UBS Profit Doubles on Trading Surge -- 3rd Update

October 20 2020 - 8:15AM

Dow Jones News

By Margot Patrick

UBS Group AG said its net profit nearly doubled in the third

quarter on a surge in client trading and deal making, freeing up

cash for dividends and share buybacks despite the coronavirus

pandemic.

Tuesday's results highlight a growing divide between stronger

and weaker banks in Europe as the pandemic hits some countries and

business models harder than others. UBS's investment bank, like

others, is benefiting from higher-than-usual customer activity

while its wealth-management arm has gained net new money from

clients to invest as global wealth rebounds from a spring rout.

Most of the Swiss bank's lending is to the world's rich and to

Swiss households and businesses, areas that have held up relatively

well in the pandemic. Many large U.S. and European rivals, in

contrast, have taken hefty provisions on their consumer and

corporate loans to reflect weaker economic outlooks than in

Switzerland.

UBS said it set aside $1.5 billion to repurchase shares next

year and has accrued $1 billion in cash for 2020 dividends. A

delayed dividend from 2019 will be paid next month, UBS said. It

had conserved the cash earlier this year after Swiss regulators

asked banks to do so.

Net profit rose to nearly $2.1 billion from $1.05 billion a year

earlier. Loan losses in the period were $89 million, lower than the

$268 million and $272 million provisions taken in the first and

second quarters, and well below the levels of many rivals.

The bank said the pandemic has been changing the way clients

interact with the bank, bringing more of them online through

mobile-banking applications and other platforms. Its wealthy

customers have also been on an "intensified search for returns,"

UBS said in a presentation, with some increasing their investments

in private markets, an area that includes buying stock and lending

money to companies that aren't publicly traded.

UBS executives said their wealthy clients have been more active

in stock markets and in making private-market investments, and have

been looking at how to position their portfolios around next

month's U.S. presidential election. In a recent investor survey,

72% said they were considering making changes before the election

and 62% planned to make investment changes after the result. The

coronavirus pandemic continued to be investors' top concern,

according to the survey.

UBS's investment bank revenue jumped to $2.49 billion from $1.75

billion a year earlier, while global wealth-management revenue rose

to $4.28 billion from $4.14 billion.

The bank's relatively insulated position has put it among

Europe's healthiest banks in terms of returns on equity and its

capital base. It has considered combining with smaller rival Credit

Suisse, according to people familiar with the matter, and analysts

expect it to be part of a burgeoning wave of banking consolidation

in the region.

From Nov. 1, former ING Groep NV Chief Executive Ralph Hamers

will take over from UBS's CEO of nine years, Sergio Ermotti. Mr.

Ermotti on Tuesday said UBS has "all the options open" for more

success under Mr. Hamers.

Under Mr. Ermotti, UBS shrank its investment bank and refocused

on wealth management. It was regarded as a largely successful

reinvention of the bank and the model has been copied by others,

including Credit Suisse.

Because of its rosier prospects, UBS's share price has

outperformed rivals this year and the broader European banks

index.

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

October 20, 2020 08:00 ET (12:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

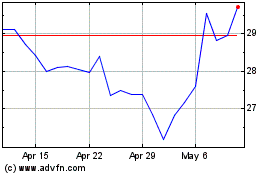

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

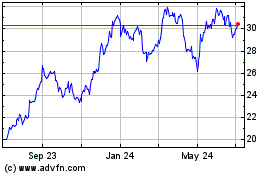

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024