This prospectus supplement, the accompanying prospectus and the documents incorporated by reference in each contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 relating to our future operations and prospects, including statements that are based on current projections and expectations about the markets in which we operate, and our beliefs concerning future performance and capital requirements based upon current available information. Such statements are based on our beliefs as well as assumptions made by and information currently available to us. When used in this document or the documents incorporated by reference, words like “may,” “might,” “will,” “expect,” “anticipate,” “believe,” “potential,” “plan,” “estimate,” and similar expressions are intended to identify forward-looking statements. Actual results could differ materially from our current expectations. For example, there can be no assurance that additional capital will not be required or that additional capital, if required, will be available on reasonable terms, if at all, at such times and in such amounts as may be needed by us. In addition to these factors, among other factors that could cause actual results to differ materially are uncertainties relating to the integration of acquired businesses, general economic conditions affecting our business segments, the continued impact of the coronavirus pandemic (COVID-19), the severe disruptions to the economy, the financial markets and the markets in which we complete, dependence of certain of our businesses on certain key customers, the risk that we will not realize all of the anticipated benefits from acquisitions as well as competitive factors relating to the aerospace industry as well as uncertainties relating to our ability to execute on our restructuring plans, the integration of acquired businesses, divestitures of parts of our business, general economic conditions affecting our business, dependence of certain of our businesses on certain key customers as well as competitive factors relating to the aviation industry. For a more detailed discussion of these and other factors affecting us, see the risk factors described in our Annual Report on Form 10-K for the fiscal year ended March 31, 2020, filed with the SEC on May 28, 2020 and in the other reports we file with the SEC. A prolonged impact of COVID-19 could also have the effect of heightening many of these risks.

The following summary is qualified in its entirety by reference to the more detailed information and consolidated financial statements appearing elsewhere or incorporated by reference in this prospectus supplement or the accompanying prospectus as well as the other materials filed with the SEC that are considered to be part of the prospectus. For a more complete understanding of our company and before making any investment decision, you should read the entire prospectus, including “Risk Factors” and the financial information and the notes thereto included and incorporated by reference herein.

We design, engineer, manufacture, repair, and overhaul a broad portfolio of aerospace and defense systems, components, and structures. We serve the global aviation industry, including original equipment manufacturers, or OEMs, and the full spectrum of military and commercial aircraft operators.

We offer a variety of products and services to the aerospace industry through two operating segments: (i) Triumph Systems & Support, whose companies’ revenues are derived from the design, development, and support of proprietary components, subsystems and systems, production of complex assemblies using external designs, as well as the provision of full life cycle solutions for commercial, regional, and military aircraft; and (ii) Triumph Aerospace Structures, whose companies supply commercial, business, regional and military manufacturers with large metallic and composite structures and produce close-tolerance parts primarily to customer designs and model-based definition, including a wide range of aluminum, hard metal and composite structure capabilities.

The products that companies within this group design, engineer, build and repair include:

Extensive product and service offerings include full post-delivery value chain services that simplify the maintenance, repair and overhaul (“MRO”) supply chain. Through its ground support equipment maintenance, component MRO and postproduction supply chain activities, Systems & Support is positioned to provide integrated planeside repair solutions globally. Capabilities include metallic and composite aircraft structures; nacelles; thrust reversers; interiors; auxiliary power units; and a wide variety of pneumatic, hydraulic, fuel and mechanical accessories. Companies in Systems & Support repair and overhaul various components for the aviation industry including:

The products that companies within this group design, manufacture, build and repair include:

We were incorporated in Delaware in 1993. Our principal executive office is located at 899 Cassatt Road, Suite 210, Berwyn, PA 19312 and our telephone number is (610) 251-1000. We maintain a website at www.triumphgroup.com. The information on our website is not incorporated by reference in this prospectus supplement, and you should not consider it a part of this prospectus supplement.

THE SHARES

The following summary is provided solely for your convenience. This summary is not intended to be complete. You should read the full text and more specific details contained elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. For a more detailed description of the shares, see “Description of Capital Stock.”

|

Issuer

|

Triumph Group, Inc.

|

|

|

|

|

Selling Shareholder

|

The shares are being sold by the Selling Shareholder, which is the funding vehicle for the Vought Aircraft Industries, Inc. Hourly Retirement Plan, a tax-qualified employee benefit pension plan sponsored by the Company.

|

|

|

|

|

Securities Offered for Resale

|

4,552,305 shares of Common Stock of Triumph, par value $0.001 per share that were contributed on a discretionary basis to the Selling Shareholder. 2,849,002 of such shares were contributed on December 17, 2020, and 1,730,703 of which were contributed on December 11, 2019 and were previously registered (27,400 of such shares of Common Stock were sold and 1,703,303 of such shares of Common Stock remain unsold by the Selling Shareholder).

|

|

|

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale by the Selling Shareholder of the shares offered hereby.

|

|

|

|

|

NYSE trading symbol

|

“TGI.”

|

|

|

|

|

Risk Factors

|

Investing in the shares involves substantial risks. See “Risk Factors.”

|

|

|

|

|

Transfer Agent

|

Computershare Trust Company, N.A.

|

|

|

|

S-7

RISK FACTORS

Investing in our securities involves risk. See the risk factors described below as well as those in our filings with the SEC that are incorporated by reference in this prospectus supplement and the accompanying prospectus. A prolonged impact of COVID-19 could further heighten many of these risk factors. Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus supplement and the accompany prospectus. These risks could materially affect our business, financial condition or results of operations and cause the value of our securities to decline. You could lose all or part of your investment.

Risks relating to our Common Stock

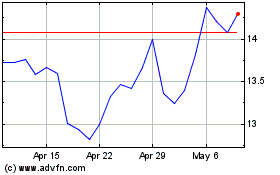

The trading price of our Common Stock has been volatile, and investors in our Common Stock may experience substantial losses.

The trading price of our Common Stock has been volatile and may become volatile again in the future. The trading price of our Common Stock will likely continue to fluctuate in response to a variety of factors, including:

|

|

•

|

the impact of the global COVID-19 pandemic;

|

|

|

•

|

any failure to meet the performance estimates of securities analysts;

|

|

|

•

|

the public’s reaction to our press releases, our other public announcements and our filings with the SEC;

|

|

|

•

|

our ability to access the credit markets for sufficient amounts of capital and on terms that are favorable or consistent with our expectations;

|

|

|

•

|

changes in buy/sell recommendations by securities analysts;

|

|

|

•

|

fluctuations in our operating results;

|

|

|

•

|

substantial sales of our Common Stock;

|

|

|

•

|

general stock market conditions;

|

|

|

•

|

a global economic slowdown that could affect our financial results and operations and the economic strength of our customers and suppliers; or

|

|

|

•

|

other economic or external factors.

|

Following periods of extreme volatility in the market price of a company’s securities, securities class-action litigation has often been instituted against that company.

Future sales of our Common Stock by us or our existing shareholders, or the perception in the public markets that these sales may occur, may depress our share price.

Sales of a substantial number of shares of our Common Stock in the public market, or the perception that these sales could occur, could cause the market price of our Common Stock to decline and may make it more difficult for you to sell your shares at a time and price that you deem appropriate.

