Fourth quarter Platform+ net revenue increased

74% year-over-year to $105.1 million

SmartCast Active accounts increased 24%

year-over-year to 15.1 million

Average Revenue Per User increased 67%

year-over-year to $21.68

VIZIO Holding Corp. (NYSE: VZIO) today announced

the following results for the three and twelve months ended

December 31, 2021, as compared to the corresponding period of last

year:

Financial and operating results for the fourth quarter ended

December 31, 2021 as compared to the corresponding period of last

year included:

- Net revenue of $628.8 million, compared to $734.3 million

- Platform+ net revenue grew 74% to $105.1 million

- Gross profit of $77.1 million, compared to $101.9 million

- Platform+ gross profit increased 39% to $67.3 million

- SmartCast Active Accounts grew 24% to 15.1 million

- SmartCast Hours increased 11% to 3.9 billion

- Average Revenue Per User (ARPU) grew 67% to $21.68

Financial and operating results for the year ended December 31,

2021 as compared to the corresponding period of last year

included:

- Net revenue increased 4% to $2.1 billion

- Platform+ net revenue grew 110% to $308.7 million

- Gross profit increased 10% to $326.3 million

- Platform+ gross profit grew 88% to $210.6 million

- SmartCast Hours increased 26% to 14.6 billion

“2021 was a transformational year for VIZIO. Since our IPO

almost one year ago, we have continued to see success in the

execution of our combined hardware and software strategy,” said

William Wang CEO of VIZIO. “Our dual revenue model has allowed us

the flexibility to invest in creating an even better consumer

experience with great products, while our advertising and data

offerings increasingly draw partners to our streaming platform.

Going forward we will continue to focus on execution on all sides

of the business, and we are excited for the year ahead as we

celebrate our 20th Anniversary in the TV market.”

Fourth quarter 2021 business highlights include:

- Returned to pre-pandemic stock levels which lead to healthier

inventory positions across retail partners

- Expanded number of gaming TVs shipped with FreeSync

certification

- Increased our direct ad client base by 20%+ and our average

revenue per advertiser by 70%+ versus Q4'20

- Grew relationships with ad categories like Auto, Media &

Entertainment, Insurance, and Retail versus Q4'20

- Expanded WatchFree+ with thousands of free on demand movies, TV

shows and VIZIO exclusives

- App launches included Discovery+, History Vault, Lifetime Movie

Club, AfroLandTV, and Crime Central

- Launched more VIZIO Features (Mission, House and Fear) curated

channels with 100% ad inventory control

Selected Financial Results

(Unaudited, in millions, except

percentages and ARPU)

Quarter Ended

December 31,

Year Ended

December 31,

Quarter

Full Year

2021

2020

2021

2020

QTD %

YTD %

Financial

Highlights

Revenue

Device

$

523.7

$

674.0

$

1,815.3

$

1,895.3

(22

)%

(4

)%

Platform+

105.1

60.3

308.7

147.2

74

%

110

%

Total Revenue

628.8

734.3

2,124.0

2,042.5

(14

)%

4

%

Gross Profit

Device

9.8

53.6

115.7

184.5

(82

)%

(37

)%

Platform+

67.3

48.3

210.6

111.9

39

%

88

%

Total Gross Profit

77.1

101.9

326.3

296.4

(24

)%

10

%

Operating Expenses

97.2

48.8

355.9

164.5

99

%

116

%

Net (loss) Income

$

(10.1

)

$

40.8

$

(39.4

)

$

102.5

(125

)%

(138

)%

Adjusted EBITDA (1)

$

17.3

$

54.4

$

107.6

$

139.0

(68

)%

(23

)%

Operational

Metrics

Smart TV Shipments

1.5

2.2

5.5

7.1

(31

)%

(22

)%

SmartCast Active Accounts (as of)

15.1

12.2

15.1

12.2

24

%

24

%

VIZIO Hours

7,915

6,577

29,337

23,264

20

%

26

%

SmartCast Hours

3,851

3,469

14,598

11,596

11

%

26

%

SmartCast ARPU (2)

