Q2 GM climbs to 46.5% as 1H 2022 operating

income reaches NT$50.5bn

Second Quarter 2022 Overview1:

- Revenue: NT$72.06 billion (US$2.43 billion)

- Gross margin: 46.5%; Operating margin: 39.1%

- Revenue from 22/28nm: 22%

- Capacity utilization rate: 100%+

- Net income attributable to shareholders of the parent:

NT$21.33 billion (US$718 million)

- Earnings per share: NT$1.74; earnings per ADS:

US$0.293

United Microelectronics Corporation (NYSE: UMC; TWSE:

2303) (“UMC” or “The Company”), a leading global semiconductor

foundry, today announced its consolidated operating results for the

second quarter of 2022.

Second quarter consolidated revenue was NT$72.06 billion,

increasing 13.6% QoQ from NT$63.42 billion in 1Q22. Compared to a

year ago, 2Q22 revenue grew 41.5% YoY from NT$50.91 billion in

2Q21. Consolidated gross margin for 2Q22 reached 46.5%. Net income

attributable to the shareholders of the parent was NT$21.33

billion, with earnings per ordinary share of NT$1.74.

Jason Wang, UMC co-president, said, “In the second quarter, we

delivered results in line with guidance, thanks to continuous

strong demand for UMC’s differentiated processes across our end

markets. Overall wafer shipments rose 4.3% from the previous

quarter, while higher average selling price and a favorable foreign

exchange rate lifted second-quarter gross margin to 46.5%. Revenue

from our 22/28nm portfolio increased 29% sequentially, driven by

the additional capacity at Fab 12A P5 that came online during the

second quarter. We are confident in the long-term growth prospects

of our 22/28nm business, which now represents 22% of UMC’s overall

wafer revenue, and has demonstrated solid traction for OLED display

drivers, image processors, WiFi, and automotive applications. As

structural trends drive semiconductor content increase in end

devices from smartphones to automobiles, it is our conviction that

28nm is a long-lasting node that will be important for many

existing and emerging applications for years to come.”

Co-president Wang said, “Going into the third quarter, we expect

our business to remain firm. While cooling demand for smartphones,

PCs, and consumer electronics may pose some short-term

fluctuations, we are actively working with customers to adjust

their product mix. Coming off a super cycle over the past two

years, the semiconductor industry is now in a period of inventory

correction. We believe UMC’s comprehensive portfolio of

differentiated, leading specialty technologies and strong

partnerships with leading customers will help us navigate the

cyclical macro environment.”

Co-president Wang added, “Moving onto our progress in

sustainability, we are pleased to become the first semiconductor

foundry globally to have emissions reduction targets validated by

the Science Based Targets initiative (SBTi), the leading body that

independently assesses emissions targets of companies and ensure

they align with the latest climate science. This reflects UMC’s

commitment to accountability and confirms our roadmap to achieve

our net-zero pledge. According to our roadmap, we will

systematically lower direct emissions from our operations, indirect

emissions from our electricity usage, as well as emissions from our

value chain in order to minimize the environmental footprint of our

operations and products.”

Summary of Operating Results

Operating Results

(Amount: NT$ million)

2Q22

1Q22

QoQ % change

2Q21

YoY % change

Operating Revenues

72,055

63,423

13.6

50,908

41.5

Gross Profit

33,472

27,504

21.7

15,908

110.4

Operating Expenses

(6,706

)

(6,513

)

3.0

(6,201

)

8.2

Net Other Operating Income and

Expenses

1,398

1,343

4.1

1,606

(12.9

)

Operating Income

28,164

22,334

26.1

11,313

149.0

Net Non-Operating Income and Expenses

(2,586

)

1,314

-

1,881

-

Net Income Attributable to Shareholders of

the Parent

21,327

19,808

7.7

11,943

78.6

EPS (NT$ per share)

1.74

1.61

0.98

(US$ per ADS)

0.293

0.271

0.165

Second quarter operating revenues increased by 13.6%

sequentially to NT$72.06 billion which was lifted to higher wafer

shipments, increase in wafer pricing as well as favorable foreign

exchange rate. Revenue contribution from 40nm and below

technologies represented 40% of wafer revenue. Gross profit grew

21.7% QoQ to NT$33.47 billion, or 46.5% of revenue. Operating

expenses grew 3.0% to NT$6.71 billion. Net other operating income

remained relatively flat at NT$1.40 billion. Net non-operating loss

amounted to NT$2.59 billion primarily from non-cash based items

recognized as marked-to-market assets. Net income attributable to

shareholders of the parent amounted to NT$21.33 billion.

