Form 8-K - Current report

February 18 2025 - 4:20PM

Edgar (US Regulatory)

false

0001812173

0001812173

2025-02-12

2025-02-12

0001812173

RBOT:ClassCommonStockParValue0.0001PerShareMember

2025-02-12

2025-02-12

0001812173

RBOT:WarrantsToPurchaseOneShareOfClassCommonStockEachAtExercisePriceOf11.50PerShareMember

2025-02-12

2025-02-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 12, 2025

VICARIOUS SURGICAL INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39384 |

|

87-2678169 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 78 Fourth Avenue |

|

|

| Waltham, Massachusetts |

|

02451 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (617) 868-1700

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

RBOT |

|

The New York Stock Exchange |

| Warrants to purchase one share of Class A common stock, each at an exercise price of $11.50 per share |

|

RBOT WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 12, 2025, John Mazzola notified the

Company that he intends to retire from his position as Chief Operating Officer of Vicarious Surgical Inc. (the “Company”),

effective April 1, 2025.

A copy of the Company’s press release announcing

Mr. Mazzola’s retirement is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

VICARIOUS SURGICAL INC. |

| |

|

|

| |

By: |

/s/ Adam Sachs |

| |

Name: |

Adam Sachs |

| |

Title: |

Chief Executive Officer |

Date: February 18, 2025

2

Exhibit 99.1

Vicarious Surgical Announces Planned Retirement

of Chief Operating Officer

WALTHAM, Mass.-- (BUSINESS WIRE) – February 18, 2025 –

Vicarious Surgical Inc. (“Vicarious Surgical” or the “Company”) (NYSE: RBOT, RBOT WS), a next-generation robotics

technology company seeking to improve lives by transforming robotic surgery, today announced Chief Operating Officer (COO) John Mazzola

will retire, effective April 1, 2025, after nearly 40 years in healthcare manufacturing, supply chain and quality control. Mr. Mazzola

will continue to serve as COO until the effective date, at which time his responsibilities will transition to Randy Clark, Company President.

“On behalf of the entire organization, I

want to express our sincere gratitude to John for his exceptional leadership and dedication over the past few years,” said Adam

Sachs, Co-Founder and Chief Executive Officer. “John has been instrumental in developing and streamlining our corporate manufacturing

processes, enhancing our product quality control, and strengthening our supply chain resilience; as a result, Vicarious Surgical is well-positioned

for its next chapter as we prepare for our upcoming first clinical use cases and pivotal trial. We are deeply grateful for his contributions

and wish him a happy and fulfilling retirement.”

About Vicarious Surgical

Founded in

2014, Vicarious Surgical is a next generation robotics company, developing a unique disruptive technology with the multiple goals of substantially

increasing the efficiency of surgical procedures, improving patient outcomes, and reducing healthcare costs. The Company’s novel

surgical approach uses proprietary human-like surgical robots to virtually transport surgeons inside the patient to perform minimally

invasive surgery. The Company is led by an experienced team of technologists, medical device professionals and physicians, and is backed

by technology luminaries including Bill Gates, Vinod Khosla’s Khosla Ventures, Innovation Endeavors, Jerry Yang’s AME Cloud

Ventures, Sun Hung Kai & Co. Ltd and Philip Liang’s E15 VC. The Company is headquartered in Waltham, Massachusetts. Learn more

at www.vicarioussurgical.com.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform

Act of 1995. The company’s actual results may differ from its expectations, estimates, and projections and, consequently, you should

not rely on these forward-looking statements as predictions of future events. All statements other than statements of historical facts

contained herein, are forward-looking statements that reflect the current beliefs and expectations of management. These forward-looking

statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in

the forward-looking statements. Most of these factors are outside Vicarious Surgical’s control and are difficult to predict. Factors

that may cause such differences include, but are not limited to: the ability to maintain the listing of Vicarious Surgical’s Class

A common stock on the New York Stock Exchange; the approval, commercialization and adoption of Vicarious Surgical’s initial product

candidates and the success of its single-port surgical robot, called the Vicarious Surgical System, and any of its future product candidates

and service offerings; changes in applicable laws or regulations; the ability of Vicarious Surgical to raise financing in the future;

the success, cost and timing of Vicarious Surgical’s product and service development activities; the potential attributes and benefits

of Vicarious Surgical’s product candidates and services; Vicarious Surgical’s ability to obtain and maintain regulatory approval

for the Vicarious Surgical System, and any related restrictions and limitations of any approved product; the size and duration of human

clinical trials for the Vicarious Surgical System; Vicarious Surgical’s ability to identify, in-license or acquire additional technology;

Vicarious Surgical’s ability to maintain its existing license, manufacture, supply and distribution agreements; Vicarious Surgical’s

ability to compete with other companies currently marketing or engaged in the development of products and services that Vicarious Surgical

is currently marketing or developing; the size and growth potential of the markets for Vicarious Surgical’s product candidates and

services, and its ability to serve those markets, either alone or in partnership with others; the pricing of Vicarious Surgical’s

product candidates and services and reimbursement for medical procedures conducted using its product candidates and services; the company’s

estimates regarding expenses, revenue, capital requirements and needs for additional financing; Vicarious Surgical’s financial performance;

economic downturns, political and market conditions and their potential to adversely affect Vicarious Surgical’s business, financial

condition and results of operations; Vicarious Surgical’s intellectual property rights and its ability to protect or enforce those

rights, and the impact on its business, results and financial condition if it is unsuccessful in doing so; and other risks and uncertainties

indicated from time to time in Vicarious Surgical’s filings with the SEC. Vicarious Surgical cautions that the foregoing list of

factors is not exclusive. The company cautions readers not to place undue reliance upon any forward-looking statements, which speak only

as of the date made. Vicarious Surgical does not undertake or accept any obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances

on which any such statement is based.

Investor Contact

Kaitlyn Brosco

Vicarious Surgical

Kbrosco@vicarioussurgical.com

Media Inquiries

media@vicarioussurgical.com

v3.25.0.1

Cover

|

Feb. 12, 2025 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 12, 2025

|

| Entity File Number |

001-39384

|

| Entity Registrant Name |

VICARIOUS SURGICAL INC.

|

| Entity Central Index Key |

0001812173

|

| Entity Tax Identification Number |

87-2678169

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

78 Fourth Avenue

|

| Entity Address, City or Town |

Waltham

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02451

|

| City Area Code |

617

|

| Local Phone Number |

868-1700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

RBOT

|

| Security Exchange Name |

NYSE

|

| Warrants to purchase one share of Class A common stock, each at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Warrants to purchase one share of Class A common stock, each at an exercise price of $11.50 per share

|

| Trading Symbol |

RBOT WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RBOT_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RBOT_WarrantsToPurchaseOneShareOfClassCommonStockEachAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

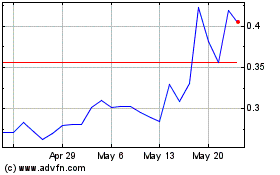

Vicarious Surgical (NYSE:RBOT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vicarious Surgical (NYSE:RBOT)

Historical Stock Chart

From Feb 2024 to Feb 2025