|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

|

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

|

|

|

|

|

|

Westinghouse Air Brake Technologies Corporation

|

|

(Name of Issuer)

|

|

|

|

Common Stock, $0.01 Par Value Per Share

|

|

(Title of Class of Securities)

|

|

|

|

929740108

|

|

(CUSIP Number)

|

|

|

|

Christoph A. Pereira

Vice President, Chief Risk Officer and Chief

Corporate Counsel

General Electric Company

41 Farnsworth Street

Boston, Massachusetts 02210

617-433-2952

With a Copy to

:

William L. Taylor

Michael Kaplan

John B. Meade

Lee Hochbaum

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

Telephone: (212) 450-4000

Facsimile: (212) 701-5800

|

|

(Name, Address and Telephone Number of Person

Authorized to

Receive Notices and Communications)

|

|

August 9, 2019

|

|

(Date of Event which Requires Filing of this Statement)

|

|

|

|

If the

filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-l(f) or 240.13d-l(g), check the following box.

o

Note: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See § 240.13d-7(b) for other parties to whom copies are to be sent.

|

|

|

|

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

|

|

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

Schedule

13D

|

|

|

CUSIP No. 929740108

|

|

Page 2 of 9 Pages

|

|

1

|

Names of Reporting Person

General Electric Company

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

(a)

o

(b)

o

|

|

3

|

SEC Use Only

|

|

|

4

|

Source of Funds

OO

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to

Items 2(d) or 2(e)

|

o

|

|

6

|

Citizenship or Place of Organization

New York

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

Sole Voting Power

2,048,515 (1)(2)

|

|

8

|

Shared Voting Power

-0-

|

|

9

|

Sole Dispositive Power

2,048,515 (1)(2)

|

|

10

|

Shared Dispositive Power

-0-

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,048,515 (1)

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

|

o

|

|

13

|

Percent of Class Represented by Amount in Row (11)

1.1% (1)

|

|

|

14

|

Type of Reporting Person (See Instructions)

CO

|

|

_______________

|

(1)

|

See Item 5 of this Schedule 13D (as defined below).

|

|

(2)

|

As described in further detail in Item 6 of this Schedule 13D (as defined below), General Electric Company is subject to a lock-up until September 6, 2019.

|

SCHEDULE 13D

EXPLANATORY NOTE

This Amendment No. 2 (this “

Amendment

No. 2

”) to the Statement of Beneficial Ownership on Schedule 13D (the “

Schedule 13D

”) amends and supplements

the Schedule 13D (the “

Original Schedule 13D

”), as filed with the Securities and Exchange Commission (the “

SEC

”)

on March 7, 2019 by General Electric Company, a corporation incorporated under the laws of the State of New York (“

GE

”

or the “

Reporting Person

”), with respect to shares of common stock, $0.01 par value per share (the “

Common

Stock

”), of Westinghouse Air Brake Technologies Corporation, a Delaware corporation (“

Wabtec

” or the

“

Issuer

”), as amended by Amendment No. 1 (“

Amendment No. 1

”) filed with the SEC on May 7,

2019 (the Original Schedule 13D and Amendment No. 1, collectively, the “

Amended Schedule 13D

”). Except as specifically

provided herein, this Amendment No. 2 does not modify any of the information previously reported in the Amended Schedule 13D. Capitalized

terms used but not defined in this Amendment No. 2 shall have the same meanings ascribed to them in the Amended Schedule 13D. As

set forth below, as a result of the transactions described herein, on August 9, 2019, the Reporting Person ceased to be the beneficial

owner of more than five percent of the Shares. The filing of this Amendment represents the final amendment to the Schedule 13D

and constitutes an exit filing for the Reporting Person.

Item 2. Identity and Background

Schedule I to this Schedule 13D is hereby

amended and restated in its entirety in the form attached hereto, which is incorporated herein by reference.

Item 4. Purpose of Transaction.

The second paragraph of Item 4 is hereby amended and restated

as follows:

In addition to the Merger Agreement and

Separation Agreement, on February 25, 2019, GE, SpinCo, Wabtec and Merger Sub entered into a letter agreement (the “

Letter

Agreement

”) relating to GE’s right to designate up to three individuals (the “

New Board Designees

”)

for appointment to the board of directors of Wabtec (the “

Wabtec Board

”) as contemplated by the Merger Agreement.

