Kohl's Slumps but Notes Upturn -- WSJ

August 21 2019 - 3:02AM

Dow Jones News

By Suzanne Kapner

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 21, 2019).

Kohl's Corp. on Tuesday reported its third consecutive decline

in quarterly sales, though it said business improved toward the end

of the period and it maintained its guidance for the year.

The results prompted concern by analysts and investors that the

strong growth Kohl's had posted for most of last year, which had

helped it buck a downward trend among department stores, has come

to an end. The shares fell 6.9% on Tuesday and are down 43% over

the past year.

"There can be no doubt that Kohl's has been blown off course,"

said Neil Saunders, a managing director with GlobalData PLC.

Total sales fell 3.1% to $4.4 billion for the quarter ended Aug.

3. Sales at stores open at least a year fell 2.9%

Net income dropped to $247 million from $292 million a year

earlier on higher online shipping costs and steeper promotions to

clear unsold goods.

Kohl's Chief Executive Michelle Gass said business improved in

the last six weeks of the quarter, with sales at stores open at

least a year rising 1%. She added that the positive sales trend

continued into August as the company got off to a strong start for

the back-to-school season.

Other department stores, including Macy's Inc. and J.C. Penney

Co., reported disappointing results last week for their summer

quarter, sending their shares lower. Walmart Inc. was one of the

few standouts, continuing its string of strong growth.

Retailers are facing the threat of high costs because of

increased tariffs on goods imported from China. On Tuesday, Home

Depot Inc. lowered its sales forecast for the current year, citing

the potential impact of tariffs as well as lower lumber prices.

Even retailers that posted higher sales are being judged harshly

by investors. T.J. Maxx parent TJX Cos. said Tuesday that sales at

stores open at least a year rose 2% in the most recent quarter.

That is on top of a 6% increase in the same period a year earlier.

Foot traffic to its stores has increased for 20 consecutive

quarters. Its shares fell slightly to $51.51 on Tuesday.

Analysts are concerned that T.J. Maxx and its sister chain

Marshalls might be facing more competition as department stores

offer deeper discounts and resale sites such as The RealReal Inc.

and thredUP Inc. gain popularity.

Mr. Saunders of GlobalData said the above-average levels of

discounting across many apparel retailers "gave those shoppers

looking for bargains more choice and more reason to shop around,

something that had a tangible impact on both T.J. Maxx and

Marshalls."

Kohl's has been trying to combat sluggish sales with initiatives

such as one that lets shoppers return items they bought on

Amazon.com Inc. to any of its more than 1,100 stores -- no box

required.

Ms. Gass said the Amazon returns partnership is bringing both

new and existing customers into Kohl's stores, particularly at

off-peak times. She said the venture is expected to be a profitable

one for Kohl's.

The retailer is also working with designers to launch exclusive

collections, such as one from Jason Wu that will arrive in stores

for the holiday season. And it is working with Facebook Inc. to

find emerging digital brands to showcase in its stores.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

August 21, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

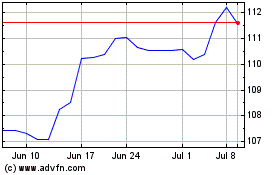

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Mar 2024 to Apr 2024

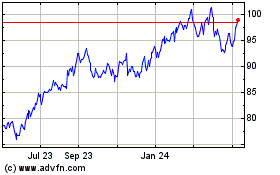

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Apr 2023 to Apr 2024