Stocks Slip Ahead of Busy Earnings Week

April 12 2021 - 1:41PM

Dow Jones News

By Joe Wallace

U.S. stocks inched lower Monday at the start of a busy week of

corporate earnings and economic data.

The Dow Jones Industrial Average fell 57 points, or 0.2%, to

33744. The S&P 500 was little changed, and the Nasdaq Composite

lost 0.2%.

Investors said they were positioning for the start of earnings

season, as well as data that will help to gauge whether a coming

burst of inflation will prove transitory.

Among the reports expected this week are those from JPMorgan

Chase, Bank of America and Wells Fargo -- and companies ranging

from Delta Air Lines to PepsiCo to UnitedHealth Group. Meanwhile,

inflation data due on Tuesday are expected to show consumer prices

picked up in March.

"All of these things need to deliver in quite a Goldilocks

manner for the current gains to remain intact," said Edward Park,

chief investment officer at U.K. investment firm Brooks

Macdonald.

Shares of technology giants have taken back control of the rally

in U.S. stocks over the past month, helping to push major indexes

to a series of all-time highs. Investors' concerns about owning

shares that are sensitive to rising interest rates have been

assuaged by a retreat in yields on U.S. government bonds. Some say

the shift into economically sensitive sectors went too far at a

time when major economies like the European Union and India are

grappling with fresh coronavirus outbreaks.

There is "a bit of a question mark in markets just saying: We're

seeing strong gains; is this quite right?" Mr. Park said.

Shares of Nuance Communications jumped 16% after Microsoft said

it agreed to acquire the speech-recognition firm for $19.7

billion.

American depository receipts for Alibaba Group Holding rose 8.7%

after companies founded by billionaire Jack Ma announced changes to

operations and structure to placate regulators. Alibaba said Monday

it would invest in measures to support merchants on its platform,

two days after China's antitrust regulator imposed a record fine.

Later on Monday, financial-technology giant Ant Group said it would

apply to become a financial holding company overseen by China's

central bank.

Meanwhile, Ingersoll-Rand shares edged down 0.3% after the

manufacturer said it had agreed to sell its unit that makes golf

carts and other vehicles to Platinum Equity for $1.68 billion.

In bond markets, the yield on the 10-year U.S. Treasury note

ticked up to 1.672% from 1.664% Friday. Yields, which move in the

opposite direction to bond prices, have fallen back from their

closing high of 1.749% in late March, but are still up from a low

of 0.915% in early January.

U.S. crude oil added 0.4% to $63.17 a barrel. The Organization

of the Petroleum Exporting Countries is due to release a regular

forecast of global supply and demand of oil Tuesday.

In overseas markets, the Stoxx Europe 600 edged down 0.5%,

pressured by declines in shares of travel & leisure

companies.

Among individual European equities, shares of Suez rose roughly

7.7% in Paris after the French waste and water management company

said Monday that it had agreed to merge with Veolia

Environnement.

Stocks pulled back in major Asian markets. China's Shanghai

Composite fell 1.1%, and Japan's Nikkei 225 lost 0.8%.

Akane Otani contributed to this article

Write to Joe Wallace at Joe.Wallace@wsj.com

(END) Dow Jones Newswires

April 12, 2021 13:26 ET (17:26 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

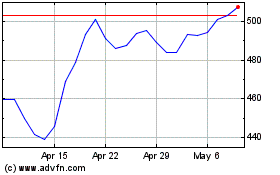

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024