Subject to certain withdrawal and confirmation rights of GE, and to Wabtec’s approval right (acting through the Nomination

and Corporate Governance Committee of the Wabtec Board as described below), each as set forth in the Letter Agreement, (i) the

first New Board Designee will be appointed by March 27, 2019, (ii) the second New Board Designee will be appointed by August 25,

2019 and (iii) the third New Board Designee will be appointed by February 25, 2020; provided that GE’s right to designate

a third New Board Designee is conditioned upon GE owning on February 25, 2020 a portion of the Common Stock and/or the Convertible

Preferred Stock it received in the Merger in respect of the SpinCo Class C preferred stock. Each New Board Designee is required

to qualify as an independent director under the rules of the New York Stock Exchange and be reasonably acceptable to the Nomination

and Corporate Governance Committee of the Wabtec Board. Ann Klee was selected as the first New Board Designee and is expected to

join the Wabtec Board in the fourth quarter of 2019. At the direction of GE, (i) one New Board Designee will be assigned to the

class of directors that is up for reelection at the first annual meeting of Wabtec’s stockholders that occurs after the Merger,

(ii) one New Board Designee will be assigned to the class of directors that is up for reelection at the second annual meeting of

Wabtec’s stockholders that occurs after the Merger and (iii) one New Board Designee will be assigned to the class of directors

that is up for reelection at the third annual meeting of Wabtec’s stockholders that occurs after the Merger. Further, if

any New Board Designee becomes a member of the Wabtec Board after the date that is six months prior to the date of Wabtec’s

next annual meeting of stockholders after he or she becomes a member of the Wabtec Board (for such New Board Designee, the “

Next

Stockholders Meeting

”) and prior to the date on which Wabtec commences mailing its proxy statement for such Next Stockholders

Meeting (the “

Next Proxy Mailing Date

”), then such New Board Designee may require Wabtec to (i) nominate such

New Board Designee for election at the Next Stockholders Meeting, (ii) recommend that Wabtec’s stockholders vote in favor

of the election of such New Board Designee and (iii) use no less rigorous efforts to support the election of such New Board Designee

than the efforts used to support each other nominee of the Wabtec Board up for election at the Next Stockholders Meeting. If any

New Board Designee becomes a member of the Wabtec Board after the Next Proxy Mailing Date and prior to the date of the Next Stockholders

Meeting, then such New Board Designee may require Wabtec to cause such New Board

Designee to be re-appointed to the Wabtec Board as of immediately following the Next Stockholders Meeting (and to be re-assigned

to the class of directors that was elected at the Next Stockholders Meeting).

Item

4 is also hereby amended and supplemented by adding the following at the end:

On August 7, 2019, GE entered into an underwriting

agreement (the “

Second Underwriting Agreement

”) with Goldman Sachs & Co. LLC, as representative of the several

underwriters listed in Schedule I thereto (the “

Underwriters

”), relating to an underwritten secondary public

offering by GE of (i) 16,969,692 shares of Common Stock and (ii) 3,515,464 shares of Common Stock issuable upon the conversion

of approximately 1,219.9922 shares of Convertible Preferred Stock (the “

Second Offering

”). Under the terms of

the Second Underwriting Agreement, the Underwriters were granted a 30-day option period to purchase from GE up to an additional

2,048,515 shares of Common Stock.

In the aggregate, the Reporting Person sold

20,485,156 shares of Common Stock comprised of (i) 16,969,692 shares of Common Stock at a price of $70.325 per share, and (ii)

approximately 1,219.9922 shares of Convertible Preferred Stock at a price of $202,644.75058 per share (equal to the product of

(x) $70.325 per share of Common Stock issuable upon conversion of the Convertible Preferred Stock multiplied by (y) the conversion

rate of 2,881.5464), for aggregate net proceeds in the amount of $1,440,618,595.70 before deducting offering expenses. Immediately

following the settlement of the Second Offering, the Reporting Person held 2,048,515 shares of Common Stock. The Second Offering

was made pursuant to an automatic shelf registration statement (333-231125) filed by Wabtec with the Securities and Exchange Commission

on April 30, 2019. The Second Offering closed on August 9, 2019.

