|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Investment Agreement

On May 28, 2020 (the “Effective Date”), TPG RE Finance Trust, Inc., a Maryland corporation (the “Company”), entered into an Investment Agreement (the “Investment Agreement”) with PE Holder L.L.C., a Delaware limited liability company (the “Purchaser”), an affiliate of Starwood Capital Group Global II, L.P. The Company has agreed to issue and sell to the Purchaser, pursuant to the Investment Agreement, up to 13,000,000 shares of the Company’s 11.0% Series B Cumulative Redeemable Preferred Stock, par value $0.001 per share (plus any additional such shares paid as dividends pursuant to the Articles Supplementary, the “Series B Preferred Stock”), and warrants (the “Warrants”) to purchase, in the aggregate, up to 15,000,000 shares (subject to adjustment) of the Company’s common stock, par value $0.001 per share (“Common Stock”), for an aggregate cash purchase price of up to $325,000,000 (the “Financing”).

The purchase of the shares of Series B Preferred Stock and Warrants pursuant to the Investment Agreement may occur in up to three tranches. On the terms and subject to the conditions set forth in the Investment Agreement, including certain customary closing conditions, (i) on the Effective Date, the Purchaser purchased and acquired from the Company, and the Company issued, sold, and delivered to the Purchaser (a) 9,000,000 shares of Series B Preferred Stock and (b) Warrants to purchase up to 12,000,000 shares of Common Stock for an aggregate purchase price equal to $225,000,000 (the “First Closing”); and (ii) the Company, at its option on or prior to December 31, 2020, may issue, sell, and deliver to the Purchaser (a) a second tranche of securities, including 2,000,000 shares of Series B Preferred Stock and Warrants to purchase up to 1,500,000 shares of Common Stock, for an aggregate purchase price equal to $50,000,000; and (b) a third tranche of securities, including 2,000,000 shares of Series B Preferred Stock and Warrants to purchase up to 1,500,000 shares of Common Stock, for an aggregate purchase price equal to $50,000,000.

The Investment Agreement contains certain representations, warranties, covenants, and agreements of the Company and the Purchaser.

Director Appointment Rights

The Company’s Board of Directors (the “Board”) has agreed to cause one designee of the Purchaser to be appointed as a member of the Board promptly following the latest of (i) the Purchaser’s written request; (ii) the First Closing; and (iii) July 1, 2020. Following such appointment, and for so long as the Purchaser beneficially owns Warrants and/or Common Stock issued upon the exercise of Warrants that represent, in the aggregate and on an as-exercised basis, at least 25% of the shares of Common Stock underlying the Warrants purchased by the Purchaser under the Investment Agreement and the Warrant Agreement (the “25% Beneficial Ownership Requirement”), the Company has agreed to (a) nominate such designee to be elected at each annual meeting of the Company’s stockholders, (b) recommend that the holders of Common Stock vote to elect such designee, and (c) use its reasonable efforts to cause the election to the Board of a slate of directors that includes such designee.

In addition, if, at any time prior to the first day on which the 25% Beneficial Ownership Requirement is not satisfied (the “25% Fall-Away Date”), a Failure Event (as defined in the Investment Agreement) occurs, then following the later of (i) such Failure Event and (ii) July 1, 2020, the Board will cause an additional designee of the Purchaser to be appointed as a member of the Board. Following such appointment and until the earlier to occur of (i) the 25% Fall-Away Date and (ii) a Payment Event (as defined in the Investment Agreement), the Company has agreed to (a) nominate such designee to be elected at each annual meeting of the Company’s stockholders, (b) recommend that the holders of Common Stock vote to elect such designee, and (c) use its reasonable efforts to cause the election to the Board of a slate of directors that includes such designee.

Voting Agreement

From and after the First Closing and until the 25% Fall-Away Date, during any such time that the Accrued Dividends (as defined in the Articles Supplementary) on any shares of Series B Preferred Stock held by the Purchaser are not then in arrears, at each meeting of the stockholders of the Company, the Purchaser has agreed to take such action as may be required so that all of the shares of Common Stock beneficially owned, directly or indirectly, by the Purchaser and entitled to vote at such meeting of stockholders are voted: (i) in favor of each director nominated or recommended by the Board for election at any meeting of stockholders of the Company; (ii) against any stockholder nomination for director that is not approved and recommended by the Board for election at any meeting of stockholders of the Company; (iii) in favor of the Company’s “say-on-pay” proposal and any proposal by the Company relating to equity compensation that has been approved by the Board or a committee of the Board; and (iv) in favor of the Company’s proposal for ratification of the appointment of the Company’s independent registered public accounting firm.

