Uber Ridership Fails to Recover as Pandemic Drives Another Big Loss

August 06 2020 - 4:36PM

Dow Jones News

By Preetika Rana

Uber Technologies Inc. posted another big loss with little sign

of recovery in its core ride-hailing business as the coronavirus

pandemic drags on.

Gross bookings for Uber's rides plunged 75% year-over-year in

the three months ended June 30, the San Francisco-based company

said Thursday, With the entire second quarter affected by the

Covid-19 outbreak, bookings fell 72% from the first quarter when

the pandemic first struck.

Uber Chief Executive Dara Khosrowshahi in May said there were

early signs of recovery in ridership as some jurisdictions were

easing shelter-in-place measures. But rising Covid-19 infection

rates have hit that recovery, keeping ridership subdued.

Total quarterly revenue fell 29% to $2.24 billion from $3.17

billion in the year-ago period. Overall gross bookings, including

Uber's food delivery business and other operations, declined 35%

year-over-year to $10.22 billion. The results were broadly in line

with Wall Street's already muted expectations. Analysts surveyed by

FactSet had forecast revenue at $2.08 billion and gross bookings at

$10.53 billion.

Uber posted a $1.8 billion net loss, far smaller than the year

ago period when one-time costs from its initial public offering

drove its largest-ever three-month loss. Stripping out one-time

costs, its second-quarter adjusted loss before interest, taxes,

depreciation and amortization widened in the most recent June

quarter to $837 million compared with a $656 million adjusted loss

in the year-ago period.

Mr. Khosrowshahi had vowed to make Uber profitable on an

adjusted Ebitda basis before the end of the year, but withdrew that

forecast in April because of the health crisis. On Thursday, the

company reaffirmed its hope to reach that milestone next year. Uber

introduced a host of measures in May to save more than $1 billion

in fixed costs, including far-reaching job cuts. The company booked

$382 million in restructuring costs in the second quarter linked to

its efforts to become leaner.

The rides segment, despite plummeting ridership, remained

profitable on an adjusted basis, signally the company's decision

before the pandemic to focus on profitable growth after years of

losses is showing results.

Uber's food-delivery business has been a bright spot during the

pandemic, with people stuck at home. Bookings more than doubled

year over year and advanced 49% over the first quarter. "As some

people stay closer to home, more people are ordering from Uber Eats

than ever before," Mr. Khosrowshahi said.

The Eats segment lost $232 million in the quarter on an adjusted

basis in the cutthroat food-delivery market where profit has

largely been elusive. Uber has tried to trim those losses, and the

second-quarter results were the best three-month performance for

its Eats business.

Last month, Uber agreed to acquire rival Postmates Inc. in a

tie-up that would allow the company to find savings amid the costly

work of building out a delivery empire and to compete with

deep-pocketed rivals. The $2.65 billion all-stock deal is expected

to close next year. Uber was vying to buy Grubhub Inc., but was

beat out by Dutch food-delivery giant Just Eat Takeaway.com NV in a

$7 billion deal.

Falling ridership during the pandemic and fierce competition in

its food-delivery business aren't Uber's only headaches. Regulators

also have Uber and other so-called gig-economy companies in their

crosshairs for allegedly misclassifying their workers as

independent contractors instead of employees.

On Wednesday, California's Labor Commission said it was suing

Uber and rival Lyft Inc. for misclassifying their drivers in that

way. The state's new gig-economy law, which took effect Jan. 1,

seeks to force the companies to classify drivers as employees,

making them eligible for benefits such as paid sick leave and

health insurance -- issues that became front-and-center during the

pandemic.

Uber and Lyft have said their drivers are properly classified

under the law. Still, the ride-hailing companies have joined other

startups that rely on gig workers and raised more than $110 million

to back a ballot initiative for November, asking that voters exempt

them from the law.

Write to Preetika Rana at preetika.rana@wsj.com

(END) Dow Jones Newswires

August 06, 2020 16:21 ET (20:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

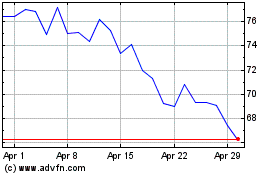

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Mar 2024 to Apr 2024

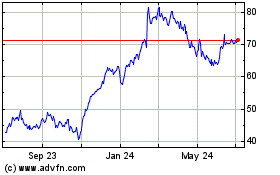

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2023 to Apr 2024