Verizon Adds Wireless Customers at Faster Pace -- WSJ

August 02 2019 - 3:02AM

Dow Jones News

By Sarah Krouse

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 2, 2019).

Verizon Communications Inc. added more wireless customers in the

second quarter than some analysts expected as the carrier stepped

up its promotions and pushed to bring faster 5G wireless service to

more cities.

The carrier said it added 245,000 net postpaid phone connections

during the period compared with the 199,000 such connections it

added during the same period last year.

JPMorgan Chase & Co. analysts said earlier this week that

they expected Verizon to top their expectation that it would add

175,000 postpaid phone connections during the second quarter after

the carrier made a marketing push.

Verizon's earnings come nearly a week after rival T-Mobile US

Inc. received approval from federal antitrust officials to merge

with Sprint.

The union of T-Mobile and Sprint, years in the making, would

create a wireless company closer to the size of Verizon and

AT&T Inc. The merger still faces further challenges from a

state lawsuit seeking to block it.

T-Mobile said last week it added 710,000 net postpaid phone

customers in the second quarter, while AT&T's wireless business

added 72,000 during the period. Postpaid customers are considered

lucrative for carriers because they pay their bill monthly under

longer-term contracts.

Verizon has put upgrading its network to 5G at the heart of its

corporate strategy and is working to identify the best ways to

generate fresh revenue from businesses and consumers alike.

Matt Ellis, Verizon's finance chief, said his company has the

right strategy regardless of whether T-Mobile and Sprint merge,

adding that if the deal goes through the companies will spend two

to three years integrating their networks. "That's a big lift as

they discussed last week," he said.

Earlier this week Verizon turned on the faster service in parts

of Washington, Indianapolis, Atlanta and Detroit. To date, its 5G

signal in cities like Chicago has been ultrafast but spotty in part

because it uses high-frequency airwaves that don't travel long

distances.

Executives defended the carrier's spectrum portfolio and said

they have the assets they need to expand coverage. Hans Vestberg,

Verizon's chief executive, told analysts the company was quickly

expanding its coverage in some of the first 5G cities and touted

the ultra-fast speeds available.

Verizon executives have said it would take years for the network

upgrades to bring in more revenue. The carrier has said it would

eventually charge $10 a month for the service, but is currently

waiving that charge for new 5G customers.

Its 4G service, meanwhile, faces competition for subscribers in

the saturated U.S. market. Verizon is trying to draw new customers

and upgrade existing customers to pricier tiers of its unlimited

data plans.

Verizon had 118.12 million wireless connections, including

tablets, smartwatches and other devices, at the end of June,

compared with 117.9 million at the end of March.

Mr. Vestberg has restructured the company by the type of

customer served, rather than the product sold. The move could help

de-emphasize legacy products like Fios video, which has lost

customers in recent years. That service lost another 52,000

customers in the second quarter.

Overall, net income attributable to Verizon was $3.9 billion,

down from $4.1 billion a year earlier. Quarterly revenue declined

slightly to $32.1 billion from $32.2 billion a year ago.

Revenue within Verizon's media unit, which includes the Yahoo

and AOL properties it acquired, was $1.8 billion, down 2.9% from a

year ago. The company said declines in desktop advertising revenue

continue to be a challenge.

The carrier is in the throes of an effort to cut $10 billion in

costs by 2021 and says it has cut $4.1 billion to date.

Verizon shares were up about 2% to $56.15 in premarket trading.

The share price is little changed from where it started the

year.

Write to Sarah Krouse at sarah.krouse@wsj.com

(END) Dow Jones Newswires

August 02, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

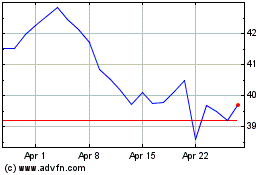

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

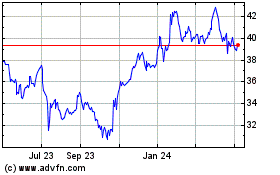

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024