- 1Q21 total revenue up 11.7% to $262.8 million

- 1Q21 direct premiums written up 9.2%

- 1Q21 diluted GAAP and non-GAAP1 adjusted earnings per share

(“EPS”) of $0.84

- 1Q21 combined ratio of 93.1%

- 1Q21 margin expansion in excess of 200 basis points

- 1Q21 annualized return on average equity of 23.2%

Universal Insurance Holdings (NYSE: UVE) (the “Company”)

reported 2021 first quarter diluted EPS of $0.84 on a GAAP and

non-GAAP1 adjusted basis. Total revenue was up 11.7% from the year

ago quarter to $262.8 million. Margins expanded in excess of 200

basis points, with an annualized return on average equity of

23.2%.

1 Excludes net realized and unrealized

gains and losses on investments as well as extraordinary

reinstatement premiums and associated commissions (“non-GAAP

adjusted EPS”). Reconciliations of GAAP to non-GAAP financial

measures are provided in the attached tables.

“We are off to a strong start to 2021 with solid first quarter

results, including close to 12% top line growth, margin expansion

in excess of 200 basis points, and a total annualized return on

average equity of 23.2%,” said Stephen J. Donaghy, Chief Executive

Officer. “We continue to make progress on our reinsurance program

renewal, and were oversubscribed on our first CAT bond in March at

rates below the low end of our initial range. We have now completed

procurement of our All States first event reinsurance program for

UPCIC for the 2021 wind season and will have additional details in

May as we finalize the remainder. In addition, we were encouraged

earlier this month when the Florida Senate passed Bill 76, which

would enable Floridians to have reliable access to property

insurance. For a number of years Florida has been a significant

outlier compared to the rest of the country when it comes to

litigated property claims, which has put significant pressure on

the Florida property insurance marketplace. We have not been immune

to these market dynamics and during the first quarter we actively

reduced our policies in force sequentially and reduced new and

renewal policy counts in aggregate this quarter when compared to

the first quarter of 2020. That being said, we continue to monitor

closely the companion bill in the House (House Bill 305), which has

differences from Senate Bill 76.”

Summary Financial Results

($thousands, except per share

data)

Three Months Ended March

31,

2021

2020

Change

(GAAP comparison)

Total revenue

$

262,757

$

235,275

11.7

%

Income (loss) before income taxes

36,351

27,584

31.8

%

Income (loss) before income taxes

margin

13.8

%

11.7

%

2.1

pts

Diluted EPS

$

0.84

$

0.61

37.7

%

Annualized return on average equity

(ROE)

23.2

%

16.1

%

7.1

pts

Book value per share, end of period

$

14.56

$

15.26

(4.6)

%

(Non-GAAP comparison)2

Adjusted operating income

36,323

35,361

2.7

%

Adjusted EPS

$

0.84

$

0.79

6.3

%

2 Reconciliation of GAAP to non-GAAP

financial measures are provided in the attached tables. Adjusted

operating income excludes net realized and unrealized gains and

losses on investments, interest expense, and extraordinary

reinstatement premiums and associated commissions. Non-GAAP

adjusted EPS excludes net realized and unrealized gains and losses

on investments, as well as extraordinary reinstatement premiums and

associated commissions.

Total revenue grew double digits for the quarter driven by

primary rate increases from 2020 earning through the book as

policies renew and an improvement in the unrealized portion of the

investment portfolio, partially offset by the impact of higher

reinsurance costs when compared to the first quarter of 2020.

Margins expanded more than 200 basis points for the quarter driven

by the incremental fall through profit from the top line as

previously described, lower losses and LAE and lower operating

expenses as a percent of direct premiums earned. GAAP diluted EPS

and non-GAAP adjusted EPS results for the quarter were driven by

the aforementioned factors, including a benefit from a reduced

share count. The Company produced an annualized return on average

equity of 23.2%.

Underwriting

($thousands, except policies in

force)

Three Months Ended March

31,

2021

2020

Change

Policies in force (as of end of

period)

976,250

910,579

7.2

%

Premiums in force (as of end of

period)

$

1,548,657

$

1,340,321

15.5

%

Direct premiums written

$

365,314

$

334,553

9.2

%

Direct premiums earned

375,606

325,951

15.2

%

Net premiums earned

243,305

220,829

10.2

%

Expense ratio3

33.9

%

32.9

%

1.0

pt

Loss & LAE ratio

59.2

%

61.2

%

(2.0

)pts

Combined ratio

93.1

%

94.1

%

(1.0

)pt

3 Expense ratio excludes interest

expense.

Direct premiums written were up 9.2% for the quarter, led by

direct premium growth of 10.2% in Florida.

On the expense side, the combined ratio improved 1.0 point for

the quarter. The improvement was driven primarily by decreased

weather, favorable prior year's reserve development, and an

increased benefit from our claims adjusting business, partially

offset by higher reinsurance costs impact on the ratio and current

year strengthening.