Earnings per ordinary share for the quarter was NT$1.74.

Earnings per ADS was US$0.293. The basic weighted average number of

outstanding shares in 2Q22 was 12,283,479,334, compared with

12,283,479,334 shares in 1Q22 and 12,206,292,756 shares in 2Q21.

The diluted weighted average number of outstanding shares was

12,553,373,552 in 2Q22, compared with 12,534,728,721 shares in 1Q22

and 12,382,592,798 shares in 2Q21. The fully diluted shares counted

on June 30, 2022 were approximately 12,553,374,000.

Detailed Financials Section

Operating revenues increased to NT$72.06 billion. COGS increased

to NT$38.58 billion, which included 1.9% sequential decrease in

depreciation, mainly reflecting higher wafer shipments. Gross

profit grew 21.7% QoQ to NT$33.47 billion. Operating expenses

slightly increased 3.0% QoQ to NT$6.71 billion, as G&A grew

15.8% to NT$2.58 billion while R&D was up 5.8% QoQ to NT$3.21

billion, representing 4.5% of revenue. Net other operating income

was NT$1.40 billion. In 2Q22, operating income grew 26.1% QoQ to

NT$28.16 billion.

COGS & Expenses

(Amount: NT$ million)

2Q22

1Q22

QoQ % change

2Q21

YoY % change

Operating Revenues

72,055

63,423

13.6

50,908

41.5

COGS

(38,583

)

(35,919

)

7.4

(35,000

)

10.2

Depreciation

(9,616

)

(9,807

)

(1.9

)

(10,187

)

(5.6

)

Other Mfg. Costs

(28,967

)

(26,112

)

10.9

(24,813

)

16.7

Gross Profit

33,472

27,504

21.7

15,908

110.4

Gross Margin (%)

46.5

%

43.4

%

31.3

%

Operating Expenses

(6,706

)

(6,513

)

3.0

(6,201

)

8.2

G&A

(2,579

)

(2,226

)

15.8

(1,901

)

35.7

Sales & Marketing

(915

)

(1,255

)

(27.1

)

(1,131

)

(19.1

)

R&D

(3,209

)

(3,033

)

5.8

(3,168

)

1.3

Expected Credit Impairment Gain (Loss)

(3

)

1

-

(1

)

90.3

Net Other Operating Income &

Expenses

1,398

1,343

4.1

1,606

(12.9

)

Operating Income

28,164

22,334

26.1

11,313

149.0

Net non-operating expense in 2Q22 was NT$2.59 billion, primarily

reflecting NT$3.68 billion in net investment loss, offset by a

NT$1.36 billion in exchange gain.

Non-Operating Income and

Expenses

(Amount: NT$ million)

2Q22

1Q22

2Q21

Non-Operating Income and Expenses

(2,586

)

1,314

1,881

Net Interest Income and Expenses

(163

)

(323

)

(310

)

Net Investment Gain and Loss

(3,675

)

576

2,276

Exchange Gain and Loss

1,361

926

(84

)

Other Gain and Loss

(109

)

135

(1

)

In 2Q22, cash inflow from operating activities was NT$35.09

billion. Cash outflow from investing activities amounted to

NT$11.72 billion, which included NT$11.63 billion in capital

expenditure, resulting in free cash flow of NT$23.46 billion. Cash

outflow from financing reached NT$13.42 billion, primarily from

NT$11.62 billion repayment in bank loans and NT$2.48 billion in

redemption of bonds. Net cash inflow in 2Q22 totaled NT$11.55

billion. Over the next 12 months, the company expects to repay NT$

4.18 billion in bank loans.

