UPS's Revenue Jumps 21% on Online Shopping Surge--Update

February 02 2021 - 9:46AM

Dow Jones News

By Paul Ziobro

United Parcel Service Inc. notched a 21% jump in fourth-quarter

sales to $24.9 billion, a record for the company, boosted by

pandemic-fueled online shopping during the holidays.

The company's operating profit grew 26% in the quarter ended

Dec. 31, a sign that added fees and a hard-line approach to volume

limits instituted for Chief Executive Carol Tomé's first peak

shipping season helped offset higher expenses.

The results were aided by small- and medium-size customers,

which boost UPS's profits because they generally pay higher

shipping rates than large retailers like Amazon.com Inc. and Target

Corp. Package volume rose more than 28% for smaller customers,

compared with 4% for the biggest shippers, in the fourth

quarter.

Combined with additional surcharges applied more broadly, UPS's

revenue per item shipped rose 7.8% in the fourth quarter, the

highest increase in more than a decade.

Amazon, UPS's biggest customer, is expected to report more than

$100 billion in quarterly sales for the first time when it

discloses results after markets close Tuesday.

Ms. Tomé became CEO in mid-2020 as consumers hunkered down and

ordered everything from toilet paper to trampolines online. The

Atlanta-based company has tried to offset the costs with new

delivery surcharges throughout the year and by negotiating higher

rates with other customers.

For the fourth quarter, UPS posted a slight increase in overall

operating margins to 11.5% on an adjusted basis, although margins

dipped slightly in its main U.S. package segment.

The company took steps to ensure its delivery network wouldn't

buckle under the stress of the holiday season with new strategies

that included holding its customers to agreed-upon shipping limits

during the season. The restrictions led to some retailers like Gap

Inc. and Nike Inc. seeing their pickups paused for a few days in

December as UPS processed record volume from those and other

merchants.

Such steps help avoid extra expenses for overtime and other

measures needed to clear bottlenecks. "We reduced what we referred

to as chaos costs," Ms. Tomé said on Tuesday's earnings call.

UPS said the steps were necessary, and they helped the company

post on-time delivery levels better than FedEx Corp. and the U.S.

Postal Service throughout the holiday season.

FedEx reported a 29% surge in shipping volumes in its Ground

unit during the quarter that ended Nov. 30. Like UPS, FedEx has

also raised prices and added fees to help manage the spike in

e-commerce packages. The Postal Service, meanwhile, struggled to

make on-time deliveries.

Ms. Tomé is in the midst of executing her "better, not bigger"

strategy at UPS, which seeks to maximize returns and profits

instead of chasing after more business. One of her first major

changes in that strategy was a recent decision to sell the Freight

business to TFI International Inc. for $800 million, which exits

UPS from a competitive business with low margins.

UPS booked a $545 million after-tax charge on the Freight sale

and a $4.9 billion noncash charge on its pension plan to reflect

low interest rates. Those moves resulted in a net loss for the

quarter of $3.26 billion, compared with a profit of $659 million a

year ago.

Excluding those items, UPS said it had adjusted profit of $2.66

a share. Analysts were looking for UPS to post per-share earnings

of $2.14 on $22.87 billion in revenue, according to FactSet.

UPS declined to provide earnings guidance for the coming year

due to uncertainty from the global pandemic. It did say it plans to

spend about $4 billion on capital expenditures and grow its

dividend, and it had no plans for share buybacks.

On e-commerce, Ms. Tomé said the company is banking that those

trends will continue in 2021. "We don't think e-commerce, as a

percentage of retail sales, will decline," she said, "which means

continued supply and demand imbalances."

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

February 02, 2021 09:31 ET (14:31 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

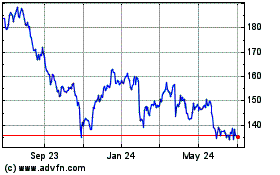

United Parcel Service (NYSE:UPS)

Historical Stock Chart

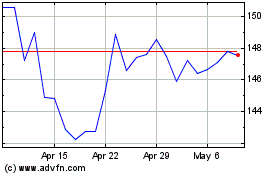

From Mar 2024 to Apr 2024

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024