|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On May 27, 2020, Under Armour, Inc. (“Under Armour” or the “Company”), closed its previously announced private offering of $440 million aggregate principal amount of 1.50% Convertible Senior Notes due 2024 (the “notes”). Under Armour also granted the initial purchasers of the notes a 13-day option to purchase up to an additional $60 million aggregate principal amount of the notes. The option was exercised in full on May 26, 2020 and closed on May 28, 2020. Under Armour currently has $500 million aggregate principal amount of notes outstanding.

The net proceeds from the offering (including the net proceeds from the exercise of the initial purchasers’ option) were approximately $487.8 million, after deducting the initial purchasers’ discount and estimated offering expenses paid by Under Armour. Under Armour used a portion of the net proceeds from the offering to pay the cost of the capped call transactions described below. Under Armour intends to use the remaining net proceeds from the offering of approximately $439.9 million to repay indebtedness outstanding under its revolving credit facility and pay related fees and expenses.

Notes and the Indenture

On May 27, 2020, Under Armour entered into an indenture with respect to the notes (the “Indenture”), by and between the Company and Wilmington Trust, National Association, as trustee (the “Trustee”).

Interest and Maturity

The notes bear interest at the rate of 1.50% per annum. The notes may bear additional interest under specified circumstances relating to Under Armour’s failure to comply with its reporting obligations under the Indenture or if the notes are not freely tradeable as and when required by the Indenture. Interest on the notes is payable semiannually in arrears on June 1 and December 1 of each year, beginning December 1, 2020. The notes will mature on June 1, 2024, unless earlier converted in accordance with their terms, redeemed in accordance with their terms or repurchased.

No Security; No Guarantee

The notes are not secured and are the Company’s senior obligations. The notes are not guaranteed by any of the Company’s subsidiaries.

Conversion Rights

The notes are convertible into cash, shares of Under Armour’s Class C common stock or a combination of cash and shares of Under Armour’s Class C common stock, at Under Armour’s election as described further below.

Prior to the close of business on the business day immediately preceding January 1, 2024, the notes will be convertible only upon satisfaction of one or more of the following conditions: (1) during any calendar quarter commencing after the calendar quarter ending on September 30, 2020 (and only during such calendar quarter), if the last reported sale price of Under Armour’s Class C common stock for at least 20 trading days (whether or not consecutive) during the period of 30 consecutive trading days ending on, and including, the last trading day of the immediately preceding calendar quarter is greater than or equal to 130% of the conversion price on each applicable trading day; or (2) during the five business day period after any five consecutive trading day period (the “measurement period”) in which the trading price per $1,000 principal amount of notes for each trading day of the measurement period was less than 98% of the product of the last reported sale price of Under Armour’s Class C common stock and the conversion rate on each such trading day; or (3) upon the occurrence of specified corporate events or distributions on Under Armour Class C common stock; or (4) if Under Armour calls any notes for redemption prior to the close of business on the business day immediately preceding January 1, 2024. On or after January 1, 2024 until the close of business on the second scheduled trading day immediately preceding the maturity date, holders may convert all or any portion of their notes at the conversion rate at any time irrespective of the foregoing conditions.

The initial conversion rate is 101.8589 shares of Under Armour’s Class C common stock per $1,000 principal amount of notes (equivalent to an initial conversion price of approximately $9.82 per share of Under Armour’s Class C common stock). The conversion rate for the notes is subject to adjustment if certain events occur, but will not be adjusted for any accrued and unpaid interest. In addition, following certain corporate events that occur prior to the maturity date or if Under Armour delivers a notice of redemption, Under Armour will in certain circumstances increase the conversion rate for a holder who elects to convert its notes in connection with such a corporate event or notice of redemption.

Optional Redemption

On or after December 6, 2022, Under Armour may redeem for cash all or any part of the notes, at its option, if the last reported sale price of Under Armour’s Class C common stock has been at least 130% of the conversion price then in effect for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading day period (including the last trading day of such period) ending on, and including, the trading day immediately preceding the date on which Under Armour provides notice of redemption at a redemption price equal to 100% of the aggregate principal amount of the notes to be redeemed, plus accrued and unpaid interest to, but excluding, the redemption date.

Fundamental Change

If Under Armour undergoes a fundamental change (as defined in the Indenture) prior to the maturity date, subject to certain conditions, holders may require Under Armour to repurchase for cash all or any portion of their notes in principal amounts of $1,000 or an integral multiple thereof. The fundamental change repurchase price will be equal to 100% of the aggregate principal amount of the notes to be repurchased, plus accrued and unpaid interest to, but excluding, the fundamental change repurchase date.

Covenants

The Indenture does not contain any financial or operating covenants or restrictions on the payments of dividends, the incurrence of indebtedness or the issuance or repurchase of securities by the Company or any of its subsidiaries.

