Uber Is Still Riding Low

August 06 2020 - 6:51PM

Dow Jones News

By Laura Forman

Uber's ride-hailing business isn't exactly riding high amid

economic re-openings. Investors who have bid up the stock this

month in anticipation of a recovery are now questioning just how

easily the company can navigate future dips.

Uber's mixed results on Thursday were a sign the ride-hailing

industry may be less resilient than investors hoped. Second-quarter

gross bookings came in below estimates, falling 35% year-over-year

to $10.2 billion. Importantly, gross bookings for its rides

business -- now renamed "Mobility" -- declined 73%.

Uber said in May that it had been seeing early signs of

recovery, albeit one that was uneven across geographies. That has

continued, with bookings in countries like France improving

significantly, while bookings in various regions of the U.S. remain

down 50% to 85% from a year earlier. On the positive side, Uber's

food delivery business continues to grow, with bookings more than

doubling from a year earlier.

Uber aims to achieve overall profitability by the end of next

year and has put aggressive cost-cutting measures in place. To its

credit, Uber's rides business remained slightly profitable on an

adjusted basis, even as ridership fell. And its July move to

acquire food delivery rival Postmates promises to bolster cost

savings through synergies and more rational pricing

longer-term.

But sustainable profitability will require both ride-hailing and

food delivery to be firing on all cylinders -- something that looks

less likely as the coronavirus pandemic stretches on. Excluding

one-time costs, Uber's second-quarter adjusted loss before

interest, taxes, depreciation and amortization widened 26% in the

June quarter versus the year-ago period. In a conference call with

investors, the company said it expected Eats adjusted operating

losses in the third quarter to be roughly in-line with the second

quarter, but improve in the final quarter of the year.

From a valuation perspective, Uber is back to pre-pandemic highs

at around 3.7 times enterprise value to forward sales. Meanwhile,

it continues to straddle both sides of the shelter-in-place trade:

the Eats business is a natural hedge to declines in rides, but

upside appears limited in any scenario.

In such a tumultuous market, Chief Executive Officer Dara

Khosrowshahi stressed that "hope is not a strategy." Investors

should take this to heart. It isn't yet clear that Uber has chosen

the right road map.

Write to Laura Forman at laura.forman@wsj.com

(END) Dow Jones Newswires

August 06, 2020 18:36 ET (22:36 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

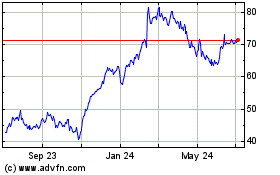

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Mar 2024 to Apr 2024

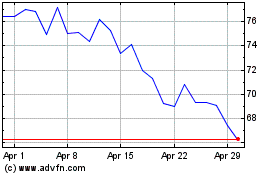

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2023 to Apr 2024