Future offerings of debt securities, which would rank senior to our Common Stock upon our liquidation, and future offerings of equity securities, may be senior to our Common Stock for the purposes of dividend and liquidating distributions, may adversely affect the market price of our Common Stock.

We may raise capital through the issuance of debt or equity securities (including preferred stock or convertible notes) from time to time. Upon liquidation, holders of our debt securities and preferred stock and lenders

S-8

with respect to other borrowings will be entitled to our available assets prior to the holders of our Common Stock. Preferred stock could have a preference on liquidating distributions or a preference on dividend payments that could limit our ability to pay dividends to the holders of our Common Stock. Because our decision to issue debt or equity securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. Thus holders of our Common Stock bear the risk of our future offerings reducing the market price of our Common Stock and diluting the value of their stock holdings in us.

We do not intend to pay dividends in the foreseeable future.

In March 2020, we suspended the declaration and payment of dividends. As a result, only appreciation of the price of our Common Stock will provide a return to shareholders, which may not occur. You may not realize any return on your investment in our Common Stock and may lose some or all of your investment. Certain of our debt arrangements, including the indentures governing the 6.250% Senior Secured Notes due September 15, 2024, the 7.750% Senior Notes due 2025 and the indenture governing the 8.875% Senior Secured First Lien Notes due 2024, restrict our paying dividends and making distributions on our capital stock.

If securities analysts do not publish research or reports about our business or if they publish negative, or inaccurate, evaluations of our stock, the price of our stock and trading volume could decline.

The trading market for our Common Stock may be impacted, in part, by the research and reports that securities or industry analysts publish about us or our business. There can be no assurance that analysts will cover us, continue to cover us or provide favorable coverage. If one or more analysts downgrade our stock or change their opinion of our stock, our share price may decline. In addition, if one or more analysts cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which could cause our share price or trading volume to decline.

Our ability to use our tax benefits could be substantially limited if we experience an “ownership change.”

Our net operating loss (“NOL”) carryforwards and certain recognized built-in losses may be limited by Section 382 (“Section 382”) of the Internal Revenue Code of 1986, as amended (the “Code”) if we experience an “ownership change.” In general, an “ownership change” occurs if 5% shareholders of our stock increase their collective ownership of the aggregate amount of the outstanding shares of the Company by more than 50 percentage points, generally over a three-year testing period. In the event of an ownership change, NOLs that exceed the Section 382 limitation in any year will continue to be allowed as carryforwards for the remainder of the carryforward period and will be able to be used to offset taxable income for years within the carryforward period subject to the Section 382 limitation in each year. However, if the carryforward period for any NOL were to expire before that loss had been fully utilized, the unused portion of that loss would be lost. Our use of new NOLs arising after the date of an ownership change would not be affected by the Section 382 limitation (unless there were another ownership change after those new losses arose).

We have a Rights Plan designed to protect against the occurrence of an ownership change. The Rights Plan is intended to act as a deterrent to any person or group acquiring 4.9% or more of our outstanding Common Stock without the approval of our board of directors. The Rights Plan, however, does not protect against all transactions that could cause an ownership change, such as public issuances and repurchases of shares of Common Stock and the conversion of certain notes into our Common Stock. The Rights Plan may not be successful in preventing an ownership change within the meaning of Section 382, and we may lose all or most of the anticipated tax benefits associated with our prior losses.

Based on our knowledge of our stock ownership, we do not believe that an ownership change has occurred since our losses were generated. Accordingly, we believe that at the current time there is no annual limitation imposed on our use of our NOLs to reduce future taxable income. The determination of whether an ownership change has occurred or will occur is complicated and depends on changes in percentage stock ownership among shareholders. Other than the Rights Plan, there are currently no restrictions on the transfer of our stock that would discourage or prevent transactions that could cause an ownership change, although we may adopt such restrictions in the future. As discussed above, the Rights Plan is intended to discourage transactions that could cause an ownership change. In addition, we have not obtained, and currently do not plan to obtain, a ruling from the Internal Revenue

S-9

Service (the “IRS”), regarding our conclusion as to whether our losses are subject to any such limitations. Furthermore, we may decide in the future that it is necessary or in our interest to take certain actions that could result in an ownership change. Therefore, no assurance can be provided as to whether an ownership change has occurred or will occur in the future.

S-10

DIVIDEND POLICY

During fiscal 2020 and 2019, we paid cash dividends of $0.16 per share and $0.16 per share, respectively. However, we suspended the declaration and payment of dividends in March 2020. Our declaration and payment of cash dividends in the future and the amount thereof will depend upon our results of operations, financial condition, cash requirements, future prospects, limitations imposed by indentures governing existing and future debt securities and other factors deemed relevant by our board of directors. No assurance can be given that cash dividends will continue to be declared and paid at historical levels or at all. Certain of our debt arrangements, including the indentures governing the 6.250% Senior Secured Notes due September 15, 2024, the 7.750% Senior Notes due 2025 and the indenture governing the 8.875% Senior Secured First Lien Notes due 2024, restrict our paying dividends and making distributions on our capital stock. We may also enter into new credit agreements or indentures that could limit our ability to pay dividends. We currently have an accumulated deficit that could limit or restrict our ability to pay dividends in the future.

S-11

USE OF PROCEEDS

We will not receive any proceeds from the sale of the shares by the Selling Shareholder. We are filing this registration statement to register for resale up to 4,552,305 shares of Common Stock so as to allow the Selling Shareholder, which is the funding vehicle for the Vought Aircraft Industries, Inc. Hourly Retirement Plan, to resell, from time to time, the shares contributed to the Selling Shareholder.

S-12

SELLING SHAREHOLDER

We have prepared this prospectus supplement to facilitate the sale by the Selling Shareholder listed in the table below, from time to time, in the aggregate, of up to 4,552,305 shares of Common Stock.

We have prepared the following table based on information given to us by, or on behalf of, the Selling Shareholder on or before the date hereof with respect to the Selling Shareholder’s beneficial ownership of our Common Stock as of December 13, 2019, and the number of shares of our Common Stock that the Selling Shareholder may offer for sale from time to time pursuant to this prospectus supplement, whether or not the Selling Shareholder has a present intention to do so. The Selling Shareholder may resell all, a portion, or none of the shares of our Common Stock from time to time. The registration of the resale of these shares does not necessarily mean that the Selling Shareholder will sell all or any of the shares registered by the registration statement of which this prospectus supplement forms a part. The Selling Shareholder may offer and sell all or any portion of the shares covered by this prospectus supplement from time to time but is under no obligation to offer or sell any such shares. Because the Selling Shareholder may sell, transfer or otherwise dispose of all, some or none of the shares covered by this prospectus supplement, we cannot determine the number of shares that will be sold, transferred or otherwise disposed of by the Selling Shareholder or the amount or percentage of shares that will be held by the Selling Shareholder upon termination of any particular offering. See “Plan of Distribution.” For purposes of the table below, we assume that the Selling Shareholder will sell all its shares of Common Stock covered by this prospectus supplement.