- The expense ratio decreased 33 basis points on a direct

premiums earned basis due to operating efficiencies, which was more

than offset by the impact of increased reinsurance costs on the net

ratio, resulting in a 1.0 point increase in the net expense ratio

for the quarter.

- The net loss and LAE ratio improved 2.0 points for the quarter.

Quarterly drivers include:

- A 45 basis point net improvement related to no weather events

being above plan.

- Favorable prior year’s reserve development of $1.2 million

(adverse development of $4.3 million in 1Q20) resulted in a 2.5

point net improvement for the quarter. Favorable development in the

current quarter was driven by ceded recoveries on the Other States

reinsurance program.

- Core losses of $145.2 million ($129.7 million in 1Q20) resulted

in a 1.1 point improvement for the quarter on a direct premium

earned basis, driven by a benefit from our claims adjusting

business, which was more than offset by increased reinsurance costs

and less than a point of current year strengthening on a direct

basis, which lead to a 1.0 point increase for the quarter on a net

basis.

Services

($thousands)

Three Months Ended March

31,

2021

2020

Change

Commission revenue

$

9,126

$

7,015

30.1

%

Policy fees

5,387

5,540

(2.8

)%

Other revenue

1,905

2,782

(31.5

)%

Total

$

16,418

$

15,337

7.0

%

Total services revenue increased 7.0% for the quarter. The

increase was primarily driven by commission revenue earned on ceded

premiums, partially offset by a decrease in new and renewal

business policy fees volume and other revenue.

Investments

($thousands)

Three Months Ended March

31,

2021

2020

Change

Net investment income

$

2,986

$

6,834

(56.3

)%

Realized gains (losses)

542

299

81.3

%

Unrealized gains (losses)

(494

)

(8,024

)

93.8

%

NM = Not Meaningful

Net investment income decreased 56.3% for the quarter. The

decrease is largely attributable to significantly lower yields on

the reinvested portfolio following the sale of a majority of

securities in the portfolio that were in an unrealized gain

position in the third and fourth quarters of 2020. Unrealized

equity losses improved substantially during the quarter when

compared to the market volatility seen last March as a result of

the COVID-19 pandemic. Total invested assets increased 10.6% to

$1.0 billion since year-end 2020.

Capital Deployment

During the first quarter, the Company repurchased approximately

15 thousand shares at an aggregate cost of $245 thousand.

On April 22, 2021, the Board of Directors declared a quarterly

cash dividend of 16 cents per share of common stock, payable on May

21, 2021, to shareholders of record as of the close of business on

May 14, 2021.

Guidance

The Company is maintaining its guidance for 2021 (assuming no

further extraordinary weather events and no realized or unrealized

gains in 2021):

- GAAP and Non-GAAP Adjusted EPS in a range of $2.75 - $3.00

- Annualized return on average equity in a range of 17.0% -

19.0%

Conference Call and Webcast

- Thursday, April 29, 2021 at 9:00 a.m. ET

- U.S. Dial-in Number: (855) 752-6647

- International: (503) 343-6667

- Participant code: 4597049

- Listen to live webcast: UniversalInsuranceHoldings.com

- Replay of the call will be available on the UVE website and by

phone at (855) 859-2056 or internationally at (404) 537-3406 using

the participant code: 4597049 through May 14, 2021

About Universal Insurance Holdings, Inc.

Universal Insurance Holdings (UVE) is a holding company offering

property and casualty insurance and value-added insurance services.

We develop, market, and write insurance products for consumers

predominantly in the personal residential homeowners lines of

business and perform substantially all other insurance-related

services for our primary insurance entities, including risk

management, claims management and distribution. We sell insurance

products through both our appointed independent agents and through

our direct online distribution channels in the United States across

19 states (primarily Florida). Learn more at

UniversalInsuranceHoldings.com.

Non-GAAP Financial Measures and Key Performance

Indicators

This press release contains non-GAAP financial measures within

the meaning of Regulation G promulgated by the U.S. Securities and

Exchange Commission (“SEC”), including adjusted earnings per

diluted share, which excludes the impact of the net realized and

unrealized gains and losses on investments as well as extraordinary

reinstatement premiums and associated commissions. Extraordinary

reinstatement premiums are not covered by reinstatement premium

protection and attach just below the Florida Hurricane Catastrophe

Fund (“FHCF”) reinsurance layer. Adjusted operating income excludes

the impact of the net realized and unrealized gains and losses on

investments, as well as interest expense and extraordinary

reinstatement premiums and associated commissions. A “non-GAAP

financial measure” is generally defined as a numerical measure of a

company’s historical or future performance that excludes or

includes amounts, or is subject to adjustments, so as to be

different from the most directly comparable measure calculated and

presented in accordance with generally accepted accounting

principles (“GAAP”). UVE management believes that these non-GAAP

financial measures, when considered together with the GAAP

financial measures, provide information that is useful to investors

in understanding period-over-period operating results separate and

apart from items that may, or could, have a disproportionately

positive or negative impact on results in any particular period.