Cash Flow Summary

(Amount: NT$ million)

For the 3-Month Period Ended

Jun. 30, 2022

For the 3-Month Period Ended

Mar. 31, 2022

Cash Flow from Operating Activities

35,091

30,118

Net income before tax

25,578

23,648

Depreciation & Amortization

11,107

11,390

Share of loss of associates and

joint ventures

2,027

1,858

Income tax paid

(2,913

)

(769

)

Changes in working capital &

others

(708

)

(6,009

)

Cash Flow from Investing Activities

(11,716

)

14,752

Decrease in financial assets measured

at amortized cost

103

26,315

Acquisition of PP&E

(10,907

)

(10,803

)

Acquisition of intangible assets

(815

)

(421

)

Others

(97

)

(339

)

Cash Flow from Financing Activities

(13,423

)

(7,959

)

Bank loans

(11,615

)

(612

)

Redemption of bonds

(2,484

)

(7,249

)

Others

676

(98

)

Effect of Exchange Rate

1,601

2,637

Net Cash Flow

11,553

39,548

Beginning balance

172,170

132,622

Ending balance

183,723

172,170

Cash and cash equivalents increased to NT$183.72 billion. Days

of inventory increased by 1 day to 62 days.

Current Assets

(Amount: NT$ billion)

2Q22

1Q22

2Q21

Cash and Cash Equivalents

183.72

172.17

124.00

Notes & Accounts Receivable

42.88

38.05

30.11

Days Sales Outstanding

51

53

53

Inventories, net

27.34

25.40

22.44

Days of Inventory

62

61

58

Total Current Assets

265.78

249.68

207.83

Current liabilities increased to NT$131.81 billion, mainly from

NT$97.04 billion in other. Long-term credit/bonds decreased to

NT$45.70 billion. Total liabilities increased to NT$216.51 billion,

leading to a debt to equity ratio of 76%.

Liabilities

(Amount: NT$ billion)

2Q22

1Q22

2Q21

Total Current Liabilities

131.81

93.12

85.00

Notes & Accounts Payable

9.95

9.06

8.42

Short-Term Credit / Bonds

13.22

22.58

19.65

Payables on Equipment

11.60

7.63

6.67

Dividends Payable

-

-

19.88

Other

97.04

53.85

30.38

Long-Term Credit / Bonds

45.70

50.07

50.97

Long-Term Investment Liabilities

8.50

8.59

20.61

Total Liabilities

216.51

180.62

181.49

Debt to Equity

76%

60%

76%

Analysis of Revenue2

Revenue from Asia-Pacific increased to 65% while business from

North America remained at 22% of sales. Business from Europe was 8%

while contribution from Japan decreased to 5%.

Revenue Breakdown by

Region

Region

2Q22

1Q22

4Q21

3Q21

2Q21

North America

22%

22%

21%

22%

22%

Asia Pacific

65%

64%

66%

65%

63%

Europe

8%

8%

7%

7%

8%

Japan

5%

6%

6%

6%

7%

Revenue contribution from 22/28nm grew to 22% of the wafer

revenue, while 40nm contribution stayed at 18% of sales.

Revenue Breakdown by

Geometry

Geometry

2Q22

1Q22

4Q21

3Q21

2Q21

14nm and below

0%

0%

0%

0%

0%

14nm<x<=28nm

22%

20%

20%

19%

20%

28nm<x<=40nm

18%

18%

18%

18%

18%

40nm<x<=65nm

19%

19%

19%

19%

19%

65nm<x<=90nm

7%

8%

8%

8%

9%

90nm<x<=0.13um

12%

12%

12%

12%

11%

0.13um<x<=0.18um

12%

13%

13%

13%

13%

0.18um<x<=0.35um

8%

7%

7%

8%

8%

0.5um and above

2%

3%

3%

3%

2%

Revenue from fabless customers accounted for 86% of revenue.

Revenue Breakdown by Customer

Type

Customer Type

2Q22

1Q22

4Q21

3Q21

2Q21

Fabless

86%

87%

86%

86%

84%

IDM

14%

13%

14%

14%

16%

Revenue from the communication segment represented 45%, while

business from computer applications decreased to 16%. Business from

consumer applications was 27% as other segments remained at 12% of

revenue.

