UnitedHealth Buy of LHC Group Seen as a 'Nice Fit' by Mizuho

March 29 2022 - 1:15PM

Dow Jones News

By Chris Wack

UnitedHealth Group Inc.'s deal to buy LHC Group Inc. for about

$5.4 billion in cash got the thumbs up from analysts at Mizuho

Securities USA, saying the merger would bolster UnitedHealth's

OptumCare business.

UnitedHealth shares hit their 52-week high of $519.59 on

Tuesday, and were trading just about flat at $509.01 at 12:20 p.m.

ET. LHC Group shares were trading up 6% to $166.48.

Mizuho said in a note that the LHC Group deal is a "nice bolt-on

strategic fit" for OptumCare, a part of the OptumHealth business,

and is intended to enhance the company's home-healthcare

capability.

The analysts expect the deal to be accretive to 2023 earnings by

about 1%, while UnitedHealth said the deal would be neutral in

2022, and moderately accretive in 2023.

Mizuho estimates that LHC Group will contribute 3% to 4% of

total OptumHealth revenue after the combination and about 5% of

total OptumHealth operating profit.

Mizuho said the combination with LHC Group is expected to

enhance OptumCare's home-based care and hospice capabilities, and

strengthen UnitedHealth's value-based care model.

The analyst reiterated its Buy rating of UnitedHealth, with a

price target of $550 a share.

Write to Chris Wack at chris.wack@wsj.com

(END) Dow Jones Newswires

March 29, 2022 13:00 ET (17:00 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

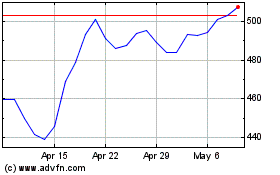

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024