Vital Energy, Inc. (NYSE: VTLE) ("Vital Energy" or the "Company")

today announced its fourth-quarter 2022 financial and operating

results and provided its 2023 outlook. Supplemental slides have

been posted to the Company's website and can be found at

www.vitalenergy.com. A conference call and webcast to discuss the

results is planned for 7:30 a.m. CT, Wednesday, February 22, 2023.

Complete details can be found within this release.

Financial Highlights

- Reported 4Q-22 and Company-record FY-22 net income of $118.2

million and $631.5 million, respectively

- Reported 4Q-22 and Company-record FY-22 cash flows from

operating activities of $108.9 million and $829.6 million,

respectively

- Generated 4Q-22 and Company-record FY-22 Consolidated EBITDAX1

of $191.1 million and $913.5 million, respectively

- Generated 4Q-22 and Company-record FY-22 Free Cash Flow1 of

$36.5 million and $219.9 million, respectively

- Divested certain non-operated properties for ~$110 million

- Repurchased $284.8 million face value of term-debt at 99.3% of

par value during FY-22

- Repurchased $37.3 million of common stock at an average price

of $76.02 per share during FY-22

- Reduced Net Debt1/Consolidated EBITDAX1 ratio to 1.18x from

2.14x at year-end 2021

Operational Highlights

- Produced 35.9 thousand barrels of oil per day ("MBO/d") and

77.9 thousand barrels of oil equivalent per day ("MBOE/d") in

4Q-22, both above the high-end of guidance

- Incurred capital expenditures of $130 million, excluding

non-budgeted acquisitions and leasehold expenditures, in 4Q-22,

below guidance range

- Grew 2022 oil production 19% over prior year, primarily related

to the acquisition and development of oil-weighted properties

- Maintained approximately eight years of oil-weighted inventory

at current activity levels, organically adding locations in

Glasscock County

- Published 2022 ESG and Climate Risk Report, reporting Scope 1

GHG emissions intensity and methane intensity reductions of 34% and

63%, respectively, compared to 2019 baseline levels

1Non-GAAP financial measure; please see

supplemental reconciliations of GAAP to non-GAAP financial measures

at the end of this release.

"Our strong financial performance in 2022 was a

direct result of the execution of our strategy to create

shareholder value by acquiring and developing oil-weighted

properties," commented Jason Pigott, President and Chief Executive

Officer. "The assets we acquired since 2019 enabled Vital Energy to

capitalize on higher oil prices, drive higher margins, and generate

$220 million in Free Cash Flow in 2022. We utilized our Free Cash

Flow and divestiture proceeds to reduce term-debt by $285 million

and repurchase $37 million of common stock while cutting our

leverage ratio almost in half."

"We enter 2023 positioned to build on our recent

momentum," continued Pigott. "Both production and capital

outperformed expectations in the fourth quarter of 2022 and our

2023 development plan is focused on our top-tier assets in northern

Howard County. We recently announced an accretive oil-weighted

acquisition that expands our Midland Basin footprint into a

prolific area of Upton County, adding additional high-margin

production and inventory. Our disciplined development and

acquisition strategies have delivered improved financial results

and a strengthened balance sheet, laying the foundation for

sustainable Free Cash Flow generation and shareholder returns."

Fourth-Quarter 2022 Financial and

Operations Summary

Financial Results. The Company reported net income

attributable to common stockholders of $118.2 million, or $7.13 per

diluted share. Adjusted Net Income1 was $57.8 million, or $3.49 per

adjusted diluted share. Consolidated EBITDAX was $191.1

million.

Production. Consistent with preliminary volumes

disclosed in early January, Vital Energy's oil and total production

during the period averaged 35,887 BO/d and 77,947 BOE/d,

respectively. Both oil and total production in fourth-quarter 2022

were above the top-end of Company guidance, driven by

outperformance from its base production and the productivity of new

wells, as well as less than expected downtime related to

offset-operator completions.

Capital Investments. Total incurred capital

expenditures were $130 million, excluding non-budgeted acquisitions

and leasehold expenditures, below the low-end of guidance as

inflationary pressures moderated. Investments included $112 million

in drilling and completions, $6 million in infrastructure,

including Vital Midstream Services investments, $7 million in other

capitalized costs and $5 million in land, exploration and data

related costs. Non-budgeted acquisitions and leasehold expenditures

(including surface land) totaled $2 million. Vital Energy completed

and turned-in-line ("TIL") 13 wells during fourth-quarter 2022.

Operating Expenses. Lease operating expenses

("LOE") during the period were $6.53 per BOE, in line with

guidance.

General and Administrative Expenses. General and

administrative ("G&A") expenses, excluding long-term incentive

plan ("LTIP") expenses, for fourth-quarter 2022 were $2.20 per BOE.

Cash and non-cash LTIP expenses were $(0.04) per BOE and $0.25 per

BOE, respectively. Cash LTIP expense was below guidance due to the

stock price decline in fourth-quarter 2022.

Liquidity. At December 31, 2022, the Company had

$70 million drawn on its $1.0 billion senior secured credit

facility and cash and cash equivalents of $44 million. At February

17, 2023, the Company had $135 million drawn on its senior secured

credit facility and cash and cash equivalents of $16 million.

2023 Outlook

Capital Investments. The 2023 outlook reflects the

Company's ongoing focus on capital discipline and maximizing Free

Cash Flow. Vital Energy plans to invest $625 - $675 million in

2023, maintaining relatively flat year-over-year activity levels.

The Company has estimated cost inflation of approximately 15% over

2022 averages.

Vital Energy expects to operate two drilling rigs

throughout the year, two completions crews for the first quarter

and one completions crew for the remaining nine months of 2023. The

Company's capital plan in 2023 remains focused primarily on

high-return projects in Howard County. All ~55 development wells

Vital Energy expects to TIL in 2023 are anticipated to be in Howard

County.

Production. The Company's activities are expected

to result in full-year 2023 oil production of 34.0 - 37.0 MBO/d and

total production of 72.0 - 76.0 MBOE/d. Production expectations

exclude volumes associated with the Company's recently announced

acquisition of producing properties (see below).

Driftwood Acquisition. On February 14, 2023, Vital

Energy announced the acquisition of oil-weighted production and

inventory from Driftwood Energy for consideration of ~1.58 million

shares of Vital Energy common stock and $127.6 million in cash.

Upon closing, which is expected in early April 2023, Vital Energy

does not anticipate any changes to its activity levels or capital

budget. The Company plans to update FY-23 guidance post-closing of

the acquisition.

