|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Millions

|

Defined

benefit

plans

|

Foreign

currency

translation

|

Total

|

|

Balance at January 1, 2021

|

$

|

(1,381)

|

$

|

(212)

|

$

|

(1,593)

|

|

Other comprehensive income/(loss) before reclassifications

|

|

(2)

|

|

(7)

|

|

(9)

|

|

Amounts reclassified from accumulated other comprehensive income/(loss) [a]

|

|

51

|

|

-

|

|

51

|

|

Net year-to-date other comprehensive income/(loss),

net of taxes of ($18) million

|

|

49

|

|

(7)

|

|

42

|

|

Balance at June 30, 2021

|

$

|

(1,332)

|

$

|

(219)

|

$

|

(1,551)

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2020

|

$

|

(1,150)

|

$

|

(206)

|

$

|

(1,356)

|

|

Other comprehensive income/(loss) before reclassifications

|

|

3

|

|

(56)

|

|

(53)

|

|

Amounts reclassified from accumulated other comprehensive income/(loss) [a]

|

|

37

|

|

-

|

|

37

|

|

Net year-to-date other comprehensive income/(loss),

net of taxes of ($12) million

|

|

40

|

|

(56)

|

|

(16)

|

|

Balance at June 30, 2020

|

$

|

(1,110)

|

$

|

(262)

|

$

|

(1,372)

|

[a]The accumulated other comprehensive income/loss reclassification components are 1) prior service cost/credit and 2) net actuarial loss which are both included in the computation of net periodic pension cost. See Note 5 Retirement Plans for additional details.

10. Accounts Receivable

Accounts receivable includes freight and other receivables reduced by an allowance for doubtful accounts. The allowance is based upon historical losses, creditworthiness of customers, and current economic conditions. At June 30, 2021, and December 31, 2020, our accounts receivable were reduced by $12 million and $17 million, respectively. Receivables not expected to be collected in one year and the associated allowances are classified as other assets in our Condensed Consolidated Statements of Financial Position. At June 30, 2021, and December 31, 2020, receivables classified as other assets were reduced by allowances of $45 million and $51 million, respectively.

Receivables Securitization Facility – The Railroad maintains an $800 million, 3-year receivables securitization facility (the Receivables Facility) maturing in July 2022. Under the Receivables Facility, the Railroad sells most of its eligible third-party receivables to Union Pacific Receivables, Inc. (UPRI), a consolidated, wholly-owned, bankruptcy-remote subsidiary that may subsequently transfer, without recourse, an undivided interest in accounts receivable to investors. The investors have no recourse to the Railroad’s other assets except for customary warranty and indemnity claims. Creditors of the Railroad do not have recourse to the assets of UPRI.

The amount recorded under the Receivables Facility was $400 million and $0 at June 30, 2021, and December 31, 2020, respectively. The Receivables Facility was supported by $1.3 billion and $1.2 billion of accounts receivable as collateral at June 30, 2021, and December 31, 2020, respectively, which, as a retained interest, is included in accounts receivable, net in our Condensed Consolidated Statements of Financial Position.

The outstanding amount the Railroad maintains under the Receivables Facility may fluctuate based on current cash needs. The maximum allowed under the facility is $800 million with availability directly impacted by eligible receivables, business volumes, and credit risks, including receivables payment quality measures such as default and dilution ratios. If default or dilution ratios increase one percent, the allowable outstanding amount under the Receivables Facility would not materially change.

The costs of the Receivables Facility include interest, which will vary based on prevailing benchmark and commercial paper rates, program fees paid to participating banks, commercial paper issuance costs, and fees of participating banks for unused commitment availability. The costs of the Receivables Facility are included in interest expense and were $1 million for both the three months ended June 30, 2021 and 2020, and $2 million and $4 million for the six months ended June 30, 2021 and 2020, respectively.

on LIBOR, plus a spread, depending upon credit ratings for our senior unsecured debt. The 5 year facility, set to expire on June 8, 2023, requires UPC to maintain a debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) coverage ratio.

The definition of debt used for purposes of calculating the debt-to-EBITDA coverage ratio includes, among other things, certain credit arrangements, finance leases, guarantees, unfunded and vested pension benefits under Title IV of ERISA, and unamortized debt discount and deferred debt issuance costs. At June 30, 2021, the Company was in compliance with the debt-to-EBITDA coverage ratio, which allows us to carry up to $38.9 billion of debt (as defined in the Facility), and we had $30.6 billion of debt (as defined in the Facility) outstanding at that date. The Facility does not include any other financial restrictions, credit rating triggers (other than rating-dependent pricing), or any other provision that could require us to post collateral. The Facility also includes a $150 million cross-default provision and a change-of-control provision.

During the six months ended June 30, 2021, we issued $945 million and repaid $820 million of commercial paper with maturities ranging from 7 to 48 days, and at June 30, 2021, we had $200 million of commercial paper outstanding. Our revolving credit facility can be used to support our outstanding commercial paper balances, and, unless we change the terms of our commercial paper program, our aggregate issuance of commercial paper will not exceed the amount of borrowings available under the Facility.

In May 2020, we entered into three bilateral revolving credit lines, totaling $600 million of available credit. During the six months ended June 30, 2021, we drew $0 and repaid $0. All three bilateral revolving credit lines matured by May 18, 2021.

Shelf Registration Statement and Significant New Borrowings – We filed an automatic shelf registration statement with the SEC that became effective on February 10, 2021. The Board of Directors authorized the issuance of up to $6 billion of debt securities, replacing the prior Board authorization in November 2019, which had $2.25 billion of authority remaining. Under our shelf registration, we may issue, from time to time, any combination of debt securities, preferred stock, common stock, or warrants for debt securities or preferred stock in one or more offerings.

During the six months ended June 30, 2021, we issued the following unsecured, fixed-rate debt securities

under our current shelf registration.

|

|

|

|

|

|

|

Date

|

Description of Securities

|

|

May 20, 2021

|

$850 million of 2.375% Notes due May 20, 2031

|

|

|

$1.0 billion of 3.200% Notes due May 20, 2041

|

|

|

$650 million of 3.550% Notes due May 20, 2061

|

We used the net proceeds from these offerings for general corporate purposes, including the repurchase of common stock pursuant to our share repurchase programs. These debt securities include change-of- control provisions. At June 30, 2021, we had remaining authority from the Board of Directors to issue up to $3.5 billion of debt securities under our shelf registration.

Receivables Securitization Facility – As of June 30, 2021, and December 31, 2020, we recorded $400 million and $0, respectively, of borrowings under our Receivables Facility as secured debt. (See further discussion of our receivables securitization facility in Note 10).

