SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of May, 2020

Commission File Number 001-14491

TIM PARTICIPAÇÕES S.A.

(Exact name of registrant as specified in its charter)

TIM PARTICIPAÇÕES S.A.

(Translation of Registrant's name into English)

Avenida João Cabral de Melo Neto, nº 850, Torre Norte, 12º andar – Sala 1212,

Barra da Tijuca - Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

2020 First Quarter Results (Including the effects of IFRS 9, 15 e 16)

Highlights

Migrating from Volume to Value: continued transformation of the customer base profile

· TIM Live's UBB customer base grew 20.2% YoY, totaling 584k connections;

· Mobile ARPU maintained a solid advance of 4.8% YoY, reaching R$ 23.9;

· TIM Live ARPU posted robust growth of 6.1% YoY, reaching R$ 84.5;

· TIM Black Família offer reached ~500 thousand clients, contributing in a positive manner to the dynamics of migration to higher-value plans.

Infrastructure Development for a Better Client Experience

· Leader in 4G coverage spanning 3,506 cities, while utilizing multiple frequencies (700 MHz, 1.8 GHz, 2.1 GHz and 2.5 GHz) in order to expand capacity;

· 4G coverage in 100% of Paraná, Santa Catarina and Espírito Santo municipalities. São Paulo and Rio de Janeiro are also entirely covered;

· VoLTE technology available in more than 3,459 cities, improving voice user experience;

· Accelerated expansion of FTTH with 2.5 million homes covered by fiber optic in 24 cities as of March.

Resilient EBITDA, with strong cost efficiency compensating for post-COVID-19 challenges

· Services Revenue up 1.7% YoY in 1Q20;

· Client Generated Net Revenues (mobile segment) rose 1.3% YoY;

· TIM Live revenues advanced 29.1% YoY, maintaining its fast growth;

· Normalized Costs and Expenses* dropped 4.9% YoY, demonstrating an efficient approach amid short-term challenges;

· Normalized EBITDA* reached R$ 1.9 billion, maintaining its solid evolution at 8.0% YoY;

· Normalized EBITDA Margin* reached 45.7% in 1Q20, maintaining a good YoY expansion (+3.1 p.p.).

*Normalized Operating Costs and Normalized EBITDA according to the items in the Costs section (+R$ 2.6 million in 1Q20 and +R$ 1.5 million in 1Q19). Net Income normalized by adjustment to deferred taxes (+R$ 30.3 million in 1Q19).

|

Conference Call in English:

|

Conference Call in Portuguese:

|

|

May 6, 2020 at:

10:00 a.m. Brasilia Time

09:00 a.m. US (NY)

Tel: +1 646 843 6054 (US)

+55 11 2188-0155 (Brazil)

Code: TIM

|

May 6, 2020 at:

10:00 a.m. Brasilia Time

09:00 a.m. US (NY)

Tel: +55 11 2188-0155 (Brasil)

Código: TIM

|

Financial Performance (Including the effects of IFRS 9, 15 and 16)

OPERATING REVENUE

Mobile Segment Details (net of taxes and deductions):

Mobile Service Revenues (MSR) reached R$ 3,840 million in 1Q20, growth of 1.2% compared to the same quarter of the previous year. The expansion slowdown reflected mostly a sharper decline in prepaid revenues, following the reduction in the number of rechargers in the segment.

The dynamic of Mobile ARPU (Average Monthly Revenues per User), which grew 4.8% YoY to reach R$ 23.9, reflects the maintenance of the company's successful efforts to monetize its customer base through migrations to higher-value plans.

The segments' ARPU, which excludes other mobile revenues, rose in prepaid by 4.6% YoY (R$ 12.1) and in postpaid (ex-M2M) by 4.3% YoY (R$ 44.5).

Breakdown of each mobile segment in the first quarter:

(i) In prepaid we saw a reduction in the number of rechargers, reflecting the economic fallout from the COVID-19 pandemic, especially income restrictions and the shuttering of many physical recharge channels. We noted a reduction of approximately 10% YoY in the number of clients that recharged in 1Q20, an impact mainly from social distancing. The TIM Pré Top offer already accounts for 72% of the segment's base and keeps contributing for a greater resiliency in recharger spending. As a result, Prepaid Revenues fell 4.5% YoY in 1Q20.

