Additional Proxy Soliciting Materials (definitive) (defa14a)

October 13 2022 - 5:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(A) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

VMWARE, INC.

(Name of

the Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a- 6(i)(1) and 0-11 |

Confidential │ ©2022 VMware,

Inc. Why is it good for VMware? Why is it good for YOU? Bring the Broadcom Transaction to Closure Reinforces our Multi-Cloud strategy Greater resources to compete, scale and win Strengthens our Ecosystem approach Ops: Help drive a historic

acquisition GTM: Expand VMware’s offerings as a leader in infrastructure software R&D: High-impact work in your area of passion For All Of Us: A track record of growth that is shared with employees The following slide was prepared for

VMware employees:

This presentation contains forward-looking

statements including, among other things, statements regarding the expected benefits to VMware and its customers, partners and stockholders of VMware’s strategy, growth opportunities and offerings, as well as the announced proposed acquisition

of VMware by Broadcom. Actual results could differ materially from those projected in the forward-looking statements as a result of certain risk factors, including but not limited to: (1) the satisfaction of the conditions precedent to consummation

of the proposed acquisition, and the ability to consummate the proposed acquisition, on a timely basis or at all; (2) business disruption following the announcement of the proposed transaction, including disruption of current plans and operations;

(3) the effects of the proposed acquisition, the spin-off of VMware from Dell and changes in VMware’s and Dell’s commercial relationships and go-to-market strategy, on VMware’s ability to (a) enter into, maintain and extend

strategically effective partnerships, collaborations and alliances (b) maintain and establish new relationships with customers, partners and suppliers, and (c) maintain operating results and its business generally; (4) difficulties in retaining and

hiring key personnel and employees, including due to the proposed acquisition and business combination; (5) the ability to implement plans, forecasts and other expectations with respect to the business after the completion of the proposed

acquisition and realize synergies; (6) the impact of the COVID-19 pandemic on VMware’s operations, financial condition, customers, the business environment, and global and regional economies; (7) the ability of VMware to adapt its offerings,

business operations and go-to-market activities to changes in how customers consume information technology resources, such as through subscription and SaaS offerings; (8) changes to VMware’s and Dell’s respective financial conditions and

strategic directions, including potential effects of the announced acquisition of VMware by Broadcom, that could adversely impact the VMware-Dell commercial relationship and collaborations; (9) the continued risk of litigation and regulatory

actions, including the outcome of any legal proceedings related to the proposed acquisition; (10) adverse changes in general economic or market conditions; (11) delays or reductions in consumer, government and information technology spending,

including due to the announced acquisition; (12) competitive factors, such as pricing pressures, industry consolidation, entry of new competitors into the industries in which VMware competes, as well as new product and marketing initiatives by

VMware’s competitors; (13) rapid technological changes in the virtualization software and cloud, end user, edge security and mobile computing and telecom industries; (14) changes in VMware’s financial condition; and (15) other business

effects, including those related to industry, market, economic, political, regulatory and global health conditions. These forward-looking statements are made as of the initial date of this presentation, are based on current expectations and are

subject to uncertainties and changes in condition, significance, value and effect as well as other risks detailed in documents filed with the Securities and Exchange Commission, including VMware’s most recent reports on Form 10-K and Form 10-Q

and current reports on Form 8- K that VMware may file from time to time, which could cause actual results to vary from expectations. VMware assumes no obligation to, and does not currently intend to, update any such forward-looking statements after

the initial date of this presentation. Forward-Looking Statements

No Offer or Solicitation This

communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements

of Section 10 of the U.S. Securities Act of 1933, as amended. Additional Information about the Transaction and Where to Find It In connection with the proposed transaction, VMware has filed with SEC a definitive proxy statement and

Broadcom has filed with the SEC a registration statement on Form S-4 that includes a proxy statement of VMware and that also constitutes a prospectus of Broadcom. Each of Broadcom and VMware may also file other relevant documents with the SEC

regarding the proposed transaction. This document is not a substitute for the proxy statement/prospectus or registration statement or any other document that Broadcom or VMware may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ

THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the registration statement and proxy statement/prospectus and other documents containing important information about Broadcom, VMware and

the proposed transaction, through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Broadcom may be obtained free of charge on Broadcom’s website at https://investors.broadcom.com. Copies of

the documents filed with the SEC by VMware may be obtained free of charge on VMware’s website at ir.vmware.com. Participants in the Solicitation Broadcom, VMware and certain of their respective directors and executive officers may be

deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Broadcom, including a description of their direct or indirect interests, by security holdings

or otherwise, is set forth in Broadcom’s proxy statement for its 2022 Annual Meeting of Stockholders, which was filed with the SEC on February 18, 2022, and Broadcom’s Annual Report on Form 10-K for the fiscal year ended October 31,

2021, which was filed with the SEC on December 17, 2021. Information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, is contained in VMware’s

proxy statement for the special meeting regarding the proposed transaction filed on October 3, 2022. Investors should read the proxy statement/prospectus carefully before making any voting or investment decisions. You may obtain free copies of these

documents from Broadcom or VMware using the sources indicated above. Additional Information Regarding the Broadcom Transaction

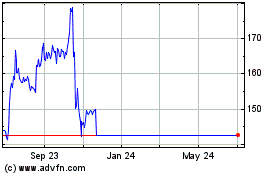

Vmware (NYSE:VMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vmware (NYSE:VMW)

Historical Stock Chart

From Apr 2023 to Apr 2024