Q3 Direct Retail Net Revenue Growth of 36% Year

over Year to $2.3 billion

19.1 million Active Customers, up 38% Year over

Year

Wayfair Inc. (NYSE: W), one of the world’s largest online

destinations for the home, today reported financial results for its

third quarter ended September 30, 2019.

Third Quarter 2019 Financial

Highlights

- Direct Retail net revenue, consisting of sales generated

primarily through Wayfair’s sites, increased $607.2 million to $2.3

billion, up 35.9% year over year

- Gross profit was $539.9 million or 23.4% of total net

revenue

- GAAP net loss was $272.0 million

- Adjusted EBITDA was $(144.2) million or (6.3)% of total net

revenue

- GAAP basic and diluted net loss per share was $2.94

- Non-GAAP diluted net loss per share was $2.23

- Non-GAAP free cash flow was $(180.9) million

- At the end of the third quarter, cash, cash equivalents, and

short-term and long-term investments totaled $1.3 billion

"We are pleased to report Q3 Direct Retail net revenue growth of

$607 million up 36 percent year over year. This period of strong

growth took place, despite some short-term tariff related

volatility. We could not be more confident in the future growth of

the business," noted Niraj Shah, CEO, co-founder and co-chairman,

Wayfair. "Our business continues to benefit from meaningful long

term investments that directly and dramatically impact the customer

experience further propelled by a massive structural shift in

shopping behavior from offline to online. To further cement our

leadership position and growth trajectory, we have continued to

expand our logistics network to meet a high level of customer

demand in both North America and Europe and, among other

initiatives, are driving deeper penetration in emerging category

opportunities across the business. We are excited for the upcoming

holiday season, and expect to continue to disrupt the current

retail landscape through innovative solutions to traditional

customer pain points as we solidify Wayfair's position as the best

place to shop across all home-related categories."

Other Third Quarter

Highlights

- The number of active customers in our Direct Retail business

reached 19.1 million as of September 30, 2019, an increase of 37.6%

year over year

- LTM net revenue per active customer was $449 as of September

30, 2019, an increase of 1.4% year over year

- Orders per customer, measured as LTM orders divided by active

customers, was 1.85 for the third quarter of 2019, compared to 1.84

for the third quarter of 2018

- Repeat customers placed 67.3% of total orders in the third

quarter of 2019, compared to 66.3% in the third quarter of

2018

- Repeat customers placed 6.1 million orders in the third quarter

of 2019, an increase of 33.6% year over year

- Orders delivered in the third quarter of 2019 were 9.1 million,

an increase of 31.5% year over year

- Average order value was $252 for the third quarter of 2019,

compared to $244 for the third quarter of 2018

- In the third quarter of 2019, 53.8% of total orders delivered

for our Direct Retail business were placed via a mobile device,

compared to 49.4% in the third quarter of 2018

Webcast and Conference

Call

Wayfair will host a conference call and webcast to discuss its

third quarter 2019 financial results today at 8 a.m. (ET).

Investors and participants can access the call by dialing (833)

286-5803 in the U.S. and (647) 689-4448 internationally. The

passcode for the conference line is 6381388. The call will also be

available via live webcast at investor.wayfair.com along with

supporting slides. An archive of the webcast conference call will

be available shortly after the call ends. The archived webcast will

be available at investor.wayfair.com.

About Wayfair

Wayfair believes everyone should live in a home they love.

Through technology and innovation, Wayfair makes it possible for

shoppers to quickly and easily find exactly what they want from a

selection of more than 14 million items across home furnishings,

décor, home improvement, housewares and more. Committed to

delighting its customers every step of the way, Wayfair is

reinventing the way people shop for their homes - from product

discovery to final delivery.

The Wayfair family of sites includes:

- Wayfair - Everything home for every budget.

- Joss & Main - Stylish designs to discover daily.

- AllModern - The best of modern, priced for real life.

- Birch Lane - Classic home. Comfortable cost.

- Perigold - The widest-ever selection of luxury home

furnishings.

