Walmart's British Arm Is Blocked From Merger With U.K. Supermarket -- Update

April 25 2019 - 6:20AM

Dow Jones News

By Saabira Chaudhuri

LONDON -- Regulators blocked the proposed merger between Walmart

Inc.'s British grocery unit and rival J Sainsbury PLC citing

competition concerns, meaning the U.S. retail giant must now find

ways to drive stand-alone growth for Asda Group in the U.K.'s

highly competitive retail market.

Britain's Competition and Markets Authority said Thursday the

merger would reduce competition and could lead to price rises for

shoppers. The decision is a major disappointment for both retailers

for whom the uncertainty about the deal has proved a distraction

since it was proposed.

One year ago, Walmart agreed to merge its British arm Asda into

Sainsbury in a deal that valued the U.K. business at about GBP7.3

billion, or $9.4 billion. Walmart agreed to keep a 42% stake in the

combined company, which would become Britain's largest grocery

chain. The deal would have given it greater heft in the U.K. while

freeing it from daily decisions about competing in an increasingly

difficult environment.

The move was part of a broader shift by Walmart to form joint

ventures in competitive, overseas markets. Asda has been one of

Walmart's most profitable foreign forays since it bought the chain

in 1999 but growth slowed amid intense competition in the U.K. from

traditional rivals such as Tesco PLC, new online players and

discounters including German chains Aldi and Lidl.

The regulatory hurdles were high from the start given the highly

consolidated nature of the U.K. grocery market where the top four

players command over a 60% share. But the companies insisted they

were confident of approval, saying the landscape has become more

fractured with the advent of online shopping and the rise in

popularity of Aldi and Lidl who have been rapidly expanding in the

U.K.

British regulators disagreed. After factoring in competition

from discount stores and how new and expanding competitors could

impact the landscape, their concerns about the merger hadn't been

allayed, the CMA said.

"We have found this deal would lead to increased prices, reduced

quality and choice of products, or a poorer shopping experience for

all of their U.K. shoppers," said Stuart McIntosh, chair of the

group that conducted the investigation.

The collapse of the proposed merger puts both companies in a

tough spot but more so Sainsbury, which lacks the financial backing

of a larger parent company. Sainsbury has been losing share to

larger rival Tesco and analysts said its profit margin would likely

decrease as it is forced to up investment.

Sainsbury's Chief Executive Mike Coupe said the CMA's conclusion

ignores the dynamic and competitive nature of the U.K. market. The

company's shares were down 4% in morning trading in London.

Walmart said it was disappointed by the decision but plans to

invest in Asda to ensure the company can compete effectively in the

U.K.

"Our focus now is continuing to position Asda as a strong U.K.

retailer delivering for customers," said Judith McKenna, head of

Walmart's international arm. "Walmart will ensure Asda has the

resources it needs to achieve that."

Some analysts have previously suggested that Walmart could look

to sell Asda to a private-equity firm if the deal collapsed, but

the business has recently improved its performance.

Earlier this month, research firm Kantar said Asda -- which has

historically targeted lower-income customers -- had overtaken

Sainsbury to become the U.K.'s number two grocery chain with a

15.4% market share. The company has grown sales for two years, in

part by attracting new shoppers from more affluent households.

"We do not think that Walmart is in rush to dispose of Asda.

Asda was never considered a problem business," said Bernstein

analyst Bruno Monteyne, who described the potential Sainsbury deal

as a unique opportunity the company had to explore. "They will go

back to good retailing."

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

April 25, 2019 06:05 ET (10:05 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

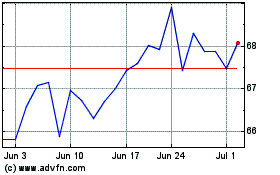

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

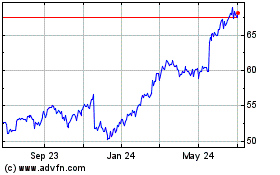

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024