15. Commitments and Contingencies

Asserted and Unasserted Claims – Various claims and lawsuits are pending against us and certain of our subsidiaries. We cannot fully determine the effect of all asserted and unasserted claims on our consolidated results of operations, financial condition, or liquidity. To the extent possible, we have recorded a liability where asserted and unasserted claims are considered probable and where such claims can be reasonably estimated. We do not expect that any known lawsuits, claims, environmental costs, commitments, contingent liabilities, or guarantees will have a material adverse effect on our consolidated results of operations, financial condition, or liquidity after taking into account liabilities and insurance recoveries previously recorded for these matters.

vary over time due to changes in federal, state, and local laws governing environmental remediation. Current obligations are not expected to have a material adverse effect on our consolidated results of operations, financial condition, or liquidity.

Insurance – The Company has a consolidated, wholly-owned captive insurance subsidiary (the captive), that provides insurance coverage for certain risks including FELA claims and property coverage which are subject to reinsurance. The captive entered into annual reinsurance treaty agreements that insure workers compensation, general liability, auto liability, and FELA risk. The captive cedes a portion of its FELA exposure through the treaty and assumes a proportionate share of the entire risk. The captive receives direct premiums, which are netted against the Company’s premium costs in other expenses in the Condensed Consolidated Statements of Income. The treaty agreements provide for certain protections against the risk of treaty participants’ non-performance, and we do not believe our exposure to treaty participants’ non-performance is material at this time. We record both liabilities and reinsurance receivables using an actuarial analysis based on historical experience in our Condensed Consolidated Statements of Financial Position. Effective January 2019, the captive insurance subsidiary no longer participates in the reinsurance treaty agreement. The Company established a trust in the fourth quarter of 2018 for the purpose of providing collateral as required under the reinsurance treaty agreement for prior years’ participation.

Indemnities – We are contingently obligated under a variety of indemnification arrangements, although in some cases the extent of our potential liability is limited, depending on the nature of the transactions and the agreements. Due to uncertainty as to whether claims will be made or how they will be resolved, we cannot reasonably determine the probability of an adverse claim or reasonably estimate any adverse liability or the total maximum exposure under these indemnification arrangements. We do not have any reason to believe that we will be required to make any material payments under these indemnity provisions.

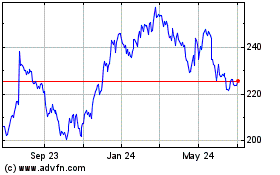

16. Share Repurchase Programs

Effective April 1, 2019, our Board of Directors authorized the repurchase of up to 150 million shares of our common stock by March 31, 2022. These repurchases may be made on the open market or through other transactions. Our management has sole discretion with respect to determining the timing and amount of these transactions. As of June 30, 2021, we repurchased a total of $45.0 billion of our common stock since commencement of our repurchase programs in 2007. The table below represents shares repurchased under repurchase programs in the first and second quarters of 2021 and 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Shares Purchased

|

Average Price Paid [a]

|

|

|

2021

|

2020

|

2021

|

2020

|

|

First quarter [b]

|

6,691,421

|

14,305,793

|

$

|

209.50

|

$

|

178.66

|

|

Second quarter [c]

|

12,204,409

|

-

|

|

222.46

|

|

-

|

|

Total

|

18,895,830

|

14,305,793

|

$

|

217.87

|

$

|

178.66

|

|

Remaining number of shares that may be repurchased under current authority

|

|

92,127,140

|

[a]In the period of the final settlement, the average price paid under the accelerated share repurchase programs is calculated based on the total program value less the value assigned to the initial delivery of shares. The average price of the completed 2020 accelerated share repurchase programs was $155.86. The average price of the initial settlement of the 2021 accelerated share repurchase programs was $221.94.

[b]Includes 8,786,380 shares repurchased in February 2020 under accelerated share repurchase programs.

[c]Includes 7,209,156 shares repurchased in May 2021 under accelerated share repurchase programs.

Management's assessments of market conditions and other pertinent factors guide the timing and volume of all repurchases. We expect to fund any share repurchases under this program through cash generated from operations, the sale or lease of various operating and non-operating properties, debt issuances, and cash on hand. Open market repurchases are recorded in treasury stock at cost, which includes any applicable commissions and fees.

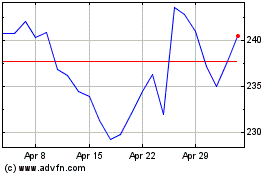

From July 1, 2021, through July 21, 2021, we repurchased 1.1 million shares at an aggregate cost of approximately $237 million.

Accelerated Share Repurchase Programs – The Company has established accelerated share repurchase programs (ASRs) with financial institutions to repurchase shares of our common stock. These

ASRs have been structured so that at the time of commencement, we pay a specified amount to the financial institutions and receive an initial delivery of shares. Additional shares may be received at the time of settlement. The final number of shares to be received is based on the volume weighted average price of the Company’s common stock during the ASR term, less a discount and subject to potential adjustments pursuant to the terms of such ASR.

On May 26, 2021, the Company received 7,209,156 shares of its common stock repurchased under ASRs for an aggregate of $2.0 billion. When the shares were received, the exchange was accounted for as an equity transaction with $1.6 billion of the aggregate amount allocated to treasury stock and the remaining $0.4 billion allocated to paid-in-surplus. This delivery of shares represents the initial and likely minimum number of shares that we may receive under the ASRs initiated in 2021. The final settlement is expected to be completed prior to the end of the fourth quarter of 2021.

On February 19, 2020, the Company received 8,786,380 shares of its common stock repurchased under ASRs for an aggregate of $2.0 billion. Upon settlement of these ASRs in the third quarter of 2020, we received 4,045,575 additional shares.

ASRs are accounted for as equity transactions, and at the time of receipt, shares are included in treasury stock at fair market value as of the corresponding initiation or settlement date. The Company reflects shares received as a repurchase of common stock in the weighted average common shares outstanding calculation for basic and diluted earnings per share.

17. Related Parties

UPRR and other North American railroad companies jointly own TTX Company (TTX). UPRR has a 36.79% economic and voting interest in TTX while the other North American railroads own the remaining interest. In accordance with ASC 323 Investments - Equity Method and Joint Venture, UPRR applies the equity method of accounting to our investment in TTX.

TTX is a rail car pooling company that owns rail cars and intermodal wells to serve North America’s railroads. TTX assists railroads in meeting the needs of their customers by providing rail cars in an efficient, pooled environment. All railroads have the ability to utilize TTX rail cars through car hire by renting rail cars at stated rates.