"Our disciplined 2023 investment plan focuses on

maximizing Free Cash Flow by concentrating development on our most

capital-efficient leasehold," commented Pigott. "This plan holds

full-year 2023 average oil production relatively flat with

fourth-quarter 2022 levels with no increase in prior-year activity

levels. Upon closing of the Driftwood acquisition, we expect to

incorporate any activity on the acquired leasehold within our

current plan. The Driftwood acquisition furthers our strategy of

making accretive acquisitions that extend oil-weighted inventory

and grow production without increasing activity levels."

Oil-Weighted Inventory

Vital Energy continues to focus on the strategic

acquisition and development of oil-weighted inventory to improve

capital efficiency and Free Cash Flow generation. As of year-end

2022, the Company had ~445 high-quality, development ready

locations in the Midland Basin with an average breakeven WTI oil

price of <$60 per barrel at 2022 average well costs. In 2022,

Vital Energy organically replaced a majority of wells developed

during the year, adding ~35 oil-weighted locations.

2022 Proved Reserves

Vital Energy's total proved reserves were 302.3

MMBOE (39% oil, 74% developed) at year-end 2022. The standardized

measure of discounted net cash flows was $4.8 billion based on SEC

benchmark pricing of $90.15 per barrel for oil and $5.20 per MMBtu

for natural gas. The PV-10 value was $5.5 billion, utilizing the

same benchmark prices.

Proved reserves decreased 16.3 MMBOE from year-end

2021. The decrease is primarily related to forecast revisions of

producing wells in the Company's legacy acreage, changes in the

development schedule and the divestiture of non-operated

properties.

Commitment to ESG

A strong commitment to ESG excellence is a core

operating principle of Vital Energy. This commitment is reflected

in the board of directors' oversight of programs and policies

related to ESG matters and the Company's annual publication of its

ESG and Climate Risk Report utilizing standards aligned with five

different reporting frameworks. In the Company's 2022 ESG and

Climate Risk Report, Vital Energy demonstrated substantial progress

towards its 2025 emissions intensity goal of 12.5 metric tons of

CO2 equivalent per MBOE produced ("mtCO2/MBOE"), reporting 2021

Scope 1 emissions intensity of 17.26 mtCO2/MBOE. The Company also

introduced a 2030 combined Scope 1 & 2 emissions intensity goal

of 10.0 mtCO2/MBOE.

Additionally, Vital Energy has incorporated a

combination of environmental and safety metrics into executive

compensation for four consecutive years, demonstrating the

importance of operating sustainably and prioritizing the health of

our employees and contractors. In 2022, environmental and safety

goals comprised 20% of the executive short-term incentive plan

goals. Significantly, in 2022, Vital Energy reported zero employee

incidents.

First-Quarter and Full-Year 2023

Guidance

The table below reflects the Company's guidance

for total and oil production and incurred capital expenditures for

first-quarter and full-year 2023. Production guidance does not

include volumes associated with the recently announced

acquisition.

|

|

|

1Q-23E |

|

FY-23E |

| Total

production (MBOE per day) |

|

72.5 - 76.5 |

|

72.0 - 76.0 |

| Oil

production (MBOPD) |

|

33.0 -

36.0 |

|

34.0 -

37.0 |

| Incurred

capital expenditures, excluding non-budgeted acquisitions ($

MM) |

|

$210 -

$230 |

|

$625 -

$675 |

The table below reflects the Company's guidance

for select revenue and expense items for first-quarter 2023.

|

|

1Q-23E |

| Average

sales price realizations (excluding derivatives): |

|

|

Oil (% of WTI) |

102% |

|

NGL (% of WTI) |

24% |

|

Natural gas (% of Henry

Hub) |

51% |

| |

|

| Net

settlements received (paid) for matured commodity derivatives ($

MM): |

|

|

Oil |

($1) |

|

NGL |

$0 |

|

Natural gas |

($2) |

| |

|

| Selected

average costs & expenses: |

|

|

Lease operating expenses

($/BOE) |

$7.50 |

|

Production and ad valorem taxes (% of oil, NGL and natural gas

sales

revenues) |

7.50% |

|

Transportation and marketing expenses

($/BOE) |

$1.70 |

|

General and administrative expenses (excluding LTIP,

$/BOE) |

$2.40 |

|

General and administrative expenses (LTIP cash,

$/BOE) |

$0.25 |

|

General and administrative expenses (LTIP non-cash,

$/BOE) |

$0.30 |

|

Depletion, depreciation and amortization

($/BOE) |

$12.25 |

|

|

|

Conference Call Details

Vital Energy plans to host a conference call at

7:30 a.m. CT on Wednesday, February 22, 2023, to discuss its

fourth-quarter financial and operating results and management's

outlook, the content of which is not part of this earnings release.

A slide presentation providing summary financial and statistical

information will be posted to the Company's website. The Company

invites interested parties to listen to the call via the Company's

website at www.vitalenergy.com, under the tab for "Investor

Relations | News & Presentations." Portfolio managers and

analysts who would like to participate on the call should dial

800.715.9871, using conference code 5063785. A replay will be

available following the call via the Company's website.

About Vital

Vital Energy, Inc. is an independent energy

company with headquarters in Tulsa, Oklahoma. Vital's business

strategy is focused on the acquisition, exploration and development

of oil and natural gas properties in the Permian Basin of West

Texas.

Additional information about Vital may be found on

its website at www.vitalenergy.com.

Forward-Looking Statements This

press release and any oral statements made regarding the contents

of this release, including in the conference call referenced

herein, contain forward-looking statements as defined under Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. All statements,

other than statements of historical facts, that address activities

that Vital Energy assumes, plans, expects, believes, intends,

projects, indicates, enables, transforms, estimates or anticipates

(and other similar expressions) will, should or may occur in the

future are forward-looking statements. The forward-looking

statements are based on management’s current belief, based on

currently available information, as to the outcome and timing of

future events. Such statements are not guarantees of future

performance and involve risks, assumptions and uncertainties.

