Statement of Changes in Beneficial Ownership (4)

December 26 2019 - 10:39AM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Banks Samuel Dean Jr |

2. Issuer Name and Ticker or Trading Symbol

TYSON FOODS, INC.

[

TSN

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

2200 W DON TYSON PARKWAY |

3. Date of Earliest Transaction

(MM/DD/YYYY)

12/23/2019 |

|

(Street)

SPRINGDALE, AR 72762

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 12/23/2019 | | J(1) | | 92.521 | A | $0 | 4823.34 (2) | D | |

| Class A Common Stock | 12/23/2019 | | A(3) | | 11719.006 | A | $0 | 16542.346 (4) | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Performance Shares | (5) | 12/23/2019 | | A | | 46876.03 | | (5) | (5) | Class A Common Stock | 46876.03 | (5) | 46876.03 | D | |

| Non-Qualified Stock Options (Right to Buy) | $91.39 | 12/23/2019 | | A (6) | | 62926 | | 12/23/2020 | 12/23/2029 | Class A Common Stock | 62926.0 | $0 | 62926 | D | |

| Explanation of Responses: |

| (1) | Represents shares of the Issuer's Class A Common Stock received by the Reporting Person pursuant to the Issuer's dividend reinvestment plan since the last Statement of Changes in Beneficial Ownership was filed by the Reporting Person. Such acquisitions are exempt from Section 16 concurrent reporting requirements pursuant to Rule 16a-11. |

| (2) | Includes 4,823.34 shares of the Issuer's Class A Common Stock acquired by the Reporting Person pursuant to the Deferred Fee Plan for Directors, which shares shall vest 180 days after termination of the Reporting Person's service as a member of the Issuer's board of directors. |

| (3) | Award of Class A Common Stock which vests on November 18, 2022 if the performance metric described in the applicable Stock Incentive Award Agreement (the "SIA") is achieved. The performance metric is the achievement of a three year (fiscal 2020-2022) cumulative adjusted operating income target as set forth in the SIA. If the performance metric is not achieved, the award expires. |

| (4) | Includes 4,823.34 shares of the Issuer's Class A Common Stock acquired by the Reporting Person pursuant to the Deferred Fee Plan for Directors, which shares shall vest 180 days after termination of the Reporting Person's service as a member of the Issuer's board of directors and 11,719.006 shares of Class A Common Stock which vest on November 18, 2022 if the performance metric described in the applicable SIA is achieved. |

| (5) | Award of performance Class A Common Stock which vests on November 18, 2022 if the performance metrics described in the applicable Stock Incentive Agreement (the "SIA) are achieved. The performance metrics set forth in the SIA are (1) achievement of a three year (fiscal 2020-2022) cumulative operating income target and (2) a favorable comparison of the relative total shareholder return of the Issuer's Class A Common Stock compared to a predetermined peer group of publicly traded companies over a three year (fiscal 2020-2022) period. Subject to the achievement of the performance metrics, the performance shares could vest at a level of 50 to 200 percent and are reported as derivative securities at the 200 percent level. If neither of the performance metrics are achieved, the award expires. |

| (6) | These options vest in equal annual increments on each of the first, second and third anniversary dates of the grant and become fully vested after three years. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Banks Samuel Dean Jr

2200 W DON TYSON PARKWAY

SPRINGDALE, AR 72762 | X |

|

|

|

Signatures

|

| /s/ R. Read Hudson as Power of Attorney for Samuel Dean Banks, Jr. | | 12/26/2019 |

| **Signature of Reporting Person | Date |

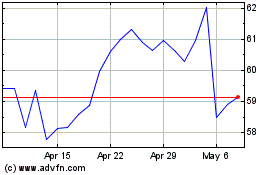

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

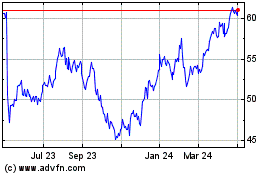

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Apr 2023 to Apr 2024