Revenue Breakdown by

Application (1)

Application

2Q22

1Q22

4Q21

3Q21

2Q21

Computer

16%

17%

17%

17%

17%

Communication

45%

45%

46%

46%

47%

Consumer

27%

26%

26%

27%

26%

Others

12%

12%

11%

10%

10%

(1) Computer consists of ICs such as CPU, GPU, HDD

controllers, DVD/CD-RW control ICs, PC chipset, audio codec,

keyboard controller, monitor scaler, USB, I/O chipset, WLAN.

Communication consists of handset components, broadband,

bluetooth, Ethernet, LAN, DSP, etc. Consumer consists of ICs

used for DVD players, DTV, STB, MP3/MP4, flash controller, game

consoles, DSC, smart cards, toys, etc.

Blended ASP Trend

Blended average selling price (ASP) grew in 2Q22.

(To view blended ASP trend, please click here for 2Q22 ASP)

Shipment and Utilization Rate3

Wafer shipments grew 4.3% QoQ to 2,622K in the second quarter,

while quarterly capacity grew to 2,528K. Overall utilization rate

in 2Q22 remained above 100%.

Wafer Shipments

2Q22

1Q22

4Q21

3Q21

2Q21

Wafer Shipments (8” K equivalents)

2,622

2,513

2,546

2,503

2,440

Quarterly Capacity Utilization

Rate

2Q22

1Q22

4Q21

3Q21

2Q21

Utilization Rate

100%+

100%+

100%+

100%+

100%+

Total Capacity (8” K equivalents)

2,528

2,420

2,419

2,383

2,370

Capacity4

Overall capacity in the second quarter increased to 2,528K

8-inch equivalent wafers. Capacity will grow in the third quarter

of 2022 to 2,539K 8-inch equivalent wafers, driven by the capacity

expansion taking place at 12X and 8N.

Annual Capacity in

thousands of wafers

Quarterly Capacity in

thousands of wafers

FAB

Geometry (um)

2021

2020

2019

2018

FAB

3Q22E

2Q22

1Q22

4Q21

WTK

6"

5 – 0.15

329

371

370

396

WTK

6"

85

84

82

81

8A

8"

3 – 0.11

755

802

825

825

8A

8"

192

192

189

190

8C

8"

0.35 – 0.11

459

452

436

383

8C

8"

115

115

113

115

8D

8"

0.18 – 0.09

380

371

359

347

8D

8"

103

103

101

95

8E

8"

0.6 – 0.14

457

449

426

418

8E

8"

118

118

116

115

8F

8"

0.18 – 0.11

514

485

434

431

8F

8"

138

138

136

137

8S

8"

0.18 – 0.11

408

373

372

372

8S

8"

111

111

109

102

8N

8"

0.5 – 0.11

917

917

831

771

8N

8"

242

235

231

232

12A

12"

0.13 – 0.014

1,070

1,044

997

997

12A

12"

301

301

267

271

12i

12"

0.13 – 0.040

641

628

595

555

12i

12"

164

164

162

164

12X

12"

0.080 – 0.022

284

217

203

183

12X

12"

80

78

77

78

12M

12"

0.13 – 0.040

395

391

98

-

12M

12"

110

110

108

104

Total(1)

9,453

9,188

8,148

7,673

Total

2,539

2,528

2,420

2,419

YoY Growth Rate

3%

13%

6%

5%

(1) One 6-inch wafer is converted into 0.5625 (62/82) 8-inch

equivalent wafer; one 12-inch wafer is converted into 2.25 (122/82)

8-inch equivalent wafers. Total capacity figures are expressed in

8-inch equivalent wafers.

CAPEX

CAPEX spending in 2Q22 totaled US$395 million. 2022 cash-based

CAPEX budget will be US$3.6 billion.

