WEX Signs Agreement to Acquire Discovery Benefits

January 17 2019 - 6:30AM

Business Wire

- Advances WEX’s employee benefits

platform with the addition of one of the fastest-growing solutions

providers in the marketplace

- Complements WEX’s technology platform

with leading benefits account technology

WEX (NYSE:WEX), a leading financial technology service provider,

today announced the signing of an agreement to acquire Discovery

Benefits, Inc. (DBI), a high-growth employee benefits administrator

to more than one million consumers across all 50 states. DBI plays

a key role in the consumer-directed healthcare ecosystem by

offering account administration technology and services.

DBI has been a well-established partner of WEX’s Health division

for more than a decade, trusting WEX’s proven healthcare technology

platform to manage a portion of its consumer-directed account

administration. This acquisition will combine one of the industry’s

fastest-growing benefits administrators—known for its leading

benefits account technology—with WEX’s dynamic, cloud-based

technology platform. The acquisition is expected to accelerate

WEX’s growth rate, provide partners and customers with a more

comprehensive suite of products and services, and expand the

Company’s diverse go-to-market channels to include consulting firms

and brokers.

“The acquisition of Discovery Benefits enhances WEX’s position

as a leading technology platform in the healthcare space and aligns

with our longer-term strategy to further reduce exposure to

macroeconomic forces,” said Melissa Smith, CEO of WEX. “This

combination strengthens our overall value proposition through new

partnerships, integrated products, and the opportunity to offer a

more comprehensive set of solutions. We are excited to extend our

reach into the rapidly-growing employee benefits market and look

forward to building on our track record of success in the

healthcare space.”

According to the latest research from Devenir on the top 20 HSA

providers, DBI is the fastest-growing provider. The company

generated approximately $100 million in revenue during 2018. Under

the terms of the agreement, WEX will pay a total cash consideration

of approximately $425 million, including $50 million which will be

deferred until January of 2020. In addition, the transaction is

expected to generate approximately $50 million in net present value

of tax benefits. WEX is in advanced discussions with its

relationship banks to expand available borrowing capacity and

expects to announce further details regarding these arrangements in

the near future. The sellers of DBI will also retain an equity

interest of approximately 5% of the entity resulting from the

combination of WEX’s Health division and Discovery Benefits. WEX

expects the acquisition to be immaterial to adjusted net income in

year one and yield approximately $15 million in annual run-rate

synergies within the first 24 months following the close of the

transaction. The transaction is expected to close in the first

quarter of 2019, subject to regulatory approvals and other

customary closing conditions.

About WEX

Powered by the belief that complex payment systems can be made

simple, WEX (NYSE: WEX) is a leading financial technology service

provider across a wide spectrum of sectors, including fleet, travel

and healthcare. WEX operates in more than 10 countries and in more

than 20 currencies through more than 3,500 associates around the

world. WEX fleet cards offer 11.5 million vehicles exceptional

payment security and control; purchase volume in its travel and

corporate solutions grew to $30.3 billion in 2017; and the WEX

Health financial technology platform helps 300,000 employers and

more than 25 million consumers better manage healthcare expenses.

For more information, visit www.wexinc.com.

Safe Harbor Statement

Certain matters discussed in this press release are

"forward-looking statements" intended to qualify for the safe

harbors from liability established by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements can

generally be identified as such by the context of the statements,

including words such as “believe,” “expect,” “anticipate,” “plan,”

“may,” “would,” “intend,” “estimate,” “guidance” and other similar

expressions, whether in the negative or affirmative, although not

all forward-looking statements contain such words. These

forward-looking statements are based on current expectations,

estimates, forecasts and projections about the industry and markets

in which the Company operates and management’s beliefs and

assumptions. There can be no assurance that the benefits of the

proposed acquisition will: be successful in accelerating the

Company’s growth rate; increase the Company’s product suite; be

successful in expanding capacity; achieve expected financial

results with regard to accretion; achieve synergy targets; close at

all or in the first quarter of 2019; or, enable advanced partner or

customer offerings. The Company cannot guarantee that it actually

will achieve the financial results, plans, intentions, expectations

or guidance disclosed in the forward-looking statements made. Such

forward-looking statements involve a number of risks and

uncertainties, any one or more of which could cause actual results

to differ materially from those described in such forward-looking

statements. Such risks and uncertainties include or relate to,

among other things: the effects of general economic conditions on

fueling patterns as well as payment and transaction processing

activity; the impact of foreign currency exchange rates on the

Company’s operations, revenue and income; changes in interest

rates; the impact of fluctuations in fuel prices; the effects of

the Company’s business expansion and acquisition efforts; potential

adverse changes to business or employee relationships, including

those resulting from the completion of an acquisition; competitive

responses to any acquisitions; uncertainty of the expected

financial performance of the combined operations following

completion of an acquisition; the ability to successfully integrate

the Company's acquisitions; the ability to realize anticipated

synergies and cost savings; unexpected costs, charges or expenses

resulting from an acquisition; the Company's failure to

successfully operate and expand ExxonMobil's European and Asian

commercial fuel card programs; the failure of corporate investments

to result in anticipated strategic value; the impact and size of

credit losses; the impact of changes to the Company's credit

standards; breaches of the Company’s technology systems or those of

third-party service providers and any resulting negative impact on

the Company’s reputation, liabilities or relationships with

customers or merchants; the Company’s failure to maintain or renew

key agreements; failure to expand the Company’s technological

capabilities and service offerings as rapidly as the Company’s

competitors; failure to successfully implement the Company’s

information technology strategies and capabilities in connection

with its technology outsourcing and insourcing arrangements and any

resulting cost associated with that failure; the actions of

regulatory bodies, including banking and securities regulators, or

possible changes in banking or financial regulations impacting the

Company’s industrial bank, the Company as the corporate parent or

other subsidiaries or affiliates; the impact of the Company’s

outstanding notes on its operations; the impact of increased

leverage on the Company's operations, results or borrowing capacity

generally, and as a result of acquisitions specifically; the

incurrence of impairment charges if the Company’s assessment of the

fair value of certain reporting units changes; the uncertainties of

litigation; as well as other risks and uncertainties identified in

Item 1A of the Company’s Annual Report for the year ended December

31, 2017, filed on Form 10-K with the Securities and Exchange

Commission on March 1, 2018.

The Company's forward-looking statements do not reflect the

potential future impact of any alliance, merger, acquisition,

disposition or stock repurchases. The forward-looking statements

speak only as of the date of this press release and undue reliance

should not be placed on these statements. The Company disclaims any

obligation to update any forward-looking statements as a result of

new information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190117005121/en/

Media Contact:Rob

Gould1-207-523-7429robert.gould@wexinc.comInvestor

Contact:Steve Eldersteve.elder@wexinc.com207.523.7769

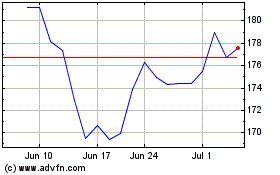

WEX (NYSE:WEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

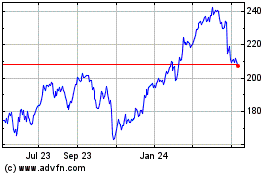

WEX (NYSE:WEX)

Historical Stock Chart

From Apr 2023 to Apr 2024