(ii) The postpaid segment had a more limited financial impact from COVID-19 in the quarter. The TIM Black Família offer reached ~500k clients, positively contributing to higher-value plans representativeness in the base mix. In addition, the segment recorded a reduction in disconnections, corroborating the return to positive net additions, and resulting in a 2.8% YoY growth in Postpaid revenues in 1Q20 (+3.7% YoY excluding interconnection). The segment's dynamics experienced relevant changes from the third week of March, with the gradual shuttering of virtually all physical sales channels. Amid this context, we witnessed a sharp contraction in gross additions, which were partially compensated for by a reduction in disconnections.

|

Interconnection Revenues (ITX) maintained a downward trajectory and in 1Q20 posted a 19.7% reduction YoY, reflecting a lower incoming traffic. The incidence of VU-M on Net Service Revenues reached 2.4% in the quarter.

Other Revenues rose 17.0% YoY in 1Q20. This performance remains impacted mainly by revenues generated by network sharing and swap agreements. The increase in network sharing volume is aligned with the company's strategy to expand the fiber transport infrastructure (backbone and backhaul) with greater efficiency in asset allocation (Capex and Opex).

|

Breakdown of Fixed Segment (net of taxes and deductions):

|

Fixed Service Revenues totaled R$ 251 million in the quarter, a 9.4% increase from 1Q19. This performance reflects the growth of TIM Live, which in rose 29.1% YoY in 1Q20 and already accounts for approximately 58% of fixed service revenues. By the end of March, TIM Live was present in 26 cities (including 6 capitals) and will further expand its coverage in the coming quarters.

|

|

The remaining services in the fixed segment dropped 9.3% YoY.

3

Detailing Handsets and Devices (net of taxes and deductions):

In the quarter, Revenues from Products fell 25.5% YoY, mainly due to a decline in the volume of handsets sold (29.4% YoY) reflecting the handset market’s sharp contraction stemming from lower disposable income and a currency devaluation increasing handset prices.

OPERATING COSTS AND EXPENSES

*Operating Costs normalized by adjustments to the sale-leaseback contract of towers (+R$ 2.6 million in 1Q20 and +R$ 1.5 million in 1Q19).

Operating Costs and Expenses were R$ 2,292 million in 1Q20 (-4.8% YoY). During the quarter, this item was impacted by non-recurring expenses – totaling R$ 2.6 million – related to adjustments to the sale-leaseback contract of towers.

Note: due to the adoption of IFRS 16, Operating Costs and Expenses - mainly those reported within the Network account - are not impacted by rents, sharing or other types of lease agreements with terms exceeding 12 months, as determined by the standard. Therefore, the amounts for long-term contracts related to infrastructure lease (in addition to others less relevant), important for the company’s operations, are reflected in the P&L under Depreciation and Financial Expenses.

Breakdown of Performance of Costs and Expenses:

Personnel rose 4.7% YoY in 1Q20. This performance was influenced mainly by organic elements such as inflation on wages.

Selling and Marketing Expenses fell 10.2% YoY in 1Q20, reflecting the structural trends seen in prior quarters with efficiency gains from initiatives focusing on process digitization, reduction of FISTEL expenses and lower prepaid recharging fees, as well as lower spending on advertising. It is important to note that this line was also impacted during part of 1Q20 by a lower volume of sales and recharging due to the economic fallout from the COVID-19 pandemic.

The Network and Interconnection Group fell 4.7% YoY in 1Q20, driven by lower costs in the interconnection subgroup (ITX). The decline in the ITX subgroup is explained by: (i) drop in the mobile termination rate (VU-M) in January and February compared to 2019 and (ii) lower pressure from traffic to other operators. The Network subgroup was impacted by lower costs from infrastructure sharing.

General and Administrative Expenses (G&A) rose 21.3% YoY in the quarter. This growth is explained mainly by higher spending on IT projects, consultancies and legal and administrative services.

Cost of Goods Sold (COGS) fell 20.1% YoY in 1Q20, aligned with the sharp decline in Prouct Revenues caused by a lower volume of handsets sold, mostly due to the COVID-19 pandemic, although higher-value products represented bigger share of the sales mix.