UVE management also believes that these non-GAAP financial measures

enhance the ability of investors to analyze UVE’s business trends

and to understand UVE’s performance. UVE’s management utilizes

these non-GAAP financial measures as guides in long-term planning.

Non-GAAP financial measures should be considered in addition to,

and not as a substitute for or superior to, financial measures

presented in accordance with GAAP. For more information regarding

our key performance indicators, please refer to the section titled

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations – Key Performance Indicators” in our

forthcoming Quarterly Report on Form 10-Q for the quarter ended

March 31, 2021.

Forward-Looking Statements

This press release may contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. The words “believe,” “expect,” “anticipate,” “will,”

“plan,” and similar expressions identify forward-looking

statements, which speak only as of the date the statement was made.

Such statements may include commentary on plans, products and lines

of business, marketing arrangements, reinsurance programs and other

business developments and assumptions relating to the foregoing.

Forward-looking statements are inherently subject to risks and

uncertainties, some of which cannot be predicted or quantified,

including those risks and uncertainties described under the heading

“Risk Factors” and “Liquidity and Capital Resources” in our 2020

Annual Report on Form 10-K, and supplemented in our subsequent

Quarterly Reports on Form 10-Q. Future results could differ

materially from those described, and the Company disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events,

or otherwise. For further information regarding risk factors that

could affect the Company’s operations and future results, refer to

the Company’s reports filed with the Securities and Exchange

Commission, including the Company’s Annual Report on Form 10-K and

the most recent quarterly reports on Form 10-Q.

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(in thousands, except per

share data)

March 31,

December 31,

2021

2020

ASSETS:

Invested Assets

Fixed maturities, at fair value

$

913,131

$

819,861

Equity securities, at fair value

91,291

84,887

Assets held for sale

6,855

—

Investment real estate, net

6,027

15,176

Total invested assets

1,017,304

919,924

Cash and cash equivalents

90,829

167,156

Restricted cash and cash equivalents

12,715

12,715

Prepaid reinsurance premiums

100,221

215,723

Reinsurance recoverable

217,625

160,417

Premiums receivable, net

62,488

66,883

Property and equipment, net

53,178

53,572

Deferred policy acquisition costs

111,193

110,614

Goodwill

2,319

2,319

Other assets

49,581

49,418

TOTAL ASSETS

$

1,717,453

$

1,758,741

LIABILITIES AND STOCKHOLDERS'

EQUITY

LIABILITIES:

Unpaid losses and loss adjustment

expenses

$

315,780

$

322,465

Unearned premiums

772,843

783,135

Advance premium

73,738

49,562

Reinsurance payable, net

24,527

10,312

Long-term debt

8,088

8,456

Other liabilities

67,812

135,549

Total liabilities

1,262,788

1,309,479

STOCKHOLDERS' EQUITY:

Cumulative convertible preferred stock

($0.01 par value) 4

—

—

Common stock ($0.01 par value) 5

469

468

Treasury shares, at cost - 15,695 and

15,680

(225,751

)

(225,506

)

Additional paid-in capital

104,624

103,445

Accumulated other comprehensive income

(loss), net of taxes

(13,567

)

3,343

Retained earnings

588,890

567,512

Total stockholders' equity

454,665

449,262

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

1,717,453

$

1,758,741

Notes:

4 Cumulative convertible preferred stock

($0.01 par value): Authorized - 1,000 shares; Issued - 10 and 10

shares; Outstanding - 10 and 10 shares; Minimum liquidation

preference - $9.99 and $9.99 per share.

5 Common stock ($0.01 par value):

Authorized - 55,000 shares; Issued - 46,911 and 46,817 shares;

Outstanding 31,216 and 31,137 shares.

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME (UNAUDITED)

(in thousands)

Three Months Ended

March 31,

2021

2020

REVENUES

Net premiums earned

$

243,305

$

220,829

Net investment income

2,986

6,834

Net realized gains/(losses) on

investments

542

299

Net change in unrealized gains/(losses) of

equity securities

(494

)

(8,024

)

Commission revenue

9,126

7,015

Policy fees

5,387

5,540

Other revenue

1,905

2,782

Total revenues

262,757

235,275

EXPENSES

Losses and loss adjustment expenses

143,963

135,048

Policy acquisition costs

56,458

46,864

Other operating expenses

25,965

25,727

Interest expense

20

52

Total expenses

226,406

207,691

Income before income tax expense

36,351

27,584

Income tax expense (benefit)