General risks relating to Vital Energy include,

but are not limited to, continuing and worsening inflationary

pressures and associated changes in monetary policy that may cause

costs to rise; changes in domestic and global production, supply

and demand for commodities, including as a result of the

coronavirus ("COVID-19") pandemic, actions by the Organization of

Petroleum Exporting Countries and other producing countries

("OPEC+") and the Russian-Ukrainian military conflict, the decline

in prices of oil, natural gas liquids and natural gas and the

related impact to financial statements as a result of asset

impairments and revisions to reserve estimates, reduced demand due

to shifting market perception towards the oil and gas industry;

competition in the oil and gas industry; the ability of the Company

to execute its strategies, including its ability to successfully

identify and consummate strategic acquisitions at purchase prices

that are accretive to its financial results and to successfully

integrate acquired businesses, assets and properties, pipeline

transportation and storage constraints in the Permian Basin, the

effects and duration of the outbreak of disease, such as the

COVID-19 pandemic, and any related government policies and actions,

long-term performance of wells, drilling and operating risks, the

possibility of production curtailment, the impact of new laws and

regulations, including those regarding the use of hydraulic

fracturing, the impact of legislation or regulatory initiatives

intended to address induced seismicity on our ability to conduct

our operations; hedging activities, tariffs on steel, the impacts

of severe weather, including the freezing of wells and pipelines in

the Permian Basin due to cold weather, possible impacts of

litigation and regulations, the impact of the Company's

transactions, if any, with its securities from time to time, the

impact of new environmental, health and safety requirements

applicable to the Company's business activities, the possibility of

the elimination of federal income tax deductions for oil and gas

exploration and development and other factors, including those and

other risks described in its Annual Report on Form 10-K for the

year ended December 31, 2022 and those set forth from time to time

in other filings with the Securities and Exchange Commission

("SEC"). These documents are available through Vital Energy's

website at www.vitalenergy.com under the tab "Investor Relations"

or through the SEC's Electronic Data Gathering and Analysis

Retrieval System at www.sec.gov. Any of these factors could cause

Vital Energy's actual results and plans to differ materially from

those in the forward-looking statements. Therefore, Vital Energy

can give no assurance that its future results will be as estimated.

Any forward-looking statement speaks only as of the date on which

such statement is made. Vital Energy does not intend to, and

disclaims any obligation to, correct, update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise, except as required by applicable

law.

The SEC generally permits oil and natural gas

companies, in filings made with the SEC, to disclose proved

reserves, which are reserve estimates that geological and

engineering data demonstrate with reasonable certainty to be

recoverable in future years from known reservoirs under existing

economic and operating conditions, and certain probable and

possible reserves that meet the SEC's definitions for such terms.

In this press release and the conference call, the Company may use

the terms "resource potential," "resource play," "estimated

ultimate recovery" or "EURs," "type curve" and "standardized

measure," each of which the SEC guidelines restrict from being

included in filings with the SEC without strict compliance with SEC

definitions. These terms refer to the Company’s internal estimates

of unbooked hydrocarbon quantities that may be potentially

discovered through exploratory drilling or recovered with

additional drilling or recovery techniques. "Resource potential" is

used by the Company to refer to the estimated quantities of

hydrocarbons that may be added to proved reserves, largely from a

specified resource play potentially supporting numerous drilling

locations. A "resource play" is a term used by the Company to

describe an accumulation of hydrocarbons known to exist over a

large areal expanse and/or thick vertical section potentially

supporting numerous drilling locations, which, when compared to a

conventional play, typically has a lower geological and/or

commercial development risk. "EURs" are based on the Company’s

previous operating experience in a given area and publicly

available information relating to the operations of producers who

are conducting operations in these areas. Unbooked resource

potential and "EURs" do not constitute reserves within the meaning

of the Society of Petroleum Engineer’s Petroleum Resource

Management System or SEC rules and do not include any proved

reserves. Actual quantities of reserves that may be ultimately

recovered from the Company’s interests may differ substantially

from those presented herein. Factors affecting ultimate recovery

include the scope of the Company’s ongoing drilling program, which

will be directly affected by the availability of capital, decreases

in oil, natural gas liquids and natural gas prices, well spacing,

drilling and production costs, availability and cost of drilling

services and equipment, lease expirations, transportation

constraints, regulatory approvals, negative revisions to reserve

estimates and other factors, as well as actual drilling results,

including geological and mechanical factors affecting recovery

rates. "EURs" from reserves may change significantly as development

of the Company’s core assets provides additional data. In addition,

the Company's production forecasts and expectations for future

periods are dependent upon many assumptions, including estimates of

production decline rates from existing wells and the undertaking

and outcome of future drilling activity, which may be affected by

significant commodity price declines or drilling cost increases.

"Type curve" refers to a production profile of a well, or a

particular category of wells, for a specific play and/or area. The

"standardized measure" of discounted future new cash flows is

calculated in accordance with SEC regulations and a discount rate

of 10%. Actual results may vary considerably and should not be

considered to represent the fair market value of the Company’s

proved reserves.

This press release and any accompanying

disclosures include financial measures that are not in accordance

with generally accepted accounting principles ("GAAP"), such as

Consolidated EBITDAX, Adjusted Net Income and Free Cash Flow. While

management believes that such measures are useful for investors,

they should not be used as a replacement for financial measures

that are in accordance with GAAP. For a reconciliation of such

non-GAAP financial measures to the nearest comparable measure in

accordance with GAAP, please see the supplemental financial

information at the end of this press release.

Unless otherwise specified, references to "average

sales price" refer to average sales price excluding the effects of

the Company's derivative transactions.

All amounts, dollars and percentages presented in

this press release are rounded and therefore approximate.

Vital Energy, Inc.