In connection with the Second Offering,

pursuant to the Second Underwriting Agreement and subject to specified exceptions, GE agreed for a period of 30 days from August

7, 2019 not to, without the consent of the representatives of the Underwriters, directly or indirectly, (i) offer, pledge, sell,

contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or

warrant for the sale of, or otherwise dispose of or transfer any shares of Common Stock or any securities convertible into or exchangeable

or exercisable for Common Stock (other than the securities to be sold in the Second Offering) (collectively, the “

Lock-Up

Securities

”), or exercise any right with respect to the registration of any of the Lock-Up Securities, or request the

filing of any registration statement of the Issuer in connection therewith, under the Securities Act of 1933, as amended, or (ii)

enter into any swap or any other agreement or any transaction that transfers, in whole or in part, directly or indirectly, the

economic consequence of ownership of the Lock-Up Securities, whether any such swap or transaction is to be settled by delivery

of Common Stock or other securities, in cash or otherwise (the “

Underwriters’ Lock-Up

”).

The foregoing description of the Second

Underwriting Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Second

Underwriting Agreement, which is attached hereto as Exhibit 1 and is incorporated herein by reference.

Item 5. Interest in Securities of the Issuer.

Items 5 (a) - (b) are hereby amended and

restated in their entirety as follows:

The information relating to the beneficial

ownership of Common Stock by the Reporting Person set forth in Rows 7 through 13 of the cover page hereto is incorporated by reference.

The Reporting Person is the beneficial owner of 2,048,515 shares of Common Stock. Such shares represent approximately 1.1% of the

shares of outstanding Common Stock. Such percentage is calculated based on a total of 191,670,594 shares of Common Stock (which

is comprised of 188,155,130 outstanding shares of Common Stock as of July 29, 2019 as set forth in the Form 10-Q filed by Westinghouse

Air Brake Technologies Corporation on August 1, 2019, plus the 3,515,464 shares of Common Stock issued on August 9, 2019 upon the

conversion of the 1,219.9922 shares of Convertible Preferred Stock sold in connection with the Second Offering).

To the Reporting Person’s knowledge,

the following persons beneficially own the shares of Common Stock set forth below:

|

|

·

|

Sébastien M. Bazin, Director, General Electric Company, holds

0 shares of Common Stock;

|

|

|

·

|

H. Lawrence Culp, Jr., Chief Executive Officer and Director, General

Electric Company, holds 3,213 shares of Common Stock;

|

|

|

·

|

Francisco D’Souza, Director, General Electric Company, holds

813 shares of Common Stock;

|

|

|

·

|

Edward P. Garden, Director, General Electric Company, holds 0 shares

of Common Stock;

1

|

|

|

·

|

Thomas W. Horton, Director, General Electric Company, holds 0 shares

of Common Stock;

|

|

|

·

|

Risa Lavizzo-Mourey, Director, General Electric Company, holds 80

shares of Common Stock;

|

|

|

·

|

Catherine Lesjak, Director, General Electric Company, holds 0 shares

of Common Stock;

|

|

|

·

|

Paula Rosput Reynolds, Director, General Electric Company, holds 84

shares of Common Stock;

|

|

|

·

|

Leslie F. Seidman, Director, General Electric Company, holds 0 shares

of Common Stock;

|

|

|

·

|

James S. Tisch, Director, General Electric Company, holds 19,013 shares

of Common Stock;

2

|

|

|

·

|

L. Kevin Cox, Senior Vice President, Chief Human Resources Officer,

General Electric Company, holds 5 shares of Common Stock;

|

|

|

·

|

Michael J. Holston, Senior Vice President, General Counsel & Secretary,

General Electric Company, holds 0 shares of Common Stock;

|

|

|

·

|

David L. Joyce, Vice Chairman, General Electric Company, holds 3,037

shares of Common Stock;

|

|

|

·

|

Jamie S. Miller, Senior Vice President and Chief Financial Officer,

General Electric Company, holds 0 shares of Common Stock;

|

|

|

·

|

Kieran P. Murphy, Senior Vice President, General Electric Company,

holds 345 shares of Common Stock;

|

|

|

·

|

Jérôme X. Pécresse, Senior Vice President, General

Electric Company, holds 209 shares of Common Stock;

|

|

|

·

|

Russell Stokes, Senior Vice President, General Electric Company, holds

1,030 shares of Common Stock;

|

|

|

·

|

Scott Strazik, Senior Vice President, General Electric Company, holds

565 shares of Common Stock; and

|

_____________

1

This number would

include shares of Common Stock, if any, owned by the Trian Entities (as defined below). Trian Fund Management, L.P. (“