Capital Expenditure by Year - in

US$ billion

Year

2021

2020

2019

2018

2017

CAPEX

$ 1.8

$ 1.0

$ 0.6

$ 0.7

$ 1.4

2022 CAPEX Plan

8"

12"

Total

10%

90%

US$3.6 billion

Third Quarter 2022 Outlook & Guidance

Quarter-over-Quarter Guidance:

- Wafer Shipments: To remain flat

- ASP in USD: To remain flat

- Gross Profit Margin: To be in the mid-40% range

- Capacity Utilization: 100%

- 2022 CAPEX: US$3.6 billion

Recent Developments / Announcements

Apr. 29, 2022

UMC ranked top 5% in corporate governance

evaluation for 8th consecutive year

May. 27, 2022

UMC shareholders approve NT$3 cash

dividend at annual shareholders’ meeting

Jun. 23, 2022

UMC’s climate goals validated by Science

Based Targets initiatives

Please visit UMC’s website for further details

regarding the above announcements

Conference Call / Webcast Announcement

Wednesday, July 27, 2022

Time: 5:00 PM (Taipei) / 5:00 AM (New York) / 10:00 AM

(London)

Dial-in numbers and Access Codes:

USA Toll Free:

1-866 836-0101

Taiwan Number:

02-2192-8016

Other Areas:

+886-2-2192-8016

Access Code:

UMC

A live webcast and replay of the 2Q22 results

announcement will be available at www.umc.com under the “Investors

/ Events” section.

About UMC

UMC (NYSE: UMC, TWSE: 2303) is a leading global semiconductor

foundry. The company provides high quality IC production with a

focus on both logic and specialty technologies to serve every major

sector of the electronics industry. UMC’s comprehensive technology

and manufacturing solutions include logic/RF, embedded high

voltage, embedded flash, RFSOI/BCD and IATF-16949 automotive

manufacturing certification for all its manufacturing facilities.

UMC operates 12 fabs that are strategically located throughout Asia

with a maximum capacity of approximately 850,000 8-inch equivalent

wafers per month. The company employs approximately 20,000 people

worldwide, with offices in Taiwan, China, United States, Europe,

Japan, Korea and Singapore. For more information, please visit:

http://www.umc.com.

Safe Harbor Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the United States Securities Act of

1933, as amended, and Section 21E of the United States Securities

Exchange Act of 1934, as amended, and as defined in the United

States Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, but are not limited to,

statements regarding anticipated financial results for the second

quarter of 2022; the expected wafer shipment and ASP; the

anticipated annual budget; capex strategies; environmental

protection goals and water management strategies; impact of foreign

currency exchange rates; expected foundry capacities; the ability

to obtain new business opportunities; and information under the

heading “Second Quarter of 2022 Outlook and Guidance.”

These forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause the actual

performance, financial condition or results of operations of UMC to

be materially different from what is stated or may be implied in

such forward-looking statements. Investors are cautioned that

actual events and results could differ materially from those

statements as a result of a number of factors including, but not

limited to: (i) dependence upon the frequent introduction of new

services and technologies based on the latest developments in the

industry in which UMC operates; (ii) the intensely competitive

semiconductor, communications, consumer electronics and computer

industries and markets; (iii) the risks associated with

international business activities; (iv) dependence upon key

personnel; (v) general economic and political conditions; (vi)

possible disruptions in commercial activities caused by natural and

human-induced events and disasters, including natural disasters,

terrorist activity, armed conflict and highly contagious diseases;

(vii) reduced end-user purchases relative to expectations and

orders; and (viii) fluctuations in foreign currency exchange rates.

Further information regarding these and other risk factors is

included in UMC’s filings with the United States Securities and

Exchange Commission, including its Annual Report on Form 20-F. All

information provided in this release is as of the date of this

release and are based on assumptions that UMC believes to be

reasonable as of this date, and UMC does not undertake any

obligation to update any forward-looking statement as a result of

new information, future events or otherwise, except as required

under applicable law.

The financial statements included in this release are prepared

and published in accordance with Taiwan International Financial

Reporting Standards, or TIFRSs, recognized by the Financial

Supervisory Commission in the ROC, which is different from

International Financial Reporting Standards, or IFRSs, issued by

the International Accounting Standards Board. Investors are

cautioned that there may be significant differences between TIFRSs

and IFRSs. In addition, TIFRSs and IFRSs differ in certain

significant respects from generally accepted accounting principles

in the ROC and generally accepted accounting principles in the

United States.