Selected operating data

| |

Three months ended December 31, |

|

Year ended

December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

2021 |

| |

(unaudited) |

|

(unaudited) |

| Sales

volumes: |

|

|

|

|

|

|

|

|

Oil (MBbl) |

|

3,302 |

|

|

|

3,779 |

|

|

|

13,838 |

|

|

11,619 |

|

NGL (MBbl) |

|

1,900 |

|

|

|

1,976 |

|

|

|

8,028 |

|

|

8,678 |

|

Natural gas (MMcf) |

|

11,812 |

|

|

|

12,516 |

|

|

|

49,259 |

|

|

57,175 |

|

Oil equivalents (MBOE)(1)(2) |

|

7,171 |

|

|

|

7,842 |

|

|

|

30,076 |

|

|

29,827 |

|

Average daily oil equivalent sales volumes (BOE/D)(2) |

|

77,947 |

|

|

|

85,240 |

|

|

|

82,400 |

|

|

81,717 |

|

Average daily oil sales volumes (Bbl/D)(2) |

|

35,887 |

|

|

|

41,080 |

|

|

|

37,912 |

|

|

31,833 |

| Average

sales prices(2): |

|

|

|

|

|

|

|

|

Oil ($/Bbl)(3) |

$ |

85.31 |

|

|

$ |

76.92 |

|

|

$ |

97.65 |

|

$ |

69.32 |

|

NGL ($/Bbl)(3) |

$ |

19.77 |

|

|

$ |

29.58 |

|

|

$ |

29.22 |

|

$ |

22.08 |

|

Natural gas ($/Mcf)(3) |

$ |

2.50 |

|

|

$ |

4.15 |

|

|

$ |

4.23 |

|

$ |

2.63 |

|

Average sales price ($/BOE)(3) |

$ |

48.64 |

|

|

$ |

51.15 |

|

|

$ |

59.66 |

|

$ |

38.46 |

|

Oil, with commodity derivatives ($/Bbl)(4) |

$ |

68.03 |

|

|

$ |

57.83 |

|

|

$ |

70.32 |

|

$ |

52.09 |

|

NGL, with commodity derivatives ($/Bbl)(4) |

$ |

19.01 |

|

|

$ |

11.07 |

|

|

$ |

24.29 |

|

$ |

10.55 |

|

Natural gas, with commodity derivatives ($/Mcf)(4) |

$ |

2.14 |

|

|

$ |

1.69 |

|

|

$ |

2.83 |

|

$ |

1.56 |

|

Average sales price, with commodity derivatives ($/BOE)(4) |

$ |

39.88 |

|

|

$ |

33.36 |

|

|

$ |

43.48 |

|

$ |

26.36 |

| Selected

average costs and expenses per BOE sold(2): |

|

|

|

|

|

|

|

|

Lease operating expenses |

$ |

6.53 |

|

|

$ |

4.27 |

|

|

$ |

5.78 |

|

$ |

3.42 |

|

Production and ad valorem taxes |

|

3.00 |

|

|

|

2.91 |

|

|

|

3.69 |

|

|

2.30 |

|

Transportation and marketing expenses |

|

2.05 |

|

|

|

1.71 |

|

|

|

1.79 |

|

|

1.61 |

|

General and administrative (excluding LTIP) |

|

2.20 |

|

|

|

1.58 |

|

|

|

1.91 |

|

|

1.54 |

|

Total selected operating expenses |

$ |

13.78 |

|

|

$ |

10.47 |

|

|

$ |

13.17 |

|

$ |

8.87 |

|

General and administrative (LTIP): |

|

|

|

|

|

|

|

|

LTIP cash |

$ |

(0.04 |

) |

|

$ |

(0.08 |

) |

|

$ |

0.11 |

|

$ |

0.35 |

|

LTIP non-cash |

$ |

0.25 |

|

|

$ |

0.23 |

|

|

$ |

0.24 |

|

$ |

0.22 |

|

Depletion, depreciation and amortization |

$ |

11.86 |

|

|

$ |

9.51 |

|

|

$ |

10.36 |

|

$ |

7.22 |

___________

|

(1) |

BOE is calculated using a conversion rate of six Mcf per one

Bbl. |

|

(2) |

The numbers presented are calculated based on actual amounts that

are not rounded. |

|

(3) |

Price reflects the average of actual sales prices received when

control passes to the purchaser/customer adjusted for quality,

certain transportation fees, geographical differentials, marketing

bonuses or deductions and other factors affecting the price

received at the delivery point. |

|

(4) |

Price reflects the after-effects of the Company's commodity

derivative transactions on its average sales prices. The Company's

calculation of such after-effects includes settlements of matured

commodity derivatives during the respective periods and an

adjustment to reflect premiums incurred previously or upon

settlement that are attributable to commodity derivatives that

settled during the respective periods. |

|

|

|

Vital Energy, Inc.

Consolidated balance sheets

|

(in thousands, except share data) |

|

December 31, 2022 |

|

December 31, 2021 |

|

|

|

(unaudited) |

|

Assets |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

44,435 |

|

|

$ |

56,798 |

|

|

Accounts receivable, net |

|

|

163,369 |

|

|

|

151,807 |

|

|

Derivatives |

|

|

24,670 |

|

|

|

4,346 |

|

|

Other current assets |

|

|

13,317 |

|

|

|

22,906 |

|

|

Total current assets |

|

|

245,791 |

|

|

|

235,857 |

|

| Property and

equipment: |

|

|

|

|

|

Oil and natural gas properties, full cost method: |

|

|

|

|

|

Evaluated properties |

|

|

9,554,706 |

|

|

|

8,968,668 |

|

|

Unevaluated properties not being depleted |

|

|

46,430 |

|

|

|

170,033 |

|

|

Less: accumulated depletion and impairment |

|

|

(7,318,399 |

) |

|

|

(7,019,670 |

) |

|

Oil and natural gas properties, net |

|

|

2,282,737 |

|

|

|

2,119,031 |

|

|

Midstream service assets, net |

|

|

85,156 |

|

|

|

96,528 |

|

|

Other fixed assets, net |

|

|

42,647 |

|

|

|

34,590 |

|

|

Property and equipment, net |

|

|

2,410,540 |

|

|

|

2,250,149 |

|

|

Derivatives |

|

|

24,363 |

|

|

|

32,963 |

|

| Operating

lease right-of-use assets |

|

|

23,047 |

|

|

|

11,514 |

|

| Other

noncurrent assets, net |

|

|

22,373 |

|

|

|

21,341 |

|

|

Total assets |

|

$ |

2,726,114 |

|

|

$ |

2,551,824 |

|

|

Liabilities and stockholders' equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

102,516 |

|

|

$ |

71,386 |

|

|

Accrued capital expenditures |

|

|

48,378 |

|

|

|

50,585 |

|

|

Undistributed revenue and royalties |

|

|

160,023 |

|

|

|

117,920 |

|

|

Derivatives |

|

|

5,960 |

|

|

|

179,809 |

|

|

Operating lease liabilities |

|

|

15,449 |

|

|

|

7,742 |

|

|

Other current liabilities |

|

|

82,950 |

|

|

|

99,471 |

|

|

Total current liabilities |

|

|

415,276 |

|

|

|

526,913 |

|

| Long-term

debt, net |

|

|

1,113,023 |

|

|

|

1,425,858 |

|

| Asset

retirement obligations |

|

|

70,366 |

|

|

|

69,057 |

|

| Operating

lease liabilities |

|

|

9,435 |

|

|

|

5,726 |

|

| Other

noncurrent liabilities |

|

|

7,268 |

|

|

|

10,490 |

|

|

Total liabilities |

|

|

1,615,368 |

|

|

|

2,038,044 |

|

| Commitments

and contingencies |

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

Preferred stock, $0.01 par value, 50,000,000 shares authorized and

zero issued as of December 31, 2022 and December 31, 2021 |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value, 40,000,000 and 22,500,000 shares

authorized, and 16,762,127 and 17,074,516 issued and outstanding as

of December 31, 2022 and December 31, 2021, respectively |

|

|

168 |

|

|

|

171 |

|

|

Additional paid-in capital |

|

|

2,754,085 |

|

|

|

2,788,628 |

|

|

Accumulated deficit |

|

|

(1,643,507 |

) |

|

|

(2,275,019 |

) |

|

Total stockholders' equity |

|

|

1,110,746 |

|

|

|

513,780 |

|

|

Total liabilities and stockholders' equity |

|

$ |

2,726,114 |

|

|

$ |

2,551,824 |

|

| |

|

|

|

|

|

|

|

|

Vital Energy, Inc.