Trian

”),

an institutional investment manager, serves as the management company for Trian Partners, L.P., Trian Partners Master Fund, L.P.,

Trian Partners Master Fund (ERISA), L.P., Trian Partners Parallel Fund I, L.P., Trian Partners Strategic Investment Fund II, L.P.,

Trian Partners Strategic Investment Fund-A, L.P., Trian Partners Strategic Investment Fund-N, L.P., Trian Partners Strategic Investment

Fund-D, L.P., Trian Partners Strategic Fund-G II, L.P., Trian Partners Strategic Fund G-III, L.P., Trian Partners Co-Investment

Opportunities Fund, Ltd., Trian SPV (Sub) X, L.P., Trian Partners Strategic Fund-K, L.P. and Trian Partners Strategic Fund-C,

Ltd. (collectively, the “

Trian Entities

”) and as such determines the investment and voting decisions of the

Trian Entities with respect to shares of Common Stock held by them. Mr. Garden is a member of Trian Fund Management GP, LLC, which

is the general partner of Trian, and therefore is in a position to determine the investment and voting decisions made by Trian

on behalf of the Trian Entities. Accordingly, Mr. Garden may be deemed to indirectly beneficially own (as that term is defined

in Rule 13d-3 under the Exchange Act) any shares of Common Stock owned by the Trian Entities, although he would disclaim beneficial

ownership of any such shares for all other purposes.

2

This number consists

of 2,900 shares of Common Stock owned by a Tisch family trust and 16,113 shares of Common Stock owned by Loews Corporation, of

which Mr. Tisch is the CEO, the President, a director and a shareholder. Mr. Tisch disclaims beneficial ownership of the shares

owned by Loews Corporation except to the extent of his pecuniary interest, if any, in those shares.

|

|

·

|

Thomas S. Timko, Vice President, Controller & Chief Accounting

Officer, General Electric Company holds 0 shares of Common Stock.

|

Item

5 (c) is hereby amended and restated in its entirety as follows:

(c) Except as set forth in this Amendment

No. 2, neither the Reporting Person nor, to the knowledge of the Reporting Person, any of the persons set forth on Schedule I hereto

has effected any transaction in the shares of Common Stock during the past 60 days.

Item 6. Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer.

Item

6 is hereby amended and supplemented by adding the following at the end:

Pursuant to the Second Underwriting

Agreement, Wabtec waived the restriction on GE’s ability to sell, transfer or otherwise divest any (i) subject shares, (ii)

preferred shares or (iii) any other securities until November 1, 2019 (as provided for in the Shareholders Agreement, as a result

of the Offering that was consummated in May 2019) and consented to the number of shares sold in the Second Offering exceeding the

Subsequent Tranche Maximum (as defined in the Shareholders Agreement). In connection with the Second Offering, Wabtec also agreed

to waive any other restrictions on GE’s ability to sell, transfer or otherwise divest such shares, and GE has agreed to sell,

transfer or otherwise divest its remaining 2,048,515 shares of Common Stock by December 31, 2019, to the extent the Underwriters

do not exercise their option to purchase such shares in full.

Item 7. Material to be Filed as Exhibits.

|

Exhibit

Number

|

|

Exhibit Name

|

|

1.

|

|

Underwriting Agreement, dated August 7, 2019, by and among Westinghouse Air Brake Technologies Corporation, General Electric Company and Goldman Sachs & Co. LLC, as representatives of the several underwriters listed in Schedule I thereto (incorporated by reference to Exhibit 1.1 to the Current Report on Form 8-K filed by Westinghouse Air Brake Technologies Corporation on August 9, 2019).