Standstill Restrictions

From the Effective Date and until the later of (i) May 28, 2022, (ii) 90 days following the date on which no designee of the Purchaser serves on the Board and the Purchaser no longer has the right to nominate a director for election to the Board and (iii) the date on which the Purchaser no longer has any information rights pursuant to Section 5.13(a) of the Investment Agreement, the Purchaser and certain of its affiliates will be subject to certain customary standstill obligations that restrict them from, among other things, purchasing additional securities of the Company, subject to certain exceptions set forth in the Investment Agreement.

Reimbursement

The Company has agreed to reimburse the Purchaser for all reasonable and documented out-of-pocket fees and expenses incurred through the closings of the transactions contemplated by the Investment Agreement in connection with the Financing, up to an aggregate amount of $1,500,0000.

Articles Supplementary for Series B Preferred Stock

Dividends on each share of Series B Preferred Stock will (i) accrue daily and be compounded semiannually on the then-applicable Preference Amount (as defined below) and on any Accrued Dividend (as defined in the Articles Supplementary) at a rate equal to the Dividend Rate (as defined below) and (ii) be payable quarterly in arrears (if, and as when authorized by the Board). “Dividend Rate,” with respect to the Series B Preferred Stock, means 11% per annum.

Dividends are payable quarterly in cash; provided, that up to 2.0% per annum of the liquidation preference may be paid, at the option of the Company, in the form of additional shares of Series B Preferred Stock. If the Company fails to declare and pay in full Dividends on the Series B Preferred Stock on two consecutive Dividend Payment Dates (as defined in the Articles Supplementary), then the Series B Preferred Stock will immediately upon such failure continue to accrue and cumulate dividends at a rate equal to the Dividend Rate as of immediately prior to such time plus an additional 2.0% per annum (such additional 2.0% per annum dividend, an “Excess Dividend”), with such Excess Dividend payable quarterly in arrears on each Dividend Payment Date in the form of additional shares of Series B Preferred Stock, for the period from and including the last Dividend Payment Date upon which the Company paid in full all accrued and unpaid Dividends on the Series B Preferred Stock through but not including the day upon which the Company pays an aggregate amount of dividends on the Series B Preferred Stock equal to all accrued and unpaid dividends.

The Series B Preferred Stock will rank (i) senior to the Common Stock and each other class or series of capital stock of the Company, other than the Company’s 12.5% Series A Cumulative Non-Voting

Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”), the terms of which do not expressly provide that such class or series ranks on a parity basis with or senior to the Series B Preferred Stock; (ii) on a parity basis with each other class or series of capital stock of the Company, other than the Series A Preferred Stock, the terms of which expressly provide that such class or series ranks on a parity basis with the Series B Preferred Stock; (iii) junior to any existing or future Indebtedness (as defined in the Articles Supplementary); and (iv) junior to (a) the Series A Preferred Stock and (b) each other class or series of capital stock of the Company, the terms of which expressly provide that such class or series ranks senior to the Series B Preferred Stock, in each case, with respect to dividend rights, rights on the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company.

The Company, at its option, may redeem for cash, any or all outstanding shares of Series B Preferred Stock at a price (the “Optional Redemption Price”) equal to (i) at any time on or before the two-year anniversary of the Original Issuance Date (as defined in the Articles Supplementary), at a price equal to the greater of (a) 105.0% of the sum of the liquidation preference of $25.00 per share of Series B Preferred Stock (the “Preference Amount”) (including all dividends (including any Accrued Dividends)) and (b) the Preference Amount (including all dividends (including Accrued Dividends)) plus the Make-Whole Amount (as defined in the Articles Supplementary) per share of Series B Preferred Stock to be redeemed; (ii) at any time after the two-year anniversary of the Original Issuance Date but on or prior to the three-year anniversary of the Original Issuance Date, at a price equal to 105.0% of the Preference Amount (including all dividends (including Accrued Dividends)) as of the redemption date; (iii) at any time after the three-year anniversary of the Original Issuance Date but on or prior to the four-year anniversary of the Original Issuance Date, at a price equal to 102.5% of the Preference Amount (including all dividends (including Accrued Dividends)) as of the redemption date; or (iv) at any time after the four-year anniversary of the Original Issuance Date, at a price equal to 100.0% of the Preference Amount (including all dividends (including Accrued Dividends)) as of the redemption date, subject to certain limitations.