Consolidated statements of operations

|

|

|

Three months ended December 31, |

|

Year ended December 31, |

|

(in thousands, except per share data) |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

(unaudited) |

|

(unaudited) |

|

Revenues: |

|

|

|

|

|

|

|

|

|

Oil sales |

|

$ |

281,665 |

|

|

$ |

290,696 |

|

|

$ |

1,351,207 |

|

|

$ |

805,448 |

|

|

NGL sales |

|

|

37,576 |

|

|

|

58,470 |

|

|

|

234,613 |

|

|

|

191,591 |

|

|

Natural gas sales |

|

|

29,528 |

|

|

|

51,918 |

|

|

|

208,554 |

|

|

|

150,104 |

|

|

Sales of purchased oil |

|

|

13,378 |

|

|

|

66,803 |

|

|

|

119,408 |

|

|

|

240,303 |

|

|

Other operating revenues |

|

|

1,984 |

|

|

|

2,337 |

|

|

|

7,014 |

|

|

|

6,629 |

|

|

Total revenues |

|

|

364,131 |

|

|

|

470,224 |

|

|

|

1,920,796 |

|

|

|

1,394,075 |

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

Lease operating expenses |

|

|

46,847 |

|

|

|

33,468 |

|

|

|

173,983 |

|

|

|

101,994 |

|

|

Production and ad valorem taxes |

|

|

21,485 |

|

|

|

22,785 |

|

|

|

110,997 |

|

|

|

68,742 |

|

|

Transportation and marketing expenses |

|

|

14,670 |

|

|

|

13,439 |

|

|

|

53,692 |

|

|

|

47,916 |

|

|

Costs of purchased oil |

|

|

13,602 |

|

|

|

67,603 |

|

|

|

122,118 |

|

|

|

251,061 |

|

|

General and administrative |

|

|

17,282 |

|

|

|

13,619 |

|

|

|

68,082 |

|

|

|

62,801 |

|

|

Organizational restructuring expenses |

|

|

— |

|

|

|

— |

|

|

|

10,420 |

|

|

|

9,800 |

|

|

Depletion, depreciation and amortization |

|

|

85,085 |

|

|

|

74,592 |

|

|

|

311,640 |

|

|

|

215,355 |

|

|

Impairment expense |

|

|

40 |

|

|

|

— |

|

|

|

40 |

|

|

|

1,613 |

|

|

Other operating expenses, net |

|

|

1,829 |

|

|

|

1,341 |

|

|

|

8,583 |

|

|

|

6,381 |

|

|

Total costs and expenses |

|

|

200,840 |

|

|

|

226,847 |

|

|

|

859,555 |

|

|

|

765,663 |

|

|

Gain (loss) on disposal of assets, net |

|

|

(6,031 |

) |

|

|

(8,903 |

) |

|

|

(1,079 |

) |

|

|

84,551 |

|

| Operating

income |

|

|

157,260 |

|

|

|

234,474 |

|

|

|

1,060,162 |

|

|

|

712,963 |

|

|

Non-operating income (expense): |

|

|

|

|

|

|

|

|

|

Gain (loss) on derivatives, net |

|

|

(7,728 |

) |

|

|

15,372 |

|

|

|

(298,723 |

) |

|

|

(452,175 |

) |

|

Interest expense |

|

|

(28,870 |

) |

|

|

(31,163 |

) |

|

|

(125,121 |

) |

|

|

(113,385 |

) |

|

Loss extinguishment of debt, net |

|

|

(1,214 |

) |

|

|

— |

|

|

|

(1,459 |

) |

|

|

— |

|

|

Other income, net |

|

|

1,831 |

|

|

|

645 |

|

|

|

2,155 |

|

|

|

1,250 |

|

|

Total non-operating expense, net |

|

|

(35,981 |

) |

|

|

(15,146 |

) |

|

|

(423,148 |

) |

|

|

(564,310 |

) |

|

Income before income taxes |

|

|

121,279 |

|

|

|

219,328 |

|

|

|

637,014 |

|

|

|

148,653 |

|

| Income tax

(expense) benefit: |

|

|

|

|

|

|

|

|

|

Current |

|

|

(1,350 |

) |

|

|

(24 |

) |

|

|

(6,121 |

) |

|

|

(1,324 |

) |

|

Deferred |

|

|

(1,705 |

) |

|

|

(3,028 |

) |

|

|

619 |

|

|

|

(2,321 |

) |

|

Total income tax expense |

|

|

(3,055 |

) |

|

|

(3,052 |

) |

|

|

(5,502 |

) |

|

|

(3,645 |

) |

| Net

income |

|

$ |

118,224 |

|

|

$ |

216,276 |

|

|

$ |

631,512 |

|

|

$ |

145,008 |

|

| Net income

per common share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

7.19 |

|

|

$ |

13.07 |

|

|

$ |

37.88 |

|

|

$ |

10.18 |

|

|

Diluted |

|

$ |

7.13 |

|

|

$ |

12.84 |

|

|

$ |

37.44 |

|

|

$ |

10.03 |

|

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

16,441 |

|

|

|

16,545 |

|

|

|

16,672 |

|

|

|

14,240 |

|

|

Diluted |

|

|

16,585 |

|

|

|

16,846 |

|

|

|

16,867 |

|

|

|

14,464 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vital Energy, Inc.

Consolidated statements of cash flows

|

|

|

Three months ended December 31, |

|

Year ended December 31, |

|

(in thousands) |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

(unaudited) |

|

(unaudited) |

| Cash flows

from operating activities: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

118,224 |

|

|

$ |

216,276 |

|

|

$ |

631,512 |

|

|

$ |

145,008 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

|

Share-settled equity-based compensation, net |

|

|

2,108 |

|

|

|

2,066 |

|

|

|

8,403 |

|

|

|

7,675 |

|

|

Depletion, depreciation and amortization |

|

|

85,085 |

|

|

|

74,592 |

|

|

|

311,640 |

|

|

|

215,355 |

|

|

Impairment expense |

|

|

40 |

|

|

|

— |

|

|

|

40 |

|

|

|

1,613 |

|

|

(Gain) loss on disposal of assets, net |

|

|

6,031 |

|

|

|

8,903 |

|

|

|

1,079 |

|

|

|

(84,551 |

) |

|

Mark-to-market on derivatives: |

|

|

|

|

|

|

|

|

|

(Gain) loss on derivatives, net |

|

|

7,728 |

|

|

|

(15,372 |

) |

|

|

298,723 |

|

|

|

452,175 |

|

|

Settlements paid for matured derivatives, net |

|

|

(62,505 |

) |

|

|

(129,361 |

) |

|

|

(486,173 |

) |

|

|

(320,868 |

) |

|

Premiums received for commodity derivatives |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