- FINANCIAL TABLES TO FOLLOW -

UNITED MICROELECTRONICS CORPORATION AND SUBSIDIARIES

Consolidated Condensed Balance Sheet As of June 30, 2022

Figures in Millions of New Taiwan Dollars (NT$) and U.S. Dollars

(US$) June 30, 2022 US$ NT$ % Assets Current assets Cash and

cash equivalents

6,184

183,723

36.8%

Accounts receivable, net

1,443

42,884

8.6%

Inventories, net

920

27,341

5.5%

Other current assets

399

11,830

2.3%

Total current assets

8,946

265,778

53.2%

Non-current assets Funds and investments

2,234

66,373

13.3%

Property, plant and equipment

4,518

134,243

26.9%

Right-of-use assets

266

7,900

1.6%

Other non-current assets

857

25,460

5.0%

Total non-current assets

7,875

233,976

46.8%

Total assets

16,821

499,754

100.0%

Liabilities Current liabilities Short-term loans

21

624

0.1%

Payables

3,194

94,907

19.0%

Current portion of long-term liabilities

424

12,593

2.5%

Other current liabilities

798

23,689

4.8%

Total current liabilities

4,437

131,813

26.4%

Non-current liabilities Bonds payable

777

23,080

4.6%

Long-term loans

761

22,619

4.5%

Lease liabilities, noncurrent

180

5,346

1.1%

Other non-current liabilities

1,132

33,648

6.7%

Total non-current liabilities

2,850

84,693

16.9%

Total liabilities

7,287

216,506

43.3%

Equity Equity attributable to the parent company Capital

4,201

124,821

25.0%

Additional paid-in capital

350

10,400

2.1%

Retained earnings and other components of equity

4,970

147,661

29.5%

Total equity attributable to the parent company

9,521

282,882

56.6%

Non-controlling interests

13

366

0.1%

Total equity

9,534

283,248

56.7%

Total liabilities and equity

16,821

499,754

100.0%

Note: New Taiwan Dollars have been translated

into U.S. Dollars at the June 30, 2022 exchange rate of NT $29.71

per U.S. Dollar.

UNITED MICROELECTRONICS CORPORATION AND

SUBSIDIARIES Consolidated Condensed Statements of

Comprehensive Income Figures in Millions of New Taiwan Dollars

(NT$) and U.S. Dollars (US$) Except Per Share and Per ADS Data

Year over Year Comparison Quarter over

Quarter Comparison Three-Month Period Ended Three-Month Period

Ended June 30, 2022 June 30, 2021 Chg. June 30, 2022 March 31, 2022

Chg. US$ NT$ US$ NT$ % US$ NT$ US$ NT$ % Operating revenues

2,425

72,055

1,713

50,908

41.5%

2,425

72,055

2,135

63,423

13.6%

Operating costs

(1,298)

(38,583)

(1,178)

(35,000)

10.2%

(1,298)

(38,583)

(1,209)

(35,919)

7.4%

Gross profit

1,127

33,472

535

15,908

110.4%

1,127

33,472

926

27,504

21.7%

46.5%

46.5%

31.3%

31.3%

46.5%

46.5%

43.4%

43.4%

Operating expenses - Sales and marketing expenses

(31)

(915)

(38)

(1,131)

(19.1%)

(31)

(915)

(42)

(1,255)

(27.1%)

- General and administrative expenses

(87)

(2,579)

(63)

(1,901)

35.7%

(87)

(2,579)

(75)

(2,226)

15.8%

- Research and development expenses

(108)

(3,209)

(107)

(3,168)

1.3%

(108)

(3,209)

(102)

(3,033)

5.8%

- Expected credit impairment gain (loss)

(0)

(3)

(0)

(1)

90.3%

(0)

(3)

0

1

-

Subtotal

(226)

(6,706)

(208)

(6,201)

8.2%

(226)

(6,706)

(219)

