UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 12b-25

NOTIFICATION OF LATE FILING

|

|

SEC FILE NUMBER

001-35573

CUSIP NUMBER

G9087Q102

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Check One)

|

|

☒ Form 10-K ☐ Form 20-F ☐ Form 11-K ☐ Form 10-Q

☐ Form 10-D ☐ Form N-SAR ☐ Form N-CSR

|

|

|

|

|

|

|

|

For Period Ended: December 31, 2019

|

|

|

|

|

|

|

|

☐ Transition Report on Form 10-K

|

|

|

|

|

|

|

|

☐ Transition Report on Form 20-F

|

|

|

|

|

|

|

|

☐ Transition Report on Form 11-K

|

|

|

|

|

|

|

|

☐ Transition Report on Form 10-Q

|

|

|

|

|

|

|

|

☐ Transition Report on Form N-SAR

|

|

|

|

|

|

|

|

For the Transition Period Ended:

|

|

|

|

|

|

|

|

|

|

Read Instructions (on back page) Before Preparing Form. Please Print or Type.

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

|

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

Tronox Holdings plc

Full Name of Registrant

Tronox Limited

Former Name if Applicable

263 Tresser Boulevard, Suite 1100 Laporte Road, Stallingborough

Address of Principal Executive Office (Street and Number)

Stamford, Connecticut 06901 Grimsby, North East Lincolnshire, DN40 2PR, United Kingdom

City, State and Zip Code

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☒

|

|

(a)

|

|

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

|

|

|

(b)

|

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

|

|

|

(c)

|

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

|

|

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

As disclosed by Tronox Holdings plc (“Tronox” or the “Company”) in its Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on April 11, 2019 (the “Form 8-K”), on April 10, 2019, Tronox consummated the acquisition of the titanium dioxide business of The National Titanium Dioxide Company, a limited company organized under the laws of the Kingdom of Saudi Arabia (“Cristal”). This transaction will be referred to in this filing as the “Cristal Transaction.”

In order to obtain regulatory approval for the Cristal Transaction, the Federal Trade Commission required Tronox to divest Cristal’s North American TiO2 business to INEOS Enterprises (“INEOS”). On May 1, 2019, Tronox completed the divestiture transaction to INEOS. In addition, on April 26, 2019, Tronox completed the divestiture of its 8120 paper laminate grade to Venator Materials PLC, which Tronox was required to undertake by the European Commission in order to consummate the Cristal Transaction.

The Annual Report on Form 10-K for the year ended December 31, 2019 (the “2019 Form 10-K”) will be the Company’s first annual report since the completion of the Cristal Transaction on April 10, 2019. Due to the timing of the completion of the Cristal Transaction and the complexity of acquiring a multinational organization coupled with the business divestitures required in order to obtain certain antitrust/competition approvals, the Company requires additional time to finalize purchase accounting analyses and disclosures related to its 2019 audited financial statements.

Tronox is therefore unable to file its 2019 Form 10-K within the prescribed time period without unreasonable effort or expense. Tronox intends to file its 2019 Form 10-K no later than the fifteenth calendar day after its prescribed due date.

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

PART IV — OTHER INFORMATION

|

|

|

|

|

|

|

|

(1)

|

Name and telephone number of person to contact in regard to this notification

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jeffrey Neuman

|

|

|

|

(646)

|

|

|

|

960-6546

|

|

(Name)

|

|

|

|

(Area Code)

|

|

|

|

(Telephone Number)

|

|

|

|

|

|

|

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). ☒ Yes ☐ No

|

|

|

|

|

|

|

|

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? ☒ Yes ☐ No

|

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

The 2019 Form 10-K will reflect the acquisition of the titanium dioxide business of Cristal by Tronox, as of April 10, 2019. Therefore, the Company’s results of operations have been significantly impacted by the Cristal Transaction, the associated impact of purchase accounting and the divestitures required to obtain certain antitrust/competition approvals.

On February 25, 2020, the Company announced certain preliminary financial results prepared in accordance with accounting principles generally accepted in the United States of America for the fiscal year and the three months ended December 31, 2019, which were furnished as Exhibit 99.1 to the Company’s Current Report on Form 8-K furnished to the SEC on February 26, 2020 (the “2019 Earnings Press Release”). The results presented in the 2019 Earnings Press Release are preliminary, unaudited, and subject to change pending the filing of the 2019 Form 10-K. Presently, the Company does not expect any material changes in the 2019 Form 10-K to its previously-reported preliminary unaudited financial results as reported in the 2019 Earnings Press Release. In the 2019 Earnings Press Release, Tronox estimated its revenue and income from continuing operations to be approximately $2.6 billion and $95 million for 2019, versus $1.8 billion and $200 million for the year ended December 31, 2018, respectively.

Forward-Looking Statements

Statements in this document that are not historical are forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “believe,” “estimate,” “will be,” “will,” “would,” “expect,” “anticipate,” “plan,” “forecast,” “target,” “guide,” “project,” “intend,” “could,” “should” or other similar words or expressions often identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding our beliefs and expectations relating to the filing of the 2019 Form 10-K and the results of our ongoing audit processes. These forward-looking statements are based on management’s current expectations, are not guarantees of future results and are subject to a number of risks and uncertainties, many of which are difficult to predict and beyond the Company’s control. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to the risk that the Company may not be able to complete the filing of its 2019 Form 10-K within the 15-day extension permitted by SEC rules, and the possibility that the ongoing audit of the Company’s results for the year ended December 31, 2019 may require changes to its consolidated financial statements or the amounts reported in the 2019 Earnings Press Release, or may identify internal control deficiencies. Other important factors are described in more detail in the Company's filings with the SEC, including those under the heading entitled “Risk Factors" in the Company’s Annual Report on Form 10-K/A for the year ended December 31, 2018 and other filings made with the SEC. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for our management to predict all risks and uncertainties, nor can management assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, synergies or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Unless otherwise required by applicable laws, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information or future developments.

Tronox Holdings plc

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date

|

|

February 28, 2020

|

|

|

|

By

|

|

|

|

/s/ Timothy C. Carlson

|

|

|

|

|

|

|

|

|

|

|

|

SVP and Chief Financial Officer

|

INSTRUCTION: The form may be signed by an executive officer of the registrant or by any other duly authorized representative. The name and title of the person signing the form shall be typed or printed beneath the signature. If the statement is signed on behalf of the registrant by an authorized representative (other than an executive officer), evidence of the representative’s authority to sign on behalf of the registrant shall be filed with the form.

|

|

|

|

|

|

|

ATTENTION

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

|

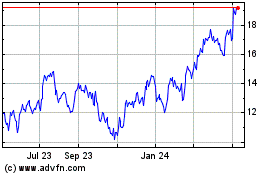

Tronox (NYSE:TROX)

Historical Stock Chart

From Mar 2024 to Apr 2024

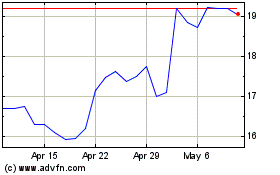

Tronox (NYSE:TROX)

Historical Stock Chart

From Apr 2023 to Apr 2024