Current Report Filing (8-k)

May 13 2021 - 8:31AM

Edgar (US Regulatory)

false

0001021162

true

0001021162

2021-05-07

2021-05-07

0001021162

us-gaap:CommonStockMember

2021-05-07

2021-05-07

0001021162

tgi:PurchaseRights1Member

2021-05-07

2021-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 7, 2021

TRIUMPH GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-12235

|

|

51-0347963

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification

No.)

|

|

|

|

|

|

899 Cassatt Road, Suite 210,

|

|

|

|

Berwyn, Pennsylvania

|

|

19312

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(610) 251-1000

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001 per share

|

|

TGI

|

|

New York Stock Exchange

|

|

Purchase Rights

|

|

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 7, 2021, Peter K.A. Wick, Executive Vice President, Aerospace Structures, of Triumph Group, Inc. (the “Company”) resigned from the Company effective immediately. Mr. Wick’s resignation occurred simultaneously with the consummation of the Asset Sale (as defined below) and was not the result of any disagreement or dispute with the Company on any matter relating to the Company’s operations, policies or practices.

Item 8.01 Other Events.

Completion of Asset Sale and Redemption of a Portion of the Company’s 8.875% Senior Secured First Lien Notes due 2024

On May 10, 2021, the Company announced that it had completed its previously announced sale of three of its Aerostructures sites to Arlington Capital Partners (the “Asset Sale”). The transaction was effective May 7, 2021 and includes the Triumph Composites business consisting of the Milledgeville, Georgia and Rayong Thailand operations, as well as its structures operations in Red Oak, Texas. The Asset Sale generated net proceeds of approximately $155 million. A copy of the Company’s press release announcing the completion of the Asset Sale is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The Company intends to use approximately $120 million of the net proceeds from the Asset Sale to redeem approximately $113 million aggregate principal amount of its 8.875% Senior Secured First Lien Notes due 2024 (the “First Lien Notes”) at a redemption price of 106.656%, plus accrued and unpaid interest. The redemption is required by the terms of the First Lien Notes, and following the redemption, approximately $587 million aggregate principal amount of First Lien Notes will remain outstanding

Item 9.01Financial Statements and Exhibits.

(d)Exhibits.

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Date:

|

May 13, 2021

|

TRIUMPH GROUP, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jennifer H. Allen

|

|

|

|

|

Jennifer H. Allen

|

|

|

|

|

Senior Vice President, General Counsel and Secretary

|

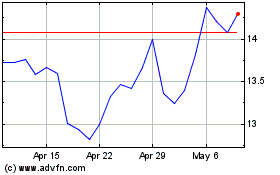

Triumph (NYSE:TGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Triumph (NYSE:TGI)

Historical Stock Chart

From Apr 2023 to Apr 2024