9,041 |

|

|

Amortization of debt issuance costs |

|

|

1,529 |

|

|

|

1,538 |

|

|

|

6,338 |

|

|

|

5,146 |

|

|

Amortization of operating lease right-of-use assets |

|

|

6,098 |

|

|

|

3,702 |

|

|

|

22,621 |

|

|

|

13,609 |

|

|

Loss on extinguishment of debt, net |

|

|

1,214 |

|

|

|

— |

|

|

|

1,459 |

|

|

|

— |

|

|

Deferred income tax expense (benefit) |

|

|

1,705 |

|

|

|

3,028 |

|

|

|

(619 |

) |

|

|

2,321 |

|

|

Other, net |

|

|

894 |

|

|

|

1,274 |

|

|

|

5,494 |

|

|

|

4,633 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

1,843 |

|

|

|

(29,150 |

) |

|

|

(9,226 |

) |

|

|

(87,831 |

) |

|

Other current assets |

|

|

796 |

|

|

|

(5,741 |

) |

|

|

8,370 |

|

|

|

(8,767 |

) |

|

Other noncurrent assets, net |

|

|

387 |

|

|

|

21,503 |

|

|

|

1,837 |

|

|

|

(8,782 |

) |

|

Accounts payable and accrued liabilities |

|

|

16,450 |

|

|

|

10,045 |

|

|

|

31,534 |

|

|

|

31,387 |

|

|

Undistributed revenue and royalties |

|

|

(89,271 |

) |

|

|

24,933 |

|

|

|

42,085 |

|

|

|

81,201 |

|

|

Other current liabilities |

|

|

22,859 |

|

|

|

22,128 |

|

|

|

(18,503 |

) |

|

|

33,331 |

|

|

Other noncurrent liabilities |

|

|

(12,297 |

) |

|

|

(805 |

) |

|

|

(26,994 |

) |

|

|

4,975 |

|

|

Net cash provided by operating activities |

|

|

108,918 |

|

|

|

209,559 |

|

|

|

829,620 |

|

|

|

496,671 |

|

| Cash flows

from investing activities: |

|

|

|

|

|

|

|

|

|

Acquisitions of oil and natural gas properties, net |

|

|

— |

|

|

|

(136,367 |

) |

|

|

(5,581 |

) |

|

|

(763,411 |

) |

|

Capital expenditures: |

|

|

|

|

|

|

|

|

|

Oil and natural gas properties |

|

|

(134,865 |

) |

|

|

(139,515 |

) |

|

|

(566,989 |

) |

|

|

(418,362 |

) |

|

Midstream service assets |

|

|

(273 |

) |

|

|

(474 |

) |

|

|

(1,436 |

) |

|

|

(2,849 |

) |

|

Other fixed assets |

|

|

(3,610 |

) |

|

|

(2,705 |

) |

|

|

(12,711 |

) |

|

|

(5,931 |

) |

|

Proceeds from dispositions of capital assets, net of selling

costs |

|

|

105,949 |

|

|

|

— |

|

|

|

108,888 |

|

|

|

393,742 |

|

|

Settlements received for contingent consideration |

|

|

322 |

|

|

|

— |

|

|

|

1,877 |

|

|

|

— |

|

|

Net cash used in investing activities |

|

|

(32,477 |

) |

|

|

(279,061 |

) |

|

|

(475,952 |

) |

|

|

(796,811 |

) |

| Cash flows

from financing activities: |

|

|

|

|

|

|

|

|

|

Borrowings on Senior Secured Credit Facility |

|

|

120,000 |

|

|

|

145,000 |

|

|

|

455,000 |

|

|

|

570,000 |

|

|

Payments on Senior Secured Credit Facility |

|

|

(90,000 |

) |

|

|

(70,000 |

) |

|

|

(490,000 |

) |

|

|

(720,000 |

) |

|

Issuance of July 2029 Notes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

400,000 |

|

|

Extinguishment of debt |

|

|

(100,583 |

) |

|

|

— |

|

|

|

(282,902 |

) |

|

|

— |

|

|

Proceeds from issuance of common stock, net of offering costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

72,492 |

|

|

Share repurchases |

|

|

(10,704 |

) |

|

|

— |

|

|

|

(37,290 |

) |

|

|

— |

|

|

Stock exchanged for tax withholding |

|

|

— |

|

|

|

(7 |

) |

|

|

(7,442 |

) |

|

|

(2,596 |

) |

|

Payments for debt issuance costs |

|

|

(213 |

) |

|

|

(89 |

) |

|

|

(1,938 |

) |

|

|

(14,686 |

) |

|

Other, net |

|

|

(447 |

) |

|

|

— |

|

|

|

(1,459 |

) |

|

|

2,971 |

|

|

Net cash (used in) provided by financing activities |

|

|

(81,947 |

) |

|

|

74,904 |

|

|

|

(366,031 |

) |

|

|

308,181 |

|

| Net

(decrease) increase in cash and cash equivalents |

|

|

(5,506 |

) |

|

|

5,402 |

|

|

|

(12,363 |

) |

|

|

8,041 |

|

| Cash and

cash equivalents, beginning of period |

|

|

49,941 |

|

|

|

51,396 |

|

|

|

56,798 |

|

|

|

48,757 |

|

| Cash and

cash equivalents, end of period |

|

$ |

44,435 |

|

|

$ |

56,798 |

|

|

$ |

44,435 |

|

|

$ |

56,798 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vital Energy, Inc.

Supplemental reconciliations of GAAP to

non-GAAP financial measures

Non-GAAP financial measures

The non-GAAP financial measures of Free Cash Flow,

Adjusted Net Income, Consolidated EBITDAX, PV-10, Net Debt and Net

Debt to Consolidated EBITDAX, as defined by the Company, may not be

comparable to similarly titled measures used by other companies.

Furthermore, these non-GAAP financial measures should not be

considered in isolation or as a substitute for GAAP measures of

liquidity or financial performance, but rather should be considered

in conjunction with GAAP measures, such as net income or loss,

operating income or loss or cash flows from operating

activities.

Free Cash Flow (Unaudited)

Free Cash Flow is a non-GAAP financial measure

that the Company defines as net cash provided by operating

activities (GAAP) before changes in operating assets and

liabilities, net, less incurred capital expenditures, excluding

non-budgeted acquisition costs. Management believes Free Cash Flow

is useful to management and investors in evaluating operating

trends in its business that are affected by production, commodity

prices, operating costs and other related factors. There are

significant limitations to the use of Free Cash Flow as a measure

of performance, including the lack of comparability due to the

different methods of calculating Free Cash Flow reported by

different companies.