9,943

7,517

NET INCOME

$

26,408

$

20,067

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

SHARE AND PER SHARE

INFORMATION

(in thousands, except per

share data)

Three Months Ended

March 31,

2021

2020

Weighted average common shares outstanding

- basic

31,208

32,591

Weighted average common shares outstanding

- diluted

31,277

32,731

Shares outstanding, end of period

31,216

32,385

Basic earnings (loss) per common share

$

0.85

$

0.62

Diluted earnings (loss) per common

share

$

0.84

$

0.61

Cash dividend declared per common

share

$

0.16

$

0.16

Book value per share, end of period

$

14.56

$

15.26

Annualized return on average equity

(ROE)

23.2

%

16.1

%

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

SUPPLEMENTARY

INFORMATION

(in thousands, except for

Policies In Force data)

Three Months Ended

March 31,

2021

2020

Premiums

Direct premiums written - Florida

$

307,011

$

278,511

Direct premiums written - Other States

58,303

56,042

Direct premiums written - Total

$

365,314

$

334,553

Direct premiums earned

$

375,606

$

325,951

Net premiums earned

$

243,305

$

220,829

Underwriting Ratios - Net

Loss and loss adjustment expense ratio

59.2

%

61.2

%

Policy acquisition cost ratio

23.2

%

21.2

%

Other operating expense ratio6

10.7

%

11.7

%

General and administrative expense

ratio6

33.9

%

32.9

%

Combined ratio

93.1

%

94.1

%

Other Items

(Favorable)/Unfavorable prior year's

reserve development

$

(1,237

)

$

4,341

Points on the loss and loss adjustment

expense ratio

(50) bps

197 bps

6 Expense ratio excludes interest

expense.

As of

March 31,

2021

2020

Policies in force

Florida

721,321

677,225

Other States

254,929

233,354

Total

976,250

910,579

Premiums in force

Florida

$

1,279,464

$

1,104,559

Other States

269,193

235,761

Total

$

1,548,657

$

1,340,321

Total Insured Value

Florida

$

194,421,426

$

169,764,009

Other States

110,930,255

95,464,246

Total

$

305,351,681

$

265,228,255

Three Months Ended March 31,

2021

Direct

Loss Ratio

Ceded

Loss Ratio

Net

Loss Ratio

Premiums earned

$

375,606

$

132,301

$

243,305

Loss and loss adjustment

expenses:

Core losses

$

145,228

38.7

%

$

28

—

%

$

145,200

59.7

%

Weather events7

—

—

%

—

—

%

—

—

%

Prior year’s reserve development

92,070

24.5

%

93,307

70.5

%

(1,237

)

(0.5

)%

Total losses and loss adjustment

expenses

$

237,298

63.2

%

$

93,335

70.5

%

$

143,963

59.2

%

7 Includes only current year weather

events beyond those expected.

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

(in thousands, except for per

share data)

Three Months Ended

Guidance

March 31,

Full Year 2021E

2021

2020

Income (Loss) Before Income

Taxes

$

36,351

$

27,584

Adjustments:

Reinstatement premium, net of

commissions8

—

—

Net unrealized (gains)/losses on equity

securities

494

8,024

Net realized (gains)/losses on

investments

(542

)

(299

)

Interest Expense

20

52

Total Adjustments

(28

)

7,777

Non-GAAP Adjusted Operating

Income

$

36,323

$

35,361

GAAP Diluted EPS

$

0.84

$

0.61

$ 2.75 - 3.00

Adjustments:

Reinstatement premium, net of

commissions8

—

—

—

Net unrealized (gains)/losses on equity

securities

0.02

0.25

—

Net realized (gains)/losses on

investments

(0.02

)

(0.01

)

—

Total Pre-Tax Adjustments

—

0.24

—

Income Tax on Above Adjustments

—

(0.06

)

—

Total Adjustments

—

0.18

—

Non-GAAP Adjusted EPS

$

0.84

$

0.79

$ 2.75 - 3.00

8 Includes extraordinary reinstatement

premiums not covered by reinstatement premium protection and

related commissions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210428006004/en/

Investor Relations Contact: Rob Luther, 954-958-1200 ext.

6750 VP, Corporate Development, Strategy & IR

rluther@universalproperty.com

Media Relations Contact: Andy Brimmer / Mahmoud Siddig,

212-355-4449 Joele Frank, Wilkinson Brimmer Katcher

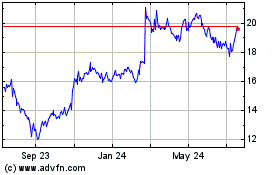

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

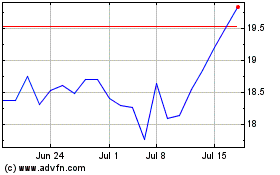

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Apr 2023 to Apr 2024