Events of Default

The Indenture contains customary events of default. If any event of default (other than certain events of bankruptcy, insolvency or reorganization involving the Company) occurs and is continuing, then, following any applicable grace period, the Trustee, by written notice to the Company, or noteholders of at least 25% of the aggregate principal amount of notes then outstanding, by written notice to the Company and the Trustee, may declare the principal amount of, and all accrued and unpaid interest on, all of the notes then outstanding to become due and payable immediately. If an event of default involving certain events of bankruptcy, insolvency or reorganization occurs, then the principal amount of, and all accrued and unpaid interest on, all of the notes then outstanding will immediately become due and payable without any further action or notice by any person. However, notwithstanding the foregoing, the Company may elect, at its option, that the sole remedy for an event of default relating to certain failures by the Company to comply with certain reporting covenants in the Indenture consist exclusively of the right of the noteholders to receive special interest on the notes for up to 360 calendar days during which such event of default has occurred and is continuing, at a specified rate for the first 180 days of 0.25% per annum, and thereafter at a rate of 0.50% per annum, on the principal amount of the notes.

The foregoing description of the Indenture and the notes does not purport to be complete and is qualified in its entirety by reference to the full text of each of the Indenture and the Form of 1.50% Convertible Senior Notes due 2024, copies of which are filed with this Current Report on Form 8-K as Exhibits 4.1 and 4.2, respectively, and are incorporated by reference herein.

Capped Call Transactions

On May 21, 2020, concurrently with the pricing of the notes, and on May 26, 2020, in connection with the exercise in full of the initial purchasers option, Under Armour entered into privately negotiated capped call transactions with JPMorgan Chase Bank, National Association, HSBC Bank USA, National Association and Citibank, N.A. (the “Option Counterparties”). The capped call transactions are expected generally to reduce potential dilution to our Class C common stock upon any conversion of notes and/or offset any cash payments we are required to make in excess of the aggregate principal amount of converted notes upon any conversion of notes, as the case may be, with such reduction and/or offset subject to a cap based on the cap price. The cap price of the capped call transactions is initially $13.4750 per share of our Class C common stock, representing a premium of 75% above the last reported sale price of our Class C common stock on May 21, 2020, and is subject to certain adjustments under the terms of the capped call transactions.

The capped call transactions are separate transactions, entered into by Under Armour with the Option Counterparties, are not part of the terms of the notes, and will not affect any holder’s rights under the notes. Holders of the notes will not have any rights with respect to the capped call transactions.

Under Armour used approximately $47.9 million of the net proceeds from the offering of the Notes to pay the cost of the capped call transactions.

Affiliates of the Option Counterparties have also acted as initial purchasers for the offering of notes for which they have received customary compensation.

The foregoing description of the capped call transactions does not purport to be complete and is qualified in its entirety by reference to the full text of the Form of Capped Call Transaction Confirmation, a copy of which is filed with this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.01 is incorporated by reference into this Item 2.03.

|

Item 3.02.

|

Unregistered Sale of Equity Securities.

|

The information set forth in Item 1.01 is incorporated herein by reference into this Item 3.02.

The notes were sold to the initial purchasers in reliance on the exemption from the registration requirements provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) in a transaction not involving a public offering, and the notes were resold by the initial purchasers to persons reasonably believed to be qualified institutional buyers as defined in, and in reliance on, Rule 144A of the Securities Act. The notes, including the additional notes that were issued in connection with the full exercise of the initial purchasers’ option, are initially convertible into a maximum of 64,935,050 shares of Under Armour Class C common stock, assuming the largest make-whole increase to the conversion rate under the Indenture. Any shares of Class C common stock that may be issued upon conversion of the notes will be issued in reliance upon Section 3(a)(9) of the Securities Act as involving an exchange by the Company exclusively with its security holders.

The offer and sale of the notes and the Class C common stock issuable upon conversion of the notes have not been and will not be registered under the Securities Act or the securities laws of any other jurisdiction, and such securities may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

On May 22, 2020, the Company issued a press release announcing the pricing of its previously announced offering of the notes discussed above.

The press release announcing the pricing of the offering was issued in accordance with Rule 135c under the Securities Act. A copy of the press release is attached as Exhibit 99.1 and incorporated by reference into this Item 8.01.

This Current Report on Form 8-K (including the exhibits attached hereto) does not constitute an offer to sell or the solicitation of an offer to buy the notes or the Class C common stock into which the notes may be convertible or any other securities, nor shall it constitute an offer to sell, solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits. The following documents are included as exhibits to this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

UNDER ARMOUR, INC.

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ David E. Bergman

|

|

|

|

|

|

David E. Bergman

|

|

Date: May 28, 2020

|

|

|

|

Chief Financial Officer

|

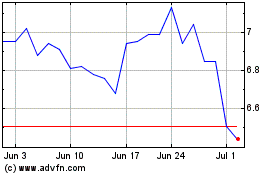

Under Armour (NYSE:UAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

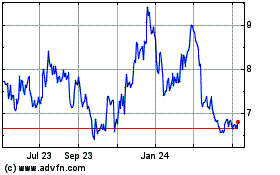

Under Armour (NYSE:UAA)

Historical Stock Chart

From Apr 2023 to Apr 2024