The following table presents a reconciliation of

net cash provided by operating activities (GAAP) to Free Cash Flow

(non-GAAP) for the periods presented:

| |

|

Three months ended December 31, |

|

Year ended December 31, |

|

(in thousands) |

|

|

2022 |

|

|

|

2021 |

|

|

2022 |

|

|

|

2021 |

|

|

|

|

(unaudited) |

|

(unaudited) |

| Net cash

provided by operating activities |

|

$ |

108,918 |

|

|

$ |

209,559 |

|

$ |

829,620 |

|

|

$ |

496,671 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

Change in current assets and liabilities, net |

|

|

(47,323 |

) |

|

|

22,215 |

|

|

54,260 |

|

|

|

49,321 |

|

|

Change in noncurrent assets and liabilities, net |

|

|

(11,910 |

) |

|

|

20,698 |

|

|

(25,157 |

) |

|

|

(3,807 |

) |

| Cash flows

from operating activities before changes in operating assets and

liabilities, net |

|

|

168,151 |

|

|

|

166,646 |

|

|

800,517 |

|

|

|

451,157 |

|

|

Less incurred capital expenditures, excluding non-budgeted

acquisition costs: |

|

|

|

|

|

|

|

|

|

Oil and natural gas properties(1) |

|

|

127,663 |

|

|

|

137,892 |

|

|

566,831 |

|

|

|

444,337 |

|

|

Midstream service assets(1) |

|

|

363 |

|

|

|

420 |

|

|

1,595 |

|

|

|

2,842 |

|

|

Other fixed assets |

|

|

3,588 |

|

|

|

3,578 |

|

|

12,150 |

|

|

|

6,807 |

|

|

Total incurred capital expenditures, excluding non-budgeted

acquisition costs |

|

|

131,614 |

|

|

|

141,890 |

|

|

580,576 |

|

|

|

453,986 |

|

| Free Cash

Flow (non-GAAP) |

|

$ |

36,537 |

|

|

$ |

24,756 |

|

$ |

219,941 |

|

|

$ |

(2,829 |

) |

___________

|

(1) |

Includes capitalized share-settled equity-based compensation and

asset retirement costs. |

|

|

|

Adjusted Net Income

(Unaudited)

Adjusted Net Income is a non-GAAP financial

measure that the Company defines as net income or loss (GAAP) plus

adjustments for mark-to-market on derivatives, premiums paid or

received for commodity derivatives that matured during the period,

impairment expense, gains or losses on disposal of assets, income

taxes, other non-recurring income and expenses and adjusted income

tax expense. Management believes Adjusted Net Income helps

investors in the oil and natural gas industry to measure and

compare the Company's performance to other oil and natural gas

companies by excluding from the calculation items that can vary

significantly from company to company depending upon accounting

methods, the book value of assets and other non-operational

factors.

The following table presents a reconciliation of

net income (GAAP) to Adjusted Net Income (non-GAAP) for the periods

presented:

| |

|

Three months ended December 31, |

|

Year ended December 31, |

|

(in thousands, except per share data) |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

(unaudited) |

|

(unaudited) |

| Net

income |

|

$ |

118,224 |

|

|

$ |

216,276 |

|

|

$ |

631,512 |

|

|

$ |

145,008 |

|

| Plus: |

|

|

|

|

|

|

|

|

|

Mark-to-market on derivatives: |

|

|

|

|

|

|

|

|

|

(Gain) loss on derivatives, net |

|

|

7,728 |

|

|

|

(15,372 |

) |

|

|

298,723 |

|

|

|

452,175 |

|

|

Settlements paid for matured derivatives, net |

|

|

(62,763 |

) |

|

|

(129,361 |

) |

|

|

(486,753 |

) |

|

|

(320,868 |

) |

|

Settlements received for contingent consideration |

|

|

580 |

|

|

|

— |

|

|

|

2,457 |

|

|

|

— |

|

|

Net premiums paid for commodity derivatives that matured during the

period(1) |

|

|

— |

|

|

|

(10,183 |

) |

|

|

— |

|

|

|

(41,553 |

) |

|

Organizational restructuring expenses |

|

|

— |

|

|

|

— |

|

|

|

10,420 |

|

|

|

9,800 |

|

|

Impairment expense |

|

|

40 |

|

|

|

— |

|

|

|

40 |

|

|

|

1,613 |

|

|

(Gain) loss on disposal of assets, net |

|

|

6,031 |

|

|

|

8,903 |

|

|

|

1,079 |

|

|

|

(84,551 |

) |

|

Loss on extinguishment of debt, net |

|

|

1,214 |

|

|

|

— |

|

|

|

1,459 |

|

|

|

— |

|

|

Income tax expense |

|

|

3,055 |

|

|

|

3,052 |

|

|

|

5,502 |

|

|

|

3,645 |

|

|

Adjusted income before adjusted income tax expense |

|

|

74,109 |

|

|

|

73,315 |

|

|

|

464,439 |

|

|

|

165,269 |

|

|

Adjusted income tax expense(2) |

|

|

(16,304 |

) |

|

|

(16,129 |

) |

|

|

(102,177 |

) |

|

|

(36,359 |

) |

|

Adjusted Net Income (non-GAAP) |

|

$ |

57,805 |

|

|

$ |

57,186 |

|

|

$ |

362,262 |

|

|

$ |

128,910 |

|

| Net income

per common share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

7.19 |

|

|

$ |

13.07 |

|

|

$ |

37.88 |

|

|

$ |

10.18 |

|

|

Diluted |

|

$ |

7.13 |

|

|

$ |

12.84 |

|

|

$ |

37.44 |

|

|

$ |

10.03 |

|

| Adjusted Net

Income per common share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

3.52 |

|

|

$ |

3.46 |

|

|

$ |

21.73 |

|

|

$ |

9.05 |

|

|

Diluted |

|

$ |

3.49 |

|

|

$ |

3.39 |

|

|

$ |

21.48 |

|

|

$ |

8.91 |

|

|

Adjusted diluted |

|

$ |

3.49 |

|

|

$ |

3.39 |

|

|

$ |

21.48 |

|

|

$ |

8.91 |

|

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

16,441 |

|

|

|

16,545 |

|

|

|

16,672 |

|

|

|

14,240 |

|

|

Diluted |

|

|

16,585 |

|

|

|

16,846 |

|

|

|

16,867 |

|

|

|

14,464 |

|

|

Adjusted diluted |

|

|

16,585 |

|

|

|

16,846 |

|

|

|

16,867 |

|

|

|

14,464 |

|

___________

|

(1) |

Reflects net premiums paid previously or upon settlement that are

attributable to derivatives settled in the respective periods

presented. |

|

(2) |

Adjusted income tax expense is calculated by applying a statutory

tax rate of 22% for each of the periods ended December 31,

2022 and 2021. |

|

|

|

Consolidated EBITDAX

(Unaudited)

Consolidated EBITDAX is a non-GAAP financial

measure defined in the Company's Senior Secured Credit Facility as

net income or loss (GAAP) plus adjustments for share-settled

equity-based compensation, depletion, depreciation and

amortization, impairment expense, gains or losses on disposal of

assets, mark-to-market on derivatives, accretion expense, interest

expense, income taxes and other non-recurring income and expenses.