UPRR had $1.6 billion and $1.5 billion recognized as investments related to TTX in our Condensed Consolidated Statements of Financial Position as of June 30, 2021, and December 31, 2020, respectively. TTX car hire expenses of $95 million and $88 million for the three months ended June 30, 2021 and 2020, respectively, and $191 and $184 million for the six months ended June 30, 2021 and 2020, respectively, are included in equipment and other rents in our Condensed Consolidated Statements of Income. In addition, UPRR had accounts payable to TTX of $62 million and $59 million as of June 30, 2021, and December 31, 2020, respectively.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

UNION PACIFIC CORPORATION AND SUBSIDIARY COMPANIES

RESULTS OF OPERATIONS

Three and Six Months Ended June 30, 2021, Compared to

Three and Six Months Ended June 30, 2020

For purposes of this report, unless the context otherwise requires, all references herein to “UPC”, “Corporation”, “Company”, “we”, “us”, and “our” shall mean Union Pacific Corporation and its subsidiaries, including Union Pacific Railroad Company, which we separately refer to as “UPRR” or the “Railroad”.

The following discussion should be read in conjunction with the Condensed Consolidated Financial Statements and applicable notes to the Condensed Consolidated Financial Statements, Item 1, and other information included in this report. Our Condensed Consolidated Financial Statements are unaudited and reflect all adjustments (consisting only of normal and recurring adjustments) that are, in the opinion of management, necessary for their fair presentation in conformity with accounting principles generally accepted in the United States of America (GAAP).

The Railroad, along with its subsidiaries and rail affiliates, is our one reportable business segment. Although we provide and analyze revenue by commodity group, we treat the financial results of the Railroad as one segment due to the integrated nature of our rail network.

Cautionary Information

Statements in this Form 10-Q/filing, including forward-looking statements, speak only as of and are based on information we have learned as of July 22, 2021. We assume no obligation to update any such information to reflect subsequent developments, changes in assumptions, or changes in other factors affecting forward-looking information. If we do update one or more of these statements, no inference should be drawn that we will make additional updates with respect thereto or with respect to other statements.

Certain statements in this report, and statements in other reports or information filed or to be filed with the SEC (as well as information included in oral statements or other written statements made or to be made by us), are forward-looking statements within the meaning of Section 27A Securities Act of 1933 and the Section 21E of the Exchange Act. These forward-looking statements and information include, without limitation, the statements and information set forth under the caption “Effects from COVID-19” in Item 2 regarding the impact of the coronavirus (COVID-19) pandemic on our business and operations; “Liquidity and Capital Resources” in Item 2 regarding our capital plan, contractual obligations, and commercial commitment; and statements under the caption “Other Matters.” Forward-looking statements and information also include any other statements or information in this report regarding: potential impacts of the COVID-19 pandemic on our business operations, financial results, liquidity, and financial position, and on the world economy (including our customers and supply chains), including as a result of decreased volume and carloadings; closing of customer manufacturing, distribution or production facilities; expectations as to operational or service improvements; expectations regarding the effectiveness of steps taken or to be taken to improve operations, service, infrastructure improvements, and transportation plan modifications; expectations as to cost savings, revenue growth, and earnings; the time by which goals, targets, or objectives will be achieved; projections, predictions, expectations, estimates, or forecasts as to our business, financial, and operational results, future economic performance, and general economic conditions; proposed new products and services; estimates of costs relating to environmental remediation and restoration; estimates and expectations regarding tax matters, expectations that claims, litigation, environmental costs, commitments, contingent liabilities, labor negotiations or agreements, or other matters will not have a material adverse effect on our consolidated results of operations, financial condition, or liquidity and any other similar expressions concerning matters that are not historical facts.

Forward-looking statements and information reflect the good faith consideration by management of currently available information, and may be based on underlying assumptions believed to be reasonable under the circumstances. However, such information and assumptions (and, therefore, such forward-looking statements and information) are or may be subject to risks and uncertainties over which management has little or no influence or control, and many of these risks and uncertainties are currently amplified by and may continue to be amplified by, or in the future may be amplified by, the COVID-19

pandemic. The Risk Factors in Item 1A of our 2020 Annual Report on Form 10-K, filed February 5, 2021, could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in the forward-looking statements, and this report, including this Item 2, should be read in conjunction with these Risk Factors. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times that, or by which, such performance or results will be achieved. Forward-looking information is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements.

Critical Accounting Policies and Estimates

We base our discussion and analysis of our financial condition and results of operations upon our Condensed Consolidated Financial Statements. The preparation of these financial statements requires estimation and judgment that affect the reported amounts of revenues, expenses, assets, and liabilities. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. If these estimates differ materially from actual results, the impact on the Condensed Consolidated Financial Statements may be material. Our critical accounting policies are available in Item 7 of our 2020 Annual Report on Form 10-K. There have not been any significant changes with respect to these policies during the first six months of 2021.

RESULTS OF OPERATIONS

Quarterly Summary

The Company reported earnings of $2.72 per diluted share on net income of $1.8 billion and an operating ratio of 55.1% in the second quarter of 2021 compared to earnings of $1.67 per diluted share on net income of $1.1 billion and an operating ratio of 61.0% for the second quarter of 2020. After freight revenues declined 24% year-over-year in the second quarter of 2020 driven by the economic impact of COVID-19 and the economic shutdown that reduced volumes by 20%, our second quarter of 2021 freight revenues increased 29% compared to the same period in 2020 driven by a 6% higher average revenue per car (ARC) and a 22% volume increase. The ARC increase was due to higher fuel surcharge revenue and core pricing gains. Operating expenses increased 17% driven by higher fuel prices, volume related costs, and higher casualty costs, partially offset by productivity. After operating income decreased 27% year-over-year in the second quarter of 2020, our second quarter of 2021 operating income increased 50% compared to the same period in 2020.

Effects from COVID-19

The economy continues to improve as pandemic restrictions ease and society reopens. However, supply chain disruptions continue. Most notably, the semiconductor chip shortage continues to impact the automotive industry, while strong international intermodal demand is contributing to network congestion. The impact of the semiconductor chip shortage is masked in our year-over-year comparison as the second quarter of 2020 saw a temporary suspension of automotive production due to the pandemic. The pandemic also has upended the intermodal supply chain as demand for consumer goods remains high. This high demand has strained the ports, railroad equipment and chassis availability, truck driver supply, and warehouse receiving capacity. These disruptions limit our revenue growth by slowing asset turns and increasing costs through lower freight car velocity and multiple handlings, which will continue to impact our third quarter and potentially the remainder of the year. Demand in most other markets positively impacted the second quarter of 2021 as they recover from the dramatic slowdown caused by the spread of COVID-19 in the second quarter of 2020.

The safety of our employees, our customers, and the communities we serve remains a high priority. In an effort to mitigate the spread of COVID-19, we are promoting and encouraging all of our employees through financial incentives to get vaccinated.

