Former White House Chief of Staff and Secretary

of Transportation brings extensive logistics industry

experience

Following its announced agreement to merge with Tortoise

Acquisition Corp. (TortoiseCorp) (NYSE: SHLL), Hyliion Inc.

(Hyliion), a leader in electrified powertrain solutions for Class 8

commercial vehicles, today announced that Andrew (Andy) H. Card Jr.

will join the board of directors of the combined entity. Card’s

appointment is subject to the approval of the shareholders of

TortoiseCorp.

As an independent board member, Card will leverage his expertise

in logistics, governmental affairs, compliance and operations to

guide and inform Hyliion’s long-term objectives to deliver the

industry’s lowest total cost of ownership and emissions performance

for fleets. Card’s nomination to the combined entity’s board

follows a respected career in public service as the former U.S.

Secretary of Transportation under President George H. W. Bush as

well as the White House Chief of Staff under President George W.

Bush.

“Every successful company starts with a successful leader, and

Hyliion has that in Thomas Healy,” Card said. “I have been

continually impressed with his strategic vision and character as

well as his intentional approach to electrifying commercial

trucking. I look forward to working with Thomas and the Hyliion

team to realize the company’s vision to spur meaningful and

sustainable change in the global trucking and logistics

industry.”

Card is the former president and CEO of the American Automobile

Manufacturers Association, a trade association for U.S.-based

automobile manufacturers, and previously served as the vice

president of government relations for General Motors. He is

currently on the boards of directors for Union Pacific Railroad, a

position he has held since 2006, and Draganfly, an industry-leading

manufacturer in the commercial drone industry.

“Andy is an esteemed, seasoned executive hailing from some of

the country’s most demanding and integral leadership roles,” said

Thomas Healy, CEO and founder of Hyliion. “His diverse professional

career, combined with his passion for driving innovative change in

global logistics, make him an ideal fit for our growing leadership

team. Fleets, brands and drivers need proven solutions now, and

with Andy’s—as well as our extended board’s—dynamic knowledge base,

I’m confident our team will continue to build the world’s leading

electrified trucking technology.”

Upon the closing of Hyliion’s business combination with

TortoiseCorp and subject to shareholder approval, Card will join

the other members of the combined entity’s board: Thomas Healy, CEO

of Hyliion; Vince Cubbage, managing director at Tortoise Capital

Advisors and CEO and chairman of TortoiseCorp; Stephen Pang,

managing director and portfolio manager at Tortoise Capital

Advisors and director of TortoiseCorp; Ed Olkkola, managing

director at Teakwood Capital; and Howard Jenkins, former chairman

and CEO of Publix Super Markets.

For more information on Hyliion, visit www.hyliion.com.

About Hyliion Headquartered in Austin, Texas, Hyliion’s

mission is to reduce the carbon intensity and greenhouse gas (GHG)

emissions of commercial transportation Class 8 vehicles by being

the leading provider of electrified powertrain solutions.

Leveraging advanced software algorithms and data analytics

capabilities, Hyliion offers fleets an easy, efficient system to

decrease fuel and operating expenses while seamlessly integrating

with their existing fleet operations. It designs, develops and

sells electrified powertrain solutions for Heavy Duty Class 8

trucks from any of the leading commercial vehicle manufacturers,

transforming the transportation industry’s environmental impact at

scale. For more information, visit www.hyliion.com.

Forward Looking Statements The information in this press

release includes “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

present or historical fact included in this presentation, regarding

Tortoise Acquisition Corp.’s proposed acquisition of Hyliion,

Tortoise Acquisition Corp.’s ability to consummate the transaction,

the benefits of the transaction and the combined company’s future

financial performance, as well as the combined company’s strategy,

future operations, estimated financial position, estimated revenues

and losses, projected costs, prospects, plans and objectives of

management are forward-looking statements. When used in this press

release, the words “could,” “should,” “will,” “may,” “believe,”

