Unilever to Miss Sales Target, Putting Pressure on CEO--Update

December 17 2019 - 4:22AM

Dow Jones News

By Saabira Chaudhuri

LONDON -- Unilever PLC warned it would miss its sales target for

the year as it faces a host of problems in some of its key markets,

a surprise announcement that puts pressure on Chief Executive Alan

Jope less than a year into the role.

The owner of Dove body wash and Ben & Jerry's ice cream said

sales growth on an underlying basis -- which strips out currency

and acquisition impacts -- would be slightly below its guidance of

growth at the lower end of 3% to 5%. Earnings, margin and cash

aren't expected to be impacted, it said.

Unilever has struggled with slow growth in North America -- its

biggest market by sales -- where volumes declined in the third

quarter. However, on Tuesday the company said it was also facing

challenges in other key markets, like South Asia and West

Africa.

The unexpected update disappointed investors, with Unilever

shares falling more than 5% in early trading, and renewed the

debate as to whether the company should spend more to boost

sales.

Unilever must increase investment in its business, said RBC

analyst James Edwardes Jones, adding that Tuesday's figures imply

the company's lowest quarterly sales growth for over a decade.

The Anglo-Dutch company gave a disappointing outlook for next

year, saying growth would be at the low end of its 3% to 5%

range.

It said there were "early signs of improving performance" in

North America but a full recovery would take time.

Unilever has been battling intense competition in the U.S. from

Procter & Gamble Co. in categories like shampoo. P&G, which

makes Tide detergent and Bounty paper towels, has invested in

product quality, packaging, marketing and retail execution.

Earlier this month, Unilever said it was replacing its North

America head with the former chief executive of Revlon Inc.

That was the latest in a series of recent personnel changes,

including a new chairman and new beauty and personal care head this

year. Having new faces "leaves some uncertainty over the approach

and plans at the group, " wrote analysts at Société Générale in a

recent note. "Investors we speak to are increasingly uneasy about

an opaqueness of what Unilever thinks it can achieve in the medium

term and what is changing to get that delivered."

Some analysts have expressed concern that Mr. Jope, a marketeer

by training who took over in January, would be less focused on

financials than his predecessor Paul Polman.

At the same time, analysts have welcomed Mr. Jope's indication

that Unilever will pull back on doing more acquisitions, following

a long run of small deals that could prove hard to scale up, and

will instead focus on selling slower-growth businesses.

"CEO Alan Jope is more enthusiastic talking about

sustainability, digital and the talent agenda than the nuts and

bolts of growth drivers, cost savings and portfolio choices," wrote

Jefferies analyst Martin Deboo in a recent note. Unilever didn't

immediately respond to a request for comment on the recent comments

from analysts.

Aside from challenges in North America, the company is also

grappling with an economic slowdown in India -- its largest market

by volume. Cash shortage in rural areas along with a combination of

flooding and droughts over the monsoon season has hindered demand.

West Africa is another problem region, Unilever said.

Unilever is exposed to slow-growth categories across much of the

developed world like black tea which, despite acquisitions intended

to drive sales, remains a drag. Its likely to see more competition

from rival Nestlé SA in its ice cream business going forward after

the Swiss company last week said it would house ice cream in a

joint venture to grow more quickly.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

December 17, 2019 04:07 ET (09:07 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

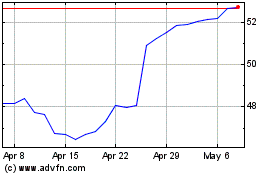

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

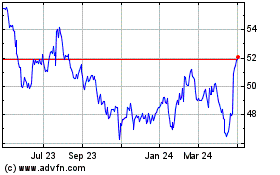

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024