$

21.68

$

12.99

$

21.68

$

12.99

67

%

67

%

________________________

(1) A reconciliation of Net (loss) income

to Adjusted EBITDA is provided below

(2) As of December 31 and based on the

preceding four quarters

Financial Outlook

(In millions)

First Quarter

2022

Platform+ Net Revenue

$90 - $95

Platform+ Gross Profit

$57 - $60

Adjusted EBITDA

$(2) - $2

Virtual Investor Event – Thursday, March 3, 2022

VIZIO management will hold a live question and answer

webcast at 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time) to

discuss VIZIO's quarterly results and outlook. To listen to the

webcast please visit this link. Following the live audio webcast, a

playback will be available on VIZIO's Investor Relations website

(investors.vizio.com) through April 30, 2022 at 11:59 p.m.

(ET).

About VIZIO

Founded and headquartered in Orange County, California, VIZIO’s

mission is to deliver immersive entertainment and compelling

lifestyle enhancements that make our products the center of the

connected home. VIZIO is driving the future of televisions through

its integrated platform of cutting-edge Smart TVs and powerful

SmartCast operating system. VIZIO also offers a portfolio of

innovative sound bars that deliver consumers an elevated audio

experience. VIZIO’s platform gives content providers more ways to

distribute their content and advertisers more tools to target and

dynamically serve ads to a growing audience that is increasingly

transitioning away from linear TV.

Supplemental Financial and Other Information

Supplemental financial and other information can be accessed

through VIZIO’s Investor Relations website at investors.vizio.com.

VIZIO announces material information to the public about VIZIO, its

products and services, and other matters through a variety of

means, including filings with the Securities and Exchange

Commission, press releases, public conference calls, webcasts, its

Investor Relations website (investors.vizio.com), its blog

(accessible via vizio.com/en/newsroom) and its Twitter account

(@VIZIO) in order to achieve broad, non-exclusionary distribution

of information to the public and for complying with its disclosure

obligations under Regulation FD.

Key Operational and Financial Metrics

We review certain key operational and financial metrics to

evaluate our business, measure our performance, identify trends

affecting our business, formulate business plans and make strategic

decisions. We regularly review and may adjust our processes for

calculating our internal metrics to improve their accuracy.

Smart TV Shipments. We define Smart TV Shipments as the

number of Smart TV units shipped to retailers or direct to

consumers in a given period. Smart TV Shipments currently drive the

majority of our revenue and provide the foundation for increased

adoption of our SmartCast operating system and the growth of our

Platform+ revenue. The growth rate between Smart TV units shipped

and Device net revenue is not directly correlated because VIZIO’s

Device net revenue can be impacted by other variables, such as the

series and sizes of Smart TVs sold during the period, the

introduction of new products as well as the number of sound bars

shipped.

SmartCast Active Accounts. We define SmartCast Active

Accounts as the number of VIZIO Smart TVs where a user has

activated the SmartCast operating system through an internet

connection at least once in the past 30 days. We believe that the

number of SmartCast Active Accounts is an important metric to

measure the size of our engaged user base, the attractiveness and

usability of our operating system, and subsequent monetization

opportunities to increase our Platform+ net revenue.

Total VIZIO Hours. We define Total VIZIO Hours as the

aggregate amount of time users spend utilizing our Smart TVs in any

capacity. We believe this usage metric is critical to understanding

our total potential monetization opportunities.

SmartCast Hours. We define SmartCast Hours as the

aggregate amount of time viewers engage with our SmartCast platform

to stream content or access other applications. This metric

reflects the size of the audience engaged with our operating system

as well as indicates the growth and awareness of our platform. It

is also a measure of the success of our offerings in addressing

increased user demand for OTT streaming. Greater user engagement

translates into increased revenue opportunities as we earn a

significant portion of our Platform+ net revenue through

advertising, which is influenced by the amount of time users spend

on our platform.

SmartCast ARPU. We define SmartCast ARPU as total

Platform+ net revenue, less revenue attributable to legacy VIZIO

V.I.A. Plus units, during the preceding four quarters divided by

the average of (i) the number of SmartCast Active Accounts at the

end of the current period; and (ii) the number of SmartCast Active

Accounts at the end of the corresponding prior year period.