Operating Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

Millions

|

2021

|

2020

|

Change

|

|

2021

|

2020

|

Change

|

|

Freight revenues

|

$

|

5,132

|

$

|

3,972

|

29

|

%

|

|

$

|

9,781

|

$

|

8,852

|

10

|

%

|

|

Other subsidiary revenues

|

|

180

|

|

150

|

20

|

|

|

|

357

|

|

364

|

(2)

|

|

|

Accessorial revenues

|

|

176

|

|

103

|

71

|

|

|

|

337

|

|

220

|

53

|

|

|

Other

|

|

16

|

|

19

|

(16)

|

|

|

|

30

|

|

37

|

(19)

|

|

|

Total

|

$

|

5,504

|

$

|

4,244

|

30

|

%

|

|

$

|

10,505

|

$

|

9,473

|

11

|

%

|

We generate freight revenues by transporting freight or other materials from our three commodity groups. Freight revenues vary with volume (carloads) and ARC. Changes in price, traffic mix, and fuel surcharges drive ARC. Customer incentives, which are primarily provided for shipping to/from specific locations or based on cumulative volumes, are recorded as a reduction to operating revenues. Customer incentives that include variable consideration based on cumulative volumes are estimated using the expected value method, which is based on available historical, current, and forecasted volumes, and recognized as the related performance obligation is satisfied. We recognize freight revenues over time as shipments move from origin to destination. The allocation of revenue between reporting periods is based on the relative transit time in each reporting period with expenses recognized as incurred.

Other revenues consist primarily of revenues earned by our other subsidiaries (primarily logistics and commuter rail operations) and accessorial revenues. Other subsidiary revenues are generally recognized over time as shipments move from origin to destination. The allocation of revenue between reporting periods is based on the relative transit time in each reporting period with expenses recognized as incurred. Accessorial revenues are recognized at a point in time as performance obligations are satisfied.

Freight revenue increased 29% during the second quarter of 2021 compared to 2020, resulting from a 22% volume increase, higher fuel surcharge revenue, and core pricing gains. Volume increases were primarily driven by recovery from the dramatic slowdown caused by the spread of COVID-19 in the second quarter of 2020.

Each of our commodity groups includes revenue from fuel surcharges. Freight revenues from fuel surcharge programs were $414 million in the second quarter of 2021 compared to $206 million in the same period of 2020. The increase was driven by higher fuel price and increased volume, partially offset by the lag impact on fuel surcharge recovery (it can generally take up to two months for changing fuel prices to affect fuel surcharge recoveries).

Accessorial revenue increased in the second quarter and the year-to-date period compared to 2020 driven by increased intermodal shipments. Other subsidiary revenues increased in the second quarter compared to 2020 driven primarily by the U.S. automotive plant shut downs in the second quarter of 2020 impacting our subsidiary that brokers intermodal and transload logistics services. Year-to-date, subsidiary revenues are down compared to the same period in 2020 as the semi-conductor shortage impacting 2021 automobile production outweighs the recovery from COVID-19 declines in 2020.

The following tables summarize the year-over-year changes in freight revenues, revenue carloads, and ARC by commodity type:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

Six Months Ended

|

|

|

|

Freight Revenues

|

June 30,

|

|

|

June 30,

|

|

|

Millions

|

2021

|

2020

|

Change

|

|

2021

|

2020

|

Change

|

|

Grain & grain products

|

$

|

795

|

$

|

644

|

23

|

%

|

|

$

|

1,561

|

$

|

1,333

|

17

|

%

|

|

Fertilizer

|

|

179

|

|

168

|

7

|

|

|

|

349

|

|

342

|

2

|

|

|

Food & refrigerated

|

|

251

|

|

205

|

22

|

|

|

|

486

|

|

455

|

7

|

|

|

Coal & renewables

|

|

423

|

|

369

|

15

|

|

|

|

764

|

|

790

|

(3)

|

|

|

Bulk

|

|

1,648

|

|

1,386

|

19

|

|

|

|

3,160

|

|

2,920

|

8

|

|

|

Industrial chemicals & plastics

|

|

498

|

|

435

|

14

|

|

|

|

933

|

|

930

|

-

|

|

|

Metals & minerals

|

|

467

|

|

368

|

27

|

|

|

|

842

|

|

837

|

1

|

|

|

Forest products

|

|

348

|

|

266

|

31

|

|

|

|

664

|

|

569

|

17

|

|

|

Energy & specialized markets

|

|

546

|

|

431

|

27

|

|

|

|

1,076

|

|

1,058

|

2

|

|

|

Industrial

|

|

1,859

|

|

1,500

|

24

|

|

|

|

3,515

|

|

3,394

|

4

|

|

|

Automotive

|

|

428

|

|

189

|

F

|

|

|

|

875

|

|

713

|

23

|

|

|

Intermodal

|

|

1,197

|

|

897

|

33

|

|

|

|

2,231

|

|

1,825

|

22

|

|

|

Premium

|

|

1,625

|

|

1,086

|

50

|

|

|

|

3,106

|

|

2,538

|

22

|

|

|

Total

|

$

|

5,132

|

$

|

3,972

|

29

|

%

|

|

$

|

9,781

|

$

|

8,852

|

10

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

Six Months Ended

|

|

|

|

Revenue Carloads

|

June 30,

|

|

|

June 30,

|

|

|

Thousands,

|

2021

|

2020

|

Change

|

|

2021

|

2020

|

Change

|

|

Grain & grain products

|

204

|

167

|

22

|

%

|

|

407

|

342

|

19

|

%

|

|

Fertilizer

|

54

|

53

|

2

|

|

|

98

|

99

|

(1)

|

|

|

Food & refrigerated

|

48

|

41

|

17

|

|

|

93

|

89

|

4

|

|

|

Coal & renewables

|

198

|

186

|

6

|

|

|

372

|

394

|

(6)

|

|

|

Bulk

|

504

|

447

|

13

|

|

|

970

|

924

|

5

|

|

|

Industrial chemicals & plastics

|

156

|

141

|

11

|

|

|

296

|

295

|

-

|

|

|

Metals & minerals

|

182

|

162

|

12

|

|

|

328

|

336

|

(2)

|

|

|

Forest products

|

64

|

50

|

28

|

|

|

124

|

106

|

17

|

|

|

Energy & specialized markets

|

138

|

115

|

20

|

|

|

277

|

277

|

-

|

|

|

Industrial

|

540

|

468

|

15

|

|

|

1,025

|

1,014

|

1

|

|

|

Automotive

|

173

|

79

|

F

|

|

|

353

|

287

|

23

|

|

|

Intermodal [a]

|

878

|

724

|

21

|

|

|

1,674

|

1,433

|

17

|

|

|

Premium

|

1,051

|

803

|

31

|

|

|

2,027

|

1,720

|

18

|

|

|

Total

|

2,095

|

1,718

|

22

|

%

|

|

4,022

|

3,658

|

10

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

Average Revenue per Car

|

2021

|

2020

|

Change

|

|

2021

|

2020

|

Change

|

|

Grain & grain products

|

$

|

3,894

|

$

|

3,861

|

1

|

%

|

|

$

|

3,838

|

$

|

3,901

|

(2)

