Current Report Filing (8-k)

May 21 2020 - 7:16AM

Edgar (US Regulatory)

false 0001336917 0001336917 2020-05-21 2020-05-21 0001336917 ua:ClassACommonStockMember 2020-05-21 2020-05-21 0001336917 ua:ClassCCommonStockMember 2020-05-21 2020-05-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 21, 2020

UNDER ARMOUR, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland

|

|

001-33202

|

|

52-1990078

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

|

|

|

|

1020 Hull Street, Baltimore, Maryland

|

|

21230

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (410) 454-6428

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

(Title of each class)

|

|

(Trading

Symbols)

|

|

(Name of each exchange

on which registered)

|

|

Class A Common Stock

|

|

UAA

|

|

New York Stock Exchange

|

|

Class C Common Stock

|

|

UA

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01.

|

Regulation FD Disclosure.

|

On May 21, 2020, Under Armour, Inc. (“Under Armour” or the “Company”) announced a proposed private offering of $400 million aggregate principal amount of Convertible Senior Notes due 2024 (the “notes”) to qualified institutional buyers pursuant to Rule 144A promulgated under the Securities Act of 1933, as amended (the “Securities Act”). The notes will be convertible into shares of the Company’s Class C common stock. Under Armour also intends to grant to the initial purchasers of the notes an option to purchase, within a thirteen day period beginning on, and including, the first date on which the notes are issued, up to an additional $60 million aggregate principal amount of the notes. In connection with the pricing of the notes, Under Armour expects to enter into privately negotiated capped call transactions with one or more of the initial purchasers of the notes and/or their respective affiliates and/or other financial institutions (the “capped call counterparties”). The capped call transactions are expected generally to reduce potential dilution to Under Armour Class C common stock upon conversion of the notes and/or offset the potential cash payments that Under Armour could be required to make in excess of the principal amount of any converted notes upon conversion thereof, with such reduction and/or offset subject to a cap.

Under Armour intends to use a portion of the net proceeds from the offering of the notes to pay the cost of the capped call transactions. If the initial purchasers exercise their option to purchase additional notes, Under Armour intends to use a portion of the net proceeds from the sale of the additional notes to pay the cost of entering into additional capped call transactions. Under Armour intends to use the remaining net proceeds from the offering to repay indebtedness outstanding under its revolving credit facility and pay related fees and expenses.

|

Item 8.01.

|

Regulation FD Disclosure.

|

On May 21, 2020, the Company issued a press release announcing the Private Placement of the Notes discussed above.

The notes will be offered and sold only to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A. The Notes and the Class C common stock into which the notes may be convertible will not be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

The press release announcing the Private Placement was issued in accordance with Rule 135c under the Securities Act. A copy of the press release announcing the offering of the notes is attached as Exhibit 99.1 and incorporated by reference into this Item 8.01.

This Current Report on Form 8-K (including the exhibit attached hereto) does not constitute an offer to sell or the solicitation of an offer to buy the notes or the Class C common stock into which the notes may be convertible or any other securities, nor shall it constitute an offer to sell, solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful. Any offers of the notes would be made only by means of a confidential offering memorandum.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits. The following documents are included as exhibits to this report:

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Exhibit

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Under Armour, Inc. press release dated May 21, 2020.

|

|

|

|

|

|

|

|

|

101

|

|

|

XBRL Instance Document - The instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

UNDER ARMOUR, INC.

|

|

|

|

|

|

|

|

Date: May 21, 2020

|

|

By:

|

|

/s/ David E. Bergman

|

|

|

|

|

|

David E. Bergman

|

|

|

|

|

|

Chief Financial Officer

|

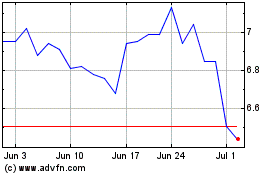

Under Armour (NYSE:UAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

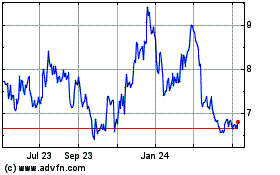

Under Armour (NYSE:UAA)

Historical Stock Chart

From Apr 2023 to Apr 2024