|

|

|

|

|

|

|

|

|

Number of Shares of

Common Stock

Owned

|

Number of Shares of

Common Stock Covered

by the Prospectus Dated

|

Number of Shares of

Common Stock

Covered by This

|

Shares Owned After the

Offering Assuming the

Sale of all Covered Shares

|

|

Name of Selling Shareholder

|

Prior To Offering

|

December 11, 2019

|

Prospectus Supplement

|

Number

|

%

|

|

Vought Aircraft Industries Inc., Master Defined Benefit Trust(1)

|

4,552,305 (2)

|

1,703,303(2)

|

4,552,305

|

—

|

—

|

|

(1)

|

The address of the Vought Aircraft Industries Inc., Master Defined Benefit Trust is Triumph Group, Inc, Attn: Steven Brown, 899 Cassatt Rd Suite 210, Berwyn PA 19312.

|

|

(2)

|

1,730,703 shares of Common Stock were previously contributed to Vought Aircraft Industries Inc., Master Defined Benefit Trust on December 11, 2019 and were previously registered (27,400 of such shares of Common Stock were sold and 1,703,303 of such shares of Common Stock remain unsold). This prospectus supplement covers the newly contributed shares and the previously contributed and unsold shares.

|

The Company’s Pension Benefits Committee and its Investment Committee, to which the Company’s board of directors have delegated responsibility for the investment of the assets of the retirement trust, have each appointed Newport Trust Company (the “Investment Manager”) to serve as investment manager and independent fiduciary to the trust with respect to the assets of the trust consisting of Common Stock of the Company (“Company Common Stock Accounts”). The trustee and custodian of the assets of the trust is JPMorgan Chase Bank, N.A. (“Trustee”). The Investment Manager will exercise its independent discretionary judgment in connection with retention, acquisition and disposition of Company stock held in the Company Common Stock Accounts in accordance with the requirements of part 4 of Title I of ERISA.

S-13

CERTAIN ERISA CONSIDERATIONS

The following is a summary of certain considerations associated with the purchase and holding of the shares by employee benefit plans that are subject to Title I of the United States Employee Retirement Income Security Act of 1974 (“ERISA”), plans, individual retirement accounts and other arrangements that are subject to Section 4975 of the Internal Revenue Code (the “Code”) or provisions under any other federal, state, local, non-U.S. or other laws, rules or regulations that are similar to such provisions of ERISA or the Code (collectively, “Similar Laws”), and entities whose underlying assets are considered to include “plan assets” of any such plan, account or arrangement (each, a “Plan”).

General Fiduciary Matters

ERISA and the Code impose certain duties on persons who are fiduciaries of a Plan subject to Title I of ERISA or Section 4975 of the Code (an “ERISA Plan”) and prohibit certain transactions involving the assets of an ERISA Plan and its fiduciaries or other interested parties. Under ERISA and the Code, any person who exercises any discretionary authority or control over the administration of such an ERISA Plan or the management or disposition of the assets of such an ERISA Plan, or who renders investment advice for a fee or other compensation to such an ERISA Plan, is generally considered to be a fiduciary of the ERISA Plan.

In considering an investment in the shares of a portion of the assets of any Plan, a fiduciary should determine whether the investment is in accordance with the documents and instruments governing the Plan and the applicable provisions of ERISA, the Code or any Similar Law relating to a fiduciary’s duties to the Plan including, without limitation, the prudence, diversification, delegation of control, conflicts of interest and prohibited transaction provisions of ERISA, the Code and any other applicable Similar Laws.

Prohibited Transaction Issues

Section 406 of ERISA and Section 4975 of the Code prohibit ERISA Plans from engaging in specified transactions involving plan assets with persons or entities who are “parties in interest,” within the meaning of ERISA, or “disqualified persons,” within the meaning of Section 4975 of the Code, unless an exemption is available. A party in interest or disqualified person who engages in a non-exempt prohibited transaction may be subject to excise taxes and other penalties and liabilities under ERISA and the Code. In addition, the fiduciary of the ERISA Plan that engages in such a non-exempt prohibited transaction may be subject to penalties and liabilities under ERISA and the Code. For example, the acquisition and/or holding of shares by an ERISA Plan with respect to which the issuer or the Selling Shareholder is considered a party in interest or a disqualified person may constitute or result in a direct or indirect prohibited transaction under Section 406 of ERISA and/or Section 4975 of the Code, unless the investment is acquired and is held in accordance with an applicable statutory, class or individual prohibited transaction exemption.

Because of the foregoing, the shares should not be purchased by any person investing “plan assets” of any Plan, unless such purchase will not constitute a non-exempt prohibited transaction under ERISA and the Code or similar violation of any applicable Similar Laws.

In this regard, the U.S. Department of Labor has issued prohibited transaction class exemptions (“PTCEs”) that may apply to the acquisition and holding of the shares that may otherwise constitute a prohibited transaction. These class exemptions include, without limitation, PTCE 84-14 respecting transactions determined by independent qualified professional asset managers, PTCE 90-1 respecting insurance company pooled separate accounts, PTCE 91-38 respecting bank collective investment funds, PTCE 95-60 respecting life insurance company general accounts, and PTCE 96-23 respecting transactions determined by in-house asset managers. In addition, Section 408(b)(17) of ERISA and Section 4975(d)(20) of the Code provide relief from the prohibited transaction provisions of ERISA and Section 4975 of the Code for certain transactions, provided that neither the seller of the securities nor any of its affiliates (directly or indirectly) have or exercise any discretionary authority or control or render any investment advice with respect to the assets of any ERISA Plan involved in the transaction, and provided further that the ERISA Plan pays no more than adequate consideration in connection with the transaction. There can be no assurance any of the above-described exemptions or any other exemption, or that all of the conditions of any such exemptions, will be satisfied with respect to any prohibited transactions that might arise in connection with the purchase of any shares.

S-14

Under ERISA Section 408(e) there is a statutory exception from the prohibited transaction rules for contributions of “qualifying employer securities.” A qualifying employer security includes stock of the plan sponsor, provided that immediately following the acquisition of the stock (i) the plan does not hold more than 25 percent of the issued and outstanding shares of the plan sponsor and (ii) at least 50 percent of the issued and outstanding shares of such stock is held by parties that are independent of the plan sponsor. In addition, the following requirements must be met: (i) the plan’s acquisition of the employer securities must be for adequate consideration, (ii) no commissions may be charged with respect to the acquisition, and (iii) immediately after the acquisition of employer securities, the fair market value of all employer securities held by the plan cannot exceed 10 percent of the fair market value of all plan assets.

Representation

Accordingly, by acceptance of a share, each purchaser and subsequent transferee will be deemed to have represented and warranted that (A) either (i) no portion of the assets used by such purchaser or transferee to acquire or hold the shares constitutes assets of any Plan or (ii) the purchase of the shares or the holding of the shares by such purchaser or transferee will not constitute a non-exempt prohibited transaction under Section 406 of ERISA, Section 4975 of the Code or a similar violation under any applicable Similar Laws, and (B) if the purchaser is an ERISA Plan, neither the issuer nor the Selling Shareholder is acting in a fiduciary capacity with respect to the purchaser’s acquisition of the shares.

