By Brian Spegele, Sha Hua and Aruna Viswanatha

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 20, 2020).

A media company linked to former Trump political adviser Steve

Bannon and exiled Chinese businessman Guo Wengui raised more than

$300 million in a private offering this spring that is now being

investigated by federal and state authorities, say people familiar

with the matter.

JPMorgan Chase & Co. and Wells Fargo & Co. have frozen

accounts tied to fundraising for the company, GTV Media Group, some

of these people said. Bank of America Corp. also closed an account

for GTV Media's parent company shortly after it was opened in

recent months, another person with knowledge of the situation

said.

The federal probe is being conducted by the Federal Bureau of

Investigation and the Securities and Exchange Commission, people

familiar with the investigation said. The investigators have been

examining whether GTV Media or associates of Mr. Guo violated

securities laws through the private share placement. The New York

state attorney general's office has also been examining the matter,

these people said.

Soon after the fundraising, some investors began pushing for

refunds after they said they never received official documentation

verifying their investments in GTV Media, among other issues that

led them to distrust Mr. Guo.

Mr. Guo, a former property tycoon who is now one of China's

most-wanted fugitives, and Mr. Bannon were two of the key people

behind GTV Media's launch this spring, according to a company

fundraising document and interviews. The document identifies Mr.

Bannon as a company director, while Mr. Guo served as the public

face for its fundraising. Associates of Mr. Guo are listed as GTV

Media executives, while Mr. Guo is described as a company

adviser.

Messrs. Guo and Bannon joined forces in the last few years as

tough critics of China's Communist Party, and recently have been

spending significant time together on Mr. Guo's yacht, according to

videos posted on a website affiliated with Mr. Guo. Mr. Guo faces

accusations of wrongdoing in China including bribery, fraud and

money laundering -- allegations he has denied.

GTV Media said in a statement that it had carried out the

private placement under the guidance of its lawyers and that "all

of the raised funds are intact."

The company added that it is fully prepared to cooperate with

any U.S. agency that has questions about the private placement or

its business.

A representative for Mr. Guo didn't provide comment, and Mr.

Bannon declined to comment.

The FBI had been examining Mr. Guo's work with Mr. Bannon even

before the private placement this spring. The Wall Street Journal,

citing people familiar with the matter, reported last month that

FBI agents had been investigating Mr. Guo and the money he used to

fund his media efforts in the U.S. for more than six months and

that prosecutors from the U.S. attorney's offices in Manhattan and

Brooklyn had been involved in the probe.

At that time, representatives for Messrs. Guo and Bannon said

neither man had been contacted by the FBI as part of the probe.

Earlier this month, Mr. Guo said in an online video that he had

been subpoenaed and that he welcomed authorities' probes. A lawyer

for Mr. Guo didn't provide comment on what information the

subpoenas were seeking and whether Mr. Guo had complied with

them.

Since fleeing China for the U.S. in 2014, Mr. Guo built a large

following online, particularly among the Chinese diaspora in the

U.S. and elsewhere, and has alleged high-level corruption in

China's Communist Party. He has also applied for asylum.

GTV Media sought to capitalize off that popularity. One

fundraising document reviewed by the Journal said the venture aimed

to be "the only uncensored and independent bridge between China and

the Western world."

The company told potential investors it would be a platform for

news, social media and e-commerce, with competitors including

Amazon.com Inc., Tencent Holdings Ltd.'s WeChat and ByteDance

Ltd.'s TikTok. A fundraising memo for potential investors this

spring didn't include a detailed business plan for GTV Media. It

stated a pre-investment valuation of $1.8 billion.

The company identified Mr. Bannon as one of several prominent

directors. Others included hedge-fund manager and China critic Kyle

Bass, Texas venture capitalist Darren Blanton and John A. Morgan,

the son of Morgan Stanley's co-founder.

Mr. Bass said on Twitter in July that he was no longer serving

on GTV Media's board, and a person familiar with the company

confirmed he had resigned. Mr. Blanton didn't respond to requests

for comment. Mr. Morgan couldn't be reached.