In 1Q20, Provisions for Doubtful Accounts (Bad Debt) rose 9.3% YoY. For the fourth consecutive quarter, the pace of growth slowed, remaining the most challenging cost-related line. After posting the first quarterly reduction in 4Q19, the line grew by 0.9% QoQ in 1Q20. The performance is explained by a higher revenue base exposed to delinquencies, due to the 5.3% YoY increase in the postpaid base, in addition to a challenging macroeconomic environment (unemployment, income and indebtedness). Still, the improvement seen in the past two quarters reflects efforts to enhance client acquisition, through more sophisticated credit models and policies, and higher efficiency in collection and recovery.

Other Operating Expenses normalized by non-recurring effects declined 11.9% YoY in 1Q20, explained mainly by a reduction in contingency expenses. The participation of this line in total normalized OPEX was 3.9% in 1Q20 (4.2% in 1Q19).

Subscriber Acquisition Costs (SAC = subsidy + commissioning + advertising expenses) totaled R$ 59.6 per gross addition in 1Q20, down by 5.2% YoY. The steep reduction was due to more efficiency in selling and marketing expenses.

|

The SAC/ARPU ratio (payback per client) fell YoY, reaching 2.4 months in 1Q20, from 2.8 months in 1Q19.

|

FROM EBITDA TO NET INCOME

* EBITDA normalized according to the items in the Costs section (+R$ 2.6 million in 1Q20 and +R$ 1.5 million in 1Q19). Net Income normalized by adjustment to deferred taxes (+R$ 30.3 million in 1Q19).

BITDA (Earnings before interest, taxes, depreciation and amortization)

EBITDA exposure to MTR was 0.4% in 1Q20. In this quarter, net MTR (revenue – cost) was positive due to interconnection revenues slightly higher than costs with MTR.

DEPRECIATION AND AMORTIZATION (D&A) / EBIT

In 1Q20, D&A rose 5.6% YoY explained mostly by an increase in the amortization of the 700 MHz license, related to the operational expansion in new cities (offset by lower software amortization), and by a higher volume of leasing contracts following the adoption of IFRS 16.

Normalized EBIT in 1Q20 rose 15.0% YoY, reflecting EBITDA growth. Normalized EBIT margin ended the quarter at 12.3%, a 1.5 p.p. expansion from 1Q19.

NET FINANCIAL RESULT

Net Financial Result in 1Q20 was negative by R$ 255 million, a R$ 8 million improvement compared to 1Q19. The difference is mainly due to:

(i) Higher financial revenues from monetary correction of the tax credit balance stemming from the right to exclude ICMS from the calculation basis for PIS and COFINS contributions (the remaining balance at the end of each period is updated by the Selic rate until its full compensation, thus becoming a recurring element for the subsequent years);

(ii) Lower expense due to a decline in the interest rate and, consequently, lower accrual of interest on debt, and a smaller volume of interest on leasings.

INCOME TAX AND SOCIAL CONTRIBUTION

In 1Q20, Income Tax and Social Contribution totaled -R$ 99 million, a R$ 33 million increase compared to 1Q19, mainly due to higher Earnings Before Taxes. On a Normalized basis, the R$ 63 million increase compares to IR/CSLL of R$ 36 million in 1Q19, when the line was impacted extraordinarily by deferred taxes.

In 1Q20, the effective rate stood at -37.9% vs. -35.5% in 1Q19 (-19.1% on a Normalized basis).

NET INCOME

CASH FLOW, DEBT AND CAPEX

* EBITDA normalized according to the items in the Costs section (+R$ 2.6 million in 1Q20 and +R$ 1.5 million in 1Q19).

CAPEX

Capex totaled R$ 904 million in 1Q20, growth of 39.1% from 1Q19. The increase was mostly due to a lower level of Capex in 1Q19, which represented only 17% of the total amount invested in 2019. The Capex of 1Q20 remains in accordance to our plan. Investments are still being destined to infrastructure (exceeding 90% of the total), mainly to projects in IT, 4G technology through 700 MHZ, transport network and FTTH expansion (which received approximately 15% of the investments made in 1Q20).