|

%

|

|

Fertilizer

|

|

3,304

|

|

3,181

|

4

|

|

|

|

3,550

|

|

3,456

|

3

|

|

|

Food & refrigerated

|

|

5,226

|

|

4,986

|

5

|

|

|

|

5,230

|

|

5,142

|

2

|

|

|

Coal & renewables

|

|

2,134

|

|

1,979

|

8

|

|

|

|

2,051

|

|

2,001

|

2

|

|

|

Bulk

|

|

3,266

|

|

3,099

|

5

|

|

|

|

3,256

|

|

3,161

|

3

|

|

|

Industrial chemicals & plastics

|

|

3,189

|

|

3,086

|

3

|

|

|

|

3,153

|

|

3,148

|

-

|

|

|

Metals & minerals

|

|

2,569

|

|

2,276

|

13

|

|

|

|

2,567

|

|

2,494

|

3

|

|

|

Forest products

|

|

5,463

|

|

5,256

|

4

|

|

|

|

5,357

|

|

5,361

|

-

|

|

|

Energy & specialized markets

|

|

3,944

|

|

3,739

|

5

|

|

|

|

3,886

|

|

3,813

|

2

|

|

|

Industrial

|

|

3,442

|

|

3,201

|

8

|

|

|

|

3,430

|

|

3,345

|

3

|

|

|

Automotive

|

|

2,479

|

|

2,388

|

4

|

|

|

|

2,482

|

|

2,487

|

-

|

|

|

Intermodal [a]

|

|

1,363

|

|

1,241

|

10

|

|

|

|

1,332

|

|

1,274

|

5

|

|

|

Premium

|

|

1,547

|

|

1,354

|

14

|

|

|

|

1,532

|

|

1,476

|

4

|

|

|

Average

|

$

|

2,449

|

$

|

2,312

|

6

|

%

|

|

$

|

2,432

|

$

|

2,420

|

-

|

%

|

[a] For intermodal shipments each container or trailer equals one carload.

Bulk – Bulk includes shipments of grain and grain products, fertilizer, food and refrigerated goods, and coal and renewables. Freight revenue from bulk shipments increased in the second quarter of 2021 compared to 2020 due to a 13% volume increase, core pricing gains, and higher fuel surcharge revenue. Strong demand for export grain and increased ethanol demand from the COVID-19 recovery drove a 22% increase in shipments of grain and grain products. Market conditions for coal were favorable in the second quarter as worldwide electricity demand recovered from the pandemic and natural gas prices rose, driving a 9% increase in volume compared to the second quarter of 2020, despite a contract loss. Year-to-date, freight revenue from bulk shipments increased compared to the same period in 2020, driven by 5% higher volume, core pricing gains, and positive mix of traffic. Strong demand for export grain drove a 19% increase in shipments of grain and grain products year-to-date, which partially offset lower volume from coal and renewables shipments in the first quarter.

Industrial – Industrial includes shipments of industrial chemicals and plastics, metals and minerals, forest products, and energy and specialized markets. Freight revenue from industrial shipments increased in the second quarter compared to the same period in 2020 due to higher volume, positive mix of traffic, core pricing gains, and higher fuel surcharge revenue. Volume increases in the second quarter of 2021 were primarily driven by the recovery from the pandemic slowdown that impacted production across a wide array of industries in the second quarter of 2020. Year-to-date, freight revenue from industrial shipments increased compared to the same period in 2020, driven by core pricing gains, positive mix of traffic, and a 1% volume increase. The pandemic recovery in the second quarter offset a majority of the losses in the first quarter caused by weather interruptions in the Gulf Coast impacting industrial chemicals and plastics and metals and mineral industries, and unfavorable regional crude oil pricing spreads impacting petroleum shipments. Forest product shipments increased due to high demand for cardboard boxes and lumber.

Premium – Premium includes shipments of finished automobiles, automotive parts, and merchandise in intermodal containers, both domestic and international. Premium freight revenue increased in the second quarter and year-to-date periods compared to same periods in 2020 due to volume increases, higher fuel surcharge revenue, positive mix of traffic, and core pricing gains. Automotive shipments in the second quarter of 2021 were more than double the shipments in the same period last year, as North American manufacturing plants temporarily suspended production due to the pandemic. This recovery is masking the impact to automotive shipments in the second quarter of 2021 due to the shortage of semiconductors. Despite the supply chain disruptions, intermodal shipments increased 21% in the second quarter of 2021 due to improving economic conditions, inventory restocking, contract wins, and continued strength of e-commerce and parcel shipments. The year-to-date period also was negatively impacted by weather disruptions in the first quarter of 2021.

Mexico Business – Each of our commodity groups includes revenue from shipments to and from Mexico. Revenue from Mexico business increased 59% to $618 million in the second quarter of 2021 compared to 2020 driven by a 53% volume increase, higher fuel surcharge revenue, and core pricing gains. Volume increases in the second quarter of 2021 were driven by the recovery from the pandemic slowdown in the second quarter of 2021, including shipments of auto parts, finished vehicles, petroleum products, brewers and beverage, and grain. Year-to-date, freight revenue increased 22% to $1,183 million as a result of increased volume, higher fuel surcharges, and core pricing gains.

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

Millions

|

2021

|

2020

|

Change

|

|

2021

|

2020

|

Change

|

|

Compensation and benefits

|

$

|

1,022

|

$

|

905

|

13

|

%

|

|

$

|

2,048

|

$

|

1,964

|

4

|

%

|

|

Depreciation

|

|

550

|

|

551

|

-

|

|

|

|

1,099

|

|

1,098

|

-

|

|

|

Purchased services and materials

|

|

478

|

|

441

|

8

|

|

|

|

968

|

|

962

|

1

|

|

|

Fuel

|

|

497

|

|

247

|

U

|

|

|

|

908

|

|

681

|

33

|

|

|

Equipment and other rents

|

|

200

|

|

211

|

(5)

|

|

|

|

412

|

|

438

|

(6)

|

|

|

Other

|

|

284

|

|

235

|

21

|

|

|

|

604

|

|

533

|

13

|

|

|

Total

|

$

|

3,031

|

$

|

2,590

|

17

|

%

|

|

$

|

6,039

|

$

|

5,676

|

6

|

%

|

Operating expenses increased $441 million and $363 million in the second quarter and year-to-date periods, respectively, compared to 2020 driven by higher fuel prices, volume-related costs, inflation, 2020 management actions responding to the sharp decline in volume (temporary unpaid leave, salary reductions, and shop closures), incentive compensation, higher casualty costs, an insurance reimbursement recognized in 2020, and higher state and local taxes. Partially offsetting these increases compared to 2020 are productivity initiatives. In addition, the year-to-date period comparison was impacted negatively by weather-related expenses.