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

August 12, 2019

|

General Electric Company

|

|

|

|

|

|

By:

|

/s/ Christoph A. Pereira

|

|

Name: Christoph A. Pereira

|

|

Title: Vice President, Chief Risk Officer and Chief Corporate Counsel

|

SCHEDULE I

dIRECTORS

AND EXECUTIVE OFFICERS OF

gENERAL eLECTRIC cOMPANY

The following table sets forth certain

information with respect to the directors and executive officers of General Electric Company. The business address of each director

and executive officer of General Electric Company is 41 Farnsworth Street, Boston, Massachusetts 02210.

|

Name

|

|

Present Principal Occupation or

Employment

|

|

Citizenship

|

|

|

|

|

|

|

Sébastien M. Bazin

(Director)

|

|

Chairman and CEO, AccorHotels

Paris, France

|

|

France

|

|

|

|

|

|

|

H. Lawrence Culp, Jr.

(Director and Chief Executive Officer)

|

|

Chairman of the Board and Chief Executive Officer, General Electric

Company

Boston, Massachusetts

|

|

United States

|

|

|

|

|

|

|

|

Francisco D’Souza

(Director)

|

|

Vice Chairman, Cognizant Technology

Solutions Corporation

Teaneck, New Jersey

|

|

United States

|

|

|

|

|

|

|

|

Edward P. Garden

(Director)

|

|

Chief Investment Officer and Founding Partner, Trian Fund Management,

L.P.

New York, New York

|

|

United States

|

|

|

|

|

|

|

Thomas W. Horton

(Director)

|

|

Partner, Global Infrastructure Partners

New York, New York

|

|

United States

|

|

|

|

|

|

|

|

Risa Lavizzo-Mourey

(Director)

|

|

Professor, University of Pennsylvania

Philadelphia, Pennsylvania

|

|

United States

|

|

|

|

|

|

|

|

Catherine Lesjak

(Director)

|

|

Former Chief Financial Officer, HP

Palo Alto, California

|

|

Canada

|

|

|

|

|

|

|

Paula Rosput Reynolds

(Director)

|

|

President and Chief Executive Officer, PreferWest LLC

Seattle, Washington

|

|

United States

|

|

|

|

|

|

|

Leslie F. Seidman

(Director)

|

|

Former Chairman, Financial Accounting Standards Board

Norwalk, Connecticut

|

|

United States

|

|

|

|

|

|

|

James S. Tisch

(Director)

|

|

President and Chief Executive Officer, Loews Corporation

New York, New York

|

|

United States

|

|

|

|

|

|

|

|

Michael J. Holston

(Senior Vice President, General Counsel & Secretary)

|

|

Senior Vice President, General Counsel & Secretary, General

Electric Company

|

|

United States

|

|

|

|

|

|

|

|

David L. Joyce

(Vice Chairman)

|

|

Vice Chairman, General Electric Company;

President & CEO, GE Aviation

|

|

United States

|

|

|

|

|

|

|

|

L. Kevin Cox

(Senior Vice President, Chief Human Resources Officer)

|

|

Senior Vice President, Chief Human Resources Officer, General

Electric Company

|

|

United States

|

|

|

|

|

|

|

|

Jamie S. Miller

(Senior Vice President, Chief Financial Officer)

|

|

Senior Vice President and Chief Financial Officer,

General Electric Company

|

|

United States

|

|

|

|

|

|

|

Kieran P. Murphy

(Senior Vice President)

|

|

Senior Vice President, General Electric Company;

President & CEO, GE Healthcare

|

|

Ireland

|

|

|

|

|

|

|

Jérôme X. Pécresse

(Senior Vice President)

|

|

Senior Vice President, General Electric Company;

President & CEO, GE Renewable Energy

|

|

France

|

|

|

|

|

|

|

Russell Stokes

(Senior Vice President)

|

|

Senior Vice President, General Electric Company;

President & CEO, GE Power Portfolio

|

|

United States

|

|

|

|

|

|

|

|

Scott Strazik

(Senior Vice President)

|

|

Senior Vice President, General Electric Company;

CEO, GE Gas Power

|

|

United States

|

|

|

|

|

|

|

Thomas S. Timko

(Vice President, Controller & Chief Accounting Officer)

|

|

Vice President, Controller & Chief Accounting Officer, General

Electric Company

|

|

United States

|

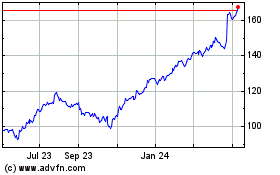

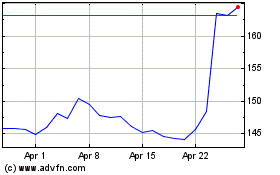

Wabtec (NYSE:WAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wabtec (NYSE:WAB)

Historical Stock Chart

From Apr 2023 to Apr 2024