VARIATION IN WORKING CAPITAL

Working capital variation was negative by R$ 1,415 million, a decrease of 2.9% when compared to 1T19. Unlike the first quarter of last year, the negative impact in 1Q20 was caused mainly by a R$ 1,302 million reduction in the Suppliers account (vs. a reduction of 541 million in 1Q19). In 2019, the impact on Working Capital from the payment of acquisitions at the end of 2018 was seen only partially in 1Q19, with the remainder impacting 2Q19. For late 2019 acquisitions, this impact was mainly seen in 1Q20.

In 1Q20, the FISTEL payment (about R$ 789 million) – usually due in March – was postponed to August 31st (with the possibility make the full payment on this date or to pay it in five instances beginning on this date). However, it is important to highlight that the share of FISTEL related to Condecine (approximately R$ 227 million) was paid in March 31st (original due date) due to lack of legal support warranting the non-payment. The injunction postponing this payment to August was released by the end of the same day e the amount was fully refunded on April 2nd. In summary, this payment negatively impacted 1Q20 Cash Flow (with benefit in this quarter thus totaling approximately R$ 562 million, relative to TFF and CFRP). On the other hand, its refund will bring a positive effect to Cash Flow of 2T20.

DEBT AND CASH

Gross Debt in 1Q20 was R$ 10,156 million, up R$ 1,012 million YoY. The current balance includes (i) leasing recognition in the total amount of R$ 8,013 million (related to the sale of towers, the LT Amazonas project and leasing contracts with terms exceeding 12 months, pursuant to IFRS 16) and (ii) hedge position in the amount of R$ 318 million (reducing gross debt). Excluding the leasing contracts related to the adoption of IFRS 16, gross debt would be R$ 3,571 million. At the end of march, TIM’s financing debt (post hedge) was R$ 2,143 million.

TIM’s financing debt consists mainly of Debentures and financing with private banks. Approximately 38% of the total financing debt is denominated in foreign currency (USD and EUR) and is fully hedged to local currency. The average cost of debt excluding leasing was 4.5% p.y. in the quarter, down compared to 7.6% p.y. in 1Q19.

In 1Q20, TIM borrowed R$ 800 million to strengthen its cash position after repaying the outstanding balance with BNDES (~R$ 620 million). In April, the company's Board of Directors approved a R$ 1,000 million debt financing to enhance liquidity ahead of possible impacts that the COVID-19 pandemic may cause on the economy. Of that figure, TIM raised R$ 574 million from Scotiabank in April and is now monitoring alternatives regarding the remainder. At the end of March, TIM had R$ 2,252 million worth of credit lines available for drawdown at BNDES and BNB.

The debt repayment schedule is presented below:

At the end of the quarter, Cash and Securities totaled R$ 1,630 million, a reduction of R$ 38 million YoY.

The average financial yield was stable at 3.9% p.y. in 1Q20, down compared to 6.5% p.y. in 1Q19, following the reduction of the Selic base rate.

In 1Q20, Net Debt totaled R$ 8,526 million, up by R$ 1,050 million compared to the same period a year earlier, when net debt was R$ 7,477 million. The increase is explained by a higher leasing volume due to more rentals and infrastructure sharing contracts being classified as financial leases under IFRS 16.

Net Debt to EBITDA stood at 1.03x in the quarter. Excluding financial leasing from the adoption of IFRS 16, Net Debt to EBITDA was 0.28x in the quarter, down compared to 0.35x in 1Q19.

QUARTERLY EVENTS AND SUBSEQUENT EVENTS

TIM REINFORCES COMMITMENT TO EMPLOYEES, CUSTOMERS AND SOCIETY IN FIGHTCOVID-19

The services will remain in full operation and the company is focused on customer demands and access to information, in addition to taking all measures to preserve the health and safety of its employees and prioritize collaboration with government agencies and other entities. These are TIM's commitments in fighting the transmission of the new coronavirus, described in a letter sent to Anatel on April 3rd.

TIM is aware that technology has an essential role to face the crisis and contain the spread of the virus.

The TIM Group's experience in Italy has been important in anticipating and adapting the necessary actions and meeting the requirements during the period of coronavirus fight in Brazil. TIM is confident that the whole of society will be united and will emerge even stronger from this situation.

