By Thomas Gryta

The stock market is surging, but few chief executives are

selling.

The S&P 500 jumped 30% and set record highs in 2019, but

only 80 CEOs in the index reduced personal holdings in the

businesses they led during the year, according to a Wall Street

Journal analysis. Insiders generally want to avoid sending negative

signals about their companies by cashing out.

Of the corporate chieftains who pared their stakes, the majority

-- 67 of them -- did so while their companies were repurchasing

shares in the market.

A company's use of cash to buy back stock typically signals that

the board sees the shares as undervalued. But a sale of stock by

the boss during a buyback period tends to contradict the board's

message, since people generally don't sell shares that they expect

to rise in value.

"I think this a real governance problem," Rob Jackson, a

commissioner at the Securities and Exchange Commission, said in an

interview. Mr. Jackson has conducted research showing that

corporate insiders sell more of their stock immediately after a

buyback announcement as compared with an ordinary trading day.

Mr. Jackson said the SEC hasn't changed its rules on share

repurchases since 2003, and further transparency is needed for

shareholders to know what their executives and boards are

doing.

"Boards of directors who are allowing buybacks to occur without

being transparent about allowing CEOs to sell into them raise real

questions about the leadership of that board," said Mr. Jackson,

who plans to leave the SEC this month to return to teaching.

The WSJ's analysis of CEO stock sales included regulatory

disclosures of executive holdings at the start and end of 2019 as

compiled by FactSet, along with share repurchase data provided by

S&P Global Market Intelligence. The group of sellers includes

CEOs who gifted shares to charity or who transferred stock as part

of a divorce. Most sold their shares through 10b5-1 trading plans,

which permit executives to schedule trades for particular times or

prices.

The list of CEOs reducing their holdings last year is dominated

by a pair of famous tech company founders: Amazon.com Inc.'s Jeff

Bezos and Facebook Inc.'s Mark Zuckerberg. Mr. Bezos reduced his

holdings by more than $38 billion, including the transfer of more

than $35 billion in his divorce, along with charitable gifts and

sales to fund his space venture, Blue Origin. Mr. Zuckerberg sold

about $1.8 billion in shares.

Even after the sales, each CEO remains his company's biggest

individual shareholder. Facebook spent $4.1 billion on buybacks in

2019, while Amazon didn't repurchase shares. Facebook shares gained

56% last year; Amazon advanced 23%.

A Facebook spokesman pointed to previous filings detailing the

stock sales of Mr. Zuckerberg and his wife to fund their charity

work, including the majority of the 2019 stock sales. An Amazon

spokeswoman declined to comment.

Excluding founders, the biggest CEO seller was PNC Financial

Services Group Inc.'s William Demchak, who sold nearly $24 million

of company shares in 2019, according to the analysis. About $20

million of that came on a single day in early November, less than a

week after the bank's stock price crossed $150 for the first time

in 18 months.

In 2019, PNC repurchased about $3.5 billion of its own stock

with about $1 billion of that coming in the last three months of

the year. PNC shares had a total shareholder return of 41% in 2019,

according to FactSet.

A PNC spokeswoman said Mr. Demchak's stock sales were his first

since becoming CEO in 2013, aside from exercising options or making

charitable gifts.

"This past year's sales were simply in connection with efforts

to improve diversification and effectuate family planning, and are

in no way inconsistent with PNC's determination that its corporate

decision to buy back shares was a prudent use of capital," she

said. The company recently expanded its stock repurchase

program.

Nell Minow, vice chair of ValueEdge Advisors, said CEOs and

other top executives shouldn't sell any company shares while in the

job and for three years after they leave the company. Her firm

advises institutional investors on corporate governance issues.

"The one thing that the buyback is supposed to communicate is

confidence in the stock and the future," she said. "That message is

completely undermined by executive sales of the stock."

The common argument that executives want to diversify

investments or need to pay taxes isn't a reason to sell, she said,

citing their annual compensation and leadership role. If needed,

they can borrow against the stockholdings, she said.

"We want CEOs to be thinking long-term up until the day that

they leave, " Ms. Minow said. "The more stock they have, the better

they do at looking long-term."

Some top executives don't ever sell shares, a message that sets

the tone for underlings, according to experts. Jeffrey Immelt, the

former CEO of General Electric Co., had such a policy.

TJX Cos. CEO Ernie Herrman sold about $14 million of the

retailer's stock last year, according to the Journal's analysis.

Half of those sales happened on a single day, Nov. 26 -- the

Tuesday before Black Friday, the biggest day of the holiday

shopping season.

The company repurchased about $1.2 billion in stock in the first

nine months of the year. TJX's total shareholder return in 2019 was

about 39%.

A TJX spokeswoman said the company has repurchased shares

regularly since 1997 and executives are permitted to trade in

company shares only during limited windows of time.

"Mr. Herrman has sold TJX stock over many years, continues to

hold very large stakes in the company, and exceeds our

stock-ownership requirements," she said, noting the stock's return.

In the past 10 years, the stock rose to above $60 a share from

below $10.

Executives at public companies are restricted in how they can

sell shares without running afoul of insider-trading rules and are

usually careful about timing their sales to not send negative

messages, said Douglas Chia, a corporate governance expert at

Soundboard Governance.

Executives now are required to report sales within two days, but

those transactions could be made public almost instantly, he said.

Otherwise, he doesn't think more regulation is needed.

"I'm not a fan of the government putting restrictions on when

people can buy or sell," Mr. Chia said. "The companies should have

policies in place to restrict this kind of activity."

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

February 09, 2020 13:14 ET (18:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

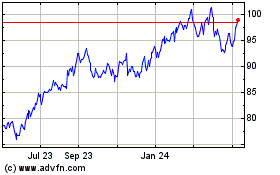

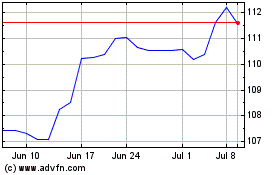

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Mar 2024 to Apr 2024

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Apr 2023 to Apr 2024