U.S. Securities and Exchange Commission

Washington, DC 20549

NOTICE OF EXEMPT SOLICITATION

1. Name of the Registrant:

Union Pacific Corporation

2. Name of persons relying on exemption:

TCI Fund Management Limited

3. Address of persons relying on exemption:

7 Clifford Street, London, W1S 2FT, United Kingdom

4. Written materials. Attach written material required to be submitted

pursuant to Rule 14a-6(g)(1)

See attached.

THE CHILDREN’S INVESTMENT MASTER FUND

c/o TCI FUND MANAGEMENT LIMITED

7 Clifford Street

London

W1S 2FT

March 25, 2021

VIA HAND DELIVERY AND EMAIL TO LANCE M. FRITZ CHAIRMAN,

PRESIDENT AND CHIEF EXECUTIVE OFFICER – LFRITZ@UP.COM

Union Pacific Corporation 1400 Douglas Street,

19th Floor Omaha, Nebraska 68179

Attention: John A. Menicucci, Jr, Lance M. Fritz

and

Board of Directors (the “Board”)

Re: Union Pacific Corporation (the “Company”)

Dear Messrs. Menicucci, Fritz, and Members of the Board:

We are writing in response to your

letter, dated March 19, 2021, which contains the Board’s statement in opposition (“Statement”) to the

shareholder proposal submitted by The Children’s Investment Master Fund on November 11, 2020 (the “Proposal”).

Terms defined in the Proposal have the same meaning in this letter.

As you are no doubt aware, the SEC

yesterday did not find a basis for exclusion of the Proposal from your proxy statement for the forthcoming annual meeting of shareholders

of the Company (the “Annual Meeting”).

Your Statement seeks to justify

why shareholders should vote against the Proposal at the Annual Meeting. The Statement recites that the Company has a goal “to

reduce by the year 2030 the absolute scope 1 and 2 GHG emissions from our operations by 26%, measured against a 2018 baseline.”

However, it also states that the Company has “not to date issued a report detailing actions we expect to take to mitigate

our carbon footprint in the future” while acknowledging that “climate change requires urgent action”.

We agree. We also remind you that a goal without

a plan is meaningless.

Therefore, formulating a plan to address

the Company’s Emissions is urgent. And disclosing the Company’s Emissions and its Reduction Plan to shareholders within

the timeline specified in the Proposal would be a clear demonstration of that urgency.

We Believe You Fail to Properly Characterize Our Proposal

In response to your arguments seeking

to justify why implementing the Proposal would not be appropriate:

1. You

state that “implementation of this proposal requesting an annual advisory vote on a ‘“Reduction Plan” is

not appropriate as a policy matter because it: will result in undue focus on year-to-year change.” Note that our Proposal

asks only for the strategy that the Company may have adopted or will adopt to reduce Emissions in the future, including any Emissions’

“progress” made year over year. The Company already discloses a great amount of information covering many other areas

of focus—particularly financial—showing year-to-year changes without damaging the long-term focus of the Board. It

is unclear why mere disclosure of Emissions and progress in the reduction of such Emissions would impact the Board’s

timeframes.

You state that the Company “looks

to the goals of the Paris Agreement.” The Paris Agreement requires a 45% reduction in global emissions by 2030 (compared

to 2010 levels) so if the focus is only on long term goals this target will not be met.

Combating climate change should be

a key priority for the Board so clearly there is a need for the Company to also focus on short-term goals. In fact, the Climate

Action 100+ Net- Zero Company Benchmark, which is backed by 550 investors with >$52trn of AUM, requires that companies have

short-term, medium-term and long-term emissions reduction targets. In other words, if targets are too far out in the future no

one will be held accountable.

2. Simple

disclosure of the Emissions and the Reduction Plan in no way restricts your “ability to adapt to improved technologies”.

The Proposal does not say what should be in the Reduction Plan and there is nothing in the Proposal that would discourage investment

in new technologies.

Adapting to improved technologies

will likely be a key factor in reducing the Company’s Emissions, but that is for the Board to decide. The Proposal simply

requests disclosure of these crucial decisions and provides for shareholders to express, in a non-binding way, approval or disapproval

of the Reduction Plan.

3. Finally,

the Proposal specifically does not direct the Board how to act— it is only advisory and only requests that the Board disclose

the Emissions and its Reduction Plan. Clearly, therefore, the Proposal does not “blur the lines between shareholders’

oversight of Company policy and governance and management’s responsibility for the day-to-day operations of the Company.”

Moreover, the Proposal’s request

is only for information and to allow shareholders to approve or disapprove of a Reduction Plan. It is generally accepted that shareholders

have the right have their voices heard on significant policy decisions related to a company and to request information from a company’s

board, so we fail to see why the Proposal is in any way controversial to you.

Your Peers Are Already Ahead of You on Climate

The Company’s railroad peers,

Canadian National Railway and Canadian Pacific Railway have recently committed to give their shareholders a “Say on Climate”.

These two companies do not agree with your arguments that disclosure of their Reduction Plans would result in an undue focus on

the short term, or restrict their ability to adapt to improved technologies.

Indeed, Canadian Pacific Railway

recommended, in its 2021 Proxy Circular, that its shareholders should vote “for” TCI’s resolution, stating, “The

CP Climate Strategy will take into account the unique considerations of CP’s business [ ] including innovation necessary

to support a low carbon transition. It will be appropriately developed and managed by CP’s proven management team and following

our leading governance practices. The Board will oversee and ensure the targets and plan are appropriate.”

Also, Canadian National Railway

announced in February 2021 that its Board would seek an annual advisory vote on its climate action plan, stating that “Innovations

in fuel-efficient locomotives, rail technology, and data analytics, combined with enhanced operating practices and cleaner fuels

have made us an industry leader, and are key to achieving our short and medium term emission targets.”

In conclusion, we would like to request

that the Board reconsiders its recommendation that shareholders vote against the Proposal.

Thank you for your time and consideration.

|

|

Very truly yours,

|

|

|

|

|

|

THE CHILDREN’S INVESTMENT MASTER FUND

|

|

|

By: TCI FUND MANAGEMENT LIMITED

|

|

|

|

|

|

|

|

|

By:

|

/s/ Christopher Hohn

|

|

|

|

Sir Christopher Hohn

|

|

|

|

Title: Authorized Signatory

|

cc: Eleazer Klein, Schulte Roth & Zabel LLP

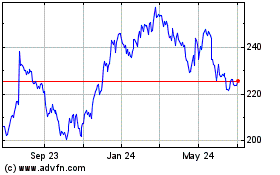

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

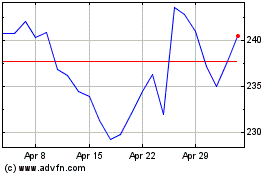

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024