U.S. Railroads Could Get Squeezed by Tariffs on Mexican Imports--2nd Update

May 31 2019 - 4:55PM

Dow Jones News

By Paul Ziobro

Proposed U.S. tariffs on Mexican imports would impact billions

of dollars of cargo moving across the border on railroads including

Kansas City Southern and Union Pacific Corp.

Both companies have spent billions of dollars upgrading

cross-border infrastructure in recent years to ferry Chevy

Silverado pickups, Corona beer and Mexican avocados into the U.S.

The railroad operators' shares were among those under pressure from

the tariff news on Friday, with Kansas City Southern trading down

4.5% and Union Pacific slipping 1.6%.

Kansas City Southern is closely tied to cross-border trade with

Mexico. It operates a network of track called the "Nafta Railway"

that can shuttle goods from Mexican factories and ocean ports to as

far north as Memphis, Tenn., bypassing congested U.S. West Coast

ports. It also carries Farm Belt commodities such as corn and U.S.

natural gas south into Mexico.

Transportation analysts at Citi estimate that 30% of the

railroad's revenue is directly tied to moving goods across the

border, and another 10% of transport business is handed off to

another carrier before crossing countries.

About 40% of that traffic involving Mexico moves north, Citi

estimates, with about a third intermodal shipments, a third

automobiles and the remainder a mix of commodities.

Kansas City Southern has warned investors about the perils of

trade tension with Mexico.

"Failure to preserve free trade provisions, or any other action

imposing import duties or border taxes, could negatively impact KCS

customers and the volume of rail shipments," the company said in

its latest annual report.

Union Pacific generated $2.5 billion last year in freight

revenue from Mexico, nearly 12% of its overall freight revenue.

Union Pacific is the only railroad that serves all six major rail

gateways to Mexico.

About 90% of Union Pacific's U.S.-bound shipments from Mexico

fell into the categories of automotive, beer and beverage and

intermodal containers. The railway doesn't carry U.S. cargo south

into Mexico, rather it interchanges at the border.

President Trump on Thursday said the U.S. would impose a 5%

tariff on all Mexican imports beginning June 10 in response to the

flow of migrants from Central America seeking asylum in the U.S.

The tariff would grow steadily to 25% on Oct. 1 unless Mexico takes

satisfactory action to halt the migrants.

The U.S. and Mexico transported about $53.2 billion in goods

across their border in March, according to the Bureau of

Transportation Statistics, with $31.3 billion of that entering the

U.S.

Trucks handle the vast majority of goods trade, including $44.3

billion worth of computers, automobiles and other goods moving

through checkpoints such as Laredo and El Paso, Texas. Rail

shipments accounted for $7.6 billion, or 14%, of the goods crossing

the border in March, the U.S. government said.

Railroads worry that tariffs and other trade disputes could damp

global trade volumes. The carriers were active in shaping the

U.S.-Mexico-Canada Agreement, the pending successor to the North

American Free Trade Agreement.

Kansas City Southern said Friday it is "aware of the President's

tweet yesterday but is not able to estimate what impact such action

might have on the flow of its cross-border freight." The railroad

said much of its Mexican freight is from U.S.-based companies such

as auto makers.

"KCS hopes that such action will not be necessary and that

efforts of the U.S. and Mexican governments to stem the flow of

immigrants through Mexico to the U.S. border are not tied to the

vital commerce that exists between the two countries," the railroad

said.

Union Pacific declined to comment.

--Paul Page contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

May 31, 2019 16:40 ET (20:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

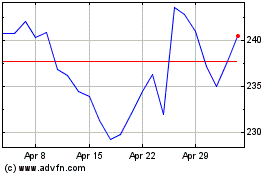

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024