CADE AND ANATEL APPROVAL FOR TIM-VIVO NETWORK SHARING AGREEMENT

On April 23rd, the general office of the CADE Antitrust council approved - without restrictions - the agreement signed between TIM and Vivo to share 2G, 3G and 4G networks. Later, on April 30th, Anatel also unanimously approved the agreement. TIM expects, initially, to consolidate the 2G network in 50 cities.

TIM CHOSES GOOGLE CLOUD AS STRATEGIC PARTNER TO PROVIDE CLOUD BIG DATA, ANALYTS AND MACHINE LEARNING PLATFORM

TIM Brasil concluded an agreement with Google Cloud to use Google Cloud Platform (GCP) as its strategic platform of cloud for Big Data, Analytics and Machine Learning. The Google Cloud platform allows the company to make analysis in real-time to achieve exclusive insights about its business. This information will help the operator to enhance even further its services to clients, the planning and optimization of the network and to provide custom offers to users, as well as product based on data and analytics. Google Cloud will be responsible for providing Google Cloud Platform and also consultancy involving the migration from current environment, redesign and optimization on cloud, as well as the support in constructing TIM’s CoE (Center of Excellence), which will be responsible to manage the environment once it is complete.

Operating and Marketing Performance

Operating and Marketing Performance

MOBILE SEGMENT:

GENERAL MARKET

The mobile market fell 0.8% YoY in 1Q20, a record low level of reduction in 20 quarters. Prepaid led the contraction, as the SIM card consolidation continued. In the past 12 months, the segment experienced net disconnections of 12.6 million users. Postpaid retained its pace of expansion with net additions of 10.8 million users. Human lines (ex-M2M) still accounted for approximately half of this performance.

TIM

TIM ended 1Q20 with 52.8 million users, ending the period at -4.1% YoY.

|

The postpaid base totaled 21.7 million lines. The addition of 1.1 million lines in the past 12 months led to 5.3% growth YoY in the number of users. The segment keeps expanding within the total base, setting a new record of 41.0% (+3.7 p.p. YoY). New activations remained as the main lever of growth in the quarter, however at low levels - similar to those observed three years ago - due to the shuttering of sales channels during March 2020. On the other hand, voluntary churn fell 3.9% compared to the prior quarter. TIM Black Família remains an important driver of value, reaching a milestone of ~500k users in the quarter. Since the end of March 2020, TIM has been adopting adjustment measures to the segment amid the pandemic, in order to help clients to keep their lines with special payment conditions.

|

The prepaid base totaled 31.2 million users, down 9.7% YoY. In the past 12 months, the segment presented 3.4 million net disconnections. During the quarter, total net disconnections hit 1.8 million. With the dynamic for new users affected, churn had a greater impact on net growth for the segment as the metric is determined by business rules that are still in place during social distancing. The uncertain macroeconomic environment could add another challenge to prepaid acquisitions. We implemented a few temporary bonuses, seeking to retain clients and avoid increased marketing costs in the future aimed at acquiring clients.

The 4G base ended 1Q20 with 38.6 million users, again presenting fast growth (8.3% YoY). Total handsets featuring this technology reached 79% of voice users (+11.1 p.p. YoY). YoY).

The M2M base ended the quarter with 3.8 million users (+60% YoY). The strong result in the year is still an outcome of the incorporation of the M2M user base of Porto Seguro Conecta in 2Q19.

FIXED SEGMENT:

|

TIM Live ended 1Q20 with 584k users (+20.2% YoY). Users starting at 100 mbps reached 36% of the total, a 20 p.p. increase YoY.

Net additions to FTTH (Fiber To The Home) remained responsible for the good performance of the business, and kept an YoY acceleration with 28k new users in the quarter and 124k in the past 12 months. It is important to note that the commercial dynamic initially saw a deceleration, as social distancing took effect. As the operation had to be adapted, our main sales channel, dubbed door-to-door, made way to digital and the impact was accommodated, allowing the resumption of growth for this service.

|

|

In 1Q20 we launched in a new city, Betim (Minas Gerais state), furthering the expansion into the segment's potential market. TIM Live coverage ended the period present in 24 cities with FTTH.