If the Company (or the Company’s Manager (as defined in the Articles Supplementary) undergoes a Change in Control (as defined in the Articles Supplementary), holders of shares of Series B Preferred Stock may require the Company to repurchase any or all of such shares of Series B Preferred Stock for a cash purchase price equal to the then-applicable Optional Redemption Price (the “Change of Control Redemption Price”). In addition, upon any such Change of Control, the Company shall have the right, but not the obligation, to redeem any or all of the outstanding shares of Series B Preferred Stock at the Change of Control Redemption Price, subject to certain limitations.

Holders of shares of Series B Preferred Stock may also require the Company to redeem all or any portion of their shares of Series B Preferred Stock, for a cash purchase price equal to 100.0% of the Preference Amount (including all dividends (including any Accrued Dividends) with respect to such shares of Series B Preferred Stock accrued but unpaid to, but not including the then-applicable redemption date), at any time: (i) after May 28, 2024 or (ii) following the occurrence of an Approval Right Default (as defined below).

Each holder of Series B Preferred Stock will have one vote per share on any matter on which holders of Series B Preferred are entitled to vote and will vote separately as a class (as described below), whether at a meeting or by written consent. The holders of Series B Preferred Stock will have exclusive voting rights on an amendment to the Company’s charter (the “Charter”) that would alter only the contract rights of the Series B Preferred Stock.

The vote or consent of the holders of at least a majority of the shares of Series B Preferred Stock outstanding at such time, voting together as a separate class, is required in order for the Company to (i)

amend or waive any provision of the Charter or the Second Amended and Restated Bylaws of the Company in a manner that would materially and adversely affect the rights, preferences, or privileges of the Series B Preferred Stock; (ii) issue any capital stock ranking senior or pari passu to the Series B Preferred Stock (or securities or rights convertible or exchangeable into, or exercisable for, any capital stock ranking senior or pari passu to the Series B Preferred Stock); (iii) issue any equity securities of any subsidiary of the Company (or any securities or rights convertible or exchangeable into, or exercisable for, such equity securities) to any third party other than the Company and or the Company’s wholly-owned subsidiary; (iv) permit any Non-Target Asset Event (as defined in the Articles Supplementary); (v) pay any dividend or distribution in cash, capital stock or other assets of the Company on or in respect of, or the repurchase or redemption of, capital stock ranking pari passu or junior to the Series B Preferred Stock, subject to certain exceptions; (vi) incur Indebtedness, subject to certain exceptions, (vii) take any Restricted Indebtedness Action (as defined in the Articles Supplementary); (viii) liquidate, dissolve, or wind up the Company; or (ix) agree to undertake any of the actions described in clauses (i) through (viii) above, in each case subject to the terms and conditions set forth in the Articles Supplementary.

The taking of any of the actions described in the prior paragraph (subject to certain exceptions and the Company’s ability to cure such action, in each case as specified in the Articles Supplementary) without the vote or consent of the holders of at least a majority of the shares of Series B Preferred Stock outstanding at such time shall be deemed to be an “Approval Right Default”.

The Warrants

The Warrants have an initial exercise price of $7.50 per share. The exercise price of the Warrants and shares of Common Stock issuable upon exercise of the Warrants are subject to customary adjustments. The Warrants are exercisable on a net settlement basis and expire on May 28, 2025.

Subject to certain limitations, no shares of Common Stock will be issued or delivered upon any proposed exercise of any Warrant, and no Warrant will be exercised, in each case, to the extent that such exercise or issuance of Common Stock would result in a Registered Holder (as defined in the Warrant Agreement) beneficially owning in excess of 19.9% of the Stockholder Voting Power (as defined in the Warrant Agreement) as of May 28, 2020 (appropriately adjusted to reflect any stock splits, stock dividends or other similar events).