Wayfair generated $8.6 billion in net revenue for the twelve

months ended September 30, 2019. Headquartered in Boston,

Massachusetts with operations throughout North America and Europe,

the company employs more than 16,000 people.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of federal and state securities laws. All statements

other than statements of historical fact contained in this press

release, including statements regarding the strength of our product

offering, the expansion of our logistics network, our future

results of operations and financial position, our business strategy

and our plans and objectives of management for future operations,

are forward-looking statements. In some cases, you can identify

forward-looking statements by terms such as "may," "will,"

"should," "expects," "plans," "anticipates," "could," "intends,"

"target," "projects," "contemplates," "believes," "estimates,"

"predicts," "potential" or "continue" or the negative of these

terms or other similar expressions.

Forward-looking statements are based on current expectations of

future events. We cannot guarantee that any forward-looking

statement will be accurate, although we believe that we have been

reasonable in our expectations and assumptions. Investors should

realize that if underlying assumptions prove inaccurate or that

known or unknown risks or uncertainties materialize, actual results

could vary materially from our expectations and projections.

Investors are therefore cautioned not to place undue reliance on

any forward-looking statements. These forward-looking statements

speak only as of the date of this press release and, except as

required by applicable law, we undertake no obligation to publicly

update or revise any forward-looking statements contained herein,

whether as a result of any new information, future events or

otherwise.

A list and description of risks, uncertainties and other factors

that could cause or contribute to differences in our results can be

found in our filings with the Securities and Exchange Commission,

including our most recent Annual Report on Form 10-K and subsequent

filings. We qualify all of our forward-looking statements by these

cautionary statements.

Non-GAAP Financial

Measures

To supplement our unaudited consolidated and condensed financial

statements presented in accordance with generally accepted

accounting principles ("GAAP"), this earnings release and the

accompanying tables and the related earnings conference call

contain certain non-GAAP financial measures, including Adjusted

EBITDA, Adjusted EBITDA as a percentage of total net revenue

("Adjusted EBITDA Margin"), free cash flow and non-GAAP net loss

and diluted net loss per share. We use these non-GAAP financial

measures internally in analyzing our financial results and believe

they are useful to investors, as a supplement to GAAP measures, in

evaluating our ongoing operational performance. We have provided a

reconciliation of these non-GAAP financial measures to the most

directly comparable GAAP financial measure in this earnings

release.

Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP

financial measures that are calculated as income (loss) before

depreciation and amortization, equity-based compensation and

related taxes, interest and other income and expense, (benefit

from) provision for income taxes, and non-recurring items. We have

included Adjusted EBITDA and Adjusted EBITDA Margin in this

earnings release because they are key measures used by our

management and our board of directors to evaluate our operating

performance, generate future operating plans and make strategic

decisions regarding the allocation of capital. In particular, the

exclusion of certain expenses in calculating Adjusted EBITDA and

Adjusted EBITDA Margin facilitates operating performance

comparisons on a period-to-period basis and, in the case of

exclusion of the impact of equity-based compensation and related

taxes, excludes an item that we do not consider to be indicative of

our core operating performance. Investors should, however,

understand that equity-based compensation will be a significant

recurring expense in our business and an important part of the

compensation provided to our employees. Accordingly, we believe

that Adjusted EBITDA and Adjusted EBITDA Margin provide useful

information to investors and others in understanding and evaluating

our operating results in the same manner as our management and

board of directors.

Free cash flow is a non-GAAP financial measure that is

calculated as net cash (used in) provided by operating activities

less net cash used to purchase property and equipment and site and

software development costs. We believe free cash flow is an

important indicator of our business performance, as it measures the

amount of cash we generate. Accordingly, we believe that free cash

flow provides useful information to investors and others in

understanding and evaluating our operating results in the same

manner as our management.

Non-GAAP diluted net loss per share is a non-GAAP financial

measure that is calculated as GAAP net loss plus equity-based

compensation expense and related taxes, (benefit from) provision

for income taxes, and non-recurring items divided by weighted

average shares. We believe that adding back equity-based

compensation expense and related taxes and (benefit from) provision

for income taxes, and non-recurring items as adjustments to our

GAAP diluted net loss before calculating per share amounts for all

periods presented provides a more meaningful comparison between our

operating results from period to period.