Compensation and Benefits – Compensation and benefits include wages, payroll taxes, health and welfare costs, pension costs, other postretirement benefits, and incentive costs. For the second quarter and year-to-date periods, expenses increased 13% and 4%, respectively, compared to 2020 due to increases in carload volumes, wage inflation, 2020 management actions responding to the sharp decline in volume (temporary unpaid leave, salary reductions, and shop closures), and incentive compensation. Partially offsetting these increases are productivity initiatives resulting in employee levels that were flat and down 6% in the second quarter and year-to-date periods, respectively, compared to 2020 despite volume increases. In addition, the year-to-date period comparison was impacted negatively by weather-related expenses.

Depreciation – The majority of depreciation relates to road property, including rail, ties, ballast, and other track material. Depreciation expense was essentially flat for the second quarter and six-month periods of 2021 compared to 2020.

Purchased Services and Materials – Expense for purchased services and materials includes the costs of services purchased (including equipment maintenance and contract expenses incurred by our subsidiaries for external transportation services); materials used to maintain the Railroad’s lines, structures, and equipment; costs of operating facilities jointly used by UPRR and other railroads; transportation and lodging for train crew employees; trucking and contracting costs for intermodal containers; leased automobile maintenance expenses; and tools and supplies. Purchased services and materials increased 8% and 1% in the second quarter and year-to-date periods, respectively, compared to 2020 primarily due to higher volume-related costs for transload services incurred by one of our subsidiaries and other volume-related costs such as transportation and lodging for train crews. In addition, the year-to-date period was negatively impacted by weather-related expense and positively impacted by lower locomotive and freight car maintenance expenses due to a smaller active fleet in the first quarter.

Fuel – Fuel includes locomotive fuel and fuel for highway and non-highway vehicles and heavy equipment. Fuel expense increased in the second quarter of 2021 compared to the same period in 2020 driven by a 71% increase in locomotive diesel fuel prices, which averaged $2.16 and $1.26 per gallon (including taxes and transportation costs) in the second quarter of 2021 and 2020, respectively, and a 22% increase in gross ton-miles. The fuel consumption rate, computed as gallons of fuel consumed divided by gross ton-mile in thousands, improved 3% versus the second quarter in 2020 offsetting some of the increased costs due to the higher price and increased volume. For the six-month period, locomotive diesel fuel prices averaged $2.01 per gallon in 2021 compared to $1.59 in 2020, driving the increase in expenses by 33%. In addition, gross ton-miles increased 8% during the year-to-date period, also driving higher fuel expense compared to 2020. The higher costs were partially offset by fuel consumption rate improvement of 2%.

Equipment and Other Rents – Equipment and other rents expense primarily includes rental expense that the Railroad pays for freight cars owned by other railroads or private companies; freight car, intermodal, and locomotive leases; and office and other rentals. Equipment and other rents expense decreased 5% in the second quarter and 6% in the year-to-date period compared to 2020 driven by lower rent on stored equipment and higher equity income from our investment in TTX Company, partially offset by increased freight car rent expense due to volume increases.

Other – Other expenses include state and local taxes; freight, equipment, and property damage; utilities, insurance, personal injury, environmental, employee travel, telephone and cellular, computer software, bad debt, and other general expenses. Other costs increased 21% and 13% in the second quarter and year-to-date periods, respectively, compared to 2020 driven by casualty expenses including personal injury, environmental, destroyed equipment, and damaged freight, an insurance reimbursement recognized in 2020, and higher state and local taxes.

Non-Operating Items

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

Millions

|

2021

|

2020

|

Change

|

|

2021

|

2020

|

Change

|

|

Other income, net

|

$

|

125

|

$

|

131

|

(5)

|

%

|

|

$

|

176

|

$

|

184

|

(4)

|

%

|

|

Interest expense

|

|

(282)

|

|

(289)

|

(2)

|

|

|

|

(572)

|

|

(567)

|

1

|

|

|

Income taxes

|

|

(518)

|

|

(364)

|

42

|

|

|

|

(931)

|

|

(808)

|

15

|

|

Other Income, net – Other income decreased in the second quarter of 2021 and year-to-date periods compared to 2020 driven by smaller gains from real estate sales. Real estate sales in the second quarter of 2021 includes a $50 million gain from a sale to the Colorado Department of Transportation, while the second quarter of 2020 includes a $69 million gain from a land and permanent easement sale to the Illinois State Toll Highway Authority.

Interest Expense – Interest expense decreased in the second quarter of 2021 compared to 2020 due to a lower effective interest rate of 4.0% in 2021 compared to 4.1% in 2020, in addition to a decrease in the weighted-average debt level of $28.0 billion in 2021 compared to $28.4 billion in 2020. Year-to-date, interest expense increased as a result of the debt exchange fees incurred in the first quarter, partially offset by a decrease in the weighted-average debt levels of $27.4 billion in 2021 compared to $27.8 billion in 2020. Year-to-date, in both periods the effective interest rate was 4.1%.

Income Taxes – Income taxes increased in the second quarter and six-month periods of 2021 compared to 2020 due to higher pre-tax income. Our effective tax rates year-to-date 2021 and 2020 were 22.9% and 23.7%, respectively. In the second quarter of 2021, Nebraska, Oklahoma, and Idaho enacted legislation to reduce their corporate income tax rates for future years resulting in a reduction of our deferred tax expense. This reduced our 2021 effective tax rate.

OTHER OPERATING/PERFORMANCE AND FINANCIAL STATISTICS

We report a number of key performance measures weekly to the Surface Transportation Board (STB). We provide this data on our website at www.up.com/investor/aar-stb_reports/index.htm.

Operating/Performance Statistics

Management continuously measures these key operating metrics to evaluate our productivity, asset utilization, and network efficiency in striving to provide a consistent, reliable service product to our customers.

Railroad performance measures are included in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

|

2021

|

2020

|

Change

|

|

2021

|

2020

|

Change

|

|

Gross ton-miles (GTMs) (billions)

|

207.8

|

170.6

|

22

|

%

|

|

400.9

|

371.9

|

8

|

%

|

|

Revenue ton-miles (billions)

|

104.8

|

85.9

|

22

|

|

|

202.1

|

185.6

|

9

|

|

|

Freight car velocity (daily miles per car) [a]

|

213

|

227

|

(6)

|

|

|

211

|

218

|

(3)

|

|

|

Average train speed (miles per hour) [b]

|

25.0

|

26.9

|

(7)

|

|

|

25.1

|

26.0

|

(3)

|

|

|

Average terminal dwell time (hours) [b]

|

22.9

|

21.6

|

6

|

|

|

23.2

|

22.8

|

2

|

|

|

Locomotive productivity (GTMs per horsepower day)

|

140

|

136

|

3

|

|

|

139

|

133

|

5

|

|

|

Train length (feet)

|

9,410

|

8,664

|

9

|

|

|

9,330

|

8,517

|

10

|

|

|

Intermodal car trip plan compliance (%)

|

71

|

82

|

(11)

|

pts

|

|

74

|

83

|

(9)

|

pts

|

|

Manifest/Automotive car trip plan compliance (%)

|

67

|

76

|

(9)

|

pts

|

|

68

|

69

|

(1)

|

pts

|

|

Workforce productivity (car miles per employee)

|

1,060

|

868

|

22

|

|

|

1,031

|

882

|

17

|

|

|

Total employees (average)

|

30,066

|

30,059

|

-

|

|

|

29,910

|

31,965

|

(6)

|

|

|

Operating ratio

|

55.1

|

61.0

|

(5.9)

|

pts

|

|

57.5

|

59.9

|

(2.4)

|

pts

|

[a]Prior years have been recast to conform to the current year presentation which reflects minor refinements.