SmartCast ARPU indicates the level at which we are monetizing our

SmartCast Active Account user base. Growth in SmartCast ARPU is

driven significantly by our ability to add users to our platform

and our ability to monetize those users.

Device gross profit. We define Device gross profit as

Device net revenue less Device cost of goods sold in a given

period. Device gross profit is directly influenced by consumer

demand, device offerings, and our ability to maintain a

cost-efficient supply chain.

Platform+ gross profit. We define Platform+ gross profit

as Platform+ net revenue less Platform+ cost of goods sold in a

given period. As we continue to grow and scale our business, we

expect Platform+ gross profit to increase over the long term.

Non-GAAP Financial Measures

To supplement our financial information presented in accordance

with generally accepted accounting principles in the United States

of America, or GAAP, VIZIO considers certain financial measures

that are not prepared in accordance with GAAP, including Adjusted

EBITDA. We define Adjusted EBITDA as total net (loss) income before

interest income, other income, provision for income taxes,

depreciation and amortization and share-based compensation. We

consider Adjusted EBITDA to be an important metric to assess our

operating performance and help us to manage our working capital

needs. Utilizing Adjusted EBITDA, we can identify and evaluate

trends in our business as well as provide investors with

consistency and comparability to facilitate period-to-period

comparisons of our business. We believe that providing users with

non-GAAP measures such as Adjusted EBITDA may assist investors in

seeing VIZIO’s operating results through the eyes of management and

in comparing VIZIO’s operating results over multiple periods with

other companies in our industry.

We use Adjusted EBITDA in conjunction with net (loss) income as

part of our overall assessment of our operating performance and the

management of our working capital needs. Our definition of Adjusted

EBITDA may differ from the definition used by other companies and

therefore comparability may be limited. In addition, other

companies may not publish Adjusted EBITDA or similar metrics.

Furthermore, Adjusted EBITDA has certain limitations in that it

does not include the impact of certain expenses that are reflected

in our consolidated statement of operations that are necessary to

run our business. Thus, Adjusted EBITDA should be considered in

addition to, not as a substitute for, or in isolation from,

measures prepared in accordance with GAAP, including net (loss)

income.

We compensate for these limitations by providing a

reconciliation of Adjusted EBITDA to net (loss) income. We

encourage investors and others not to rely on any single financial

measure and to view Adjusted EBITDA in conjunction with net (loss)

income.

Forward-looking information

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements generally relate to future events or VIZIO’s future

financial or operating performance. In some cases, you can identify

forward looking statements because they contain words such as

“may,” “will,” “should,” “expects,” “plans,” “anticipates,” “going

to,” “could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential,” or “continue,” or

the negative of these words or other similar terms or expressions

that concern our expectations, strategy, priorities, plans, or

intentions.

Forward-looking statements in this press release include, but

are not limited to, statements regarding VIZIO’s future financial

and operating performance, including our outlook and guidance, and

our expectations regarding advertising spend commitments. Our

expectations and beliefs regarding these matters may not

materialize, and actual results in future periods are subject to

risks and uncertainties, including changes in our plans or

assumptions, that could cause actual results to differ materially

from those projected. These risks include the possibility that: we

are not able to keep pace with technological advances in our

industry and successfully compete in highly competitive markets; we

do not have the ability to continue to sell our Smart TVs; we

cannot attract and maintain SmartCast Active Accounts; we cannot

increase SmartCast Hours; we are not able to attract and maintain

popular content on our platform; we are not able to maintain

relationships with advertisers; and we cannot adapt to market

conditions and technological developments, including with respect

to our platform's compatibility with applications developed by

content providers.

The forward-looking statements contained in this press release

are also subject to other risks and uncertainties, including those

more fully described in our filings with the Securities and

Exchange Commission, including our prospectus filed pursuant to

Rule 424(b) under the Securities Act of 1933, as amended, on March

25, 2021, and in our Quarterly Reports on Form 10-Q filed on May

12, 2021, August 5, 2021, and November 10, 2021. Additional

information will also be set forth in our Annual Report on Form

10-K for the fiscal year ended December 31, 2021. The

forward-looking statements in this press release are based on

information available to VIZIO as of the date hereof, and VIZIO

disclaims any obligation to update any forward-looking statements,

except as required by law.