We calculate forward-looking non-GAAP Adjusted EBITDA based on

internal forecasts that omit certain amounts that would be included

in forward-looking GAAP net loss. We do not attempt to provide a

reconciliation of forward-looking non-GAAP Adjusted EBITDA guidance

to forward looking GAAP net loss because forecasting the timing or

amount of items that have not yet occurred and are out of the

Company’s control is inherently uncertain and unavailable without

unreasonable efforts. Further, we believe that such reconciliations

would imply a degree of precision and certainty that could be

confusing to investors. Such items could have a substantial impact

on GAAP measures of financial performance.

We do not, nor do we suggest that investors should, consider

such non-GAAP financial measures in isolation from, or as a

substitute for, financial information prepared in accordance with

GAAP. Investors should also note that the non-GAAP financial

measures we use may not be the same non-GAAP financial measures,

and may not be calculated in the same manner, as that of other

companies, including other companies in our industry.

The following table reflects the reconciliation of net loss to

Adjusted EBITDA and Adjusted EBITDA Margin for each of the periods

indicated (in thousands):

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Reconciliation of Adjusted

EBITDA

Net loss

$

(272,035

)

$

(151,726

)

$

(654,362

)

$

(360,235

)

Depreciation and amortization

50,250

32,544

134,172

87,426

Equity-based compensation and related

taxes

65,275

36,317

173,963

95,074

Interest expense, net

14,432

7,066

33,922

18,269

Other (income), net

(2,182

)

(1,054

)

(5,582

)

(2,661

)

Provision for income taxes

76

448

1,502

953

Adjusted EBITDA

$

(144,184

)

$

(76,405

)

$

(316,385

)

$

(161,174

)

Net revenue

$

2,305,487

$

1,705,645

$

6,593,567

$

4,765,170

Adjusted EBITDA Margin

(6.3

)%

(4.5

)%

(4.8

)%

(3.4

)%

The following table presents Adjusted EBITDA attributable to our

segments, and the reconciliation of net loss to consolidated

Adjusted EBITDA is presented in the preceding table (in

thousands):

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Segment Adjusted EBITDA

U.S.

$

(62,878

)

$

(26,036

)

$

(91,002

)

$

(26,774

)

International

(81,306

)

(50,369

)

(225,383

)

(134,400

)

Adjusted EBITDA

$

(144,184

)

$

(76,405

)

$

(316,385

)

$

(161,174

)

A reconciliation of GAAP net loss to non-GAAP diluted net loss,

the most directly comparable GAAP financial measure, in order to

calculate non-GAAP diluted net loss per share, is as follows (in

thousands, except per share data):

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Net loss

$

(272,035

)

$

(151,726

)

$

(654,362

)

$

(360,235

)

Equity-based compensation and related

taxes

65,275

36,317

173,963

95,074

Provision for income taxes

76

448

1,502

953

Non-GAAP net loss

$

(206,684

)

$

(114,961

)

$

(478,897

)

$

(264,208

)

Non-GAAP net loss per share, basic and

diluted

$

(2.23

)

$

(1.28

)

$

(5.22

)

$

(2.96

)

Weighted average common shares

outstanding, basic and diluted

92,540

89,792

91,820

89,144

The following table presents a reconciliation of free cash flow

to net cash used in operating activities for each of the periods

indicated (in thousands):

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Net cash (used in) provided by operating

activities

$

(76,441

)

$

7,804

$

(160,523

)

$

42,331

Purchase of property and equipment

(68,628

)

(49,411

)

(183,968

)

(110,504

)

Site and software development costs

(35,831

)

(17,196

)

(94,697

)

(45,769

)

Free cash flow

$

(180,900

)

$

(58,803

)

$

(439,188

)

$

(113,942

)

Key Financial and Operating Metrics (in thousands, except LTM

Net Revenue per Active Customer and Average Order Value)

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Consolidated Financial Metrics