[b]As reported to the STB.

Gross and Revenue Ton-Miles – Gross ton-miles are calculated by multiplying the weight of loaded and empty freight cars by the number of miles hauled. Revenue ton-miles are calculated by multiplying the weight of freight by the number of tariff miles. Gross ton-miles and revenue ton-miles both increased 22% during the second quarter of 2021 compared to 2020, driven by a 22% increase in carloadings. Year-to-date, gross ton-miles and revenue ton-miles increased 8% and 9%, respectively, driven by a 10% increase in carloadings. Changes in commodity mix drove the variance in year-over-year increases between gross ton-miles, revenue ton-miles, and carloads.

Freight Car Velocity – Freight car velocity measures the average daily miles per car on our network. The two key drivers of this metric are the speed of the train between terminals (average train speed) and the time a rail car spends at the terminals (average terminal dwell time). Both train speed and terminal dwell slowed in the second quarter and six-month periods of 2021 compared to the same periods in 2020 partially driven by intermodal supply chain disruptions due to continued high demand for consumer goods as well as incidents affecting the network. Continued implementation of our operating plan helped to partially offset these declines. Weather-related challenges in the first quarter of 2021 also contributed to the declines in the year-to-date period.

Locomotive Productivity – Locomotive productivity is gross ton-miles per average daily locomotive horsepower. Locomotive productivity increased in the second quarter and year-to-date periods compared to the same periods in 2020 as continued implementation of our operating plan prompted transportation plan changes and lower locomotive dwell times that more than offset the increased active fleet required by increased volume.

Train Length – Train length is the average maximum train length on a route measured in feet. Our train length increased in the second quarter and six-month periods compared to same periods in 2020 as a result of blending service products and transportation plan changes designed to improve overall operational efficiency.

Car Trip Plan Compliance – Car trip plan compliance is the percentage of cars delivered on time in accordance with our original trip plan. Our network trip plan compliance is broken into the intermodal and manifest/automotive products. Intermodal trip plan compliance deteriorated in the second quarter and year-to-date periods of 2021 compared to 2020 as a result of high demand for consumer goods that strained the ports, railroad equipment and chassis availability, truck driver supply, and warehouse receiving capacity; and incidents affecting the network. Manifest trip plan compliance deteriorated in the second quarter and year-to-date periods of 2021 compared to 2020 as volume increases and incidents within the quarter presented network challenges that required increased resource allocation and rebalancing compared to historically low 2020 volumes due to COVID-19. Both metrics were negatively impacted by weather-related challenges in the year-to-date period.

Workforce Productivity – Workforce productivity is average daily car miles per employee. Workforce productivity improved 22%, as employee counts were essentially flat compared to 2020, while higher carload volumes increased average daily car miles. Productivity initiatives and smaller capital workforce offset a 22% increase in carload volumes to keep employee levels flat with last year for the second quarter. Although impacted by weather-related challenges in the first quarter, year-to-date, workforce productivity improved 17% as average daily car miles increased 9% while employees decreased 6% compared to 2020.

Operating Ratio – Operating ratio is our operating expenses reflected as a percentage of operating revenue. Our second quarter operating ratio of 55.1% improved 5.9 points compared to 2020 and our year-to-date operating ratio of 57.5% improved 2.4 points compared to 2020 mainly due to productivity initiatives and core pricing gains, partially offset by higher fuel prices, inflation, and other cost increases.

Adjusted Debt / Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

Millions, Except Ratios

|

Jun. 30,

|

Dec. 31,

|

|

for the Trailing Twelve Months Ended [a]

|

2021

|

2020

|

|

Net income

|

$

|

5,882

|

$

|

5,349

|

|

Add:

|

|

|

|

|

|

Income tax expense

|

|

1,754

|

|

1,631

|

|

Depreciation

|

|

2,211

|

|

2,210

|

|

Interest expense

|

|

1,146

|

|

1,141

|

|

EBITDA

|

$

|

10,993

|

$

|

10,331

|

|

Adjustments:

|

|

|

|

|

Other income, net

|

|

(279)

|

|

(287)

|

|

Interest on operating lease liabilities [b]

|

|

53

|

|

59

|

|

Adjusted EBITDA

|

$

|

10,767

|

$

|

10,103

|

|

Debt

|

$

|

28,812

|

$

|

26,729

|

|

Operating lease liabilities

|

|

1,553

|

|

1,604

|

|

Unfunded pension and OPEB, net of taxes of $180 and $195

|

|

607

|

|

637

|

|

Adjusted debt

|

$

|

30,972

|

$

|

28,970

|

|

Adjusted debt / Adjusted EBITDA

|

|

2.9

|

|

2.9

|

[a]The trailing twelve month income statement information ended June 30, 2021, is recalculated by taking the twelve months ended December 31, 2020, subtracting the six months ended June 30, 2020, and adding the six months ended June 30, 2021.

[b]Represents the hypothetical interest expense we would incur (using the incremental borrowing rate) if the property under our operating leases were owned or accounted for as finance leases.

Adjusted debt to Adjusted EBITDA (earnings before interest, taxes, depreciation, amortization, and adjustments for other income, net and interest on operating lease liabilities) is considered a non-GAAP financial measure by SEC Regulation G and Item 10 of SEC Regulation S-K and may not be defined and calculated by other companies in the same manner. We believe this measure is important to management and investors in evaluating the Company’s ability to sustain given debt levels (including leases) with the cash generated from operations. In addition, a comparable measure is used by rating agencies when reviewing the Company’s credit rating. Adjusted debt to adjusted EBITDA should be considered in addition to, rather than as a substitute for, net income. The table above provides reconciliations from net income to

adjusted debt to adjusted EBITDA. At June 30, 2021, and December 31, 2020, the incremental borrowing rate on operating leases was 3.4% and 3.7%, respectively.