“anticipate,” “intend,” “estimate,” “expect,” “project,” the

negative of such terms and other similar expressions are intended

to identify forward-looking statements, although not all

forward-looking statements contain such identifying words. These

forward-looking statements are based on management’s current

expectations and assumptions about future events and are based on

currently available information as to the outcome and timing of

future events. Except as otherwise required by applicable law,

Tortoise Acquisition Corp. and Hyliion disclaim any duty to update

any forward looking statements, all of which are expressly

qualified by the statements in this section, to reflect events or

circumstances after the date of this press release. Tortoise

Acquisition Corp. and Hyliion caution you that these

forward-looking statements are subject to numerous risks and

uncertainties, most of which are difficult to predict and many of

which are beyond the control of either Tortoise Acquisition Corp.

or Hyliion. In addition, Tortoise Acquisition Corp. cautions you

that the forward-looking statements contained in this press release

are subject to the following factors: (i) the occurrence of any

event, change or other circumstances that could delay the business

combination or give rise to the termination of the agreements

related thereto; (ii) the outcome of any legal proceedings that may

be instituted against Tortoise Acquisition Corp. or Hyliion

following announcement of the transactions; (iii) the inability to

complete the business combination due to the failure to obtain

approval of the shareholders of Tortoise Acquisition Corp., or

other conditions to closing in the transaction agreement; (iv) the

risk that the proposed business combination disrupts Tortoise

Acquisition Corp.’s or Hyliion’s current plans and operations as a

result of the announcement of the transactions; (v) Hyliion’s

ability to realize the anticipated benefits of the business

combination, which may be affected by, among other things,

competition and the ability of Hyliion to grow and manage growth

profitably following the business combination; (vi) costs related

to the business combination; (vii) changes in applicable laws or

regulations; and (viii) the possibility that Hyliion may be

adversely affected by other economic, business, and/or competitive

factors. Should one or more of the risks or uncertainties described

in this press release, or should underlying assumptions prove

incorrect, actual results and plans could different materially from

those expressed in any forward-looking statements. Additional

information concerning these and other factors that may impact the

operations and projections discussed herein can be found in

Tortoise Acquisition Corp.’s periodic filings with the Securities

and Exchange Commission (the “SEC”), including its Annual Report on

Form 10-K for the fiscal year ended December 31, 2019. Tortoise

Acquisition Corp.'s SEC filings are available publicly on the SEC’s

website at www.sec.gov.

Important Information for Investors and Shareholders In

connection with the proposed business combination, Tortoise

Acquisition Corp. will file a proxy statement with the SEC.

Additionally, Tortoise Acquisition Corp. will file other relevant

materials with the SEC in connection with the business combination.

Copies may be obtained free of charge at the SEC’s web site at

www.sec.gov. Security holders of Tortoise Acquisition Corp. are

urged to read the proxy statement and the other relevant materials

when they become available before making any voting decision with

respect to the proposed business combination because they will

contain important information about the business combination and

the parties to the business combination. The information contained

on, or that may be accessed through, the websites referenced in

this press release is not incorporated by reference into, and is

not a part of, this press release.

Participants in the Solicitation Tortoise Acquisition

Corp. and its directors and officers may be deemed participants in

the solicitation of proxies of Tortoise Acquisition Corp.’s

shareholders in connection with the proposed business combination.

Security holders may obtain more detailed information regarding the

names, affiliations and interests of certain of Tortoise

Acquisition Corp.’s executive officers and directors in the

solicitation by reading Tortoise Acquisition Corp.’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2019, and the

proxy statement and other relevant materials filed with the SEC in

connection with the business combination when they become

available. Information concerning the interests of Tortoise

Acquisition Corp.’s participants in the solicitation, which may, in

some cases, be different than those of their stockholders

generally, will be set forth in the proxy statement relating to the

business combination when it becomes available.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200730005211/en/

Danielle South danielle@redfancommunications.com

512-662-7078

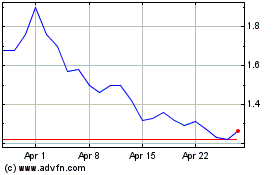

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Apr 2023 to Apr 2024