Investors are Sick of Health Insurance -- Overheard

April 16 2019 - 12:57PM

Dow Jones News

By Charley Grant

Talk about a tough crowd.

Health-insurance giant UnitedHealth Group, one of the star

performers of the stock market until this year, had its usual round

of good news for investors in its first-quarter earnings results.

Adjusted net earnings of $3.73 a share grew by 23% from a year

earlier and topped analyst estimates, and the company increased its

full-year profit forecast.

Investors, however, reacted as though they got a surprise

medical bill. Shares fell 4% in Tuesday morning trading. That was

the worst earnings-related reaction since a brief selloff in 2015,

according to FactSet. But that selloff was in reaction to

disappointing guidance, not to a clean report.

UnitedHealth shares are down nearly 10% so far in 2019, after a

decade of nearly uninterrupted gains.

Investors can successfully predict future earnings and cash

flows, but there is no predicting the mood of Mr. Market.

Write to Charley Grant at charles.grant@wsj.com

(END) Dow Jones Newswires

April 16, 2019 12:42 ET (16:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

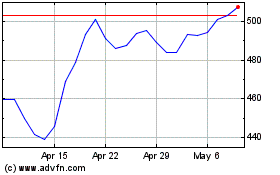

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024