LIQUIDITY AND CAPITAL RESOURCES

Financial Condition

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows

|

|

|

|

|

|

Millions,

|

|

|

|

|

|

for the Six Months Ended June 30,

|

2021

|

2020

|

|

Cash provided by operating activities

|

$

|

4,219

|

$

|

4,392

|

|

Cash used in investing activities

|

|

(1,071)

|

|

(1,417)

|

|

Cash used in financing activities

|

|

(3,807)

|

|

(1,107)

|

|

Net change in cash, cash equivalents and restricted cash

|

$

|

(659)

|

$

|

1,868

|

Operating Activities

Cash provided by operating activities decreased in the first six months of 2021 compared to the same period of 2020 driven by increased tax payments, partially offset by higher net income. Tax payments in 2020 were deferred by provisions of IRS Notice 2020-23 and the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

Investing Activities

Cash used in investing activities decreased in the first six months of 2021 compared to the same period of 2020 primarily driven by reduced capital investment in all asset categories.

The table below details cash capital investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

Millions,

|

|

|

for the Six Months Ended June 30,

|

2021

|

2020

|

|

Rail and other track material

|

$

|

233

|

$

|

282

|

|

Ties

|

|

213

|

|

271

|

|

Ballast

|

|

100

|

|

139

|

|

Other [a]

|

|

232

|

|

312

|

|

Total road infrastructure replacements

|

|

778

|

|

1,004

|

|

Line expansion and other capacity projects

|

|

110

|

|

144

|

|

Commercial facilities

|

|

62

|

|

68

|

|

Total capacity and commercial facilities

|

|

172

|

|

212

|

|

Locomotives and freight cars [b]

|

|

93

|

|

164

|

|

Positive train control

|

|

31

|

|

35

|

|

Technology and other

|

|

116

|

|

184

|

|

Total cash capital investments

|

$

|

1,190

|

$

|

1,599

|

[a]Other includes bridges and tunnels, signals, other road assets, and road work equipment.

[b]Locomotives and freight cars include lease buyouts of $23 million in 2021 and $14 million in 2020.

Capital Plan

In 2021, we expect our capital expenditures to be approximately $2.9 billion, essentially flat with 2020. We will continue to harden our infrastructure, replace older assets, and improve the safety and resilience of the network. Although implementation of our new transportation plan has generated capacity, the 2021 plan includes additional investments intended to support growth and improve productivity and operational efficiency. Further revisions may occur if business conditions or the regulatory environment affect our ability to generate sufficient returns on these investments.

Financing Activities

Cash used in financing activities increased in the first six months of 2021 compared to the same period of 2020 driven by an increase in shares repurchased and a decrease in debt issued.

See Note 14 of the Condensed Consolidated Financial Statements for a description of all our outstanding financing arrangements and significant new borrowings and Note 16 of the Condensed Consolidated Financial Statements for a description of our share repurchase programs.

Free Cash Flow – Free cash flow is defined as cash provided by operating activities less cash used in investing activities and dividends paid. Cash flow conversion rate is cash from operating activities less cash used for capital investments as a ratio of net income.

Free cash flow and cash flow conversion rate are not considered financial measures under GAAP by SEC Regulation G and Item 10 of SEC Regulation S-K and may not be defined and calculated by other companies in the same manner. We believe free cash flow and cash flow conversion rate are important to management and investors in evaluating our financial performance and measures our ability to generate cash without additional external financing. Free cash flow and cash flow conversion rate should be considered in addition to, rather than as a substitute for, cash provided by operating activities.

The following table reconciles cash provided by operating activities (GAAP measure) to free cash flow (non-GAAP measure):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Millions,

|

|

|

|

for the Six Months Ended June 30,

|

2021

|

2020

|

|

|

Cash provided by operating activities

|

$

|

4,219

|

$

|

4,392

|

|

|

Cash used in investing activities

|

|

(1,071)

|

|

(1,417)

|

|

|

Dividends paid

|

|

(1,350)

|

|

(1,319)

|

|

|

Free cash flow

|

$

|

1,798

|

$

|

1,656

|

|

The following table reconciles cash provided by operating activities (GAAP measure) to cash flow conversion rate (non-GAAP measure):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Millions,

|

|

|

|

for the Six Months Ended June 30,

|

2021

|

2020

|

|

|

Cash provided by operating activities

|

$

|

4,219

|

$

|

4,392

|

|

|

Cash used in capital investments

|

|

(1,190)

|

|

(1,599)

|

|

|

Total (a)

|

$

|

3,029

|

$

|

2,793

|

|

|

Net income (b)

|

$

|

3,139

|

$

|

2,606

|

|

|

Cash flow conversion rate (a/b)

|

|

96

|

%

|

107

|

%

|

Current Liquidity Status

We are continually evaluating our financial condition and liquidity. We analyze a wide range of economic scenarios and the impact on our ability to generate cash. These analyses inform our liquidity plans and activities outlined below and indicate we have sufficient capacity to sustain an extended period of lower volumes.

During the second quarter, we generated $2.3 billion of cash from operating activities. On June 30, 2021, we had $1.1 billion of cash and cash equivalents, $2.0 billion of credit available under our revolving credit facility, and up to $400 million undrawn on the Receivables Facility. We have $506 million of debt maturing before the end of the year, including $250 million in term loans and $200 million of commercial paper. Depending upon market conditions, we plan to renew our term loans and continue to maintain the commercial paper program. We have been, and we expect to continue to be, in compliance with our debt covenants. We paid our quarterly dividend on June 30, 2021. Our financing activities in the second quarter of 2021 continue to lower our effective interest rate. In April, we completed a $1.7 billion debt exchange and drew $400 million on the Receivables Facility. In May, we issued $2.5 billion of long-term debt. In the

second quarter, we repurchased $2.7 billion under our share repurchase programs, including entering into a $2.0 billion accelerated share repurchase program ($1.6 billion assigned to the initial delivery of shares).

As described in the notes to the Condensed Consolidated Financial Statements and as referenced in the table below, we have contractual obligations that may affect our financial condition. However, based on our assessment of the underlying provisions and circumstances of our contractual obligations, including material sources of off-balance sheet and structured finance arrangements, there is no known trend, demand, commitment, event, or uncertainty that is reasonably likely to occur that would have a material adverse effect on our consolidated results of operations, financial condition, or liquidity. In addition, our commercial obligations, financings, and commitments are customary transactions that are similar to those of other comparable corporations, particularly within the transportation industry.

The following table identifies material obligations as of June 30, 2021.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jul. 1

|

Payments Due by Dec. 31,

|

|

|

|

|

through

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contractual Obligations

|

|

|

Dec. 31,

|

|

|

|

|

|

|

|

|

|

After

|

|

|

|

Millions

|

Total

|

2021

|

2022

|

2023

|

2024

|

2025

|

2025

|

Other

|

|

Debt [a]

|

$

|

52,724

|

$

|

982

|

$

|

2,743

|

$

|

2,308

|

$

|

2,327

|

$

|

2,308

|

$

|

42,056

|

$

|

-

|

|

Purchase obligations [b]

|

|

2,863

|

|

882

|

|

882

|

|

272

|

|

208

|

|

162

|

|

457

|

|

-

|

|

Operating leases [c]

|

|

1,766

|

|

91

|

|

291

|

|

249

|