VIZIO HOLDING CORP.

Consolidated Statement of

Operations

(Unaudited, in millions, except

share and per share amounts)

Year Ended

December 31,

2021

2020

2019

Net revenue:

Device

$

1,815.3

$

1,895.3

$

1,773.6

Platform+

308.7

147.2

63.2

Total net revenue

2,124.0

2,042.5

1,836.8

Cost of goods sold:

Device

1,699.6

1,710.8

1,648.6

Platform+

98.1

35.3

23.0

Total cost of goods sold

1,797.7

1,746.1

1,671.6

Gross profit:

Device

115.7

184.5

125.0

Platform+

210.6

111.9

40.2

Total gross profit

326.3

296.4

165.2

Operating expenses:

Selling, general and administrative

286.1

115.8

98.7

Marketing

32.8

31.3

22.7

Research & development

34.2

15.1

10.3

Depreciation and amortization

2.8

2.3

4.1

Total operating expenses

355.9

164.5

135.8

Income (loss) from operations

(29.6

)

131.9

29.4

Interest income, net

0.3

—

1.2

Other income, net

3.0

0.5

0.2

Total non-operating income

3.3

0.5

1.4

Income (loss) before income taxes

(26.3

)

132.4

30.8

Provision for income taxes

13.1

29.9

7.7

Net (loss) income

$

(39.4

)

$

102.5

$

23.1

Net (loss) income per share attributable

to common stockholders

Basic

$

(0.22

)

$

0.56

$

0.12

Diluted

$

(0.22

)

$

0.55

$

0.12

Weighted-average common shares outstanding

(in thousands)

Basic

175,502

144,381

144,127

Diluted

175,502

147,012

147,063

VIZIO HOLDING CORP.

Consolidated Balance

Sheets

(Unaudited, in millions except

share amounts in thousands)

As of

December 31,

2021

2020

Assets

Current assets:

Cash and cash equivalents

$

331.6

$

207.7

Accounts receivable, net

375.1

405.6

Other receivables due from related

parties

5.1

1.0

Inventories

11.9

10.5

Income tax receivable

26.2

1.3

Other current assets

84.8

55.5

Total current assets

834.7

681.6

Property, equipment and software, net

10.3

7.9

Goodwill

44.8

44.8

Deferred income taxes

30.4

26.7

Other assets

15.6

14.0

Total assets

$

935.8

$

775.0

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable due to related

parties

$

224.8

$

209.4

Accounts payable

118.9

166.8

Accrued expenses

185.8

155.0

Accrued royalties

56.8

81.1

Other current liabilities

4.8

5.2

Total current liabilities

591.1

617.5

Other long-term liabilities

14.1

8.2

Total liabilities

605.2

625.7

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.0001 par value;

100,000 shares authorized in March 2021, no shares issued and

outstanding as of December 31, 2021

—

—

Series A convertible preferred stock,

$0.0001 par value; 25,000 shares authorized; 0 and 250 shares

designated and 0 and 135 shares issued and outstanding as of

December 31, 2021 and 2020, respectively

—

2.6

Common stock, $0.0001 par value; 1,350,000

and 675,000 shares authorized as of December 31, 2021 and 2020,

respectively:

- Class A, 116,258 and 150,831 shares issued and 113,209 and

150,831 outstanding as of December 31, 2021 and 2020,

respectively

- Class B, 76,815 and 0 shares issued and outstanding as of

December 31, 2021 and 2020, respectively

- Class C, no shares issued and outstanding as of December 31

2021 and 2020, respectively

—

—

Additional paid in capital

323.3

98.9

Accumulated other comprehensive (loss)

income

(0.2

)

0.9

Retained earnings

7.5

46.9

Total stockholders’ equity

330.6

149.3

Total liabilities and stockholders’

equity

$

935.8

$

775.0

VIZIO HOLDING CORP.