Net Revenue

$

2,305,487

$

1,705,645

$

6,593,567

$

4,765,170

Adjusted EBITDA

$

(144,184

)

$

(76,405

)

$

(316,385

)

$

(161,174

)

Free cash flow

$

(180,900

)

$

(58,803

)

$

(439,188

)

$

(113,942

)

Direct Retail Financial and Operating

Metrics

Direct Retail Net Revenue

$

2,299,680

$

1,692,456

$

6,562,620

$

4,722,267

Active Customers

19,071

13,860

19,071

13,860

LTM Net Revenue per Active Customer

$

449

$

443

$

449

$

443

Orders Delivered

9,121

6,938

26,446

19,278

Average Order Value

$

252

$

244

$

248

$

245

The following table presents Direct Retail and Other net

revenues attributable to the Company’s reportable segments for the

periods presented (in thousands):

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

U.S. Direct Retail

$

1,960,847

$

1,460,056

$

5,593,923

$

4,043,270

U.S. Other

5,807

13,189

30,947

42,903

U.S. segment net revenue

1,966,654

1,473,245

5,624,870

4,086,173

International Direct Retail

338,833

232,400

968,697

678,997

International segment net revenue

338,833

232,400

968,697

678,997

Total net revenue

$

2,305,487

$

1,705,645

$

6,593,567

$

4,765,170

WAYFAIR INC. CONSOLIDATED AND

CONDENSED BALANCE SHEETS (In thousands, except share and per share

data) (Unaudited)

September 30, 2019

December 31, 2018

Assets

Current assets

Cash and cash equivalents

$

1,295,385

$

849,461

Short-term investments

6,049

114,278

Accounts receivable, net of allowance of

$17,849 and $9,312 at September 30, 2019 and December 31, 2018,

respectively

75,677

50,603

Inventories

68,622

46,164

Prepaid expenses and other current

assets

224,968

195,430

Total current assets

1,670,701

1,255,936

Property and equipment, net

547,056

606,977

Goodwill and intangible assets, net

19,211

2,585

Operating lease right-of-use assets

756,716

—

Long-term investments

—

6,526

Other noncurrent assets

13,951

18,826

Total assets

$

3,007,635

$

1,890,850

Liabilities and Stockholders'

Equity

Current liabilities

Accounts payable

$

814,439

$

650,174

Accrued expenses

267,351

212,997

Unearned revenue

151,367

148,057

Other current liabilities

200,502

127,995

Total current liabilities

1,433,659

1,139,223

Lease financing obligation, net of current

portion

—

183,056

Operating lease liabilities

813,861

—

Long-term debt

1,435,927

738,904

Other liabilities

6,617

160,388

Total liabilities

3,690,064

2,221,571

Convertible preferred stock, $0.001 par

value per share: 10,000,000 shares authorized and none issued at

September 30, 2019 and December 31, 2018

—

—

Stockholders’ deficit:

Class A common stock, par value $0.001 per

share, 500,000,000 shares authorized, 65,502,165 and 62,329,701

shares issued and outstanding at September 30, 2019 and December

31, 2018, respectively

66

63

Class B common stock, par value $0.001 per

share, 164,000,000 shares authorized, 27,372,273 and 28,417,882

shares issued and outstanding at September 30, 2019 and December

31, 2018, respectively

27

28

Additional paid-in capital

1,054,135

753,657

Accumulated deficit

(1,735,201

)

(1,082,689

)

Accumulated other comprehensive (loss)

(1,456

)

(1,780

)

Total stockholders’ deficit

(682,429

)

(330,721

)

Total liabilities and stockholders’

deficit

$

3,007,635

$

1,890,850

WAYFAIR INC. CONSOLIDATED AND

CONDENSED STATEMENTS OF OPERATIONS (In thousands, except per share

data) (Unaudited)

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Net revenue

$

2,305,487

$

1,705,645

$

6,593,567

$

4,765,170

Cost of goods sold (1)

1,765,566

1,312,875

5,023,590

3,663,569

Gross profit

539,921

392,770

1,569,977

1,101,601

Operating expenses:

