Store sales reflect confident consumers, but online rivals

pressure profits

By Khadeeja Safdar and Suzanne Kapner

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 21, 2018).

A parade of U.S. retail chains on Tuesday reported rising sales

in the latest quarter, another sign of healthy consumer spending

heading into the critical holiday shopping season.

Investors were unimpressed, dumping shares of Target Corp.,

Kohl's Corp. and others that released their quarterly results. The

selloff, part of a broader market decline, included retailers such

as Amazon.com Inc. and Walmart Inc. that didn't report on

Tuesday.

A tight labor market and increasing wages have buoyed consumer

confidence, prompting Americans to purchase more fashion apparel,

flat-screen televisions and homewares. But retail profits have been

under pressure from online competition as well as higher spending

on workers' wages, shipping costs and recent tariffs on

Chinese-made imports.

Target said more shoppers visited its stores and website, and

bought products across all its merchandising categories,

particularly toys, beauty products and baby items. The company

reported a 5.1% increase in comparable sales in the third quarter

from the same period a year earlier, including a 49% increase in

digital sales.

"We continue to benefit from a very healthy consumer and

macroeconomic backdrop," Target CEO Brian Cornell said on a

conference call Tuesday, adding that the company has captured sales

from retailers that are closing stores or liquidating.

However, profit margins declined in the latest quarter as Target

spent more on its supply chain and wages. The company has made

investments heading into the holidays, including several delivery

and pickup options, new products and lower prices.

Target shares, which had rallied for most of the year, tumbled

10.5% to $69.03.

Mr. Cornell said Target wouldn't provide 2019 financial

guidance, but said he was optimistic about the company's ability to

boost profits next year. "We're poised to benefit from far greater

scale across all of our initiatives," he said.

Some analysts said a decline in operating profit is necessary to

support Target's growth. "Some on Wall Street may lament the dip,

but the truth is you cannot reinvent a retailer on the cheap," Neil

Saunders, managing director of GlobalData Retail, wrote in a note

Tuesday.

Best Buy Co., which has been reporting strong demand for

electronics in recent quarters, said comparable sales increased

4.3% in the third quarter for its domestic stores and website. It

was the sixth straight quarter of comparable growth above 4%.

The company's profit margin, however, slipped on supply chain

and other spending. CEO Hubert Joly said the sales growth reflects

the company's efforts to add services as well as the favorable

economic environment. "Because of the investments we've made, we

are competitive in the marketplace," he said on a conference

call.

Best Buy cited strong demand in the quarter for smartphones,

videogames, home appliances and wearable gadgets. The gains were

partly offset by declines in tablet computers, it said.

Meanwhile, Kohl's reported a 2.5% increase in comparable sales

for the latest quarter, citing demand for apparel. The

department-store chain's margins increased slightly from a year

earlier, but sales growth was slower than recent quarters.

Kohl's CEO Michelle Gass told analysts on a conference call that

she felt good about the health of consumers. "There's certainly no

reason to believe that will change as we head into the holidays,"

she said.

Both Target and Best Buy reported higher quarterly profits than

a year ago, but much of the gains came from lower tax rates

following the U.S. federal overhaul. Operating profits declined in

the latest quarter from a year ago. Without a lower tax rate,

Kohl's profits would have missed analysts' expectations.

The results failed to reassure investors, who have been

unloading shares of many retailers following the latest batch of

earnings reports after driving up the stock prices earlier in the

year.

Shares of Kohl's fell 9.2%, while Best Buy bucked the trend,

gaining 2.1%. TJX Cos. fell 4.4% after the parent of TJMaxx and

HomeGoods said earnings were hurt by a pension settlement

charge.

TJX, which reported strong sales and profit growth in the latest

quarter, was also hurt by higher freight costs, a problem facing

many retailers. Kohl's warned that higher shipping costs in the

holiday quarter would be a drag on margins.

Tuesday's results follow strong sales reports from the country's

biggest retailer Walmart, department-store chain Macy's Inc. and

the internet giant Amazon.com, which are all competing for American

wallets. Shares of Walmart fell 2.7% and Macy's fell 3.4% Tuesday,

while Amazon shed 1.1%.

Not all chains are riding the tide of rising consumer spending.

Wedding gown retailer David's Bridal filed Monday for bankruptcy

protection, cutting $400 million in debt while it restructures

operations.

Mall-stalwart L Brands Inc., the parent of Victoria's Secret,

said Monday it was halving its annual dividend after posting

another quarter of falling sales at its flagship lingerie brand.

Shares of L Brands dropped 17.7% Tuesday, the largest percentage

drop since December 2008.

Comparable sales at the Gap brand fell 7% in the third quarter,

compared with a 1% increase last year. That metric at its parent

company, Gap Inc., was flat, helped by a 4% increase at Old Navy,

its biggest division by sales. The company also lowered its profit

guidance for the year.

On a conference call Tuesday, Gap Inc. CEO Art Peck said he

might close hundreds of underperforming Gap stores. "These stores

are a drag on the health and a drag on the performance of the

brand," he said.

Some retailers are benefiting from the struggles of others.

Following the collapse of Toys "R" Us and store closings at Sears

Holdings Corp., retailers including Best Buy and Target have

pursued their business and picked up market share.

Some chains are still struggling with strategic and operational

challenges. Lowe's Cos. said Tuesday it plans to exit from its

Mexico retail operations and shed two U.S. home-improvement

businesses, after it reported slower same-store sales gains than

rival Home Depot Inc. and a 27% decline in profit from a year

ago.

Corrections & Amplifications TJX Cos. lowered its fiscal

year GAAP earnings to reflect a pension settlement charge.

Excluding the charge and other expenses, the retailer said it

raised its adjusted profit goals on a split-adjusted basis. An

earlier version incorrectly said TJX slashed its profit goals amid

higher inventory and expenses. (Nov. 20, 2018)

Write to Khadeeja Safdar at khadeeja.safdar@wsj.com and Suzanne

Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

November 21, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

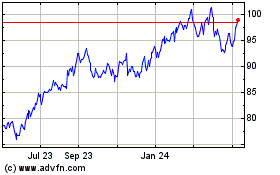

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Mar 2024 to Apr 2024

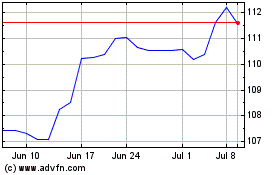

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Apr 2023 to Apr 2024