The foregoing discussion is general in nature and is not intended to be all-inclusive. Due to the complexity of these rules and the penalties that may be imposed upon persons involved in non-exempt prohibited transactions, it is particularly important that fiduciaries, or other persons considering purchasing the shares (and holding the shares) on behalf of, or with the assets of, any Plan, consult with their counsel regarding the potential applicability of ERISA, Section 4975 of the Code and any Similar Laws to such transactions and whether an exemption would be applicable to the purchase and holding of the shares.

The sale of shares to any purchaser is in no way a recommendation or representation that an investment in the shares is advisable or appropriate with respect to Plans generally or any particular Plan. Purchasers of the shares have the exclusive responsibility for ensuring that their purchase and holding of the shares complies with the fiduciary responsibility rules of ERISA and does not violate the prohibited transaction rules of ERISA, the Code or Similar Laws.

S-15

DESCRIPTION OF CAPITAL STOCK

General

The following summary description of our capital stock is based on the provisions of the Delaware General Corporation Law (the “DGCL”), our certificate of incorporation, as amended (our “Amended and Restated Certificate of Incorporation”), and our by-laws, as amended (our “Amended and Restated By-laws”). This description does not purport to be complete and is qualified in its entirety by reference to the full text of the DGCL, as it may be amended from time to time, and to the terms of our Amended and Restated Certificate of Incorporation and Amended and Restated By-laws, as each may be amended from time to time, which are incorporated by reference as exhibits to the registration statement of which this prospectus supplement is a part. See “Where You Can Find More Information.” As used in this “Description of Capital Stock,” the terms “Triumph,” the “Company”, “we,” “our” and “us” refer to Triumph Group, Inc., a Delaware corporation, and do not, unless otherwise specified, include our subsidiaries.

Our authorized capital stock consists of 100,000,000 shares of Common Stock, par value $0.001 per share, and 250,000 shares of preferred stock, par value $0.01 per share (the “Preferred Stock”). The number of authorized shares of any class may be increased or decreased by an amendment to our Amended and Restated Certificate of Incorporation proposed by our board of directors and approved by a majority of voting shares voted on the issue at a meeting at which a quorum exists.

Each shareholder of record of our Common Stock is entitled to one vote for each share held on every matter properly submitted to the shareholders for their vote. As and when dividends are declared or paid thereon, holders of Common Stock are entitled to participate in such dividends ratably on a per share basis.

Common Stock

Upon our liquidation, dissolution or winding up, the holders of our Common Stock are entitled to receive ratably our net assets available, if any, after the payment of all debts and other liabilities and subject to the prior rights of any outstanding Preferred Stock.

Holders of our Common Stock have no preemptive, subscription, redemption, conversion or exchange rights and no sinking fund provisions.

The rights, preferences and privileges of holders of Common Stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of Preferred Stock that we may designate and issue in the future.

Preferred Stock

Our Amended and Restated Certificate of Incorporation authorizes us to issue 250,000 shares of Preferred Stock, par value $0.01 per share. The Preferred Stock is issuable in series with such voting rights, if any, designations, powers, preferences and other rights and such qualifications, limitations and restrictions as may be determined by our board of directors. Our board of directors is authorized, subject to limitations prescribed by law and our Amended and Restated Certificate of Incorporation, to provide for the issuance of the shares of Preferred Stock and to establish from time to time the number of shares to be included in each such series, and to fix the designations, powers, preferences and rights of the shares of each such series and the qualifications, limitations or restrictions thereof. As of the date of this prospectus supplement, no shares of our Preferred Stock were outstanding.

Anti-Takeover Effects of Provisions of the Amended and Restated Certificate of Incorporation, Amended and Restated By-laws and Other Agreements

Our Amended and Restated By-laws contain certain provisions that may be deemed to have an anti-takeover effect and may delay, deter or prevent a tender offer or takeover attempt that a stockholder might consider in its best interest.

S-16

Our Amended and Restated By-laws provide that special meetings of the stockholders, for any purpose or purposes may be called by the Chairman or the President and shall be called by the Chairman or the President or Secretary at the request in writing of a majority of our board of directors, or at the request in writing in compliance with our Amended and Restated By-laws of stockholders of record owning at least 25% in amount of the entire capital stock of the Company issued and outstanding and entitled to vote.

Our Amended and Restated By-laws establish an advance notice procedure for the nomination, other than by or at the direction of our board of directors, of candidates for election as directors as well as for other stockholder proposals to be considered at annual meetings or special meetings of stockholders. In general, notice of intent to nominate a director or raise business at such meetings must be received by us not less than 90 nor more than 120 days prior the first anniversary of the preceding year’s annual meeting (in the case of an annual meeting) or prior to the date of the special meeting (in the case of a special meeting). The notice must contain certain specified information concerning the person to be nominated or the matters to be brought before the meeting and concerning the stockholder submitting the proposal.

Shareholder Rights Plan

We have a shareholder rights plan, which we refer to as our Tax Benefits Preservation Plan (the “Rights Plan”). Under the Rights Plan, if any person or group acquires beneficial ownership of 5% or more of our then-outstanding voting stock, shareholders other than the 5% triggering shareholder will have the right to purchase a unit consisting of one one-thousandth of a share of Series B Junior Participating Preferred Stock, par value $0.01 per share (the “Series B Preferred Stock”), at a purchase price of $100.00 per share, subject to adjustment. The Rights Plan is intended to help protect certain Company tax attributes, such as current year net operating loss and the net operating loss carryovers, capital loss carryovers, general business credit carryovers, alternative minimum tax credit carryovers, foreign tax credit carryovers and other similar tax carryovers, as well as any loss or deduction attributable to a “net unrealized built- in loss” within the meaning of Section 382 of the Internal Revenue Code of 1986, as amended, and the Treasury Regulations promulgated thereunder, of the Company or any of its subsidiaries (collectively, “Tax Benefits”) by deterring any person from becoming a 5% Shareholder (as defined in the Rights Plan).

Rights Certificates; Exercise Period

Initially, the Rights will be attached to all Common Stock certificates representing shares then outstanding, and no separate rights certificates (“Rights Certificates”) will be distributed. Subject to certain exceptions specified in the Rights Plan, the Rights will separate from the Common Stock and a distribution date (the “Distribution Date”) will occur upon the earlier of (i) ten (10) business days following a public announcement that an Acquiring Person (as defined in the Rights Plan) has become a 5% Shareholder (the “Stock Acquisition Date”) and (ii) ten (10) business days (or such later date as our board of directors shall determine) following the commencement of a tender offer or exchange offer that would result in a person or group becoming an Acquiring Person.

Until the Distribution Date, (i) the Rights will be evidenced by the Common Stock certificates (or, in the case of book entry shares, by the notations in the book entry accounts) and will be transferred with and only with such Common Stock, (ii) new Common Stock certificates issued after the Record Date will contain a notation incorporating the Rights Plan by reference and (iii) the surrender for transfer of any certificates for Common Stock outstanding will also constitute the transfer of the Rights associated with the Common Stock represented by such certificates. Pursuant to the Rights Plan, the Company reserves the right to require prior to the occurrence of a Triggering Event (as defined below) that, upon any exercise of Rights, a number of Rights be exercised so that only whole shares of Series B Preferred Stock will be issued.