Quality and Network

Quality and Network

QUALITY AND CUSTOMER EXPERIENCE

With the social distancing caused by the COVID-19 pandemic, at the end of March, 100% of TIM's brick-and-mortar stores were closed. This led to an even higher need for digital sales channels. In this quarter, sales in postpaid and consumer control rose 4.6% YoY. Also, digital recharges keep increasing their penetration in total sales, up +3.6 p.p. YoY in 1Q20.

The app Meu TIM again proved to be a highly relevant platform in customer relationship, streamlining customer service and promoting adequate functions to help clients manage their plans. The app's total unique users grew 18.9% YoY. Even with added relationship difficulties, human interactions declined 24.9% YoY, corroborating our caring strategy and cutting dependence on call centers.

Additional important factors are the digital means for billing and payment, which maintained growth during 1Q20. The invoices delivered via digital channels rose 12.3% YoY. Meanwhile, the number of users paying via digital channels also expanded by +11.7% YoY. Another important function offered to customers is the possibility to add credit and/or to check one's balance, in addition to receiving invoices through WhatsApp.

|

In the latest Satisfaction and Perceived Quality Survey released by Anatel in 2020, TIM maintained a superior perception in terms of general satisfaction for broadband and fixed services, compared to the average in Brazil.

|

|

NETWORK DEVELOPMENT

As a fundamental pillar within TIM's strategic plans, the expansion and enhancement of network infrastructure is associated with the continuous improvement of service quality. At the beginning of the year, TIM took another important step in this process. Even with the challenges concerning the fight against the novel coronavirus, the company maintained its investments in network expansion and completed the 4G coverage in all 399 municipalities in the state of Paraná, all 295 municipalities in the state of Santa Catarina and all 78 municipalities in the state of Espírito Santo, becoming the third, fourth and fifth states with 100% of their municipalities covered by the technology.1

Capex dedicated to infrastructure projects (Network + IT) topped 90% in 1Q20, again underpinned by analytical tools that allowed an efficient resource allocation. Highlighted projects:

o Expansion of the fiber optic network (backbone, backhaul and FTTH);

o Frequency refarming;

o Densification of sites;

o Aggregation of carriers;

o Agreements in sharing and transport network.

Regarding the main actions and projects underway for modernization, efficiency and/or enhancement of our infrastructure during this quarter, we highlight:

o Expansion of refarming of 2.1 GHz frequency in 4G, reaching approximately 304 cities;

o Installation of multiple data centers to enhance experience (25 at the end of 1Q), of which are 14 DCC (Data Center Core) and 11 are DCE (Data Center Edge);

o Infrastructure virtualization project;

o Expansion of VoLTE, available in more than 3,450 cities;

o Expansion of network capacity through the solution Massive MIMO;

o Approval of the Network Sharing Agreement with Vivo: 50 cities with shared 2G as an initial effort;

o Consolidation of NB-IoT network, present in more than 3,322 municipalities, enabling the creation of IoT solutions not only in big cities, but in distant municipalities.

1 São Paulo, Rio de Janeiro, Espírito Santo, Santa Catarina and Paraná are the states with 4G coverage from TIM for 100% of their municipalities.

As the leader in 4G coverage in Brazil, TIM reached 3,506 cities (94% of the country's urban population) in the first quarter of 2020. The 37% growth YoY in network elements for this technology adds to our focus to increase capacity and quality of the mobile network. As a result, 4G data traffic accounted for approximately 87% of the total, up 8 p.p. compared to 1Q19.

Fixed broadband coverage is also enjoying constant expansion, having reached in the first quarter of this year 2.5 million homes in FTTH, while FTTC surpassed 3.6 million. This represents a total of 5.6 million homes in 26 cities (FTTH + FTTC)2. In 1Q20, FTTH initiated commercial activities in a new city: Betim (Minas Gerais state).

In transport infrastructure, TIM reached a total of 21,652 sites in the quarter and 84% of said units are connected via high capacity backhaul. The company exceeded 102,000km with its fiber optic for backbone and backhaul (representing an 11.2% advance YoY).

Lastly, by reaching a total of 1,582 active Biosites at the end of 1Q20, TIM again proves that it keeps targeting the development of this infrastructure, which is aligned with its corporate social responsibility values, in addition to being a solution for the densification of the mobile access network (antennas/towers) with a very low visual impact. In addition, Biosites also have a lower cost, are installed quickly and contribute to the harmonization with the environment and urban infrastructure – a multi-functionality beyond the transmission of telecommunications, lighting and security cameras.

