Today's Logistics Report: Tracking a Vaccine; Lasting Postal Slowdown; Megaships' Broken Promise

October 23 2020 - 11:09AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Planning and tracking technology is forming around the sprawling

supply chain for prospective Covid-19 vaccines. Data-mining company

Palantir Technologies Inc. is helping the federal government set up

the system that will track the manufacture, distribution and

administration of Covid-19 vaccines, the WSJ's Peter Loftus and

Rolfe Winkler, even as big drugmakers continue to develop and test

hoped-for medical solutions to the pandemic. The tracking system,

dubbed Tiberius, would build on work that Palantir has been doing

for federal health officials tracking coronavirus hospitalizations.

Pharmaceutical manufacturers are already using their more focused

supply-chain technologies and visibility tools to manage the

transport progress of vaccines from sourcing to distribution. The

Tiberius platform would take data from those companies,

distributors and others involved with vaccines and integrate it

with demographic and other health data to help health authorities

make decisions on where to send doses and to track the results.

TRANSPORTATION

A new report details a dramatic and lasting slowdown in mail

delivery after former logistics executive Louis DeJoy became

postmaster general. The report by the U.S. Postal Service's

inspector general says actions Mr. DeJoy initiated or which were

accelerated after he took office in June resulted in widespread

pileups of mail. The WSJ's Rebecca Smith and Joe Palazzolo write

that the report says backups at processing facilities and post

offices still haven't been eliminated, casting a shadow over the

Postal Service because of the heightened role mail delivery plays

this year during the presidential election and the pandemic. The

problems are adding to the headaches of shippers this year as the

surge in digital commerce has stressed parcel networks. The report

said on-time delivery of first-class mail plunged below 80% in July

and was 86.8% as of Sept. 3, still well below an internal target of

96%.

TRANSPORTATION

Megaships were supposed to bring a new shine to the bottom lines

of container ship operators and stimulate a new era of fast-growing

international trade. Economist and historian Marc Levinson argues

in a WSJ essay that the opposite has occurred, with the behemoth

Emma Maersk that launched in 2006 and the larger vessels in the

ship's wake making freight transportation slower and less reliable.

Mr. Levinson, author of a new book, "Outside the Box: How

Globalization Changed from Moving Stuff to Spreading Ideas," have

helped stifle globalization by slowing the movement of industrial

commerce and undermining confidence in tightly organized supply

chains. Shippers have borne a burden by keeping more inventory,

reversing a decades-long focus on minimizing production,

transportation and inventory costs. Some shipping experts will

argue with that assessment but container lines may be more

measured. They're making big profits this year, after all,

operating with less capacity.

QUOTABLE

IN OTHER NEWS

New U.S. applications for unemployment benefits fell but remain

far above pre-pandemic peaks. (WSJ)

Sales of previously owned homes in the U.S. rose to a 14-year

high in September. (WSJ)

Turkey's currency fell to a record low against the dollar.

(WSJ)

Persian Gulf waters off Iraq have become an important waypoint

for Iranian oil smugglers looking to avoid U.S. sanctions.

(WSJ)

Walmart Inc. is suing the federal government in a pre-emptive

move against what it said is an impending opioid-related civil

lawsuit. (WSJ)

United Parcel Service Inc. plans to offer nearly 100,000 of its

workers a way to save for emergencies within its retirement plan.

(WSJ)

A California court says Uber Technologies Inc. and Lyft Inc.

must comply with an order that requires them to reclassify their

drivers as employees. (WSJ)

American Airlines Group Inc. lost $2.4 billion in the third

quarter and Southwest Airlines lost $1.2 billion despite an uptick

in passenger traffic. (WSJ)

Pandemic-driven consumer purchasing drove Unilever Ltd.'s North

American underlying sales up 9.1% in the third quarter. (WSJ)

Coca-Cola Co. expects to see growth this year in China, even as

global sales decline. (WSJ)

Gucci's third-quarter sales fell 12%, lagging other big luxury

labels. (WSJ)

Apparel retailer Gap Inc. will close about 350 U.S. stores as it

focuses on growing digital sales. (CNBC)

Huawei Technologies Inc. has stockpiled chips as it launches a

smartphone amid U.S. sanctions on the Chinese company. (Washington

Post)

Airbus SE has told suppliers it expects to boost production of

its A320neo aircraft by nearly 18% next year. (Financial Times)

Japan's Mitsubishi Heavy Industries is close to halting

development of a regional jet. (Nikkei Asian Review)

Shippers are paying record fees for empty containers because of

a steep imbalance in trade in and out of China. (Lloyd's List)

Loaded container imports into the ports of Seattle and Tacoma

reached their highest level in a year in September but were off

6.8% from last year. (Port Technology)

An investigation concludes that decaying dangerous cargo caused

the 2018 fire that heavily damaged the Maersk Honam and killed five

seafarers. (ShippingWatch)

Scorpio Bulkers Inc. is on pace to shed the last of its bulk

ships by the end of the first quarter. (TradeWinds)

Union Pacific Corp.'s freight volumes rose 19% from the second

quarter to the third quarter while costs rose 11%. (Dow Jones

Newswires)

CSX Corp.'s third-quarter operating income fell 11% to $1.1

billion. (Trains)

Wales will nationalize its passenger rail service. (BBC)

E-commerce facilities represented 37% of all new leases for

Prologis Inc. in the third quarter, above the historical average of

21%. (Supply Chain Dive)

Amazon.com Inc. is building a 1 million-square-foot distribution

center in Hagerstown, Md. (Herald Mail)

Sam's Club will have its store robots take inventory while they

scrub floors. (Progressive Grocer)

ABOUT US

Paul Page is editor of WSJ Logistics Report. Follow the WSJ

Logistics Report team: @PaulPage, @jensmithWSJ and @CostasParis.

Follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

October 23, 2020 10:54 ET (14:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

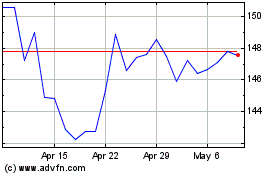

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

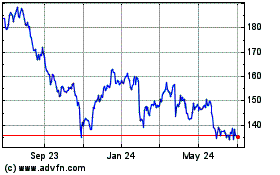

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024