The definition of “Acquiring Person” contained in the Rights Plan contains several exemptions, including for (i) the Company; (ii) any of the Company’s subsidiaries; (iii) any employee benefit plan of the Company, or of any subsidiary of the Company, or any person organized, appointed or established by the Company for or pursuant to the terms of any such plan; (iv) any person that becomes a 5% Shareholder as a result of a reduction in the number of shares of Company securities outstanding due to a repurchase of Company securities by the Company or a stock dividend, stock split, reverse stock split or similar transaction, unless and until such person increases its ownership by more than one (1) percentage point over such person’s lowest percentage stock ownership on or after

S-17

the consummation of the relevant transaction; (v) any person who, together with all affiliates and associates of such person, was a 5% Shareholder on the date of the Rights Plan (as disclosed in public filings with the SEC on the date of the Rights Plan), unless and until such person and its affiliates and associates increase their aggregate ownership by more than one (1) percentage point over their lowest percentage stock ownership on or after the date of the Rights Plan, provided that this clause (v) will not apply to any such person who has decreased its ownership below 5%; (vi) any person who, within ten (10) business days of being requested by the Company to do so, certifies to the Company that such person became an Acquiring Person inadvertently or without knowledge of the terms of the Rights and who, together with all affiliates and associates, thereafter within ten (10) business days following such certification disposes of such number of shares of Common Stock so that it, together with all affiliates and associates, ceases to be an Acquiring Person; and (vii) any person that our board of directors has affirmatively determined in its sole discretion shall not be deemed an Acquiring Person.

The Rights are not exercisable until the Distribution Date and will expire at the earliest of (i) 5:00 P.M., New York City time, on March 13, 2022 (ii) the time at which the Rights are redeemed or exchanged as provided in the Rights Plan, (iii) the time at which our board of directors determines that the Rights Plan is no longer necessary or desirable for the preservation of Tax Benefits, and (iv) the close of business on the first day of a taxable year of the Company to which our board of directors determines that no Tax Benefits, once realized, as applicable, may be carried forward.

As soon as practicable after the Distribution Date, Rights Certificates will be mailed to holders of record of the Common Stock as of the close of business on the Distribution Date and, thereafter, the separate Rights Certificates alone will represent the Rights. After the Distribution Date, the Company generally would issue Rights with respect to shares of Common Stock issued upon the exercise of stock options or pursuant to awards under any employee plan or arrangement, which stock options or awards are outstanding as of the Distribution Date, or upon the exercise, conversion or exchange of securities issued by the Company after the Rights Plan’s adoption (except as may otherwise be provided in the instruments governing such securities). In the case of other issuances of shares of Common Stock after the Distribution Date, the Company generally may, if deemed necessary or appropriate by our board of directors, issue Rights with respect to such shares of Common Stock.

Preferred Share Provisions

Each one one-thousandth of a share of Series B Preferred Stock, if issued:

|

|

•

|

will not be redeemable;

|

|

|

•

|

will entitle the holder thereof to quarterly dividend payments of $0.001 or an amount equal to the dividend paid on one share of Common Stock, whichever is greater;

|

|

|

•

|

will, upon any liquidation of the Company, entitle the holder thereof to receive either $0.001 plus accrued and unpaid dividends and distributions to the date of payment or an amount equal to the payment made on one share of Common Stock, whichever is greater;

|

|

|

•

|

will have the same voting power as one share of Common Stock; and

|

|

|

•

|

will, if shares of Common Stock are exchanged via merger, consolidation or a similar transaction, entitle holders thereof to a payment equal to the payment made on one share of Common Stock.

|

Flip-in Trigger

In the event that a person or group of affiliated or associated persons becomes an Acquiring Person (unless the event causing such person or group to become an Acquiring Person is a transaction described under Flip-over Trigger, below), each holder of a Right will thereafter have the right to receive, upon exercise, Common Stock (or, in certain circumstances, cash, property or other securities of the Company) having a value equal to two times the exercise price of the Right. Notwithstanding the foregoing, following the occurrence of such an event, all Rights that are, or (under certain circumstances specified in the Rights Plan) were, beneficially owned by any Acquiring Person

S-18

will be null and void. However, Rights are not exercisable following the occurrence of such an event until such time as the Rights are no longer redeemable by the Company as set forth below.

Flip-over Trigger

In the event that, at any time following the Stock Acquisition Date, (i) the Company engages in a merger or other business combination transaction in which the Company is not the surviving corporation, (ii) the Company engages in a merger or other business combination transaction in which the Company is the surviving corporation and the Common Stock is changed or exchanged, or (iii) more than fifty percent (50%) of the Company’s assets, cash flow or earning power is sold or transferred, each holder of a Right (except Rights that have previously been voided as set forth above) shall thereafter have the right to receive, upon exercise, common stock of the acquiring company having a value equal to two times the exercise price of the Right.

Exchange Feature

At any time after a person becomes an Acquiring Person and prior to the acquisition by such person or group of fifty percent (50%) or more of the outstanding Common Stock, our board of directors may exchange the Rights (other than Rights owned by such person or group which have become void), in whole or in part, at an exchange ratio of one one-thousandth of a share of Series B Preferred Stock (or of a share of a class or series of the Company’s preferred stock having equivalent rights, preferences and privileges), per Right (subject to adjustment).

Equitable Adjustments

The purchase price payable, and the number of Units of Series B Preferred Stock or other securities or property issuable, upon exercise of the Rights are subject to adjustment from time to time to prevent dilution (i) in the event of a stock dividend on, or a subdivision, combination or reclassification of the Series B Preferred Stock, (ii) if holders of the Series B Preferred Stock are granted certain rights or warrants to subscribe for Common Stock or Series B Preferred Stock or convertible securities at less than the current market price of the Common Stock or the Series B Preferred Stock, or (iii) upon the distribution to holders of the Series B Preferred Stock of evidences of indebtedness or assets (excluding regular quarterly cash dividends) or of subscription rights or warrants (other than those referred to above).

With certain exceptions, no adjustment in the purchase price will be required until cumulative adjustments amount to at least one percent (1%) of the purchase price. No fractional Units will be issued and, in lieu thereof, an adjustment in cash will be made based on the market price of the Series B Preferred Stock on the last trading day prior to the date of exercise.

Redemption Rights

At any time until ten (10) business days following the Stock Acquisition Date, the Company may, at its option, redeem the Rights in whole, but not in part, at a price of $0.001 per Right (payable in cash, Common Stock or other consideration deemed appropriate by our board of directors). Immediately upon the action of our board of directors ordering redemption of the Rights, the Rights will terminate and the only right of the holders of Rights will be to receive the $0.001 redemption price.

Amendment of Rights

Any of the provisions of the Rights Plan may be amended by our board of directors prior to the Distribution Date except that our board of directors may not extend the expiration of the Rights beyond 5:00 P.M. (New York City time) on March 13, 2022 unless such extension is approved by the stockholders of the Company prior to 5:00 P.M. (New York City time) on March 13, 2022. After the Distribution Date, the provisions of the Rights Plan may be amended by our board of directors in order to cure any ambiguity, to make changes that do not adversely affect the interests of holders of Rights, or to shorten or lengthen any time period under the Rights Plan. The foregoing notwithstanding, no amendment may be made at such time as the Rights are not redeemable, except to cure any ambiguity or correct or supplement any provision contained in the Rights Plan which may be defective or inconsistent with any other provision therein.