(6,513)

3.0%

Net other operating income and expenses

47

1,398

54

1,606

(12.9%)

47

1,398

45

1,343

4.1%

Operating income

948

28,164

381

11,313

149.0%

948

28,164

752

22,334

26.1%

39.1%

39.1%

22.2%

22.2%

39.1%

39.1%

35.2%

35.2%

Net non-operating income and expenses

(87)

(2,586)

63

1,881

-

(87)

(2,586)

44

1,314

-

Income from continuing operations before income tax

861

25,578

444

13,194

93.9%

861

25,578

796

23,648

8.2%

35.5%

35.5%

25.9%

25.9%

35.5%

35.5%

37.3%

37.3%

Income tax expense

(138)

(4,088)

(45)

(1,327)

207.8%

(138)

(4,088)

(121)

(3,582)

14.1%

Net income

723

21,490

399

11,867

81.1%

723

21,490

675

20,066

7.1%

29.8%

29.8%

23.3%

23.3%

29.8%

29.8%

31.6%

31.6%

Other comprehensive income (loss)

(126)

(3,749)

(65)

(1,935)

93.8%

(126)

(3,749)

48

1,422

-

Total comprehensive income (loss)

597

17,741

334

9,932

78.6%

597

17,741

723

21,488

(17.4%)

Net income attributable to: Shareholders of the parent

718

21,327

402

11,943

78.6%

718

21,327

667

19,808

7.7%

Non-controlling interests

5

163

(3)

(76)

-

5

163

8

258

(36.6%)

Comprehensive income (loss) attributable to: Shareholders of

the parent

592

17,578

337

10,008

75.6%

592

17,578

715

21,229

(17.2%)

Non-controlling interests

5

163

(3)

(76)

-

5

163

8

259

(36.6%)

Earnings per share-basic

0.059

1.74

0.033

0.98

0.059

1.74

0.054

1.61

Earnings per ADS (2)

0.293

8.70

0.165

4.90

0.293

8.70

0.271

8.05

Weighted average number of shares outstanding (in millions)

12,283

12,206

12,283

12,283

Notes: (1) New Taiwan Dollars have been translated

into U.S. Dollars at the June 30, 2022 exchange rate of NT $29.71

per U.S. Dollar. (2) 1 ADS equals 5 common shares.

UNITED

MICROELECTRONICS CORPORATION AND SUBSIDIARIES Consolidated

Condensed Statements of Comprehensive Income Figures in

Millions of New Taiwan Dollars (NT$) and U.S. Dollars (US$) Except

Per Share and Per ADS Data For the Three-Month Period Ended

For the Six-Month Period Ended June 30, 2022 June 30, 2022 US$ NT$

% US$ NT$ % Operating revenues

2,425

72,055

100.0%

4,560

135,478

100.0%

Operating costs

(1,298)

(38,583)

(53.5%)

(2,508)

(74,501)

(55.0%)

Gross profit

1,127

33,472

46.5%

2,052

60,977

45.0%

Operating expenses - Sales and marketing expenses

(31)

(915)

(1.3%)

(73)

(2,170)

(1.6%)

- General and administrative expenses

(87)

(2,579)

(3.5%)

(162)

(4,806)

(3.5%)

- Research and development expenses

(108)

(3,209)

(4.5%)

(210)

(6,242)

(4.6%)

- Expected credit impairment loss

(0)

(3)

(0.0%)

(0)

(2)

(0.0%)

Subtotal

(226)

(6,706)

(9.3%)

(445)

(13,220)

(9.7%)

Net other operating income and expenses

47

1,398

1.9%

93

2,741

2.0%

Operating income

948

28,164

39.1%

1,700

50,498

37.3%

Net non-operating income and expenses

(87)

(2,586)

(3.6%)

(43)

(1,273)

(1.0%)

Income from continuing operations before income tax

861

25,578

35.5%

1,657

49,225

36.3%

Income tax expense

(138)

(4,088)

(5.7%)

(258)

(7,669)

(5.6%)

Net income

723

21,490

29.8%

1,399

41,556

30.7%

Other comprehensive income (loss)