Customer service and merchant fees (1)

91,255

66,664

256,230

182,340

Advertising

281,846

202,587

784,981

541,815

Selling, operations, technology, general

and administrative (1)

426,529

268,785

1,153,286

721,120

Total operating expenses

799,630

538,036

2,194,497

1,445,275

Loss from operations

(259,709

)

(145,266

)

(624,520

)

(343,674

)

Interest expense, net

(14,432

)

(7,066

)

(33,922

)

(18,269

)

Other income, net

2,182

1,054

5,582

2,661

Loss before income taxes

(271,959

)

(151,278

)

(652,860

)

(359,282

)

Provision for income taxes

76

448

1,502

953

Net loss

$

(272,035

)

$

(151,726

)

$

(654,362

)

$

(360,235

)

Net loss per share, basic and diluted

$

(2.94

)

$

(1.69

)

$

(7.13

)

$

(4.04

)

Weighted average number of common stock

outstanding used in computing per share amounts, basic and

diluted

92,540

89,792

91,820

89,144

(1) Includes equity-based compensation and related taxes as

follows:

Cost of goods sold

$

1,450

$

727

$

3,759

$

1,929

Customer service and merchant fees

2,374

1,549

6,619

3,652

Selling, operations, technology, general

and administrative

61,451

34,041

163,585

89,493

$

65,275

$

36,317

$

173,963

$

95,074

WAYFAIR INC. CONSOLIDATED AND

CONDENSED STATEMENTS OF CASH FLOWS (In thousands)

(Unaudited)

Nine months ended September

30,

2019

2018

Cash flows from operating

activities

Net loss

$

(654,362

)

$

(360,235

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation and amortization

134,172

87,426

Equity-based compensation

162,014

88,148

Amortization of discount and issuance

costs on convertible notes

40,737

13,699

Other non-cash adjustments

(1,659

)

177

Changes in operating assets and

liabilities:

Accounts receivable

(25,309

)

(3,157

)

Inventories

(22,716

)

(7,757

)

Prepaid expenses and other current

assets

(29,648

)

(37,376

)

Accounts payable and accrued expenses

215,786

187,733

Unearned revenue and other liabilities

22,382

80,509

Other assets

(1,920

)

(6,836

)

Net cash (used in) provided by operating

activities

(160,523

)

42,331

Cash flows from investing

activities

Sale and maturities of short-term

investments

115,468

45,955

Purchase of property and equipment

(183,968

)

(110,504

)

Site and software development costs

(94,697

)

(45,769

)

Other investing activities

(15,977

)

(399

)

Net cash used in investing activities

(179,174

)

(110,717

)

Cash flows from financing

activities

Proceeds from issuance of convertible

notes, net of issuance costs

935,146

—

Premiums paid for capped call

confirmations

(145,728

)

—

Taxes paid related to net share settlement

of equity awards

(1,510

)

(1,097

)

Deferred financing costs

(791

)

—

Net proceeds from exercise of stock

options

90

104

Net cash provided by (used in) financing

activities

787,207

(993

)

Effect of exchange rate changes on cash

and cash equivalents

(1,586

)

(945

)

Net increase (decrease) in cash and cash

equivalents

445,924

(70,324

)

Cash and cash equivalents

Beginning of period

849,461

558,960

End of period

$

1,295,385

$

488,636

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191031005257/en/

Media Relations Contact: Jane Carpenter, 617-502-7595

PR@wayfair.com

Investor Relations Contact: Jane Gelfand

IR@wayfair.com

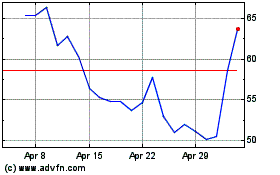

Wayfair (NYSE:W)

Historical Stock Chart

From Mar 2024 to Apr 2024

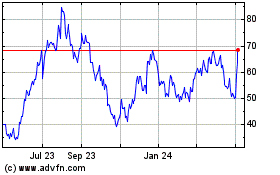

Wayfair (NYSE:W)

Historical Stock Chart

From Apr 2023 to Apr 2024