Virgin Galactic - "Buy the Rumor, Sell the News."?

July 21 2021 - 11:59AM

Finscreener.org

Virgin Galactic (NYSE:

SPCE) is an American spaceflight company founded by Richard

Branson. VG is an interesting but speculative asset due to its

uniqueness in the market.

June was spectacular for Virgin Galactic. Shares price was

skyrocketing ahead of the next launch, and after the successful

launch was completed, prices began to "land" again. A similar

situation happened on the eve of the previous launch this

winter.

The main reason for falling is the $500m stock sale

announcement. This usually has a short-term negative impact on the

stock, but not in the case of the highly volatile Virgin

Galactic.

How it was before?

In February 2021, VG shares reached an all-time high, after

which, following a series of negative news, a prolonged decline

began. In mid-May, the decline finds its bottom at $14.3. Against

the background of a new test flight, an upward bounce occurs.

This momentum is reinforced by the news of the next voyage with

Sir Richard Branson on board. But the record of the price of $62.8

was not reached. The highest price in June was $57.5 per share.

With it begins the recession, which continues to this day.

After the rally in May, the quotes have lost about half of their

value. Today the price is even below the average analyst target of

$38.38

There is also a 20.35% upside potential for price growth to the

target price from todayU+02019s value - $32.42 (data as of

Wednesday, 07/21/2021).

SPCEU+02019s range of support level starts at $30.25, the last

area is at the price of $27.42 per share on the daily range. All

calculations are based on pivot points technical analysis.

It is worth noting that Virgin GalacticU+02019s share price

reacted weakly to the successful flight of its main competitor Blue

Origin. During the trading session that day, the VG lost only a

couple of percent. It may indicate a strong investor

position.

What next?

One of the upcoming events of the company is the publication of

the report for the II quarter of 2021 - on August 5, after the

close of the main trading session. Analysts polled by FactSet

expect the company to post a loss of $0.33 per share, compared with

a loss of $0.3 per share in the second quarter of last year.

Revenue is expected to grow to $400,000 from zero a year ago.

Virgin has small revenue streams outside of commercial flights.

Investors are eagerly awaiting the next flights this year, which

could resume the rally in VGU+02019s stock. The next important step

will be information on the launch of the companyU+02019s commercial

flights.

In the long term, there is also a space for research flights,

which could be an additional source of income. And, of course, the

program has great potential for long-range hypersonic flights.

Ultimately, this could change the rules of the game in

intercontinental travel.

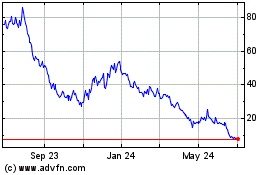

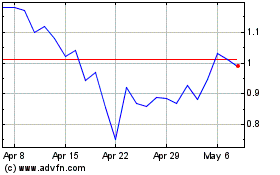

Virgin Galactic (NYSE:SPCE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Virgin Galactic (NYSE:SPCE)

Historical Stock Chart

From Apr 2023 to Apr 2024