(126)

(3,749)

(5.2%)

(79)

(2,327)

(1.7%)

Total comprehensive income (loss)

597

17,741

24.6%

1,320

39,229

29.0%

Net income attributable to: Shareholders of the parent

718

21,327

29.6%

1,385

41,134

30.4%

Non-controlling interests

5

163

0.2%

14

422

0.3%

Comprehensive income (loss) attributable to: Shareholders of

the parent

592

17,578

24.4%

1,306

38,807

28.7%

Non-controlling interests

5

163

0.2%

14

422

0.3%

Earnings per share-basic

0.059

1.74

0.113

3.35

Earnings per ADS (2)

0.293

8.70

0.564

16.75

Weighted average number of shares outstanding (in millions)

12,283

12,283

Notes: (1) New Taiwan Dollars have been translated into U.S.

Dollars at the June 30, 2022 exchange rate of NT $29.71 per U.S.

Dollar. (2) 1 ADS equals 5 common shares.

UNITED

MICROELECTRONICS CORPORATION AND SUBSIDIARIES Consolidated

Condensed Statement of Cash Flows For The Six-Month Period

Ended June 30, 2022 Figures in Millions of New Taiwan Dollars (NT$)

and U.S. Dollars (US$) US$ NT$

Cash flows from operating

activities : Net income before tax

1,657

49,225

Depreciation & Amortization

757

22,497

Share of loss of associates and joint ventures

131

3,885

Income tax paid

(124)

(3,682)

Changes in working capital & others

(226)

(6,716)

Net cash provided by operating activities

2,195

65,209

Cash flows from investing activities : Decrease in

financial assets measured at amortized cost

889

26,418

Acquisition of property, plant and equipment

(731)

(21,710)

Acquisition of intangible assets

(42)

(1,236)

Others

(14)

(436)

Net cash provided by investing activities

102

3,036

Cash flows from financing activities : Decrease in

short-term loans

(45)

(1,349)

Redemption of bonds

(328)

(9,733)

Proceeds from long-term loans

24

710

Repayments of long-term loans

(390)

(11,588)

Others

19

578

Net cash used in financing activities

(720)

(21,382)

Effect of exchange rate changes on cash and cash equivalents

143

4,238

Net increase in cash and cash equivalents

1,720

51,101

Cash and cash equivalents at beginning of period

4,464

132,622

Cash and cash equivalents at end of period

6,184

183,723

Note: New Taiwan Dollars have been translated

into U.S. Dollars at the June 30, 2022 exchange rate of NT $29.71

per U.S. Dollar.

___________________________________ 1Unless otherwise stated,

all financial figures discussed in this announcement are prepared

in accordance with TIFRSs recognized by Financial Supervisory

Commission in the ROC, which is different from IFRSs issued by the

International Accounting Standards Board. They represent

comparisons among the three-month period ending June 30, 2022, the

three-month period ending March 31, 2022, and the equivalent

three-month period that ended June 30, 2021. For all 2Q22 results,

New Taiwan Dollar (NT$) amounts have been converted into U.S.

Dollars at the June 30, 2022 exchange rate of NT$ 29.71 per U.S.

Dollar. 2 Revenue in this section represents wafer sales 3

Utilization Rate = Quarterly Wafer Out / Quarterly Capacity 4

Estimated capacity numbers are based on calculated maximum output

rather than designed capacity. The actual capacity numbers may

differ depending upon equipment delivery schedules, pace of

migration to more advanced process technologies, and other factors

affecting production ramp-up.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220727005418/en/

Michael Lin / David Wong UMC, Investor Relations +

886-2-2658-9168, ext. 16900 jinhong_lin@umc.com

david_wong@umc.com

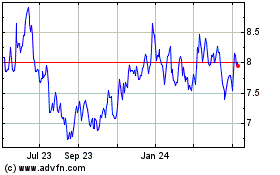

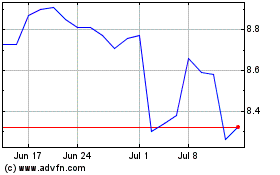

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Apr 2023 to Apr 2024