S-19

Miscellaneous

Until a Right is exercised, the holder thereof, as such, will have no separate rights as a shareholder of the Company, including the right to vote or to receive dividends in respect of the Rights. While the distribution of the Rights will not be taxable to stockholders or to the Company, shareholders may, depending upon the circumstances, recognize taxable income in the event that the Rights become exercisable for Common Stock (or other consideration) of the Company or for common stock of the acquiring company or in the event of the redemption of the Rights as set forth above.

This summary description of the Rights and the Rights Plan does not purport to be complete and is qualified in its entirety by reference to the Rights Plan.

Listing

Our Common Stock is listed on the NYSE under the symbol “TGI.”

Transfer Agent and Registrar

The transfer agent and registrar for our Common Stock is Computershare Trust Company, N.A.

S-20

PLAN OF DISTRIBUTION

We have registered the shares of Common Stock to allow the Selling Shareholder to sell all or a portion of the shares to the public from time to time after the date of this prospectus supplement. The Selling Shareholder may sell the shares directly or in negotiated transactions through underwriters, broker-dealers or agents.

The shares may be sold pursuant to the methods described below from time to time by or for the account of the Selling Shareholder on the NYSE, or any other national securities exchange or automated interdealer quotation system on which our Common Stock is then listed, or otherwise in one or more transactions at:

|

|

•

|

a fixed price or prices, which may be changed;

|

|

|

•

|

market prices prevailing at the time of sale;

|

|

|

•

|

prices related to prevailing market prices; or

|

|

|

•

|

prices determined on a negotiated or competitive bid basis.

|

These sales may be effected in any manner permitted by law, including by any one or more of the following methods:

|

|

•

|

a block trade (which may involve crosses) in which the broker or dealer so engaged will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

purchases by a broker or dealer as principal;

|

|

|

•

|

ordinary brokerage transactions and transactions in which the broker solicits purchasers; or

|

|

|

•

|

privately negotiated transactions.

|

The SEC may deem the Selling Shareholder and any broker-dealers or agents who participate in the distribution of the shares to be an “underwriter” within the meaning of Section 2(11) of the Securities Act of 1933, as amended (the “Securities Act”). As a result, the SEC may deem any profits made by the Selling Shareholder as a result of selling the shares and any discounts, commissions or concessions received by any broker-dealers or agents to be underwriting discounts and commissions under the Securities Act. To our knowledge, there are currently no plans, agreements, arrangements or understandings between the Selling Shareholder and any underwriter, broker-dealer or agent regarding the sale of the shares.

To comply with the securities laws of some states, if applicable, the Selling Shareholder may only sell shares in these jurisdictions through registered or licensed brokers or dealers. In addition, in certain jurisdictions, the shares may not be sold unless they have been registered or qualified for sale in these jurisdictions, or an exemption from registration or qualification is available and complied with. The Selling Shareholder and any other persons participating in the sales of the shares pursuant to this prospectus supplement may be subject to applicable provisions of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules and regulations under the Exchange Act. The Selling Shareholder may also sell shares in reliance upon Rule 144 of the Securities Act, provided it meets the criteria and conforms to the requirements of Rule 144, rather than under this prospectus supplement.

With respect to a particular offering of the shares, to the extent required by law, we will file an another prospectus supplement or, if appropriate, a post-effective amendment to the registration statement of which this prospectus supplement is a part, disclosing the following information:

|

|

•

|

the amount of shares being offered and sold;

|

S-21

|

|

•

|

the respective purchase prices and public offering prices and other material terms of the offering;

|

|

|

•

|

the names of any participating agents, broker-dealers or underwriters employed by the Selling Shareholder in connection with such sale; and

|

|

|

•

|

any applicable commissions, discounts, concessions and other items constituting compensation from the Selling Shareholder.

|

If the Selling Shareholder sell the shares through underwriters, broker-dealers or agents, we will not be responsible for underwriting discounts, and concessions or commissions (which commissions will not exceed those customary in the types of transactions involved) or agents’ commissions.

The Selling Shareholder may pledge or grant a security interest in some or all of the shares owned by it, and if it defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the shares from time to time pursuant to this prospectus supplement. The Selling Shareholder also may transfer and donate shares in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be the Selling Shareholder for purposes of this prospectus supplement.

We will not receive any portion of the proceeds of the sale of the shares offered by this prospectus supplement.

S-22

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC under the Exchange Act. Our SEC filings are available to the public at the SEC’s website at www.sec.gov.

This prospectus supplement is part of a registration statement filed by us with the SEC. The exhibits to our registration statement or to documents filed under the Exchange Act and incorporated by reference herein contain the full text of certain contracts and other important documents we have summarized in this prospectus supplement. Since these summaries may not contain all the information that you may find important in deciding whether to purchase the securities that may be offered under this prospectus supplement, you should review the full text of these documents. The registration statement and the exhibits can be obtained from the SEC as indicated above, or from us.

S-23

Incorporation of certain documents by reference

The SEC allows us to “incorporate by reference” information into this prospectus supplement, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus supplement, except for any information superseded by information contained directly in this prospectus supplement, any subsequently filed document deemed incorporated by reference or any free writing prospectus prepared by or on behalf of us. This prospectus supplement incorporates by reference the documents set forth below that we have previously filed with the SEC (other than information deemed furnished and not filed in accordance with SEC rules, including Items 2.02 and 7.01 of Form 8-K).

|

|

•

|

our Annual Report on Form 10-K for the fiscal year ended March 31, 2020, filed with the SEC on May 28, 2020;

|

|

|

•

|

the information specifically incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended March 31, 2020 from our definitive proxy statement on Schedule 14A, filed with the SEC on June 2, 2020;

|

|

|

•

|

our Current Reports on Form 8-K, filed with the SEC on April 2, 2020, April 14, 2020, June 12, 2020, July 21, 2020, August 5, 2020 (Film No. 201075076), August 6, 2020, August 18, 2020, October 5, 2020, November 18, 2020 and December 17, 2020; and

|

|

|

•

|

the description of our Common Stock contained in our Registration Statement on Form 8-A, filed with the SEC on September 27, 1996, and any amendment or report filed for the purpose of updating such description.

|

All documents filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement and before the termination of the offering also shall be deemed to be incorporated herein by reference. We are not, however, incorporating by reference any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K.

If requested, we will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in the prospectus but not delivered with the prospectus. Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference into such documents. To obtain a copy of these filings at no cost, you may write or telephone us at the following address:

Triumph Group, Inc.

899 Cassatt Road, Suite 210

Berwyn, PA 19312

(610) 251-1000

Attention: Jennifer H. Allen

S-24

LEGAL MATTERS

The validity of the shares of our Common Stock offered by this prospectus supplement will be passed upon for us by Skadden, Arps, Slate, Meagher & Flom LLP.

EXPERTS

Ernst & Young LLP, independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report on Form 10-K for the year ended March 31, 2020, and the effectiveness of our internal control over financial reporting as of March 31, 2020, as set forth in their reports, which are incorporated by reference in this prospectus supplement and elsewhere in this registration statement. Our financial statements are incorporated by reference in reliance on Ernst & Young LLP’s reports, given on their authority as experts in accounting and auditing.

