By Jaewon Kang and Annie Gasparro

U.S. grocers are adjusting their operations to try to keep up

with customers who are emptying their shelves amid angst over the

new coronavirus, even as their own employees face heightened risk

of infection.

Across the country, lines to get into stores snaked around

corners, checkout times stretched as long as an hour and whole

aisles were rendered bare this week as companies told more workers

to stay home and schools began to cancel classes.

President Trump on Sunday held a conference call with more than

two dozen grocery and supply chain executives, including those from

Walmart Inc., Target Corp., Costco Wholesale Corp., Sysco Corp. and

Tyson Foods Inc.

Kroger Co. Chief Executive Rodney McMullen wrote in a memo to

employees on Sunday that a worker in Colorado and another in

Washington tested positive for Covid-19, the respiratory disease

caused by the virus. He said the stores will remain open and that

the nation's biggest supermarket chain would give paid time off to

workers diagnosed with Covid-19 and those placed under mandatory

quarantine.

"Our stores, facilities, plants and offices are busier than ever

before, " Mr. McMullen wrote.

Kroger and Trader Joe's said they were shortening store hours to

give workers more time to clean and restock.

Publix Super Markets Inc., which operates more than 1,100

stores, on Saturday said it would shorten store and pharmacy hours

to close at 8 p.m. Walmart Inc. said its U.S. stores would close

overnight to clean and disinfect surfaces. Wegmans Food Markets

Inc. said it would shorten hours, trim options at its hot-food bars

and set purchase limits for foods including eggs, frozen

vegetables, boxed cereal and rice.

Some retailers added security in their stores. Target said it

has increased off-duty police presence in some stores and Costco

said it is adding additional security at a handful of locations.

The Washington State Department of Health urged consumers not to

overstock.

Food companies had been preparing for greater demand, but the

surge was higher and faster than expected, executives said.

"We don't know how to anticipate for that," said Susan Morris,

chief operating officer at Albertsons Cos., the nation's

second-largest grocer.

She said the company spent the past two weeks adding extra stock

at its more than 2,200 stores. But "you get to a point in time

where products are simply not available." Albertsons said it is

also carrying less variety of goods to speed up the restocking

process.

Some of the supermarkets run by Koninklijke Ahold Delhaize NV,

owner of the Stop & Shop and Food Lion chains, were running low

on bottled water, cheese and other items this week.

JJ Fleeman, president of Peapod, the online delivery business

for Ahold, said it expected demand for some items to be several

times higher than usual, but the surge this week was several times

higher than that.

"We're literally making adjustments in the moment," Mr. Fleeman

said.

Peapod said it is adding drivers and warehouse workers and

installing more computer servers to handle orders faster. Its

website briefly crashed in some parts of the country on Friday

while those upgrades were taking place.

Executives say they are confident near term they can meet

demand, especially now that many households have "pantry loaded."

Longer term they are trying to make adjustments in case of deeper

threats to the supply chain.

In the U.K., where online deliveries make up about 7.7% of the

grocery market according to research firm Kantar, more than double

the share in the U.S., retailers have also warned their services

could be stretched as the pandemic advances.

Early Sunday, in a joint letter published in British newspapers,

the country's largest supermarkets asked shoppers to "be

considerate in the way they shop" and stop buying more than

needed.

"There is enough for everyone if we all work together," said the

letter. It sought to reassure shoppers that supermarkets were doing

everything they could to restock shelves quickly and that online

delivery and click-and-collect services were "running at full

capacity."

U.S. retailers have experience preparing for surges in demand

ahead of natural disasters such as hurricanes and blizzards. This

pandemic is unique because it created a similar emergency across

the entire country with no clear end, said industry executives

including John Ross, CEO of IGA Inc., an association of about 600

U.S. independent grocers.

"The difference here is scaling up contingency plans for a

national emergency," he said.

Mark Hogan, a 41-year-old architect in San Francisco, started

buying extra snacks and other food two weeks ago. He said the pasta

and canned vegetables at his local Whole Foods had run out when he

went two days ago. The line at a nearby Trader Joe's on Friday was

three-blocks long, he said.

"It seems like at least in San Francisco, the reality completely

set in today," he said on Friday.

Warehouse workers and drivers are starting to feel the strain.

Steven Spinner, chief executive of distributor United Natural Foods

Inc., said during an earnings call this week that it has been

challenging to meet the rise in demand over the past two weeks.

Distributors and retailers are "spending 28 hours a day" to keep

the stocks full, he said.

The delivery operations that other food sellers built out in

recent years to compete with Amazon.com Inc. have also been

strained because of the sudden demand in recent days.

Amazon Prime Now, the online ordering service that delivers

within a few hours, said there were no delivery slots available

this weekend in some cities such as New York.

Target on Friday paused next-day delivery of online orders

around the country amid high demand from shoppers stocking up on

household items. Grocery delivery company Fresh Direct LLC on

Thursday warned its customers of delays and said its employees will

bring items only to the door.

Supermarket operators are now trying to speed up orders from

suppliers and are hiring more workers in stores to refill empty

shelves. Albertsons' Seattle division said on Thursday that it is

hiring drivers and in-store workers immediately.

Mike Fogarty, owner of a two-store chain called Choice Market in

Colorado, said his team has been working around the clock to try to

keep shelves full. They ran out of rubbing alcohol and some

cleaning supplies this week and he expects some dried foods to sell

out this weekend.

After his supplier told him it couldn't supply toilet paper for

his chain until April 1, he found a manufacturer that makes larger

rolls for stadiums and concert venues. He worries he won't have as

much luck replacing some other goods such as produce if suppliers

choose to first serve bigger retailers asking for more product.

"It's fundamentally a whole new era," he said.

The manufacturers of toilet paper and other items flying off

store shelves say they are ramping up production to meet higher

demand for their household essentials and long-lasting foods.

John Church, chief supply chain officer at General Mills Inc.,

said his team is making last-minute changes to where it sends

inventory to meet demand. "We have plants running at near

capacity," he said.

Conagra Brands Inc. is devoting more of its factory lines to

top-selling items. Campbell Soup Co. Chief Executive Mark Clouse

said the company is lining up multiple suppliers for important

ingredients, in case factories around the world close.

Michael Kirban, CEO of Vita Coco, said he is ramping up

production of his coconut water in Brazil to meet high demand in

the U.S. He said weekly sales have spiked 200% at Walmart.com and

60% at Amazon.com.

"No one can prepare for that. Not even Amazon," Mr. Kirban

said.

--Alex Leary contributed to this article.

Write to Jaewon Kang at jaewon.kang@wsj.com and Annie Gasparro

at annie.gasparro@wsj.com

(END) Dow Jones Newswires

March 15, 2020 16:02 ET (20:02 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

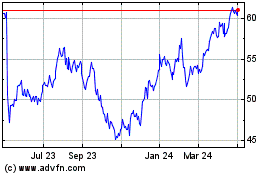

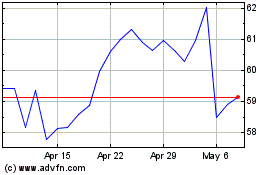

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Apr 2023 to Apr 2024