By Preetika Rana and Heather Haddon

Restaurants' increasing dependence on companies like DoorDash

Inc. and Uber Technologies Inc.'s Eats during the coronavirus

pandemic has inflamed their frustrations with the delivery services

and prompted some eateries to strike back.

For years, smaller restaurants have bristled at the commissions

food-delivery apps charge, up to 30% in some cases, an amount

particularly painful these days, as many dining rooms have been

emptied by the pandemic. In response, some restaurants are looking

to decrease their reliance on delivery giants by siding with

smaller firms that offer more favorable rates, encouraging

customers to do pickup orders and training staff to double as

drivers.

The delivery companies, which also include Grubhub Inc. and

Postmates Inc., say they have offered discounts to customers to

encourage more orders during the crisis. However, the pandemic

comes as many of the bigger delivery companies are facing pressure

from investors to deliver profits.

Restaurant chains typically have stronger negotiating power. For

example, McDonald's Corp. lowered the commission it pays Uber Eats

down to about 15% of each order. That is a luxury small restaurants

don't have, especially without in-store dining, which helped

restaurants offset thin margins on deliveries.

"We're bleeding," said Richard Hoban, co-owner of Verdine, a

Houston-based vegan restaurant that pays Uber Eats and DoorDash a

30% commission on each order.

Verdine's sales in the week through March 21 -- the first week

after major U.S. cities imposed lockdowns -- plunged 65% compared

with a typical week. To-go orders accounted for most of the sales

volume. The restaurant earned just about enough to pay employees

but couldn't cover rent and other costs after accounting for app

commissions, Mr. Hoban said. Before the pandemic, to-go sales

accounted for just 8% of weekly sales.

Verdine severed ties with DoorDash -- which it said brought the

restaurant fewer orders than Uber Eats -- and launched a

social-media campaign to promote Favor Delivery, a lesser-known

local app that waived commissions for restaurants.

"We'll remember the way they treated us long after this is

over," said Mr. Hoban, who said he plans to stick with Favor

Delivery, a subsidiary of Texas-based H-E-B LP.

Representatives for DoorDash, Uber Eats, Postmates, and Grubhub

declined to comment on the restaurants' specific complaints,

instead pointing to a list of measures they have taken, aimed at

driving more orders for small restaurant partners.

In the first week after several major cities started ordering

people to stay home, U.S. consumers spent 10% more on orders via

DoorDash, Uber Eats, Grubhub and Postmates compared with the

previous week, according to credit and debit transactions analyzed

by market research firm Edison Trends.

Mattia Cosmi, who runs the Italian Homemade Company in San

Francisco, estimated promotions on DoorDash and other apps drove

20% of delivery volume since the city imposed a shutdown. But

business is down overall, he said, and a break in commissions would

help ease the pain.

In March, DoorDash and Postmates said they would offer a

commission-free month to new businesses looking to sign up on their

platforms. They didn't waive delivery commissions for existing

restaurants. DoorDash and Uber Eats waived commissions for in-store

pickups, though restaurant owners say fewer people choose that

option over delivery.

Separately, both companies said they would waive delivery fees

for consumers on orders from more than 100,000 independent

restaurants. Postmates said it was offering consumers free

deliveries for orders from select restaurants.

Restaurants argued the moves didn't go far enough, leaving them,

not consumers, disproportionately footing the bill.

"Instead of just discounting delivery fees to guests, shouldn't

third-party delivery companies also be reducing the commission

charged to restaurants during the crisis?" said Jason Morgan, chief

executive of a Plano, Texas-based fast casual-dining company that

includes the bellagreen and Original ChopShop brands.

Mr. Morgan started a social-media campaign to encourage

customers to order directly from his platform instead of third

parties, saying a week's worth of their commissions equates to what

he pays staff for 1,200 hours of their labor.

Grubhub in March said it would suspend commissions for all

independent restaurants on its platform. Some restaurant owners

said they thought the delivery service was waiving commissions only

to realize later that they would have to pay them back in the

future.

"Grubhub's announcement obviously isn't what they made it out to

be," said New York City Councilman Mark Gjonaj, chair of the city

council's small business committee. It is considering imposing a

10% cap on commissions charged by the third-party delivery

services.

A Grubhub spokeswoman said the company's program is meant to

help new and existing restaurants on its platform until they

receive help from the stimulus package. The company is allowing

restaurants to break up repayments into installments and is

considering a longer deferment time before repayments start.

"Everything is fluid right now, and we're adjusting the program

details as needed," she said.

Coronavirus hit just as money-losing Uber Eats, DoorDash and

Postmates were pivoting from growth-at-all-costs to initial public

offerings and possible mergers to shore up their finances. Food

delivery, always an expensive service, has gotten more challenging,

as rivals increasingly overlap in the same locales, and restaurant

chains cut deals with multiple providers. Any discounts to

restaurants will further dent these delivery companies' bottom

lines.

Schlow Restaurant Group, a fine-dining company led by James

Beard Award-winning chef Michael Schlow, unsuccessfully lobbied

several delivery companies to reduce their commissions, said Alex

Levin, the company's director of strategic business and executive

pastry chef. Schlow is encouraging guests to order carryout

directly through the restaurant.

Some restaurants are trying their own delivery services. Owners

have their servers acting as delivery drivers and carryout-order

expediters.

Joe Kahn, founder and chief executive of Columbus, Ohio-based

Condado Tacos, said his servers now carry out food to customers

waiting in his restaurant parking lots. He's working with them to

become delivery drivers rather than give business to the apps.

"My hope is it will knock down these fees," Mr. Kahn said. "If

we can rally behind that, the third parties would have no choice

but to reduce those rates."

Louisville, Ky.-based EZ-Chow, which helps integrate takeout and

delivery into restaurants' websites, recorded a 30% increase in the

number of restaurant locations that began using its service in the

week through March 21, compared with a week earlier, according to

founder Mo Sloan.

He said restaurants may re-evaluate how they handle delivery

post-lockdown. "Restaurants will say, 'Why do I have to pay 30% to

you if I can do it myself?'" Mr. Sloan said. "After this is all

over, that pain isn't going to go away."

Write to Preetika Rana at preetika.rana@wsj.com and Heather

Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

April 01, 2020 08:29 ET (12:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

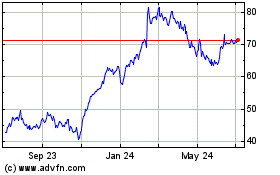

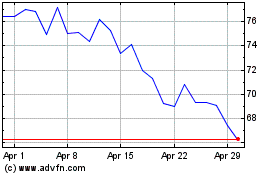

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2023 to Apr 2024