Registration Rights Agreement

Pursuant to the Investment Agreement, the Company and the Purchaser entered into a Registration Rights Agreement on May 28, 2020, whereby the Purchaser is entitled to customary registration rights with respect to the shares of Common Stock for which the Warrants may be exercised.

Guaranty Agreement Amendments

On May 28, 2020, the Company’s wholly-owned subsidiary, TPG RE Finance Trust Holdco, LLC (“Holdco”), entered into amendments (the “Amendments”) to the following guaranty agreements:

|

|

•

|

Amended and Restated Guarantee Agreement, dated as of May 4, 2018, made by and between Holdco and Wells Fargo Bank, National Association (the “Wells Fargo Guarantee”);

|

|

|

•

|

Amended and Restated Guaranty, dated as of May 4, 2018, made by and between Holdco in favor of Morgan Stanley Bank, N.A. (the “Morgan Stanley Guaranty”);

|

|

|

•

|

Amended and Restated Guarantee Agreement, dated as of May 4, 2018, made by and between Holdco and JPMorgan Chase Bank, National Association (the “JPMorgan Guarantee”);

|

|

|

•

|

Amended and Restated Guarantee Agreement, dated as of May 4, 2018, made by and between Holdco and Goldman Sachs Bank USA (the “Goldman Guarantee”);

|

|

|

•

|

Amended and Restated Limited Guaranty, dated as of May 4, 2018, made and entered into by and between Holdco and U.S. Bank National Association (the “U.S. Bank Guaranty”);

|

|

|

•

|

Guaranty, dated as of August 13, 2019, made by Holdco for the benefit of Barclays Bank PLC (the “Barclays Guaranty”); and

|

|

|

•

|

Amended and Restated Guaranty, dated as of May 4, 2018, made by Holdco in favor of Bank of America, N.A. (the “Bank of America Guaranty” and, together with the Wells Fargo Guarantee, the Morgan Stanley Guaranty, the JPMorgan Guarantee, the Goldman Guarantee, the U.S. Bank Guaranty and the Barclays Guaranty, the “Guarantees”).

|

Prior to entering into the Amendments, the Guarantees generally required Holdco to maintain compliance with the following financial covenants (among others):

|

|

•

|

Tangible Net Worth: maintenance of minimum tangible net worth of at least 75% of the net cash proceeds of all prior equity issuances made by Holdco or the Company plus 75% of the net cash proceeds of all subsequent equity issuances made by Holdco or the Company;

|

|

|

•

|

Debt to Equity: maintenance of a debt to equity ratio not to exceed 3.5 to 1.0; and

|

|

|

•

|

Interest Coverage: maintenance of a minimum interest coverage ratio (EBITDA to interest expense) of no less than 1.5 to 1.0.

|

With respect to the “tangible net worth” covenant, the Amendments revise the definition of “tangible net worth” such that the baseline amount for testing is reset as of April 1, 2020 to $1.1 billion plus 75% of future equity issuances as of April 1, 2020. With respect to the “debt to equity” covenant, the Amendments revise the definition of “equity” to include preferred equity, as well as an “equity adjustment” equal to the sum of all Current Expected Credit Loss reserves and any loan loss reserves, write-downs, impairments or realized losses taken against the value of any assets of Holdco or its subsidiaries from and after April 1, 2020; provided, however, that the “equity adjustment” may not exceed the amount of (a) Holdco’s total equity less (b) the product of Holdco’s total indebtedness multiplied by 25%. Finally, the Amendments revise the “interest coverage” covenant so that Holdco is now required to maintain a minimum interest coverage ratio (EBITDA to interest expense) of no less than (i) prior to April 1, 2020, 1.5 to 1.0; (ii) from and after April 1, 2020 but prior to December 2, 2020, 1.4 to 1.0; and (iii) from and after December 2, 2020, 1.5 to 1.0.

The foregoing descriptions of the Investment Agreement, the terms of the Series B Preferred Stock and the Warrants, the Articles Supplementary, the Warrant Agreement, the Registration Rights Agreement, the Amendments and the transactions contemplated thereby are not complete and are qualified in their entirety by reference to the full text of the Investment Agreement, the Articles Supplementary, the Warrant Agreement, the Registration Rights Agreement and the Amendments, which are attached to this Current Report on Form 8-K as Exhibit 10.1, Exhibit 3.1, Exhibit 10.2, Exhibit 10.3, and Exhibits 10.4, 10.5, 10.6, 10.7, 10.8, 10.9 and 10.10, respectively, and are incorporated herein by reference.