S-25

Prospectus

Triumph Group, Inc.

Common Stock

Preferred Stock

Depositary Shares

Debt Securities

Guarantees of Debt Securities

Warrants

Subscription Rights

Purchase Contracts

Units

We may offer, issue and sell, together or separately:

|

|

•

|

shares of our common stock;

|

|

|

•

|

shares of our preferred stock, which may be issued in one or more series;

|

|

|

•

|

depositary receipts, representing fractional shares of our preferred stock, which are called depositary shares;

|

|

|

•

|

debt securities, which may be issued in one or more series and which may be senior debt securities or subordinated debt securities;

|

|

|

•

|

guarantees of debt securities;

|

|

|

•

|

warrants to purchase shares of our common stock, shares of our preferred stock or our debt securities;

|

|

|

•

|

subscription rights to purchase shares of our common stock, shares of our preferred stock or our debt securities;

|

|

|

•

|

purchase contracts to purchase shares of our common stock, shares of our preferred stock or our debt securities; and

|

|

|

•

|

units, comprised of one or more securities in any combination.

|

This registration statement may also be used by one or more selling securityholders, including Vought Aircraft Industries, Inc., Master Defined Benefit Trust, which is the funding vehicle for the Vought Aircraft Industries, Inc. Hourly Retirement Plan, who we have previously contributed securities to.

We will provide the specific prices and terms of these securities in one or more supplements to this prospectus at the time of offering. We will not receive any proceeds from the sale of our securities by any selling

securityholder. You should read this prospectus and the accompanying prospectus supplement carefully before you make your investment decision.

This prospectus may not be used to sell securities unless accompanied by a prospectus supplement.

Investing in our securities involves a number of risks. See “Risk Factors” on page 6 before you make your investment decision.

We or any selling securityholder may offer securities through underwriting syndicates managed or co-managed by one or more underwriters or dealers, through agents or directly to purchasers. If required, the prospectus supplement for each offering of securities will describe the plan of distribution for that offering. For general information about the distribution of securities offered, please see “Plan of Distribution” in this prospectus.

Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the trading symbol “TGI.” Each prospectus supplement will indicate whether the securities offered thereby will be listed on any securities exchange.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus or any accompanying prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 17, 2020

TABLE OF CONTENTS

|

WHERE YOU CAN FIND MORE INFORMATION

|

2

|

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

3

|

|

|

DESCRIPTION OF SECURITIES

|

6

|

|

|

DESCRIPTION OF CAPITAL STOCK

|

7

|

|

|

DESCRIPTION OF DEPOSITARY SHARES

|

12

|

|

|

DESCRIPTION OF DEBT SECURITIES AND GUARANTEES

|

14

|

|

|

DESCRIPTION OF WARRANTS

|

17

|

|

|

DESCRIPTION OF SUBSCRIPTION RIGHTS

|

18

|

|

|

DESCRIPTION OF PURCHASE CONTRACTS AND PURCHASE UNITS

|

19

|

|

i

ABOUT THIS PROSPECTUS

References in this prospectus to “we,” “us,” “our” or the “Company” mean Triumph Group, Inc. and its consolidated subsidiaries, unless the context otherwise requires.

This prospectus is part of a Registration Statement on Form S-3, or the Registration Statement, that we filed with the Securities and Exchange Commission, or SEC, using the “shelf” registration process. Under this process, we or any selling securityholders that may be named in a prospectus supplement, if required, may sell from time to time the securities described in the prospectus in one or more offerings any combination of the securities described in this prospectus.

This prospectus only provides you with a general description of the securities we may offer. Each time we or any of the selling securityholders offer securities under this prospectus, we or the selling securityholders will provide a prospectus supplement, if required, that will contain more specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change any of the information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus. We urge you to carefully read this prospectus, any applicable prospectus supplement and any free writing prospectuses we have authorized for use in connection with a specific offering, together with the information incorporated herein by reference as described under the heading “Where You Can Find More Information.”

This prospectus is neither an offer to sell nor a solicitation of an offer to buy any securities other than those registered by this prospectus, nor is it an offer to sell or a solicitation of an offer to buy securities where an offer or solicitation would be unlawful.

You should rely only on the information contained in or incorporated by reference into this prospectus or any applicable prospectus supplement. Neither we nor any selling securityholder have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information in this prospectus and any applicable prospectus supplement, and any related free writing prospectus that we prepare, as well as the information in any document incorporated or deemed to be incorporated into this prospectus and any applicable prospectus supplement, is accurate only as of the date on the front cover of the documents containing the information.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our SEC filings are available to the public at the SEC’s website at www.sec.gov.

The SEC allows us to “incorporate by reference” information into this prospectus and any accompanying prospectus supplement, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus and any accompanying prospectus supplement, except for any information superseded by information contained directly in this prospectus, any subsequently filed document deemed incorporated by reference or any free writing prospectus prepared by or on behalf of us. This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that we have previously filed with the SEC (other than information deemed furnished and not filed in accordance with SEC rules, including Items 2.02 and 7.01 of Form 8-K).

|

|

•

|

our Annual Report on Form 10-K for the fiscal year ended March 31, 2020, filed with the SEC on May 28, 2020;

|

|

|

•

|

the information specifically incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended March 31, 2020 from our definitive proxy statement on Schedule 14A, filed with the SEC on June 2, 2020;

|

|

|

•

|

our Quarterly Reports on Form 10-Q for the fiscal quarters ended June 30, 2020 and September 30, 2020, filed with the SEC on August 5, 2020 and November 5, 2020.

|

|

|

•

|

our Current Reports on Form 8-K, filed with the SEC on April 2, 2020, April 14, 2020, June 12, 2020, July 21, 2020, August 5, 2020 (Film No. 201075076), August 6, 2020, August 18, 2020, October 5, 2020, November 18, 2020 and December 17, 2020; and

|

|

|

•

|

the description of our common stock contained in our Registration Statement on Form 8-A, filed with the SEC on September 27, 1996, and any amendment or report filed for the purpose of updating such description.

|

All documents filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus and before the termination of the offering also shall be deemed to be incorporated herein by reference. We are not, however, incorporating by reference any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K.

If requested, we will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in the prospectus but not delivered with the prospectus. Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference into such documents. To obtain a copy of these filings at no cost, you may write or telephone us at the following address:

Triumph Group, Inc.

