Union-Pacific Says It Will Need 3,000 Fewer Workers in 2020 -- 3rd Update

January 23 2020 - 5:55PM

Dow Jones News

By Paul Ziobro

Union Pacific Corp. plans to run its railroad with nearly 3,000

fewer workers this year as the company pushes ahead with a new

operating plan that runs fewer, longer trains.

The Omaha, Neb.-based company said it plans to reduce its

average number of workers by around 8% in 2020 after reducing its

staffing by 11% in 2019. The railroad averaged around 37,500

workers during 2019 and nearly 42,000 during 2018.

Union Pacific is in the midst of a vast transformation of its

operations as it runs fewer trains with more cars.

It is also closing some yards that sort trains as it eliminates

additional handling of cargo.

The strategy, known as precision-scheduled railroading, is

sweeping across the U.S. freight railroading industry after being

honed by Canadian railroads

"The service design is reducing work that doesn't need to occur

and that's eliminating jobs," Union Pacific Chief Executive Lance

Fritz said in an interview Thursday. The company averaged 34,500

workers during the fourth quarter.

He said that as the railroad ships more goods, the company

should be able to add back some jobs. "As volume comes back, we'll

be able to grow our workforce," he said.

Rival CSX Corp., which operates in the eastern U.S. and is

further along in implementing precision-scheduled railroading,

ended 2019 with about 20,900 people, nearly 1,600 fewer jobs than

the previous year. It had 27,000 in December 2016 before the late

Hunter Harrison was named CEO and revamped the company.

As recently as two years ago, Union Pacific was offering

railroad workers signing bonuses of as much as $25,000 as it and

other freight railroads were struggling to fill jobs.

But the recent changes to the operating plan mean that Union

Pacific can operate its network with fewer people.

Union Pacific on Thursday said its quarterly profit fell almost

10% as revenue decreased from the comparable quarter a year

ago.

The company's fourth-quarter earnings were $1.4 billion, or

$2.02 a share, down from $2.12 a share a year earlier. Analysts

polled by FactSet expected $2.07 a share.

Revenue was $5.21 billion, down 9.5%. Analysts had a consensus

expectation of $5.22 billion.

The company said it expected an increase in shipping volume for

the full year after a slump in 2019.

It is also targeting at least $500 million in cost cuts.

Shares of Union Pacific rose 1.9% on Thursday.

Allison Prang contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

January 23, 2020 17:40 ET (22:40 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

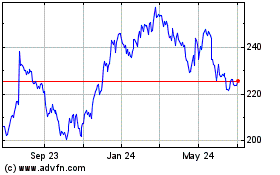

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

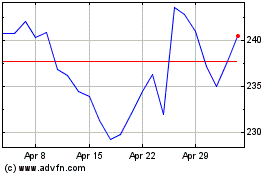

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024