Wells Fargo Curtails Jumbo Loans Amid Market Turmoil

April 04 2020 - 6:31PM

Dow Jones News

By Ben Eisen

Wells Fargo & Co. substantially curtailed its program for

making large loans this week, one of the most pronounced signs yet

of how the recent market turmoil is cutting off access to some

types of mortgages.

America's largest mortgage lender will only refinance jumbo

mortgages for customers who hold at least $250,000 in liquid assets

with the bank, according to a bank spokesman. The change is

effective immediately.

That means that a customer who already has a jumbo loan with

Wells Fargo can't refinance to take advantage of falling rates

unless they keep money with the bank. The bank hasn't changed

policies for loans used to purchase properties.

A jumbo loan is one considered too big to be sold to government

mortgage corporations Fannie Mae and Freddie Mac. In most markets,

it must be larger than $510,400 this year, but in the highest-cost

areas it must be larger than $765,600.

Wells Fargo extended more residential mortgages than any other

lender last year, according to industry-research group Inside

Mortgage Finance. It was also the biggest lender for jumbo loans,

extending some $70 billion of them in 2019.

Conventional loans that are guaranteed by Fannie Mae or Freddie

Mac are still widely available. But loans without government

backing, like jumbo loans, have been harder to come by during the

recent market fluctuations because there has been limited appetite

for investors to buy these loans.

Reflecting this, the average interest rate on a 30-year jumbo

mortgage on Friday was 3.86%, well above the 3.44% on a conforming

mortgage, according to indexes kept by Optimal Blue LLC. These are

typically closely aligned during more normal periods.

Some banks don't sell jumbo loans to investors, but rather keep

them on their balance sheets. Wells Fargo faces limitations on its

ability to do so. Since 2018, the Federal Reserve has capped the

bank's total assets because of risk-management failures tied to its

fake-accounts scandal. That gives it limited flexibility to make

loans that it holds onto.

"These difficult business decisions reflect efforts to

prioritize how we serve customers and maintain prudent balance

sheet discipline," the bank spokesman said Saturday.

The bank also said earlier this week that it would stop

purchasing all jumbo loans made by third-party mortgage bankers.

Its third-party mortgage business, known as correspondent lending,

amounted to about one fifth of its total business in the final

three months of 2019, according to Inside Mortgage Finance.

Write to Ben Eisen at ben.eisen@wsj.com

(END) Dow Jones Newswires

April 04, 2020 18:16 ET (22:16 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

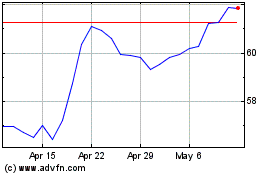

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

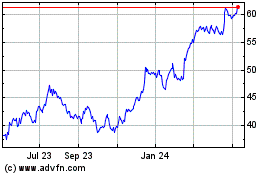

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024