Consolidated EBITDAX is used by the Company’s management for

various purposes, including as a measure of operating performance

and compliance under the Company's Senior Secured Credit Facility.

Additional information on the calculation of Consolidated EBITDAX

can be found in the Company's Tenth Amendment to the Senior Secured

Credit Facility as filed with the SEC on November 3, 2022.

The following table presents a reconciliation of

net income (loss) (GAAP) to Consolidated EBITDAX (non-GAAP) for the

periods presented:

|

|

|

Three months

ended |

|

Year ended |

|

(in thousands) |

|

December 31, 2022 |

|

September 30, 2022 |

|

June 30, 2022 |

|

March 31, 2022 |

|

December 31, 2022 |

|

|

|

(unaudited) |

|

Net income (loss) |

|

$ |

118,224 |

|

|

$ |

337,523 |

|

|

$ |

262,546 |

|

|

$ |

(86,781 |

) |

|

$ |

631,512 |

|

| Plus: |

|

|

|

|

|

|

|

|

|

|

|

Share-settled equity-based compensation, net |

|

|

2,108 |

|

|

|

1,638 |

|

|

|

2,604 |

|

|

|

2,053 |

|

|

|

8,403 |

|

|

Depletion, depreciation and amortization |

|

|

85,085 |

|

|

|

74,928 |

|

|

|

78,135 |

|

|

|

73,492 |

|

|

|

311,640 |

|

|

Impairment expense |

|

|

40 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

40 |

|

|

Organizational restructuring expenses |

|

|

— |

|

|

|

10,420 |

|

|

|

— |

|

|

|

— |

|

|

|

10,420 |

|

|

(Gain) loss on disposal of assets, net |

|

|

6,031 |

|

|

|

(4,282 |

) |

|

|

(930 |

) |

|

|

260 |

|

|

|

1,079 |

|

|

Mark-to-market on derivatives: |

|

|

|

|

|

|

|

|

|

|

|

(Gain) loss on derivatives, net |

|

|

7,728 |

|

|

|

(100,748 |

) |

|

|

65,927 |

|

|

|

325,816 |

|

|

|

298,723 |

|

|

Settlements paid for matured derivatives, net |

|

|

(62,763 |

) |

|

|

(124,611 |

) |

|

|

(174,009 |

) |

|

|

(125,370 |

) |

|

|

(486,753 |

) |

|

Settlements received for contingent consideration |

|

|

580 |

|

|

|

322 |

|

|

|

1,555 |

|

|

|

— |

|

|

|

2,457 |

|

|

Accretion expense |

|

|

933 |

|

|

|

954 |

|

|

|

973 |

|

|

|

1,019 |

|

|

|

3,879 |

|

|

Interest expense |

|

|

28,870 |

|

|

|

30,967 |

|

|

|

32,807 |

|

|

|

32,477 |

|

|

|

125,121 |

|

|

(Gain) loss extinguishment of debt, net |

|

|

1,214 |

|

|

|

(553 |

) |

|

|

798 |

|

|

|

— |

|

|

|

1,459 |

|

|

Income tax expense (benefit) |

|

|

3,055 |

|

|

|

(3,768 |

) |

|

|

7,092 |

|

|

|

(877 |

) |

|

|

5,502 |

|

|

Consolidated EBITDAX (non-GAAP) |

|

$ |

191,105 |

|

|

$ |

222,790 |

|

|

$ |

277,498 |

|

|

$ |

222,089 |

|

|

$ |

913,482 |

|

PV-10 (Unaudited)

PV-10 is a non-GAAP financial measure that is

derived from the standardized measure of discounted future net cash

flows, which is the most directly comparable GAAP financial

measure. PV-10 is a computation of the standardized measure of

discounted future net cash flows on a pre-tax basis. PV-10 is equal

to the standardized measure of discounted future net cash flows at

the applicable date, before deducting future income taxes,

discounted at 10 percent. Management believes that the presentation

of PV-10 is relevant and useful to investors because it presents

the discounted future net cash flows attributable to the Company's

estimated proved reserves prior to taking into account future

corporate income taxes, and it is a useful measure for evaluating

the relative monetary significance of the Company's proved oil, NGL

and natural gas assets. Further, investors may utilize the measure

as a basis for comparison of the relative size and value of proved

reserves to other companies. The Company uses this measure when

assessing the potential return on investment related to proved oil,

NGL and natural gas assets. However, PV-10 is not a substitute for

the standardized measure of discounted future net cash flows. The

PV-10 measure and the standardized measure of discounted future net

cash flows do not purport to present the fair value of the

Company's oil, NGL and natural gas reserves of the property.

|

(in millions) |

|

December 31, 2022 |

|

Standardized measure of discounted future net cash flows |

|

$ |

4,755 |

|

| Less present

value of future income taxes discounted at 10% |

|

|

(709 |

) |

| PV-10

(non-GAAP) |

|

$ |

5,464 |

|

Net Debt

(Unaudited)

Net Debt, a non-GAAP financial measure, is

calculated as the face value of long-term debt plus any outstanding

letters of credit, less cash and cash equivalents. Management

believes Net Debt is useful to management and investors in

determining the Company's leverage position since the Company has

the ability, and may decide, to use a portion of its cash and cash

equivalents to reduce debt. Net Debt as of December 31, 2022

was $1.08 billion.

Net Debt to Consolidated EBITDAX

(Unaudited)

Net Debt to Consolidated EBITDAX, a non-GAAP

financial measure, is calculated as Net Debt divided by

Consolidated EBITDAX, for the previous four quarters, as defined in

the Company's Senior Secured Credit Facility. Net Debt to

Consolidated EBITDAX is used by the Company’s management for

various purposes, including as a measure of operating performance,

in presentations to its board of directors and as a basis for

strategic planning and forecasting.

Investor Contact: Ron Hagood

918.858.5504 ron.hagood@vitalenergy.com

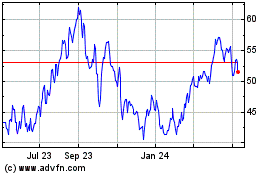

Vital Energy (NYSE:VTLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

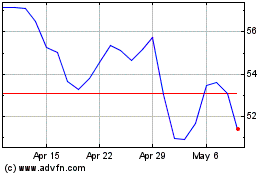

Vital Energy (NYSE:VTLE)

Historical Stock Chart

From Apr 2023 to Apr 2024