Current Report Filing (8-k)

July 15 2020 - 8:48AM

Edgar (US Regulatory)

0000823768

false

0000823768

2020-07-15

2020-07-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): July 15, 2020

Waste Management, Inc.

(Exact Name of Registrant as Specified

in Charter)

|

Delaware

|

|

1-12154

|

|

73-1309529

|

|

(State or Other

Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

1001 Fannin, Houston, Texas

|

|

77002

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone number, including

area code: (713) 512-6200

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

WM

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 2.04

|

Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement.

|

On May 22, 2019, Waste

Management, Inc., a Delaware corporation (the “Company”), issued $750,000,000 aggregate principal amount of its 2.950%

Senior Notes due 2024, $750,000,000 aggregate principal amount of its 3.200% Senior Notes due 2026, $1,000,000,000 aggregate principal

amount of its 3.450% Senior Notes due 2029 and $500,000,000 aggregate principal amount of its 4.000% Senior Notes due 2039 (collectively,

the “Notes”). Pursuant to the terms of the Indenture, dated as of September

10, 1997 (the “Base Indenture”), between the Company and The Bank of New York Mellon Trust Company, N.A. (the current

successor to Texas Commerce Bank National Association), as trustee (the “Trustee”), the respective officers’

certificates dated as of May 22, 2019 issued thereunder relating to the applicable series of the Notes (collectively with the

Base Indenture, the “Indenture”) and Section 5 of each series of the Notes, because the Company’s pending

acquisition of Advanced Disposal Services, Inc. (“Advanced Disposal”) was not completed on or prior to July 14, 2020,

the Company is required to redeem the entire outstanding principal amount of the Notes, totaling $3,000,000,000, at a redemption

price equal to 101% of the aggregate principal amount of each series of the Notes, plus accrued but unpaid interest on the principal

amount of such series of the Notes to, but not including, the redemption date. Pursuant to the terms of the Indenture and Section

5 of each series of the Notes, the Company provided notice of the redemption to the Trustee and the holders of the Notes on July

15, 2020. The date of redemption will be July 20, 2020.

The Company plans to

use a combination of cash on hand and borrowings under its revolving credit facility to fund the redemption and currently anticipates

funding the acquisition of Advanced Disposal using a combination of credit facilities and commercial paper.

Cautionary Note Regarding Forward-Looking

Statements

This filing contains

forward-looking statements that involve risks and uncertainties. Factors that could cause actual results to differ materially from

those expressed or implied by the forward-looking statements in this filing are discussed in the Company’s most recent Annual

Report on Form 10-K and subsequent reports on Form 10-Q.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

hereunto duly authorized.

|

|

WASTE MANAGEMENT, INC.

|

|

|

|

|

|

|

|

Date: July 15, 2020

|

By:

|

/s/ Charles C. Boettcher

|

|

|

|

Charles C. Boettcher

|

|

|

|

Executive

Vice President, Corporate Development & Chief Legal Officer

|

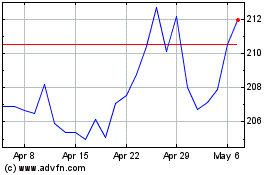

Waste Management (NYSE:WM)

Historical Stock Chart

From Mar 2024 to Apr 2024

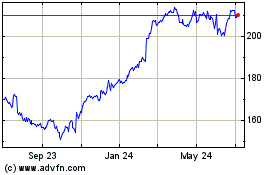

Waste Management (NYSE:WM)

Historical Stock Chart

From Apr 2023 to Apr 2024