By Ben Eisen

Wells Fargo & Co. is slashing costs, cutting staff and

tightening up on lending to ride out the coronavirus recession. Its

rivals might not be too far behind.

The fourth-largest U.S. lender entered the pandemic in worse

shape than its peers. The bank is still clawing its way back from a

2016 fake-account scandal that put it on the wrong side of

customers and regulators. Revenue has fallen for two years in a

row, and the bank recently reported its first quarterly loss since

2008.

"We have not done what is necessary to run an efficient

company," Chief Executive Charles Scharf said in a memo to

employees this month.

Wells's unique mix of challenges is forcing it to cut costs

first, but it might not be the last. The bank's approach to

belt-tightening could offer some clues about what is to come for

the rest of the industry.

Other big banks cut billions of dollars in costs and laid off

thousands of employees in the wake of the last financial crisis,

putting them in a better position to withstand this one. Some have

pledged not to lay off employees in 2020. Whether they are forced

to make cuts later on will depend on the length and severity of the

recession.

Some are already trimming costs. Goldman Sachs Group Inc. has

been hiring employees in cheaper states like Texas and Utah and is

now weighing an expansion of its money-management arm into South

Florida, people familiar with the matter said. JPMorgan Chase &

Co. has tightened standards around some of its home loans. Truist

Financial Corp. said it cut staff and closed branches last

quarter.

Wells Fargo never substantially laid off employees after the

financial crisis. Now it is entering its own lean period.

Mr. Scharf said this month that Wells Fargo needed to trim at

least $10 billion in annual costs to line up with its peers, a move

that executives say will include layoffs in nearly every corner of

the bank. Layoff counts haven't been finalized and likely won't

take place all at once, but are expected to number in the tens of

thousands in all, according to people familiar with the matter.

At the end of 2019, Wells Fargo had almost 260,000 employees,

the most of the four largest U.S. banks, despite having the least

in assets. Wells Fargo's expenses have made up a larger share of

revenue than that of its rivals.

Loan losses could prove to be the biggest long-term cost to

banks. The largest have collectively set aside tens of billions of

dollars in preparation over the past six months. Wells Fargo has

less capacity to handle defaults, as well as less flexibility to

extend credit because of a cap on its asset growth set by the

Federal Reserve in 2018.

As the pandemic took hold this spring, Wells Fargo was early and

aggressive in tightening credit. The bank made it tougher for some

homeowners to refinance large mortgages in April. It stopped

accepting new applications for personal lines of credit in May.

Around the same time, it cut off auto lending through the majority

of its independent car-dealership clients. It said it wouldn't take

new private student-loan customers for the coming academic year,

starting this month.

"We're trying not to look back on this period of time and regret

the loans that we made," Chief Financial Officer John Shrewsberry

said on a call with reporters this month after the bank disclosed

earnings. (The bank later said Mr. Shrewsberry would retire after

22 years at the bank and six years as CFO.)

Wells Fargo also has tightened standards around the new

commercial loans it extends, raising the bar for making loans to

even its longtime customers, people familiar with the matter said.

It already has broad exposure to a swath of hard-hit industries

such as oil and gas. More than a quarter of its commercial loan

portfolio is in real estate, an area where the bank is already

seeing higher charge-offs.

Mr. Scharf became CEO last fall with a mandate to improve the

bank's standing with regulators and turn around its operations. He

brought with him a strategy he used in his prior job as CEO of Bank

of New York Mellon Corp., where he streamlined management, laid off

employees and consolidated office space.

The bank recently hired Mike Santomassimo, one of Mr. Scharf's

key lieutenants at BNY Mellon who helped carry out cost cuts. Mr.

Santomassimo will take over as CFO at Wells Fargo in the fall.

Wells Fargo recently started a group tasked with ensuring that

staffing decisions fulfill all regulatory requirements, according

to people familiar with the matter. Major staffing decisions are

being sent through that committee, though they are ultimately

approved by the operating committee and board of directors.

At the bank, changes are visible in the day-to-day. Managers are

being instructed to hire workers in cheaper hubs like Minneapolis

and Charlotte, N.C.; a separate layer of human-resources approval

is required to hire in expensive cities, like its home base of San

Francisco, according to people familiar with the matter.

Mr. Scharf has said that managers must have at least seven

direct reports, a change aimed at thinning the ranks of middle

management, according to people familiar with the matter. If they

don't meet the minimum, their employees are reassigned.

Efforts to remake the bank in part reflect the new CEO's focus

on the nitty-gritty of corporate operations.

Mr. Scharf has made no secret of his disdain for the company's

performance-review process. In a shift, all employees were

subjected to a midyear review that assigns them a rating between

one and five, people familiar with the matter said. In the past,

some managers were known to copy and paste prior reviews when

grading their direct reports, some of the people said.

Liz Hoffman contributed to this article.

Write to Ben Eisen at ben.eisen@wsj.com

(END) Dow Jones Newswires

July 25, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

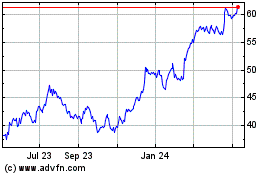

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

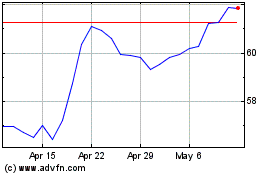

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024