Currently, the Company is authorized to use more than 110 MHz, with 36 MHz in frequencies below 1 GHz distributed as follows:

|

Average Spectrum Weighted by Population

|

|

700 MHz

|

850 MHz

|

900 MHz

|

1,800 MHz

|

2,100 MHz

|

2,500 MHz

|

|

20

|

11

|

5

|

35

|

22

|

20

|

2 (+) Rio de Janeiro (RJ), São Gonçalo (RJ), Nilópolis (RJ), Nova Iguaçu (RJ), São João do Meriti (RJ), Duque de Caxias (RJ), São Paulo (SP), Mauá (SP), Poá (SP), Suzano (SP), Francisco Morato (SP), Franco da Rocha (SP), Diadema (SP), Salvador (BA), Lauro de Freitas (BA), Camaçari (BA), Feira de Santana (BA), Recife (PE), Olinda (PE), Jaboatão dos Guararapes (PE), Paulista (PE), Goiânia (GO), Aparecida de Goiânia (GO), Anápolis (GO) and Manaus (AM).

Corporate Social Responsibility

To access the quarterly report on Social and Corporate Responsibility, please refer to: www.tim.com.br/ri/ ESG-Report.

Disclaimer

The consolidated financial and operating information disclosed in this document, except where otherwise indicated, is presented in accordance with the International Financial Reporting Standards (IFRS) and in Brazilian Reais (R$), in compliance with the Brazilian Corporate Law (Law 6,404/76). Comparisons refer to the first quarter of 2019 (1Q19) and the year to date 2020 (3M20), except when otherwise indicated.

This document may contain forward-looking statements. Such statements are not statements of historical fact and reflect the beliefs and expectations of the Company's management. The words "anticipates,” "believes,” "estimates,” "expects,” "forecasts,” "plans,” "predicts,” "projects,” "targets" and similar words are intended to identify these statements, which necessarily involve known and unknown risks and uncertainties foreseen, or not, by the Company. Therefore, the Company’s future operating results may differ from current expectations and readers of this report should not base their assumptions exclusively on the information given herein. Forward-looking statements only reflect opinions on the date on which they are made and the Company is not obliged to update them in light of new information or future developments.

Investor Relations Contacts

Telephone Number: (+55 21) 4109-3360 / 4112-6048

E-mail: ri@timbrasil.com.br

Investor Relations Website: www.tim.com.br/ir

Attachments

Attachment 1: Balance Sheet

Attachment 2: Balance Sheet Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

Attachment 3: Income Statement

Attachment 4: Income Statement Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

Attachment 5: Cash Flow Statement

Attachment 6: Operating Indicators

The Complete Financial Statements, including the Explanatory Notes, are available on the Company's Investor Relations website.

Attachment 1

TIM PARTICIPAÇÕES S.A.

Balance Sheet

Attachment 2

TIM PARTICIPAÇÕES S.A.

Balance Sheet Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

Attachment 3

TIM PARTICIPAÇÕES S.A.

Income Statement

Attachment 4

TIM PARTICIPAÇÕES S.A.

Income Statement Comparison (Pro-forma x With IFRS 9 and 15 x With IFRS 16)

Attachment 5

TIM PARTICIPAÇÕES S.A.

Cash Flow Statement

Attachment 6

TIM PARTICIPAÇÕES S.A.

Operating Ratios

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

TIM PARTICIPAÇÕES S.A.

|

|

|

|

|

|

|

|

Date: May 5, 2020

|

By:

|

/s/ Adrian Calaza

|

|

|

|

|

|

|

|

|

|

Name: Adrian Calaza

|

|

|

|

|

Title: Chief Financial Officer and Investor Relations Officer

TIM Participações S.A.

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

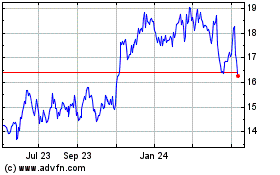

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

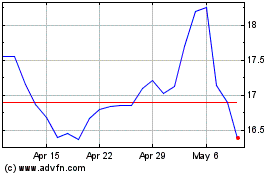

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024