Consolidated Statement of Cash

Flows

(Unaudited, in millions)

Year Ended December

31,

2021

2020

2019

Cash flows from operating

activities:

Net (loss) income

$

(39.4

)

$

102.5

$

23.1

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

2.8

2.3

4.1

Deferred income taxes

(3.7

)

1.9

(0.6

)

Share-based compensation expense and

common stock warrants

134.4

4.8

6.0

Changes in operating assets and

liabilities:

Accounts receivable

30.5

(44.8

)

130.5

Other receivables due from related

parties

(4.1

)

4.4

(3.2

)

Inventories

(1.4

)

2.7

13.1

Income taxes receivable

(24.9

)

(0.5

)

2.0

Other current assets

(30.0

)

(19.5

)

—

Other assets

(1.6

)

(4.4

)

1.3

Accounts payable due to related

parties

15.4

(16.5

)

(24.8

)

Accounts payable

(47.9

)

2.1

(79.2

)

Accrued expenses

30.5

(5.5

)

12.3

Accrued royalties

(24.3

)

(3.6

)

(3.1

)

Income taxes payable

—

—

—

Other current liabilities

(0.3

)

3.5

0.1

Other long-term liabilities

5.9

2.9

(1.7

)

Net cash provided by operating

activities

41.9

32.3

79.9

Cash flows from investing

activities:

Purchases of property and equipment

(4.4

)

(1.8

)

(0.8

)

Purchase of investments

(0.2

)

—

—

Net cash used in investing activities

(4.6

)

(1.8

)

(0.8

)

Cash flows from financing

activities:

Proceeds from exercise of stock

options

12.4

0.2

0.2

Payment of dividends on Series A

convertible preferred stock

(0.6

)

—

—

Proceeds from IPO, net of $10,700 in

direct offering costs

148.0

—

—

Payments of other offering costs

(2.8

)

—

—

Withholding taxes paid on behalf of

employees on net settled share-based awards

(71.0

)

—

—

Proceeds from sale of stock under ESPP

1.7

—

—

Net cash provided by financing

activities

87.7

0.2

0.2

Effect of exchange rate changes on cash

and cash equivalents

(1.1

)

0.4

0.1

Net increase in cash and cash

equivalents

123.9

31.1

79.4

Cash and cash equivalents at beginning

of year

207.7

176.6

97.2

Cash and cash equivalents at end of

year

$

331.6

$

207.7

$

176.6

Supplemental disclosure of cash flow

information:

Cash paid for income taxes

$

36.1

$

27.6

$

6.4

Cash paid for interest

$

0.2

$

0.2

$

0.2

Supplemental disclosure of non-cash

investing and financing activities:

Right-of-use assets obtained in exchange

for new operating lease liabilities

$

3.6

$

5.2

$

0.2

Cash paid for amounts included in the

measurement of operating lease liabilities

$

2.9

$

2.5

$

1.8

IPO costs not yet paid

$

0.3

$

—

$

—

VIZIO HOLDING CORP.

Reconciliation of Net (Loss)

Income to Adjusted EBITDA

(Unaudited, in millions)

Three Months Ended

December 31,

Year Ended

December 31,

2021

2020

2021

2020

Net (loss) income

$

(10.1

)

$

40.8

$

(39.4

)

$

102.5

Adjusted to exclude the following:

Interest (income) expense, net

(0.2

)

0.1

(0.3

)

—

Other income, net

(3.2

)

(0.1

)

(3.0

)

(0.5

)

Provision for (benefit from) income

taxes

(6.5

)

12.2

13.1

29.9

Depreciation and amortization

0.8

0.6

2.8

2.3

Share-based compensation

36.5

0.8

134.4

4.8

Adjusted EBITDA

$

17.3

$

54.4

$

107.6

$

139.0

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220301006319/en/

Investors and Analysts: Michael Marks IR@vizio.com

Media: press@vizio.com

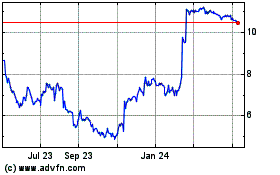

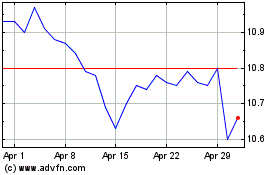

VIZIO (NYSE:VZIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

VIZIO (NYSE:VZIO)

Historical Stock Chart

From Apr 2023 to Apr 2024