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02. The issuances of the shares of Series B Preferred Stock and Warrants pursuant to the Investment Agreement are intended to be exempt from registration under the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder (the “Securities Act”), by virtue of the exemption provided by Section 4(a)(2) of the Securities Act.

|

Item 3.03.

|

Material Modification to Rights of Security Holders.

|

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On May 27, 2020, the Company filed with the State Department of Assessments and Taxation of Maryland an Articles Supplementary (the “Articles Supplementary”) for the purposes of amending its Charter to establish the terms of the Series B Preferred Stock.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.03.

On May 29, 2020, the Company issued a press release announcing the Financing. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Description of Exhibit

|

|

|

|

|

|

|

|

|

3.1

|

|

|

Articles Supplementary of 11.0% Series B Cumulative Redeemable Preferred Stock of TPG RE Finance Trust, Inc.

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Investment Agreement, dated as of May 28, 2020, by and between TPG RE Finance Trust, Inc. and PE Holder, L.L.C.

|

|

|

|

|

|

|

|

|

10.2

|

|

|

Registration Rights Agreement, dated as of May 28, 2020, by and between TPG RE Finance Trust, Inc. and PE Holder, L.L.C.

|

|

|

|

|

|

|

|

|

10.3

|

|

|

Warrant Agreement, dated as of May 28, 2020, by and between TPG RE Finance Trust, Inc. and PE Holder, L.L.C.

|

|

|

|

|

|

|

|

|

10.4

|

|

|

First Amendment to Amended and Restated Guarantee Agreement, dated as of May 28, 2020, made by and between TPG RE Finance Trust Holdco, LLC and Wells Fargo Bank, National Association

|

|

|

|

|

|

|

|

|

10.5

|

|

|

First Amendment to Amended and Restated Guaranty, dated as of May 28, 2020, made by and between TPG RE Finance Trust Holdco, LLC in favor of Morgan Stanley Bank, N.A.

|

|

|

|

|

|

|

|

|

10.6

|

|

|

First Amendment to Amended and Restated Guarantee Agreement, dated as of May 28, 2020, made by and between TPG RE Finance Trust Holdco, LLC and JPMorgan Chase Bank, National Association

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.7

|

|

|

First Amendment to Amended and Restated Guarantee Agreement, dated as of May 28, 2020, made by and between TPG RE Finance Trust Holdco, LLC and Goldman Sachs Bank USA

|

|

|

|

|

|

|

|

|

10.8

|

|

|

First Amendment to Amended and Restated Limited Guaranty, dated as of May 28, 2020, made and entered into by and between TPG RE Finance Trust Holdco, LLC and U.S. Bank National Association

|

|

|

|

|

|

|

|

|

10.9

|

|

|

First Amendment to Guaranty, dated as of May 28, 2020, made by TPG RE Finance Trust Holdco, LLC for the benefit of Barclays Bank PLC

|

|

|

|

|

|

|

|

|

10.10

|

|

|

First Amendment to Amended and Restated Guaranty, dated as of May 28, 2020, made by TPG RE Finance Trust Holdco, LLC in favor of Bank of America, N.A.

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Press Release, dated May 29, 2020.

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TPG RE FINANCE TRUST, INC.

|

|

|

|

|

|

By:

|

|

/s/ Robert Foley

|

|

|

|

Robert Foley

|

|

|

|

Chief Financial and Risk Officer

|

Dated: May 29, 2020

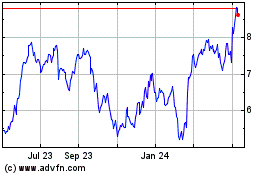

TPG Real Estate Finance (NYSE:TRTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

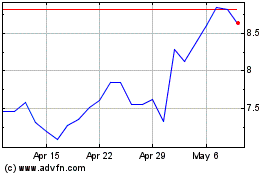

TPG Real Estate Finance (NYSE:TRTX)

Historical Stock Chart

From Apr 2023 to Apr 2024