Current Report Filing (8-k)

October 02 2019 - 8:54AM

Edgar (US Regulatory)

false0000860731

0000860731

2019-10-02

2019-10-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM 8-K

_____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

October 2, 2019 (September 30, 2019)

Date of Report (Date of earliest event reported)

_____________________________________________

TYLER TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

_____________________________________________

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-10485

|

|

75-2303920

|

|

(State or other jurisdiction of incorporation organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

5101 TENNYSON PARKWAY

|

PLANO

|

Texas

|

75024

|

|

(Address of principal executive offices)

|

(City)

|

(State)

|

(Zip code)

|

(972) 713-3700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

|

|

|

|

|

|

|

Title of each class

|

Trading symbol

|

Name of each exchange

on which registered

|

|

COMMON STOCK, $0.01 PAR VALUE

|

TYL

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On September 30, 2019, Tyler Technologies (“Tyler”), as borrower, entered into a new Credit Agreement (the “Credit Agreement”) with the various lenders party thereto and Wells Fargo Bank, National Association, as Administrative Agent, Swingline Lender, and Issuing Lender. The Credit Agreement provides for an unsecured revolving credit facility in an aggregate principal amount of up to $400 million, including subfacilities for standby letters of credit and swingline loans, each in a maximum amount to be mutually determined and on customary terms and conditions. The Credit Agreement matures on September 30, 2024, and loans may be prepaid at any time, without premium or penalty, subject to certain minimum amounts and payment of any LIBOR breakage costs. The new Credit Agreement replaces Tyler’s existing $300 million secured credit facility, which was scheduled to mature in November 2020.

The credit facility will be available on a revolving basis until the maturity date. At the time of the closing, Tyler had no borrowings outstanding under either the new Credit Agreement or the prior credit agreement. The Credit Agreement includes an uncommitted accordion mechanism by which Tyler may request incremental loans, in the form of incremental term loans or an increase in the revolving credit facility, providing an ability for Tyler to increase the credit facility by an amount up to (a) the greater of (i) $250 million and (ii) 100% of Tyler’s EBITDA for the prior four quarter period plus (b) additional indebtedness up to the amount which would cause Tyler’s total net leverage ratio to equal or exceed 3.25 to 1.00. The Credit Agreement contains certain customary representations and warranties, affirmative and negative covenants, and events of defaults. The Credit Agreement is unsecured and requires Tyler to maintain certain financial ratios and other financial conditions and prohibits Tyler from making certain investments, advances, cash dividends, or loans and limits incurrence of additional indebtedness and liens. Tyler’s obligations under the Credit Agreement are also guaranteed by its direct and indirect material domestic subsidiaries.

Loans under the revolving credit facility will bear interest, at Tyler’s option, at a per annum rate of either (1) the Administrative Agent’s prime commercial lending rate (subject to certain higher rate determinations) plus a margin of 0.125% to 0.75% or (2) the one-, two-, three-, or six-month LIBOR rate plus a margin of 1.125% to 1.75%. The margin in each case is based upon Tyler’s total net leverage ratio, as determined pursuant to the Credit Agreement. In addition to paying interest on the outstanding principal of loans under the revolving credit facility, Tyler is required to pay a commitment fee, initially 0.15% per annum, ranging from 0.15% to 0.30% based upon Tyler’s total net leverage ratio. Borrowings under the Credit Agreement may be used for general corporate purposes, including working capital requirements, acquisitions and capital expenditures.

The foregoing is a summary of the material terms and conditions of the Credit Agreement and not a complete description of the Credit Agreement. Accordingly, the foregoing is qualified in its entirety by reference to the full text of the Credit Agreement attached to this Current Report on Form 8-K as Exhibit 10.1, which is incorporated by reference.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

TYLER TECHNOLOGIES, INC.

|

|

|

|

|

|

|

|

|

|

/s/ Brian K. Miller

|

|

October 2, 2019

|

|

By:

|

Brian K. Miller

Executive Vice President and Chief Financial

Officer (principal financial officer)

|

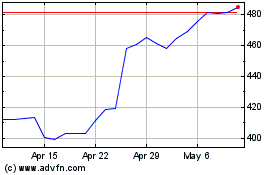

Tyler Technologies (NYSE:TYL)

Historical Stock Chart

From Mar 2024 to Apr 2024

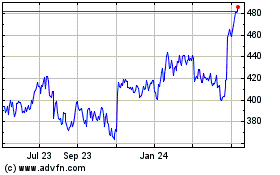

Tyler Technologies (NYSE:TYL)

Historical Stock Chart

From Apr 2023 to Apr 2024