheaton will be able to pay taxes when due;

- that Wheaton has filed its tax returns and paid applicable taxes

in compliance with Canadian tax laws;

- that Wheaton's application of the CRA Settlement is accurate (including

the Company's assessment that there has been no material change in the Company's facts or change in law or jurisprudence);

- that Wheaton's assessment of the tax exposure and impact on the

Company and its subsidiaries of the implementation of a 15% global minimum tax is accurate;

- that any sale of Common Shares under the at-the-market equity

program will not have a significant impact on the market price of the Common Shares and that the net proceeds of sales of Common Shares,

if any, will be used as anticipated;

- that the trading of the Common Shares will not be adversely affected

by the differences in liquidity, settlement and clearing systems as a result of multiple listings of the Common Shares on the LSE, the

TSX and the NYSE;

- that the trading of the Company's Common Shares will not be suspended;

- the estimate of the recoverable amount for any PMPA with an indicator

of impairment;

- that neither Wheaton nor the Mining Operations will suffer significant

impacts as a result of an epidemic or pandemic; and

- such other assumptions and factors as set out in the Disclosure.

There can be no assurance that forward-looking statements

will prove to be accurate and even if events or results described in the forward-looking statements are realized or substantially realized,

there can be no assurance that they will have the expected consequences to, or effects on, Wheaton. Readers should not place undue reliance

on forward-looking statements and are cautioned that actual outcomes may vary. The forward-looking statements included herein are for

the purpose of providing readers with information to assist them in understanding Wheaton's expected financial and operational performance

and may not be appropriate for other purposes. Any forward-looking statement speaks only as of the date on which it is made, reflects

Wheaton's management's current beliefs based on current information and will not be updated except in accordance with applicable securities

laws. Although Wheaton has attempted to identify important factors that could cause actual results, level of activity, performance or

achievements to differ materially from those contained in forward-looking statements, there may be other factors that cause results, level

of activity, performance or achievements not to be as anticipated, estimated or intended.

View original content:https://www.prnewswire.com/news-releases/wheaton-precious-metals-exceeds-2024-production-guidance-and-provides-2025-and-long-term-outlook-projecting-40-growth-in-the-next-five-years-302379461.html

SOURCE Wheaton Precious Metals Corp.

View original content: http://www.newswire.ca/en/releases/archive/February2025/18/c7246.html

%CIK: 0001323404

For further information: For further information: Investor Contact,

Emma Murray, Vice President, Investor Relations, Tel: 1-844-288-9878, Email: info@wheatonpm.com

CO: Wheaton Precious Metals Corp.

CNW 17:00e 18-FEB-25

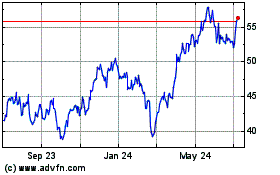

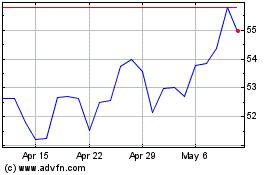

Wheaton Precious Metals (NYSE:WPM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Wheaton Precious Metals (NYSE:WPM)

Historical Stock Chart

From Feb 2024 to Feb 2025