899 Cassatt Road, Suite 210

Berwyn, PA 19312

(610) 251-1000

Attention: Jennifer H. Allen

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 relating to our future operations and prospects, including statements that are based on current projections and expectations about the markets in which we operate, and our beliefs concerning future performance and capital requirements based upon current available information. Such statements are based on our beliefs as well as assumptions made by and information currently available to us. When used in this document or the documents incorporated by reference, words like “may,” “might,” “will,” “expect,” “anticipate,” “believe,” “potential,” “plan,” “estimate,” and similar expressions are intended to identify forward-looking statements. Actual results could differ materially from our current expectations. For example, there can be no assurance that additional capital will not be required or that additional capital, if required, will be available on reasonable terms, if at all, at such times and in such amounts as may be needed by us. In addition to these factors, among other factors that could cause actual results to differ materially are uncertainties relating to the integration of acquired businesses, general economic conditions affecting our business segments, the continued impact of the coronavirus pandemic (COVID-19), the severe disruptions to the economy, the financial markets and the markets in which we complete, dependence of certain of our businesses on certain key customers, the risk that we will not realize all of the anticipated benefits from acquisitions as well as competitive factors relating to the aerospace industry as well as uncertainties relating to our ability to execute on our restructuring plans, the integration of acquired businesses, divestitures of parts of our business, general economic conditions affecting our business, dependence of certain of our businesses on certain key customers as well as competitive factors relating to the aviation industry. For a more detailed discussion of these and other factors affecting us, see the risk factors described in our Annual Report on Form 10-K for the fiscal year ended March 31, 2020, filed with the SEC on May 28, 2020 and in the other reports we file with the SEC. A prolonged impact of COVID-19 could also have the effect of heightening many of these risks.

THE COMPANY

The following summary is qualified in its entirety by reference to the more detailed information and consolidated financial statements appearing elsewhere or incorporated by reference in this prospectus, as well as the other materials filed with the SEC that are considered to be part of this prospectus. For a more complete understanding of our company and before making any investment decision, you should read this entire prospectus, including “Risk Factors” and the financial information and the notes thereto included and incorporated by reference herein.

General

We design, engineer, manufacture, repair, and overhaul a broad portfolio of aerospace and defense systems, components, and structures. We serve the global aviation industry, including original equipment manufacturers, or OEMs, and the full spectrum of military and commercial aircraft operators.

Products and Services

We offer a variety of products and services to the aerospace industry through two operating segments: (i) Triumph Systems & Support, whose companies’ revenues are derived from the design, development, and support of proprietary components, subsystems and systems, production of complex assemblies using external designs, as well as the provision of full life cycle solutions for commercial, regional, and military aircraft; and (ii) Triumph Aerospace Structures, whose companies supply commercial, business, regional and military manufacturers with large metallic and composite structures and produce close-tolerance parts primarily to customer designs and model-based definition, including a wide range of aluminum, hard metal and composite structure capabilities.

Systems & Support’s capabilities include hydraulic, mechanical and electromechanical actuation, power and control; a complete suite of aerospace gearbox solutions, including engine accessory gearboxes and helicopter transmissions; active and passive heat exchange technology; fuel pumps, fuel metering units and Full Authority Digital Electronic Control fuel systems; hydromechanical and electromechanical primary and secondary flight controls; and a broad spectrum of surface treatment options.

Extensive product and service offerings include full post-delivery value chain services that simplify the maintenance, repair and overhaul (“MRO”) supply chain. Through its ground support equipment maintenance, component MRO and postproduction supply chain activities, Systems & Support is positioned to provide integrated planeside repair solutions globally. Capabilities include metallic and composite aircraft structures; nacelles; thrust reversers; interiors; auxiliary power units; and a wide variety of pneumatic, hydraulic, fuel and mechanical accessories. Companies in Systems & Support repair and overhaul various components for the aviation industry including:

|

|

|

|

Air cycle machines

|

Blades and vanes

|

|

APUs

|

Cabin panes, shades, light lenses and other components

|

|

Constant speed drives

|

Combustors

|

|

Engine and airframe accessories

|

Stators

|

|

Flight control surfaces

|

Transition ducts

|

|

Integrated drive generators

|

Sidewalls

|

|

Nacelles

|

Light assemblies

|

|

Remote sensors

|

Overhead bins

|

|

Thrust reversers

|

Fuel bladder cells

|

Aerospace Structures’ products include wings, wing boxes, fuselage panels, horizontal and vertical tails, and subassemblies such as floor grids. Aerospace Structures also has the capability to engineer detailed structural designs in metal and composites. Aerospace Structures capabilities also include advanced composite and interior structures, joining processes such as welding, autoclave bonding and conventional mechanical fasteners.

The products that companies within this group design, manufacture, build and repair include:

|

|

|

|

Aircraft wings

|

Flight control surfaces

|

|

Composite and metal bonding

|

Integrated testing and certification services

|

|

Engine nacelles

|

Stretch-formed leading edges and fuselage skins

|

|

Comprehensive processing services

|

Wing spars and stringers

|

|

Empennages

|

Composite ducts and floor panels

|

Company Information

We were incorporated in Delaware in 1993. Our principal executive office is located at 899 Cassatt Road, Suite 210, Berwyn, PA 19312 and our telephone number is (610) 251-1000. We maintain a website at www.triumphgroup.com. The information on our website is not incorporated by reference in this prospectus and any accompanying prospectus supplement, and you should not consider it a part of this prospectus and any accompanying prospectus supplement.

RISK FACTORS

Investing in our securities involves risk. See the risk factors described in our most recent Annual Report on Form 10-K (together with any material changes thereto contained in subsequently filed Quarterly Reports on Form 10-Q) and those contained in our other filings with the SEC that are incorporated by reference in this prospectus and any accompanying prospectus supplement. A prolonged impact of COVID-19 could further heighten many of these risk factors. Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus and any accompanying prospectus supplement. These risks could materially affect our business, financial condition or results of operations and cause the value of our securities to decline. You could lose all or part of your investment.

USE OF PROCEEDS

Except as otherwise set forth in any accompanying prospectus supplement, we expect to use the net proceeds from the sale of securities for general corporate purposes. We will not receive any of the proceeds from the sale of securities being offered by any selling securityholder.

DESCRIPTION OF SECURITIES

This prospectus contains summary descriptions of the common stock, preferred stock, depositary shares, debt securities, guarantees of debt securities, warrants, subscription rights, purchase contracts and units that may be offered and sold from time to time. These summary descriptions are not meant to be complete descriptions of each security. However, at the time of an offering and sale, this prospectus together with the accompanying prospectus supplement will contain the material terms of the securities being offered.

DESCRIPTION OF CAPITAL STOCK

General

The following summary description of our capital stock is based on the provisions of the Delaware General Corporation Law (the “DGCL”), our certificate of incorporation, as amended (our “Amended and Restated Certificate of Incorporation”), and our by-laws, as amended (our “Amended and Restated By-laws”). This description does not purport to be complete and is qualified in its entirety by reference to the full text of the DGCL, as it may be amended from time to time, and to the terms of our Amended and Restated Certificate of Incorporation and Amended and Restated By-laws, as each may be amended from time to time, which are incorporated by reference as exhibits to the registration statement of which this prospectus is a part. See “Where You Can Find More Information.” As used in this “Description of Capital Stock,” the terms “Triumph,” the “Company”, “we,” “our” and “us” refer to Triumph Group, Inc., a Delaware corporation, and do not, unless otherwise specified, include our subsidiaries.

Our authorized capital stock consists of 100,000,000 shares of common stock, par value $0.001 per share, and 250,000 shares of preferred stock, par value $0.01 per share (the “Preferred Stock”). The number of authorized shares of any class may be increased or decreased by an amendment to our Amended and Restated Certificate of Incorporation proposed by our board of directors and approved by a majority of voting shares voted on the issue at a meeting at which a quorum exists.