TriplePoint Venture Growth BDC Corp. Announces Extension and Expansion of Its Revolving Credit Facility

December 14 2020 - 5:27PM

Business Wire

Facility Increased to $325 Million

TriplePoint Venture Growth BDC Corp. (NYSE: TPVG) (the

“Company,” “TPVG,” “we,” “us,” or “our”), the leading financing

provider to venture growth stage companies backed by a select group

of venture capital firms in the technology and other high growth

industries, today announced it has extended and expanded its

revolving credit facility (“Credit Facility”). Deutsche Bank AG

serves as administrative agent and as a lender, together with

existing lenders KeyBank National Association, TIAA, FSB, MUFG

Union Bank, N.A., Hitachi Capital America Corporation and NBH Bank,

and along with new lender, Customers Bank, under the Credit

Facility.

The Credit Facility, as amended, among other things, increases

the capacity of the Credit Facility from $300 million to $325

million, extends the revolving period to November 30, 2022 and

extends the scheduled maturity date to May 31, 2024. The $25

million increase was made under the accordion feature in the Credit

Facility, which allows the Company, under certain circumstances, to

increase the size of the Credit Facility to up to $400 million.

“We are pleased to have increased and extended our revolving

credit facility and appreciate the continued support of our leading

and expanded banking group,” said Christopher Mathieu, Chief

Financial Officer of TPVG. “This amended facility further

strengthens our liquidity position and prospects for growing the

portfolio as we end the year and enter into 2021.”

Borrowings under the Credit Facility are subject to various

covenants including the leverage restrictions contained in the

Investment Company Act of 1940, as amended, provided that the

Company’s asset coverage ratio under the Credit Facility shall not

be less than 150%. More information regarding the amendment to the

Credit Facility, including a copy thereof, can be found in our

Current Report on Form 8-K, filed with the Securities and Exchange

Commission (the “SEC”) on December 14, 2020.

ABOUT TRIPLEPOINT VENTURE GROWTH BDC CORP.

The Company was formed to expand the venture growth stage

business segment of TriplePoint Capital LLC, the leading global

provider of financing across all stages of development to

technology, life sciences and other high growth companies backed by

a select group of venture capital firms. The Company’s investment

objective is to maximize its total return to stockholders primarily

in the form of current income and, to a lesser extent, capital

appreciation by lending primarily with warrants to venture growth

stage companies. The Company is an externally managed, closed-end,

non-diversified management investment company that has elected to

be regulated as a business development company under the Investment

Company Act of 1940, as amended.

FORWARD-LOOKING STATEMENTS

Statements included herein may constitute “forward-looking

statements,” which relate to future events or our future

performance or financial condition. These statements are not

guarantees of future events, performance, condition or results and

involve a number of risks and uncertainties. Actual results and

conditions may differ materially from those in the forward-looking

statements as a result of a number of factors, including those

described from time to time in the Company’s filings with the SEC.

You should not place undue reliance on these forward-looking

statements. The Company undertakes no duty to update any

forward-looking statements made herein, whether as a result of new

information, future events or otherwise, except as may be required

by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201214005841/en/

The IGB Group Leon Berman 212-477-8438 lberman@igbir.com

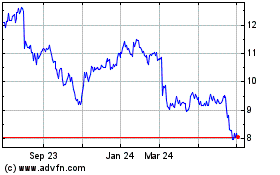

TriplePoint Venture Grow... (NYSE:TPVG)

Historical Stock Chart

From Mar 2024 to Apr 2024

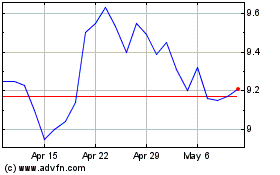

TriplePoint Venture Grow... (NYSE:TPVG)

Historical Stock Chart

From Apr 2023 to Apr 2024