Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 12 2020 - 3:27PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-233608

Final Term Sheet

May 12, 2020

VERIZON COMMUNICATIONS INC.

€1,350,000,000 1.300% Notes due 2033

€800,000,000 1.850% Notes due 2040

|

|

|

|

|

|

|

Issuer:

|

|

Verizon Communications Inc. (“Verizon”)

|

|

|

|

|

Title of Securities:

|

|

1.300% Notes due 2033 (“Euro Notes due 2033”)

1.850% Notes due 2040 (“Euro Notes due 2040”)

|

|

|

|

|

Trade Date:

|

|

May 12, 2020

|

|

|

|

|

Settlement Date (T+4):

|

|

May 18, 2020

|

|

|

|

|

|

Maturity Date:

|

|

Euro Notes due 2033:

Euro Notes due 2040:

|

|

May 18, 2033

May 18,

2040

|

|

|

|

|

|

Interest Payment Dates:

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

Annually in arrears on each May 18, commencing May 18, 2021

Annually in arrears on each May 18, commencing May 18, 2021

|

|

|

|

|

|

Aggregate Principal Amount Offered:

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

€1,350,000,000

€800,000,000

|

|

|

|

|

|

Public Offering Price:

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

99.798% plus accrued interest, if any, from May 18, 2020

99.983% plus accrued interest, if any, from May 18, 2020

|

|

|

|

|

|

Pricing Benchmark:

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

13-year EUR mid-swap

20-year EUR mid-swap

|

|

|

|

|

|

Pricing Benchmark Yield:

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

-0.033%

+0.051%

|

|

|

|

|

|

Re-offer Spread vs. Pricing Benchmark:

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

MS + 135.00 basis points

MS + 180.00 basis points

|

|

|

|

|

|

Re-offer Yield (annual):

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

1.317%

1.851%

|

|

|

|

|

|

Government Benchmark:

|

|

Euro Notes due 2033:

Euro Notes due

2040:

|

|

DBR 0.000% due February 15, 2030

DBR

4.250% due July 4, 2039

|

|

|

|

|

|

Re-offer Spread vs. Government Benchmark:

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

B + 181.7 basis points

B + 208.8 basis points

|

|

|

|

|

|

Underwriting Discount:

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

37.5 basis points

47.5 basis

points

|

|

|

|

|

|

Proceeds to Verizon (before expenses):

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

99.423%

99.508%

|

|

|

|

|

|

|

|

Interest Rate:

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

1.300% per annum

1.850% per annum

|

|

|

|

|

Denominations:

|

|

Minimum of €100,000 and integral multiples of €1,000 in excess of €100,000

|

|

|

|

|

Redemption:

|

|

Euro Notes due 2033: (i) at any time prior to February 18, 2033 (three months prior to maturity) (the “Euro

Notes due 2033 Par Call Date”), make-whole call at the greater of 100% of the principal amount of the Euro Notes due 2033 being redeemed, or the discounted present value at the Comparable Government Bond Rate plus 30 basis points, assuming for

such purpose that the Euro Notes due 2033 matured on the Euro Notes due 2033 Par Call Date, plus accrued and unpaid interest and (ii) at any time on or after the Euro Notes due 2033 Par Call Date, at 100% of the principal amount of the Euro

Notes due 2033 being redeemed plus accrued and unpaid interest

Euro Notes due

2040: (i) at any time prior to November 18, 2039 (six months prior to maturity) (the “Euro Notes due 2040 Par Call Date”), make-whole call at the greater of 100% of the principal amount of the Euro Notes due 2040 being

redeemed, or the discounted present value at the Comparable Government Bond Rate plus 35 basis points, assuming for such purpose that the Euro Notes due 2040 matured on the Euro Notes due 2040 Par Call Date, plus accrued and unpaid interest and

(ii) at any time on or after the Euro Notes due 2040 Par Call Date, at 100% of the principal amount of the Euro Notes due 2040 being redeemed plus accrued and unpaid interest

|

|

|

|

|

|

CUSIPs:

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

92343V FJ8

92343V FK5

|

|

|

|

|

|

ISINs:

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

XS2176560444

XS2176561095

|

|

|

|

|

|

Common Codes:

|

|

Euro Notes due 2033:

Euro Notes

due 2040:

|

|

217656044

217656109

|

|

|

|

|

Listing:

|

|

Verizon intends to apply to list the notes on the New York Stock Exchange (the “NYSE”). Trading in the notes on the NYSE is expected to begin within 30 days after the original issue, but the listing application

is subject to review by the NYSE. Verizon has no obligation to maintain such listing and may delist the notes at any time.

|

|

|

|

|

|

|

|

|

|

|

|

Allocation

|

|

Principal Amount of

Euro Notes due 2033

|

|

|

Principal Amount of

Euro Notes due 2040

|

|

|

Barclays Bank PLC

|

|

€

|

303,750,000.00

|

|

|

€

|

180,000,000.00

|

|

|

Credit Suisse Securities (Europe) Limited

|

|

€

|

303,750,000.00

|

|

|

€

|

180,000,000.00

|

|

|

J.P. Morgan Securities plc

|

|

€

|

303,750,000.00

|

|

|

€

|

180,000,000.00

|

|

|

Mizuho International plc

|

|

€

|

303,750,000.00

|

|

|

€

|

180,000,000.00

|

|

|

Loop Capital Markets LLC

|

|

€

|

47,250,000.00

|

|

|

€

|

28,000,000.00

|

|

|

MUFG Securities EMEA plc

|

|

€

|

47,250,000.00

|

|

|

€

|

28,000,000.00

|

|

|

Academy Securities, Inc.

|

|

€

|

13,500,000.00

|

|

|

€

|

8,000,000.00

|

|

|

Blaylock Van, LLC

|

|

€

|

13,500,000.00

|

|

|

€

|

8,000,000.00

|

|

|

Great Pacific Securities

|

|

€

|

13,500,000.00

|

|

|

€

|

8,000,000.00

|

|

|

Total

|

|

€

|

1,350,000,000.00

|

|

|

€

|

800,000,000.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reference Document:

|

|

Preliminary Prospectus Supplement, subject to completion, dated May 12, 2020, Prospectus dated September 4, 2019

|

The issuer has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission

(the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about

the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if

you request it by calling Barclays Bank PLC at +1-888-603-5847, Credit Suisse Securities (Europe) Limited toll free at +1-800-221-1037, J.P. Morgan Securities plc at +44-207-134-2468 or Mizuho International plc at +44(0)20-7090-6698, or contacting the issuer at:

Investor Relations

Verizon Communications Inc.

One Verizon Way

Basking Ridge, New Jersey

07920

Telephone: (212) 395-1525

Internet Site: www.verizon.com/about/investors

Any

disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded. Such disclaimers or other notices were automatically generated as a result of this communication being sent via Bloomberg or

another email system.

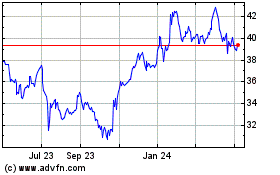

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

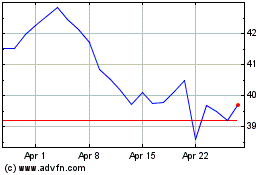

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024