UBS Launches the First US-listed 2x Leveraged ESG ETN

September 20 2021 - 10:00AM

Business Wire

UBS Investment Bank today announced the recent listing of the

first US-listed 2x Leveraged ESG ETN, which is specified in the

table below.

ETN Ticker

ETN Name

ETN CUSIP

Underlying Index Bloomberg

Ticker

ESUS

ETRACS 2x Leveraged MSCI USA ESG Focus TR

ETN

90278V743

M2USESG

About the MSCI USA ESG Focus Gross Total Return USD

Index

The MSCI USA ESG Focus Gross Total Return USD Index (the

“Index”) is derived by selecting constituents of the MSCI USA Index

(Bloomberg: “M2US Index”; referred to herein as the “Parent

Index”), through an optimization process that aims to maximize

exposure of environmental, social and governance (“ESG”) factors

for a target tracking error budget under certain constraints. The

Index is sector-diversified and targets companies with high ESG

ratings in each sector. Companies involved in tobacco,

controversial weapons, fossil fuel extraction and thermal coal

power are not eligible for inclusion in the Index. The Parent Index

is a market cap weighted benchmark index that includes large and

mid-cap stocks across the U.S. equity markets. The Index was

first disseminated publicly on August 11, 2016 and has no live

performance history prior to that date.

For more information on the ETNs: Prospectus Supplement

About ETRACS

ETRACS ETNs are senior unsecured notes issued by UBS AG, are

traded on NYSE Arca, and can be bought and sold through a broker or

financial advisor. An investment in ETRACS ETNs is subject to a

number of risks, including the risk of loss of some or all of the

investor’s principal, and is subject to the creditworthiness of UBS

AG. Investors are not guaranteed any coupon or distribution amount

under the ETNs. We urge you to read the more detailed

explanation of risks described under “Risk Factors” in the

applicable prospectus supplement for the ETRACS ETN.

UBS AG has filed a registration statement (including a

prospectus and supplements thereto) with the Securities and

Exchange Commission, or SEC, for the offerings of securities to

which this communication relates. Before you invest, you should

read the prospectus, along with the applicable prospectus

supplement to understand fully the terms of the securities and

other considerations that are important in making a decision about

investing in the ETRACS ETNs. The applicable offering document for

the ETRACS ETNs may be obtained by clicking the Prospectus

Supplement hyperlink above. You may also get these documents

without cost by visiting EDGAR on the SEC website at www.sec.gov.

The securities related to the offerings are not deposit liabilities

and are not insured or guaranteed by the Federal Deposit Insurance

Corporation or any other governmental agency of the United States,

Switzerland or any other jurisdiction.

About UBS

UBS provides financial advice and solutions to wealthy,

institutional and corporate clients worldwide, as well as private

clients in Switzerland. UBS's strategy is centered on our leading

global wealth management business and our premier universal bank in

Switzerland, enhanced by Asset Management and the Investment Bank.

The bank focuses on businesses that have a strong competitive

position in their targeted markets, are capital efficient, and have

an attractive long-term structural growth or profitability

outlook.

UBS is present in all major financial centers worldwide. It has

offices in more than 50 regions and locations, with about 30% of

its employees working in the Americas, 31% in Switzerland, 19% in

the rest of Europe, the Middle East and Africa and 20% in Asia

Pacific. UBS Group AG employs over 68,000 people around the world.

Its shares are listed on the SIX Swiss Exchange and the New York

Stock Exchange (NYSE).

This material is issued by UBS AG and/or any of its subsidiaries

and/or any of its affiliates ("UBS"). Products and services

mentioned in this material may not be available for residents of

certain jurisdictions. Past performance is not necessarily

indicative of future results. Please consult the restrictions

relating to the product or service in question for further

information. Activities with respect to US securities are conducted

through UBS Securities LLC, a US broker/dealer. Member of SIPC

(http://www.sipc.org/).

ETRACS ETNs are sold only in conjunction with the relevant

offering materials. UBS has filed a registration statement

(including a prospectus, as supplemented by the applicable

prospectus supplement, for the offering of the ETRACS ETNs) with

the Securities and Exchange Commission (the “SEC”) for the offering

to which this communication relates. Before you invest, you should

read these documents and any other documents that UBS has filed

with the SEC for more complete information about UBS and the

offering to which this communication relates. You may get these

documents for free by visiting EDGAR on the SEC website at

www.sec.gov. Alternatively, you can request the applicable

prospectus and prospectus supplement by calling toll-free

(+1-877-387 2275). In the US, securities underwriting, trading and

brokerage activities and M&A advisor activities are provided by

UBS Securities LLC, a registered broker/dealer that is a wholly

owned subsidiary of UBS AG, a member of the New York Stock Exchange

and other principal exchanges, and a member of SIPC. UBS Financial

Services Inc. is a registered broker/dealer and affiliate of UBS

Securities LLC.

The securities referred to herein are not sponsored, endorsed,

issued, sold or promoted by MSCI, and MSCI bears no liability with

respect to any such securities or any index on which such

securities are based. The respective ETN prospectus contains a more

detailed description of the limited relationship MSCI has with

UBS.

UBS specifically prohibits the redistribution or reproduction of

this material in whole or in part without the prior written

permission of UBS and UBS accepts no liability whatsoever for the

actions of third parties in this respect.

© UBS 2021. The key symbol, UBS and ETRACS are among the

registered and unregistered trademarks of UBS. Other marks may be

trademarks of their respective owners. All rights reserved.

1 Individual investors should instruct

their broker/advisor/custodian to call us or should call together

with their broker/advisor/custodian.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210920005601/en/

Media contact Alison Keunen 1-212-713-2296

alison.keunen@ubs.com Institutional Investor contact1

+1-877-387 2275

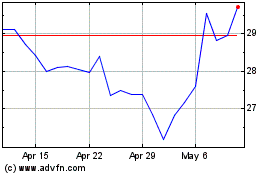

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

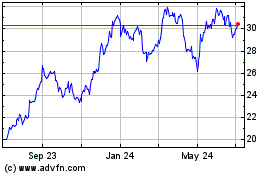

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024