The fundraising documents reviewed by the Journal say GTV Media

aimed to sell a 10% stake in the company for as much as $200

million, with the rest held by another company affiliated with Mr.

Guo.

Mr. Guo said in an online video in June that GTV Media had

raised more than $300 million, with demand for shares exceeding

expectations.

GTV Media didn't register the deal with the SEC. To avoid

registration, companies generally must sell shares only to wealthy

"accredited investors" who meet requirements such as having more

than $1 million in assets, excluding the value of a primary

residence, or earning more than $200,000 a year. GTV Media said it

sought to sell shares to such accredited investors.

Spokespeople for the SEC, the FBI field office in New York, the

Manhattan U.S. attorney's office and New York state attorney

general declined to comment.

It couldn't be determined how much money is in the accounts

linked to GTV Media. A Chase account for GTV Media collected funds

from investors willing to give at least $100,000 to GTV Media,

according to documents reviewed by the Journal.

Separately, smaller investors were told they could invest in the

GTV Media offering through another entity called Voice of Guo Media

Inc. Several of these investors said they were told that the money

sent to Voice of Guo Media would be invested in GTV Media on their

behalf.

Mr. Guo said in June that Voice of Guo Media had raised nearly

$120 million. That company didn't respond to requests for comment.

GTV Media said in its statement that it didn't issue shares to

anyone through Voice of Guo Media.

SEC investigators have been reaching out to conduct interviews

with investors who are now pushing GTV Media or Voice of Guo Media

to refund their money and are lodging complaints about Mr. Guo and

his associates, some of the people familiar with the matter

said.

The Journal reviewed documentation from investors including

copies of bank transfers, shareholder agreements and text

messages.

As U.S.-China relations have soured during the Trump

administration, Mr. Guo has proven divisive among U.S. critics of

China. Some such as Mr. Bannon have aligned themselves with Mr.

Guo, while others say they distrust him. The FBI previously viewed

Mr. Guo as a potential agency informant and tried unsuccessfully to

cultivate him as one around 2017, say people familiar with the

matter.

Some have openly questioned Mr. Guo's loyalty to the U.S. In

2018, a company affiliated with Mr. Guo hired Virginia-based

research firm Strategic Vision to investigate individuals Mr. Guo

said were tied to top Chinese Communist Party officials, according

to court filings.

Strategic Vision had issues with the request and accused Mr. Guo

of being a "dissident-hunter" for China. The contract between the

companies is now in litigation.

A lawyer for Mr. Guo has denied those claims, saying in a

previous statement to the Journal: "Mr. Guo is the most-wanted

dissident worldwide by the Chinese Communist Party and has been

their most outspoken and vitriolic critic since his arrival in the

United States."

A New York state court on June 28 dismissed a lawsuit filed by

Mr. Guo against Dow Jones & Co., publisher of the Journal, over

its reporting about the litigation between Strategic Vision and the

Guo-linked entity. Mr. Guo has indicated he plans to appeal.

The recent fundraising has also drawn scrutiny abroad. In

Taiwan, local news media reported that police had prevented one

supporter of Mr. Guo from transferring $43,000 to Voice of Guo

because they suspected financial fraud. In New Zealand, dozens of

protesters criticized a decision by Australia and New Zealand

Banking Group Ltd., or ANZ, to block transfers worth $2 million to

GTV Media, according to another local news-media report. ANZ

declined to comment.

Mr. Guo has complained online about banks blocking transfers,

alleging they are under the influence of China's Communist

Party.

Rebecca Davis O'Brien and Dave Michaels contributed to this

article.

Write to Brian Spegele at brian.spegele@wsj.com, Sha Hua at

sha.hua@wsj.com and Aruna Viswanatha at

Aruna.Viswanatha@wsj.com

(END) Dow Jones Newswires

August 20, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

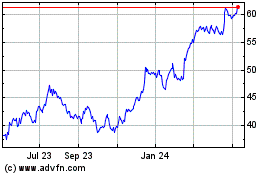

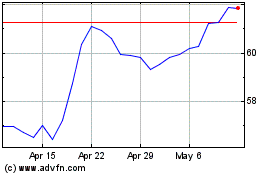

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024